Marion County Claim of Lien Form (Oregon)

All Marion County specific forms and documents listed below are included in your immediate download package:

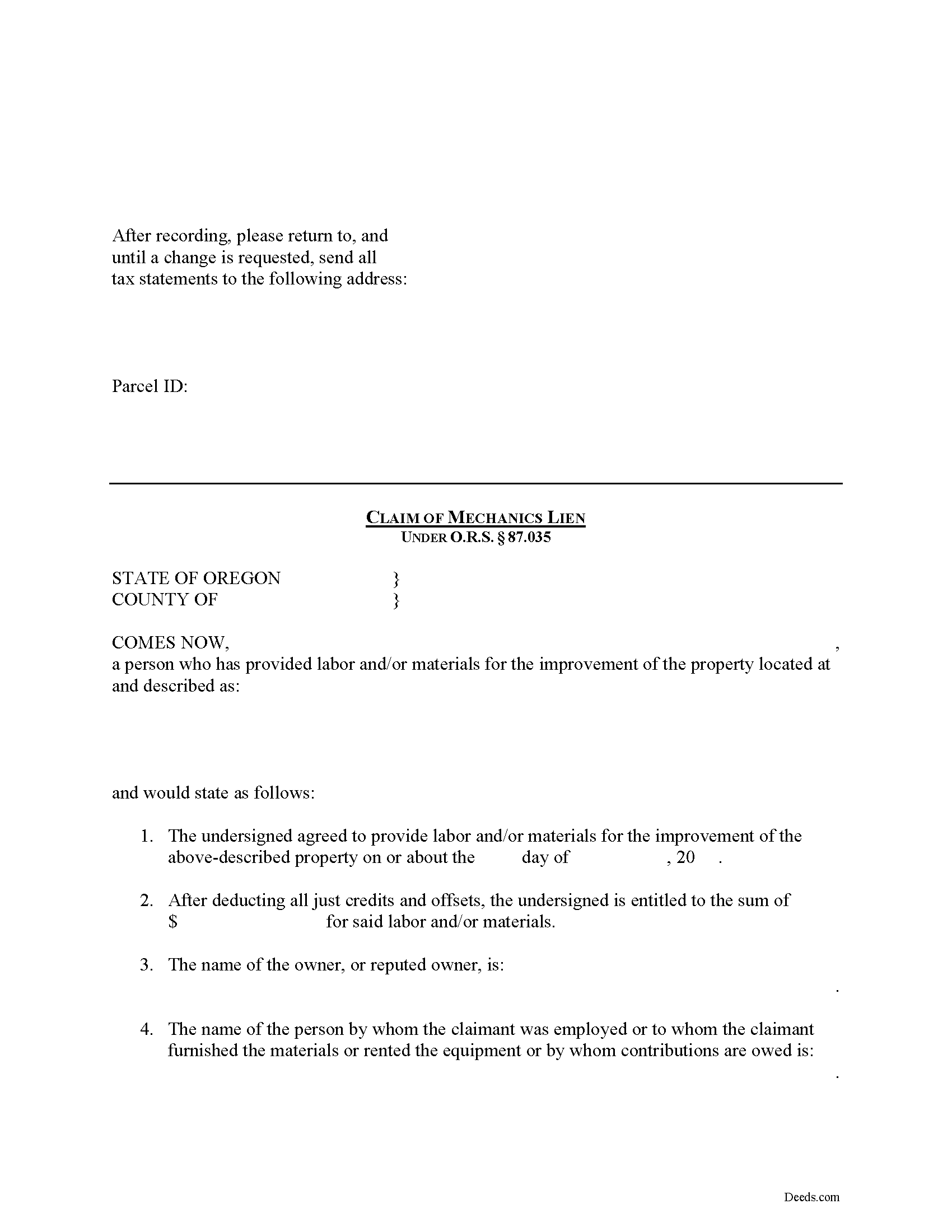

Claim of Lien Form

Fill in the blank Claim of Lien form formatted to comply with all Oregon recording and content requirements.

Included Marion County compliant document last validated/updated 6/24/2025

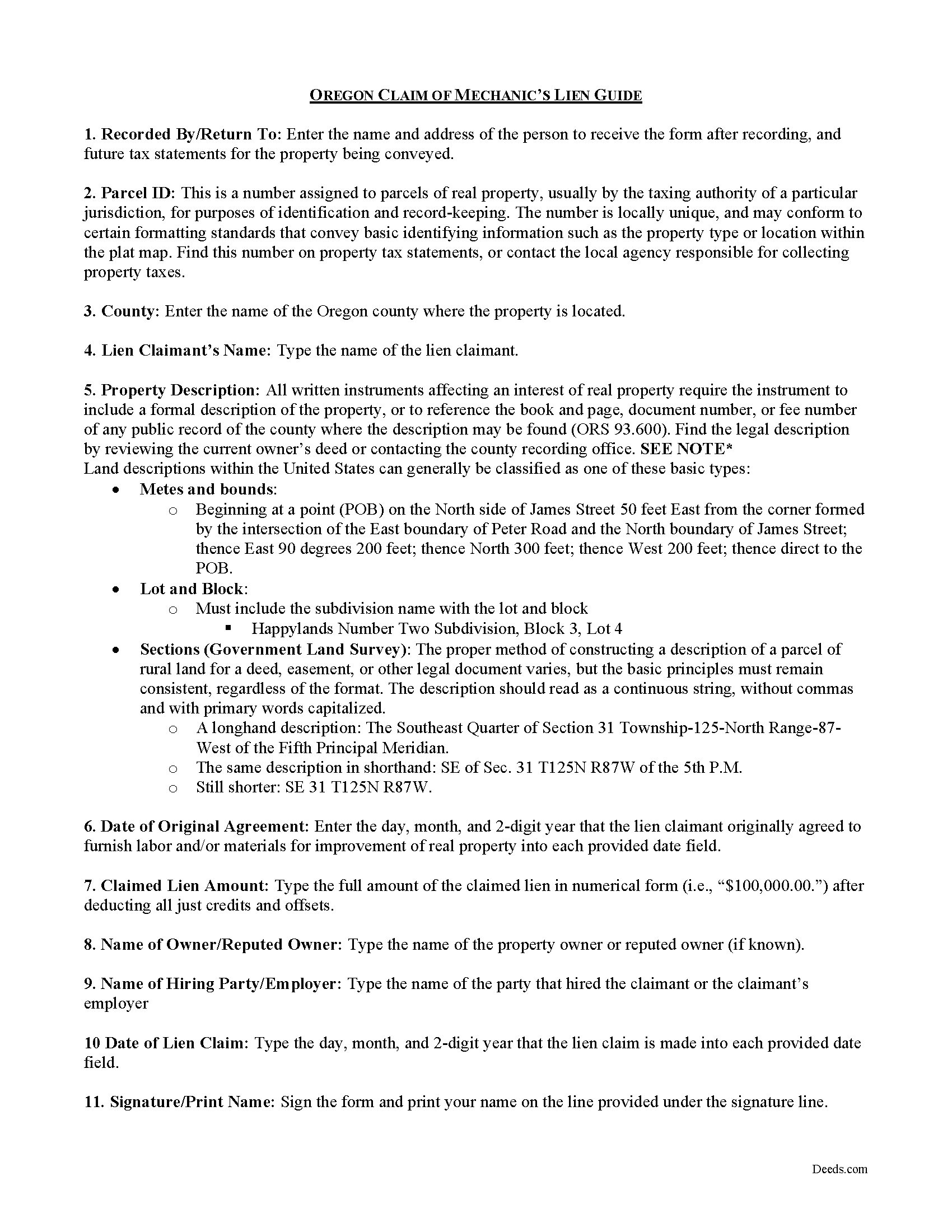

Claim of Lien Guide

Line by line guide explaining every blank on the form.

Included Marion County compliant document last validated/updated 4/1/2025

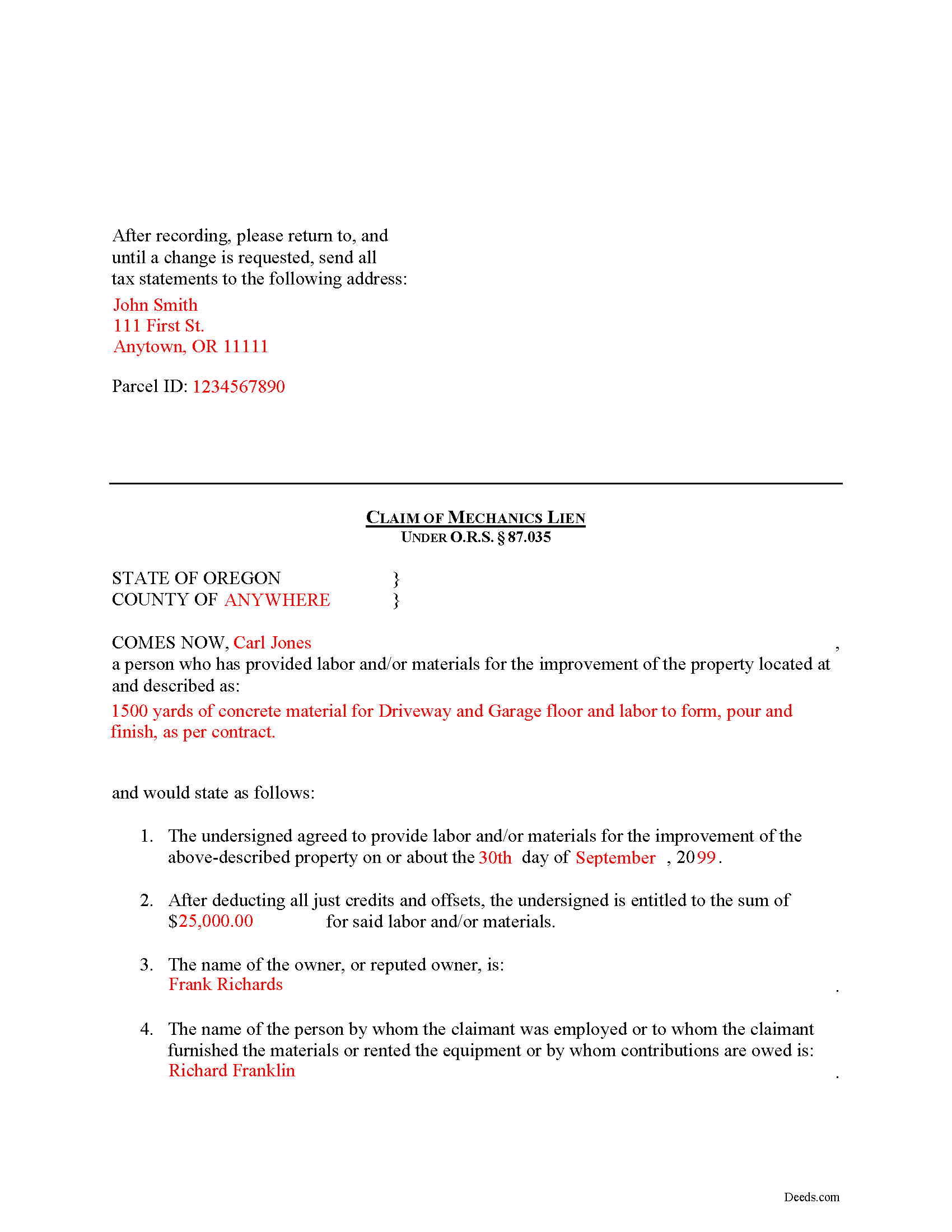

Completed Example of the Claim of Mechanics Lien Document

Example of a properly completed form for reference.

Included Marion County compliant document last validated/updated 7/10/2025

The following Oregon and Marion County supplemental forms are included as a courtesy with your order:

When using these Claim of Lien forms, the subject real estate must be physically located in Marion County. The executed documents should then be recorded in the following office:

Marion County Clerk

555 Court St NE, 2nd floor / PO Box 14500, Salem, Oregon 97309

Hours: 8:30 to 5:00 M-F

Phone: (503) 588-5225

Local jurisdictions located in Marion County include:

- Aumsville

- Aurora

- Detroit

- Donald

- Gates

- Gervais

- Hubbard

- Idanha

- Jefferson

- Keizer

- Mehama

- Mount Angel

- Saint Benedict

- Saint Paul

- Salem

- Scotts Mills

- Silverton

- Stayton

- Sublimity

- Turner

- Woodburn

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marion County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marion County using our eRecording service.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can the Claim of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marion County that you need to transfer you would only need to order our forms once for all of your properties in Marion County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Marion County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marion County Claim of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Mechanic's Lien Claims in Oregon

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Contractors, subcontractors, and material suppliers can often have problems getting paid by property owners or other parties involved in the chain of dealings. Luckily, there is a remedy for these persons known as a construction lien. A construction lien works like a mortgage by creating a security interest in the title to real property as a form of collateral. A contractor or other party holds this interest and in turn can foreclose on it to force payment.

In Oregon, any person performing labor upon, transporting or furnishing any material to be used in, or renting equipment used in the construction of any improvement is entitled to a lien upon the improvement for the labor, transportation or material furnished or equipment rented at the instance of the owner of the improvement or the construction agent of the owner. O.R.S. 87.010(1). To claim a lien, the party providing labor or furnishing materials must first send a preliminary notice to the owner, in the form of a Notice of Right to a Lien, within 8 days of such furnishing. O.R.S. 87.021(1). The purpose of this notice is to make the owner aware that someone will be performing work that entitles the contractor to claim a lien, which in turn protects the owner from a "hidden lien." If the notice is not sent on time, a claimant can still send one out later and claim a lien but, the lien only covers the 8-day period before the pre-lien notice is sent.

Once the pre-lien notice has been sent and work has begun, and the proper party never receives timely payment, a mechanic's lien can be claimed not later than 75 days after the person has ceased to provide labor, rent equipment, or furnish materials or 75 days after completion of construction, whichever is earlier. O.R.S. 87.035(1). The lien must be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated. O.R.S. 87.035(2).

The claim of lien contains the following information: (a) a statement of demand, after deducting all just credits and offsets; (b) the name of the owner, or reputed owner, if known; (c) the name of the person by whom the claimant was employed or to whom the claimant furnished the materials or rented the equipment or by whom contributions are owed; and (d) a description of the property to be charged with the lien sufficient for identification, including the address if known. O.R.S. 87.035(3). The claim of lien must be verified by the oath of the person filing or of some other person having knowledge of the facts, subject to the criminal penalties for false swearing. O.R.S. 87.035(4)

A person filing a claim of lien must mail the owner and the mortgagee a notice in writing that the claim has been filed. O.R.S. 87.039(1). A copy of the claim of lien must be attached to the notice. Id. The notice must be mailed no later than 20 days after the date of filing. Id. By keeping track of dates, staying organized, and keeping a vigilant eye on each account, protects the claimant's right to a construction lien.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. Please contact an Oregon attorney with any questions about construction liens.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Claim of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!

DEBBY G.

January 12th, 2023

I was so confused on how to complete the form. But I followed the instructions and used the example and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhoads H.

December 3rd, 2020

Excellent, thank you.

Thank you!

Scott P.

October 24th, 2020

So far so good

Thank you!

Rebecca H.

December 14th, 2020

Very pleased with the ease of this deed form. Completing the deed form to make sure everything was in my name took ten minutes. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Desiree R.

August 19th, 2024

very easy to use

We are delighted to have been of service. Thank you for the positive review!

Paul S.

October 23rd, 2020

Directions were good.

It was an easy process.

Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

Laurie R.

August 31st, 2022

FIVE STARS !!!

Clear instructions

Easy to navigate

Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne W.

January 20th, 2020

I was very pleased to find this service, as (another website) charges about $40 for the same service, so yours was a bargain.

Thank you!

Charles S.

May 11th, 2025

It's useful to have forms specific to the County as well as the State. The examples are also helpful, but it would be even more helpful to see an example of a complete and successfully filed package. I will go the County Recorder's Office to see if I can find an example there.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Robert L.

September 28th, 2020

It was easy for me to open an account and upload a document for recording.

Thank you for your feedback. We really appreciate it. Have a great day!