Lincoln County Assignment of Trust Deed by Beneficiary or Successor in Interest Form

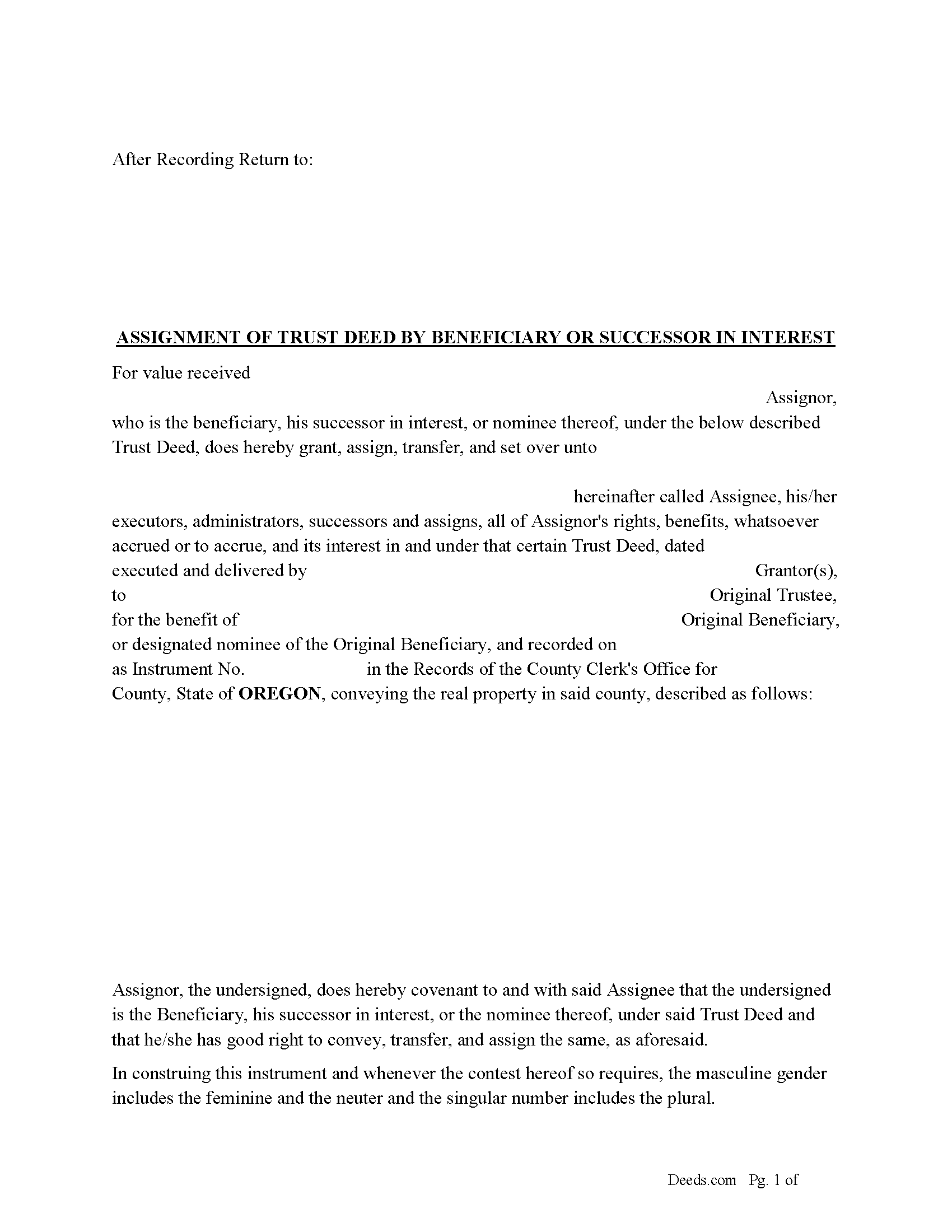

Lincoln County Assignment of Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

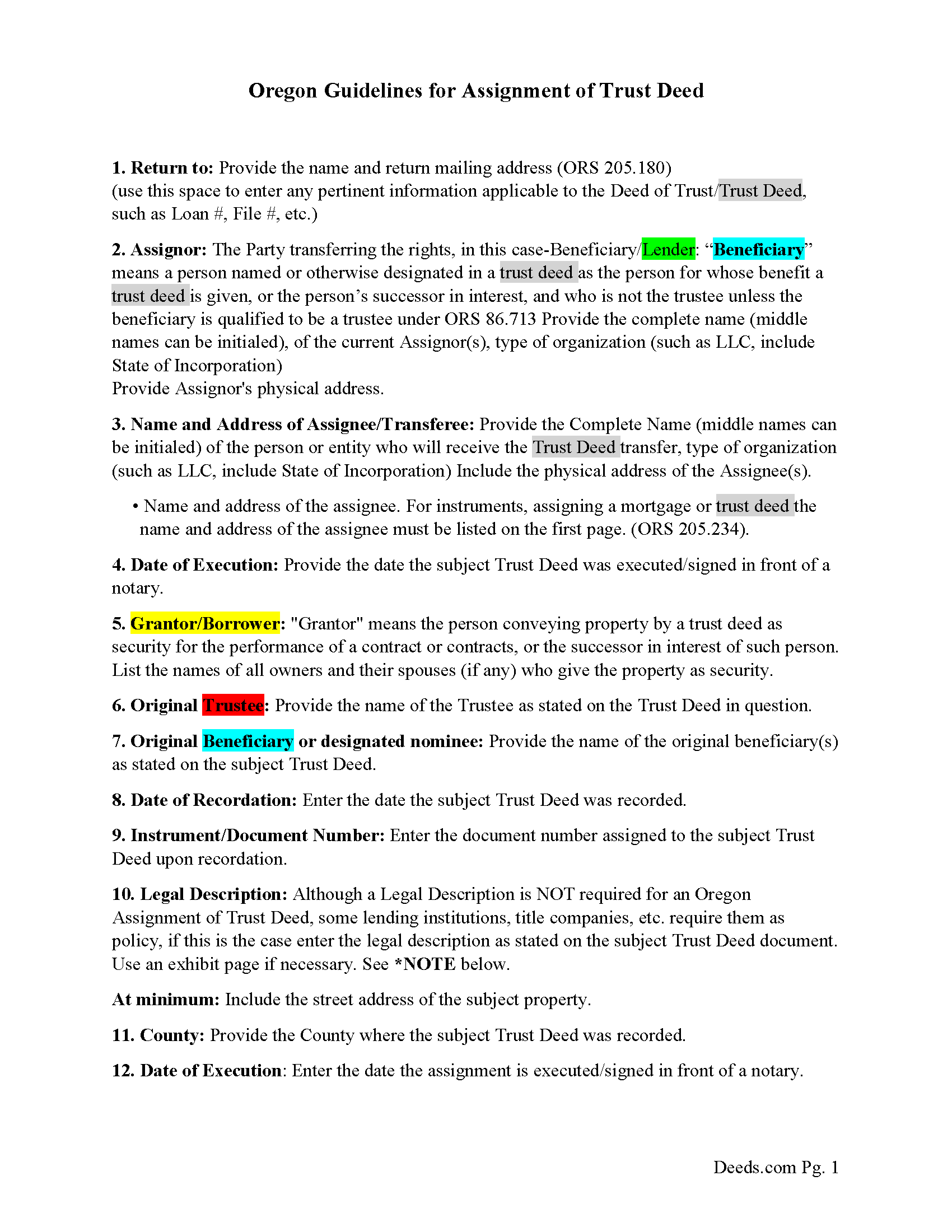

Lincoln County Assignment of Trust Deed Guidelines

Line by line guide explaining every blank on the form.

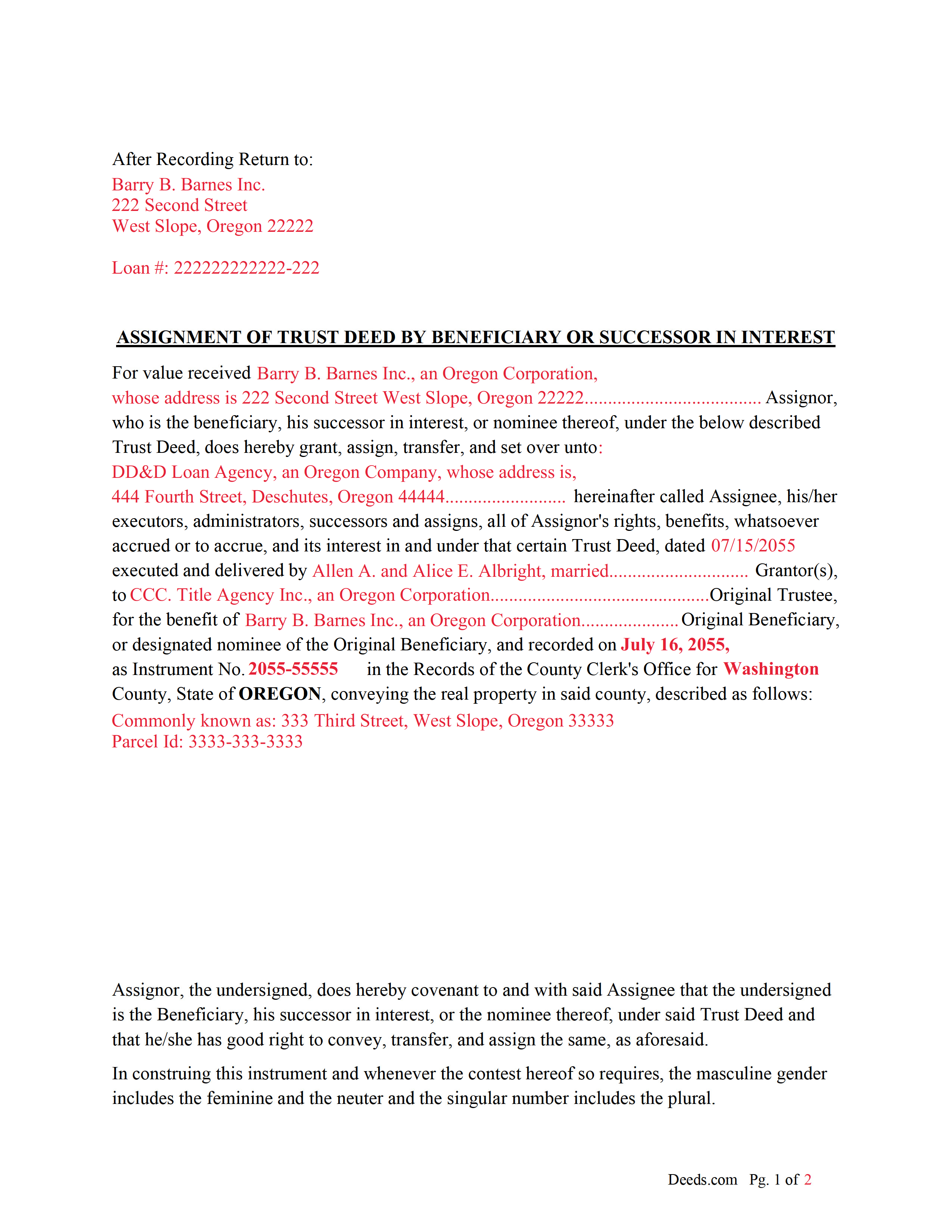

Lincoln County Completed Example of Assignment of Trust Deed Document

Example of a properly completed form for reference.

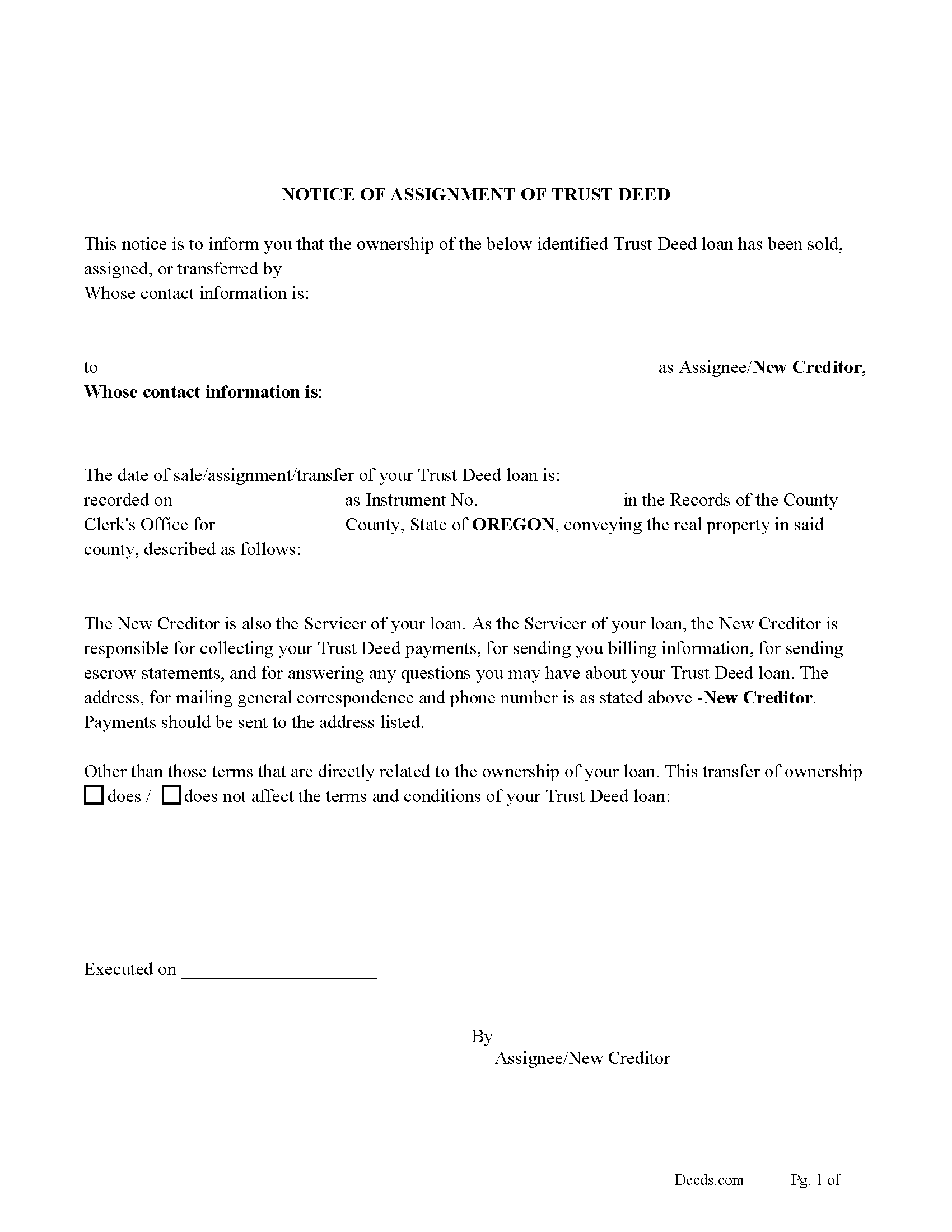

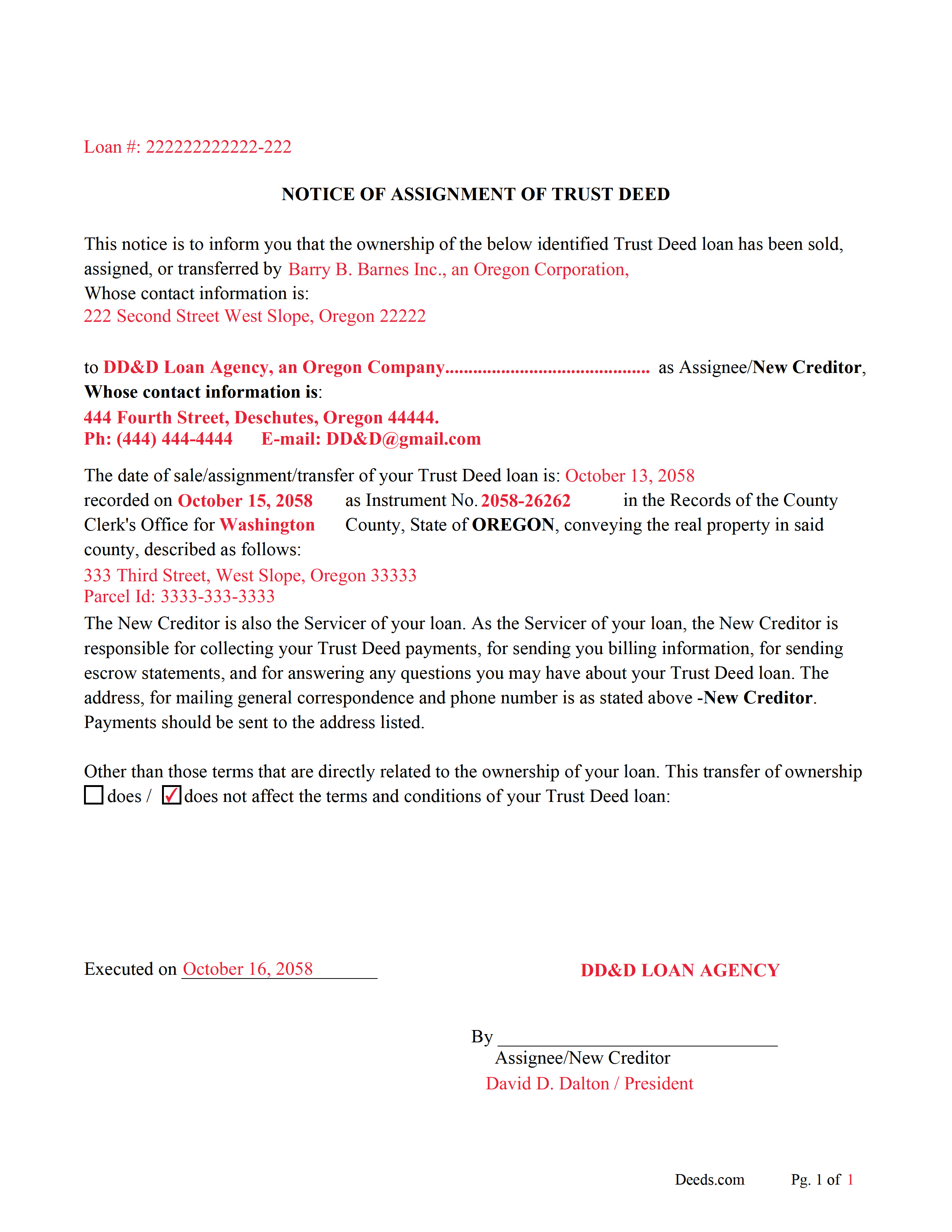

Lincoln County Notice of Assignment of Trust Deed Form

Fill in the blank form formatted to comply with content requirements.

Lincoln County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Lincoln County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk

Newport, Oregon 97365-3869

Hours: 8:30 to 5:00 M-F / Recording: 9:00 to 4:00

Phone: (541) 265-4131 or 4121

Recording Tips for Lincoln County:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Have the property address and parcel number ready

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Depoe Bay

- Eddyville

- Gleneden Beach

- Lincoln City

- Logsden

- Neotsu

- Newport

- Otis

- Otter Rock

- Seal Rock

- Siletz

- South Beach

- Tidewater

- Toledo

- Waldport

- Yachats

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (541) 265-4131 or 4121 for current fees.

Questions answered? Let's get started!

In this form the assignment/transfer of a Trust Deed/Deed of Trust is made by the beneficiary/lender or successor in interest.

("Trust deed" means a deed executed in conformity with ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Beneficiary" means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).) (ORS 86.705(2))

ORS 86.060 Assignment of mortgage Mortgages may be assigned by an instrument in writing, executed and acknowledged with the same formality as required in deeds and mortgages of real property, and recorded in the records of mortgages of the county where the land is situated.

ORS 86.715 Trust deed deemed to be mortgage on real property A trust deed is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced), in which event the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) shall control. For the purpose of applying the mortgage laws, the grantor in a trust deed is deemed the mortgagor and the beneficiary is deemed the mortgagee.

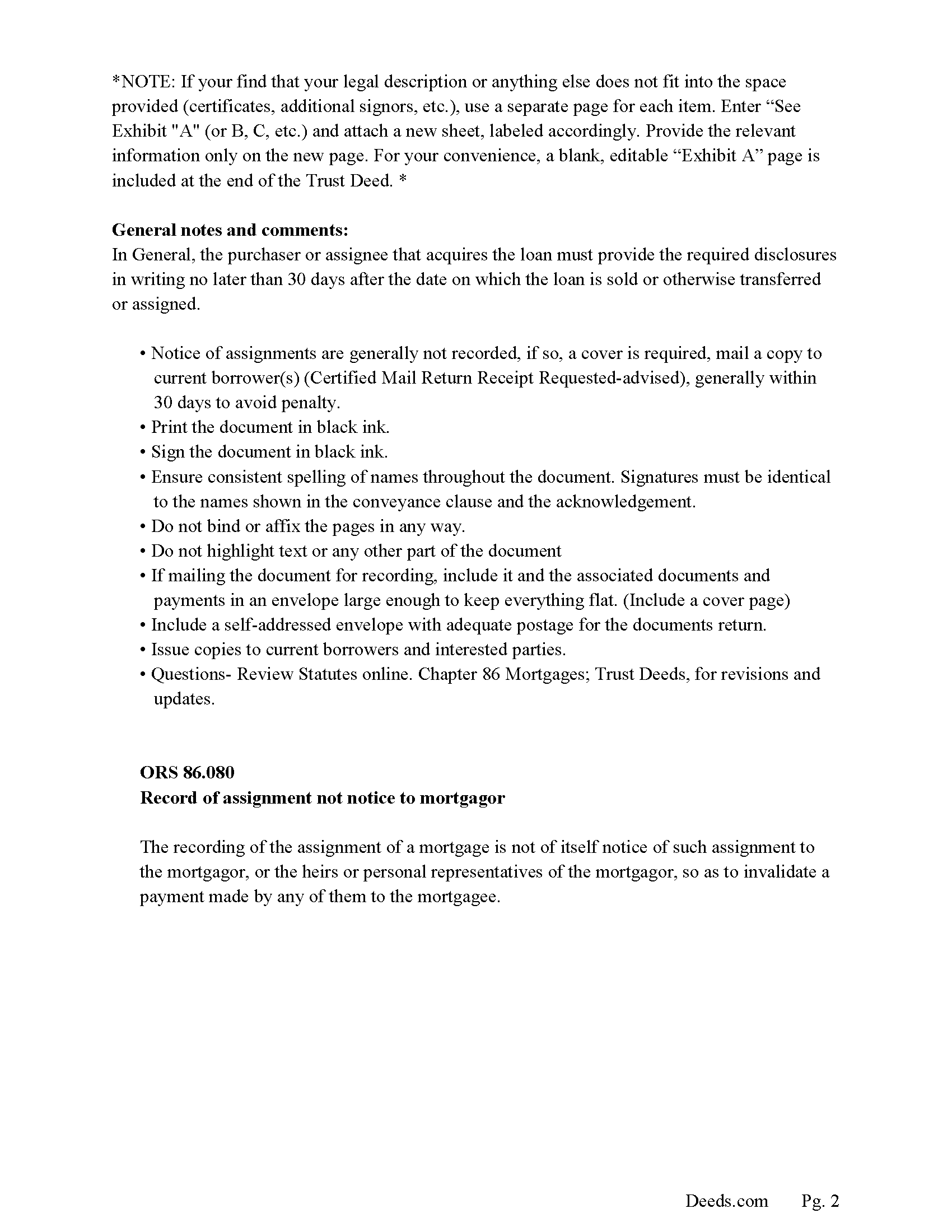

Included are "Notice of Assignment of Trust Deed" forms. The current Mortgagor/Borrower/Grantor must be notified of the assignment, generally within 30 days to avoid penalty.

ORS 86.080 Record of assignment not notice to mortgagor

The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor, or the heirs or personal representatives of the mortgagor, so as to invalidate a payment made by any of them to the mortgagee.

(Oregon Assignment Package includes form, guidelines, and completed example) For use in Oregon only.

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Assignment of Trust Deed by Beneficiary or Successor in Interest meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Assignment of Trust Deed by Beneficiary or Successor in Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

O. Peter P.

June 21st, 2019

I find your forms hard to use, inasmuch as the forms cannot be converted to a Word Document. Editing and deleting of extra lines is not possible, making for a deed with large blank spaces. Document that results is not usable for me.

Sorry to hear that we did not meet your expectations. We have canceled your order and payment. We do hope you find something more suitable to your needs elsewhere. Have a wonderful day.

Barbara H.

October 4th, 2019

So far so good. Thanks for making this easy and affordable.

Thank you for your feedback. We really appreciate it. Have a great day!

F Michael C.

June 15th, 2021

Very easy to use and no hidden costs. You get to download whatever you need and can save it and even reuse it. So it's like having your own library of form that you pay for once. They even give you more related forms than you ask for and it turned out we needed some if those forms as well. The forms meet what our county requires for margins in records and so on. So I will use deeds.com again when I need a different kind of legal form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suzette H.

October 6th, 2021

helped clarify how process works Thanks

Thank you!

Chastity S.

March 14th, 2019

Very confusing and a waste of money, Now I will have to pay for another service from another site. Very disappointed.

Thank you for your feedback. Sorry to hear about your disappointment. It is certainly a good idea to seek a more full service route if you are not completely sure of what you are doing. We have canceled your order and payment.

Jamie W.

September 27th, 2019

Very fast service. Wish I knew about this earlier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jonathan F.

September 4th, 2020

An excellent service. Makes filing deeds so much easier than having to go to the courthouse or use FedEx. I will be a customer for the rest of my legal career.

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Dana L.

January 29th, 2021

So far, so good! Love you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done. So unless you know a way to correct this I likely won't use your forms again.

Thank you!

Patricia D.

January 5th, 2019

I looked around for forms and came to this site. I had to do 15 deeds and this form was very useful to completing that. Very impressed. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

JERRY M.

March 11th, 2020

Had to modify the document form fill field to accept the information required. Had limited number of characters.

Thank you for your feedback. We really appreciate it. Have a great day!

Tamica D.

April 22nd, 2020

Exceptional service. Thank you for your assistance.

Thank you!

Michelle A.

January 5th, 2025

deeds.com is user-friendly and very easy to navigate. Guides, samples, and free supplement forms are available for every State and are frequently updated. The cost is economical. I recommend these products

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!