Lane County Certificate of Trust Form (Oregon)

All Lane County specific forms and documents listed below are included in your immediate download package:

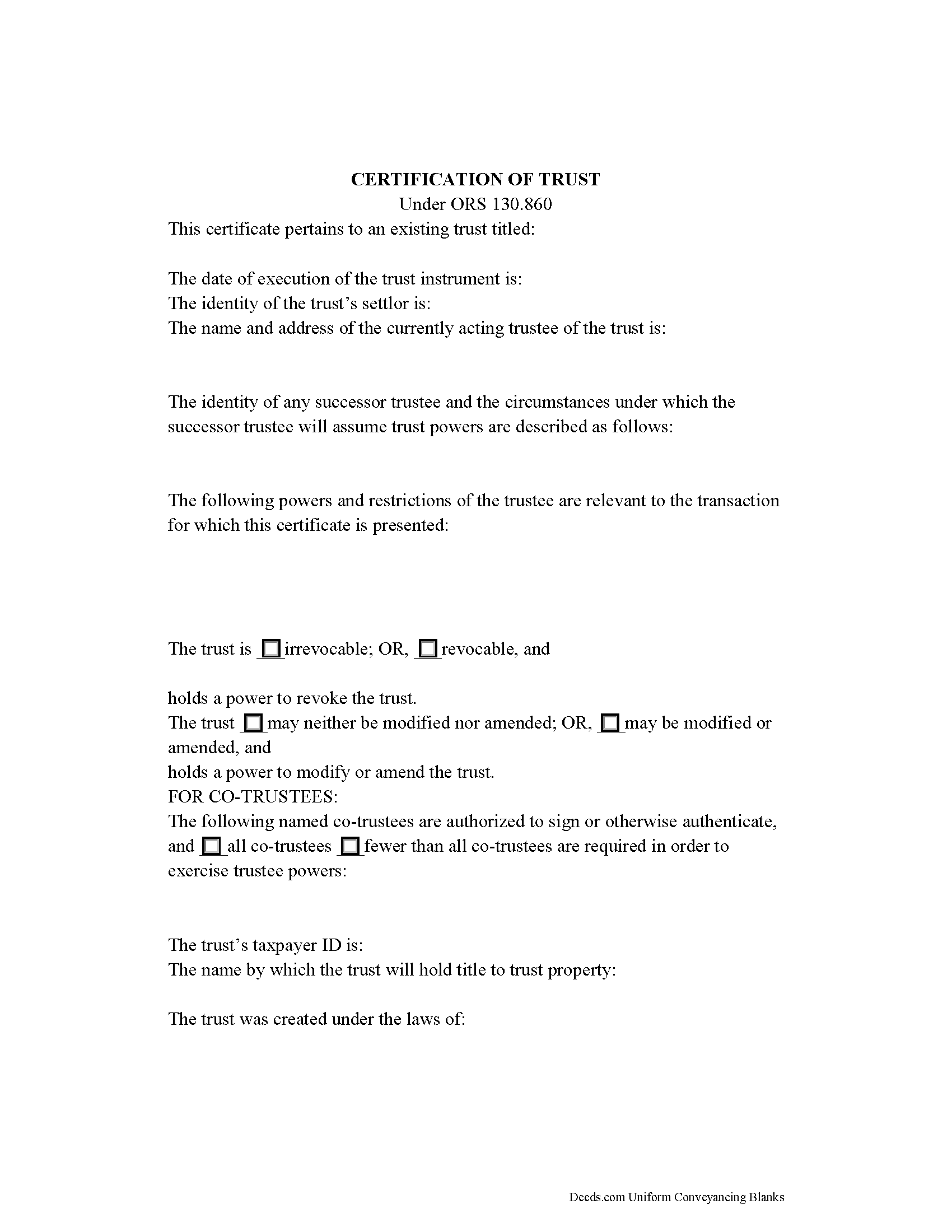

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lane County compliant document last validated/updated 5/12/2025

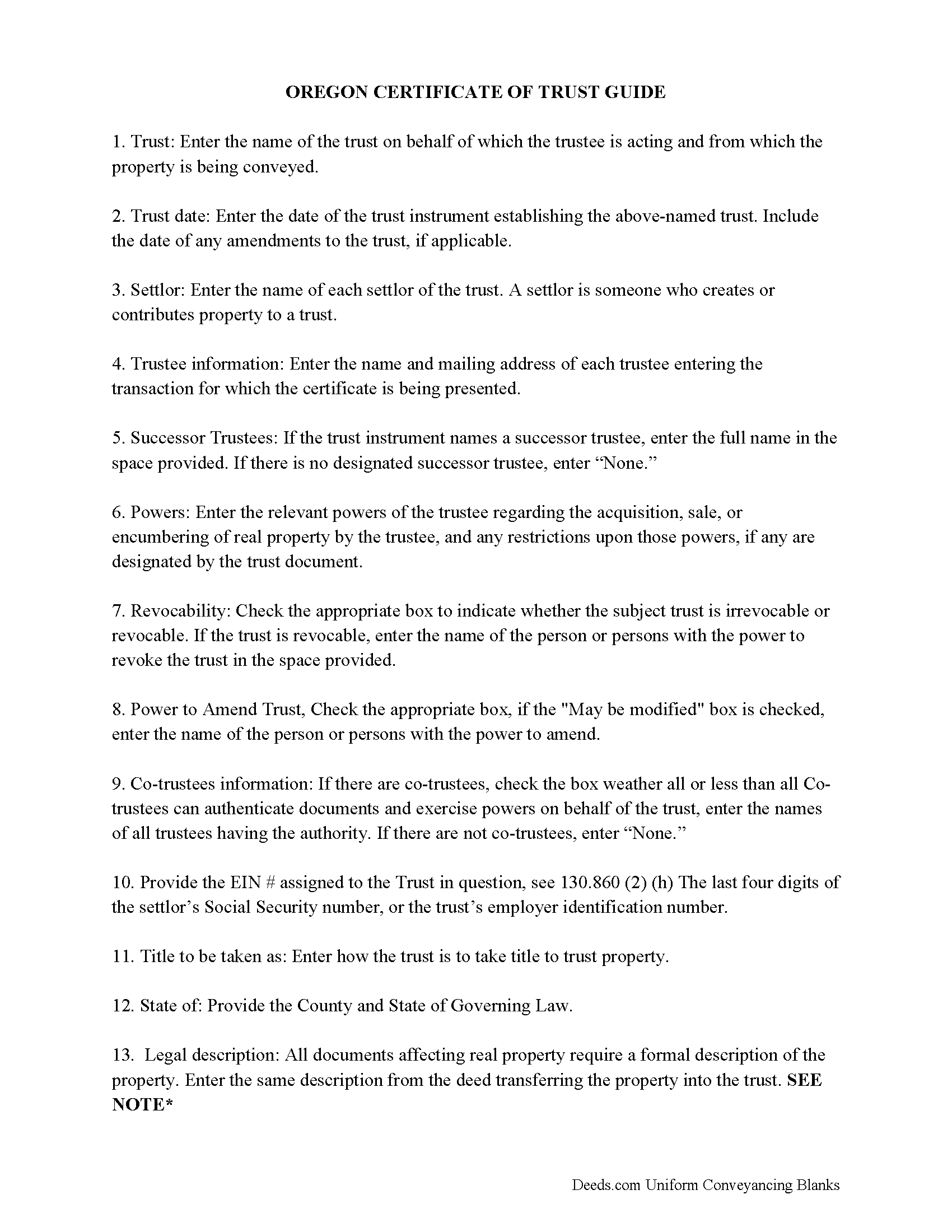

Certificate of Trust Guide

Line by line guide explaining every blank on the form.

Included Lane County compliant document last validated/updated 6/26/2025

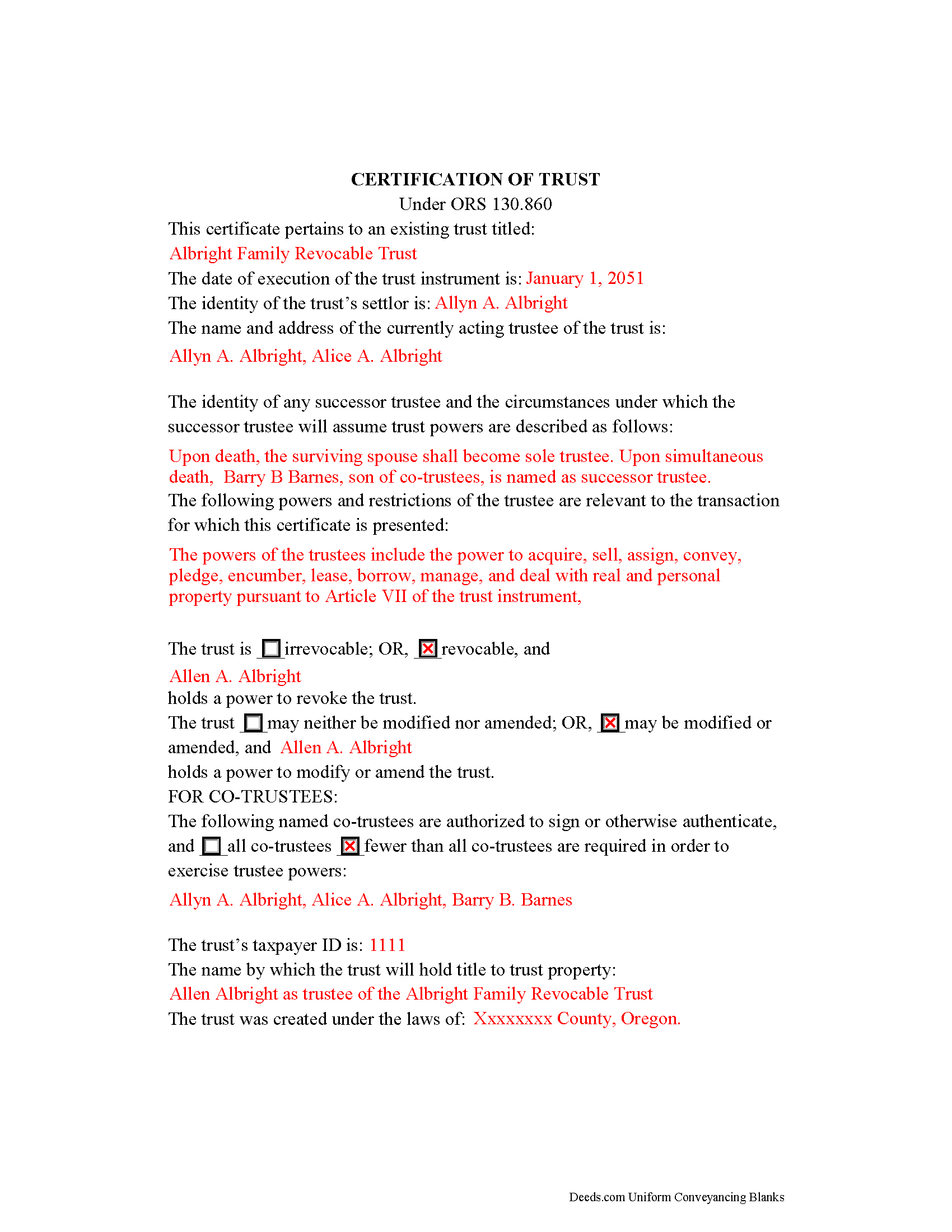

Completed Example of the Certificate of Trust Document

Line by line guide explaining every blank on the form.

Included Lane County compliant document last validated/updated 7/1/2025

The following Oregon and Lane County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Lane County. The executed documents should then be recorded in the following office:

County Clerk: Deeds & Records

125 E 8th Ave, Eugene, Oregon 97401

Hours: 9:00 to 12:00 & 1:00 to 4:00 Mon-Fri / Research: 8:00 to 5:00

Phone: 541-682-3654

Local jurisdictions located in Lane County include:

- Alvadore

- Blachly

- Blue River

- Cheshire

- Cottage Grove

- Creswell

- Culp Creek

- Deadwood

- Dexter

- Dorena

- Elmira

- Eugene

- Fall Creek

- Florence

- Junction City

- Lorane

- Lowell

- Mapleton

- Marcola

- Noti

- Oakridge

- Pleasant Hill

- Saginaw

- Springfield

- Swisshome

- Thurston

- Veneta

- Vida

- Walterville

- Walton

- Westfir

- Westlake

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lane County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lane County using our eRecording service.

Are these forms guaranteed to be recordable in Lane County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lane County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lane County that you need to transfer you would only need to order our forms once for all of your properties in Lane County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Lane County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lane County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Oregon Certification of Trust for Real Property Transactions

A trust is an arrangement whereby a person (the settlor or trustor) transfers property to another person, a trustee, who manages the assets for the benefit of a third (the beneficiary), pursuant to the terms established by the settlor in the trust instrument. Living trusts in Oregon are governed by the Uniform Trust Code, codified at Chapter 130 of the Revised Statutes.

When engaging in business with a trustee, parties to the transaction can request that the trustee provide a certification of trust. To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument. The certification of trust, presented to anyone who is not a trust beneficiary, contains the essential information about the trust required for the pending or contemplated transaction, certifying its existence and the trustee's authority to do business as fiduciary.

The statutory requirements for a certification of trust are located at ORS 130.860. The certificate must state that the trust exists (generally by citing the trust's name) and provide the date of the trust instrument, and, in addition, the date of any amendment made to the trust. It should also include the name of the trust's settlor and the name and address of each currently acting trustee, and may also contain the name of a successor trustee, if any, "and the circumstances under which any successor trustee or trustees will assume trust powers" (ORS 130.860(8)).

The certificate also enumerates the trustee's powers relevant to the pending transaction. Some trustees may provide copies of excerpts from the trust instrument designating the trustee and establishing the requisite powers (130.860(6)). For trusts administered by multiple trustees, the certificate establishes whether trustees can act individually, or if a majority of, or all trustees are needed to exercise trustee powers.

Further, the certificate indicates whether the trust is irrevocable or revocable, along with the name of any person who can revoke the trust. In Oregon, the certificate should also specify if the trust can be amended or modified, and by whom.

Identifying information, such as the last four digits of the trust's taxpayer identification number, the jurisdiction under the laws of which the trust is governed, and the name by which the trust holds title to property, is also required. The certificate must also include a statement that the trust "has not been revoked, modified, or amended in any manner" to cause the within statements to be incorrect (130.860(4)).

For transactions involving real property, the certificate should also include a legal description of the subject real property. Recipients may require that the certificate also contain other facts "that are reasonably related to the administration of the trust" (130.860(7)(a)).

Certifications of trust in Oregon must be executed by all trustees (130.860(3)). Depending on the circumstances, the recipient of a certificate may require that the certificate be executed by a settlor or settlors and/or by a beneficiary or beneficiaries "if the certification is reasonably related to a pending or contemplated transaction with the person" (130.860(7)(b),(c)).

Recipients of a certification of trust may rely on the statements contained within as fact without further inquiry (130.860(9)(a)). Transactions are not enforceable against the trust if a recipient has actual knowledge that a trustee is acting outside the scope of the trust (130.860(9)(c)). Those who fail to request or accept a certificate of trust under ORS 130.860 are still afforded the protections of persons dealing with trustees under ORS 130.855 (130.860(12)).

Contact a lawyer for guidance about trusts, trustees, certifications of trust, and rights of persons dealing with trustees in Oregon.

(Oregon COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lane County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lane County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Sue D.

November 28th, 2019

Great program

Thank you!

Charles C.

December 2nd, 2020

This was my first experience with e-recording. Deeds.com was AWESOME! Within one hour, I signed up with Deeds.com, recorded a deed in a neighboring county and had access to a copy of the recorded deed. I also appreciate the fact that there are no monthly or annual fees. Thanks Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Kaleigh S.

April 8th, 2020

I used Deeds.com to record two judgments with the County Recorder's Office. The site was very easy to use and I had my recorded copies back the very next day. I highly recommend their service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave W.

April 14th, 2020

Hello,

The instructions were clear and easy to navigate.

Thanks,

Dr. Dave Wayne

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joel M.

November 8th, 2024

Very easy and efficient. The team was quick to respond when I had questions and made it very simple.

We are delighted to have been of service. Thank you for the positive review!

LEIGH M.

February 19th, 2022

Skamania County, WA tax affidavit wouldn't download. Otherwise, a good program

Thank you!

Jo A B.

June 18th, 2022

Clean crisp website with helpful information; however. If the site states the following files are included, a single .zip, .rar, , ,download should be available instead of individual.

Thank you for your feedback. We really appreciate it. Have a great day!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

catherine c.

August 22nd, 2020

very efficient with communication and follow-up(s) will be using again, thank you!:)

Thank you!

Jeff H.

July 1st, 2021

Very simple and fast service, and the fees are appropriate. It would be good to get email notifications when there are new messages and/or status updates.

Thank you for your feedback. We really appreciate it. Have a great day!

Shelly D.

March 13th, 2020

Excellent

Thank you!