Malheur County Notice of Right to Lien Form (Oregon)

All Malheur County specific forms and documents listed below are included in your immediate download package:

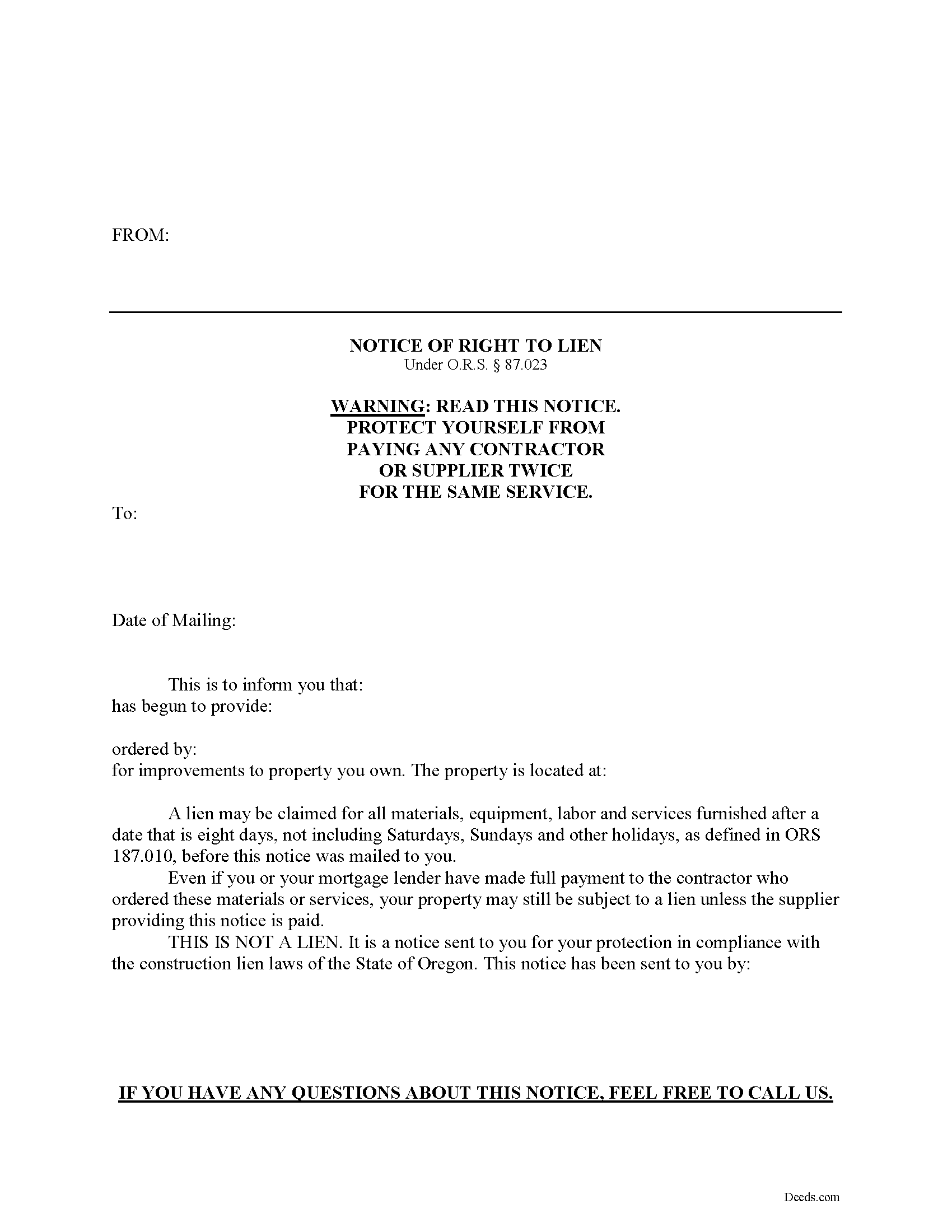

Notice of Right to Lien Form

Fill in the blank Notice of Right to Lien form formatted to comply with all Oregon recording and content requirements.

Included Malheur County compliant document last validated/updated 6/6/2025

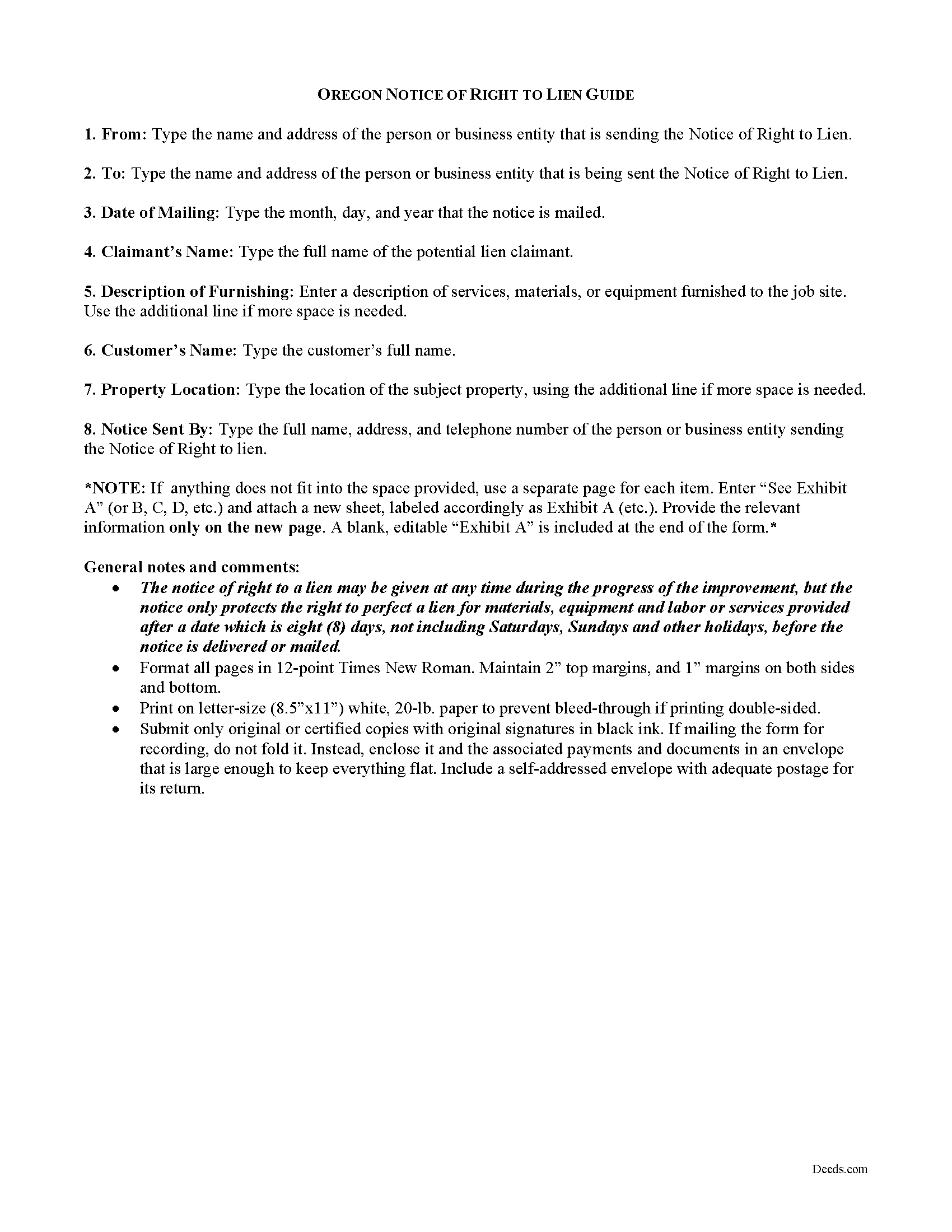

Notice of Right to Lien Guide

Line by line guide explaining every blank on the form.

Included Malheur County compliant document last validated/updated 4/7/2025

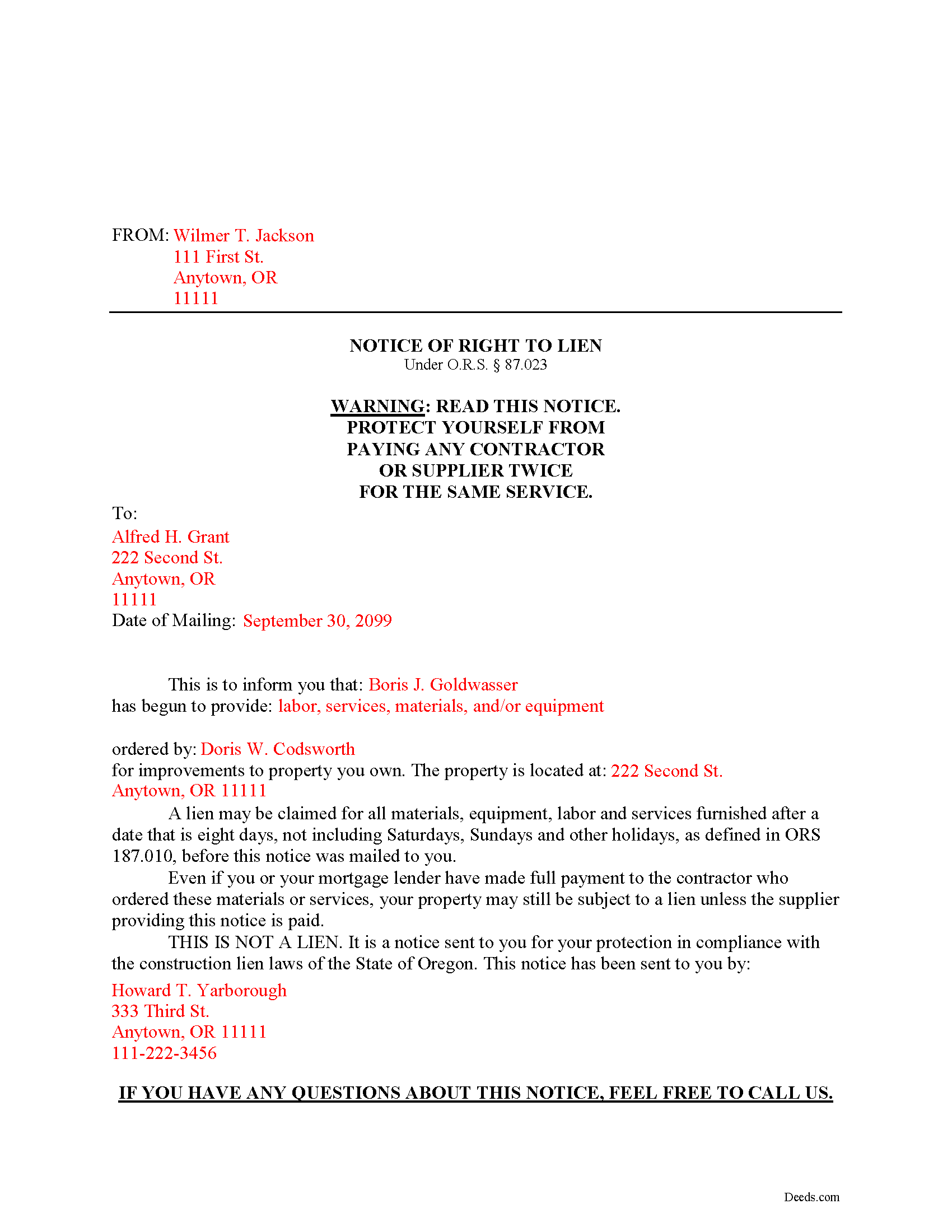

Completed Example of the Notice of Right to Lien Document

Example of a properly completed form for reference.

Included Malheur County compliant document last validated/updated 5/9/2025

The following Oregon and Malheur County supplemental forms are included as a courtesy with your order:

When using these Notice of Right to Lien forms, the subject real estate must be physically located in Malheur County. The executed documents should then be recorded in the following office:

Malheur County Clerk

251 B St W, Suite 4, Vale, Oregon 97918

Hours: 8:30 to 5:00 M-F

Phone: (541) 473-5151

Local jurisdictions located in Malheur County include:

- Adrian

- Arock

- Brogan

- Harper

- Ironside

- Jamieson

- Jordan Valley

- Juntura

- Nyssa

- Ontario

- Riverside

- Vale

- Westfall

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Malheur County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Malheur County using our eRecording service.

Are these forms guaranteed to be recordable in Malheur County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Malheur County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Right to Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Malheur County that you need to transfer you would only need to order our forms once for all of your properties in Malheur County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Malheur County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Malheur County Notice of Right to Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Preliminary Notice in Oregon -- Notice of Right to Lien

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

"Except for when material, equipment, services or labor is furnished at the request of the owner, a person furnishing any materials, equipment, services or labor for which a lien may be perfected, must give a notice of right to a lien to the owner of the site." O.R.S. 87.021(1). In Oregon, this means that contractors must send a property owner a preliminary notice if they ever intend on later filing of a mechanic's lien. Even if they don't anticipate needing a lien, it's generally good practice to send out such notices.

The notice of right to a lien may be given at any time during the work, but the notice only protects the right to perfect a lien for materials, equipment and labor or services provided after a date which is eight days, not including Saturdays, Sundays and other holidays, before the notice is delivered or mailed. Id.

The Notice includes the following information: (1) name and address of the lien claimant, (2) name and address of the property owner, (3) description of services, materials, or equipment furnished, (4) customer's name, and (5) the address where items were furnished. O.R.S. 87.023. Send the Notice by registered or certified mail with a return receipt requested, to ensure there are no issues of whether the proper party ever received it.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. Please consult an Oregon attorney with any questions about preliminary notices or any other issue related to liens.

Our Promise

The documents you receive here will meet, or exceed, the Malheur County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Malheur County Notice of Right to Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

DENNIS K.

July 22nd, 2020

I am a civil engineer, not an attorney. I deal with easements on a regular basis but not so much on the "recording" side of things. I normally prepare the graphic exhibits that accompany the dedication language but I am not the one who provides that language. Your forms solved that issue for me. Thanks.

Thank you!

Jamie P.

July 28th, 2022

The forms are easy to download. Easy to fill out. The information on the site and on the web provided by Deeds.com have been immensely helpful.

Thank you!

Brian W.

February 20th, 2025

Quick, Simple and a Ton of Time Saved...

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Robert B.

March 17th, 2021

Excellent service. Very efficient. Electronic filing was far faster and less stress than doing it in person.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David B.

May 16th, 2024

Prompt review and submission of documents could be an appropriate tagline for this business. The attention to detail and rapid response makes the company a great go to for servicing needs related to deeds.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Carol K.

October 8th, 2020

Amazing! That's all I can say. From the time I started the process to the time the deed was recorded was less than two hours! What a great, streamlined, seamless process

Thank you!

Johnnye G.

April 22nd, 2021

I appreciate being able to find the forms needed for my Gift Deed. It was simple to understand and complete. Now, if Utah will accept this form, I will be thrilled. Mailing today. It remains to be seen if it will be accepted.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara C.

September 5th, 2021

I have used these forms now at least 3 times in order to sell the same parcel of land. The forms are great and I'm happy that I could use them more than once. To no fault of Deeds.com I used them many times to sell the same land. First the man died that was buying, before it got recorded. Then his wife was going to finish it, but then decided it should be sold to another party who was a friend of hers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen G.

January 15th, 2022

Well, we are 10 days from leaving the country for months and needed to notarize and record deed changes to our rental properties. We worried about USPS, UPS, DHL, etc. and hardcopies in the County's bureaucrats' hands. Soooo, we learned of Deeds.com from the County web site via one of the bulk digital recorders telling me about Deeds.com. Hit their site, read their instructions, concluded my tiny brain and decrepit abilities could handle the chore. WITHIN AN HOUR OF UPLOADING EVERYTHING INCLUDING C.C. FOR PMT IT WAS RECORDED AND I printed out copies. WORTH the $$ in speed, convenience and PEACE of mind. Pardon the loud trumpeting.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William C.

March 31st, 2020

Excellent service. Reasonably priced. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Amy R.

January 8th, 2025

Forms I was looking for were easy to find, easy to download and accessible at any time in my account.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Muhamed H.

February 3rd, 2022

Nice!

Thank you!