Lincoln County Transfer on Death Deed Form

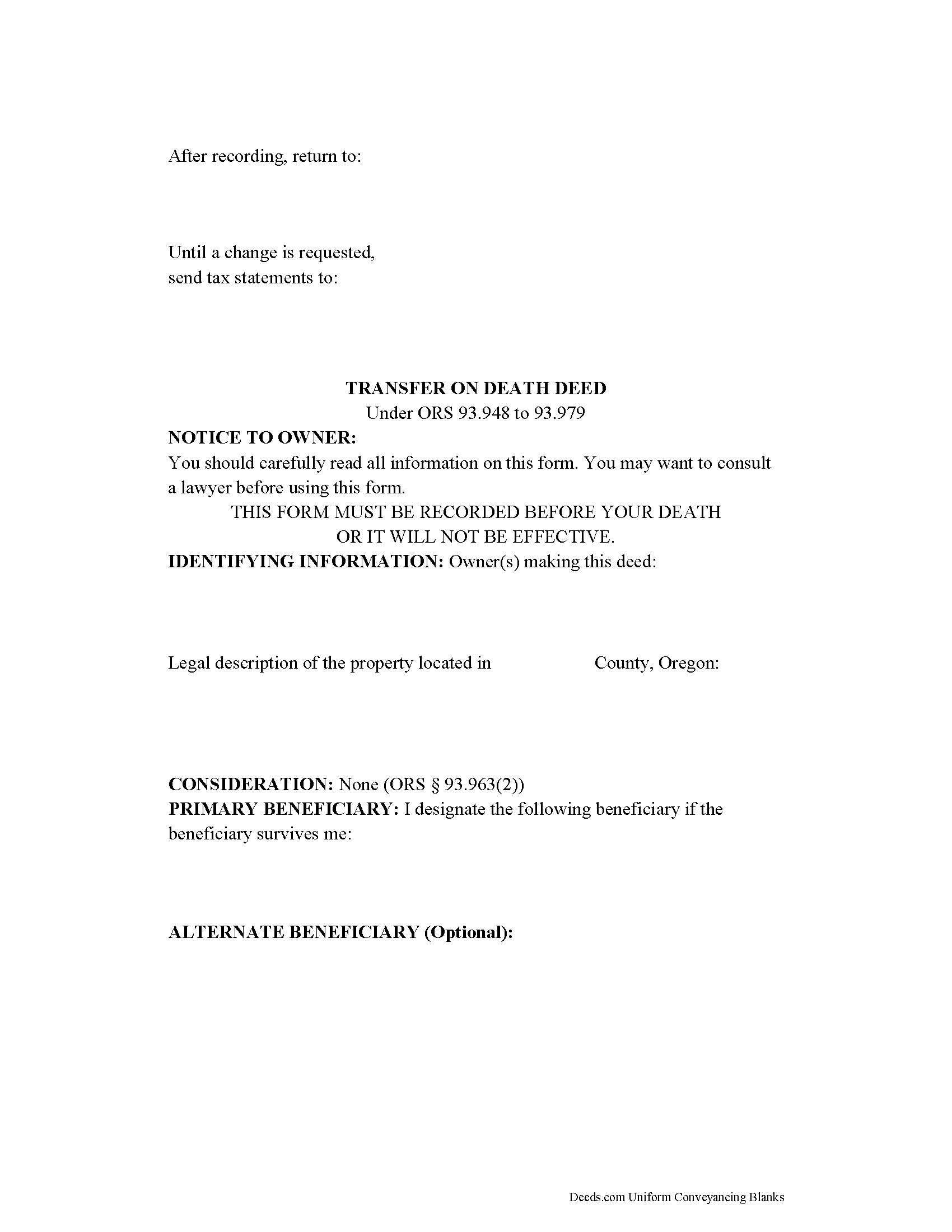

Lincoln County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

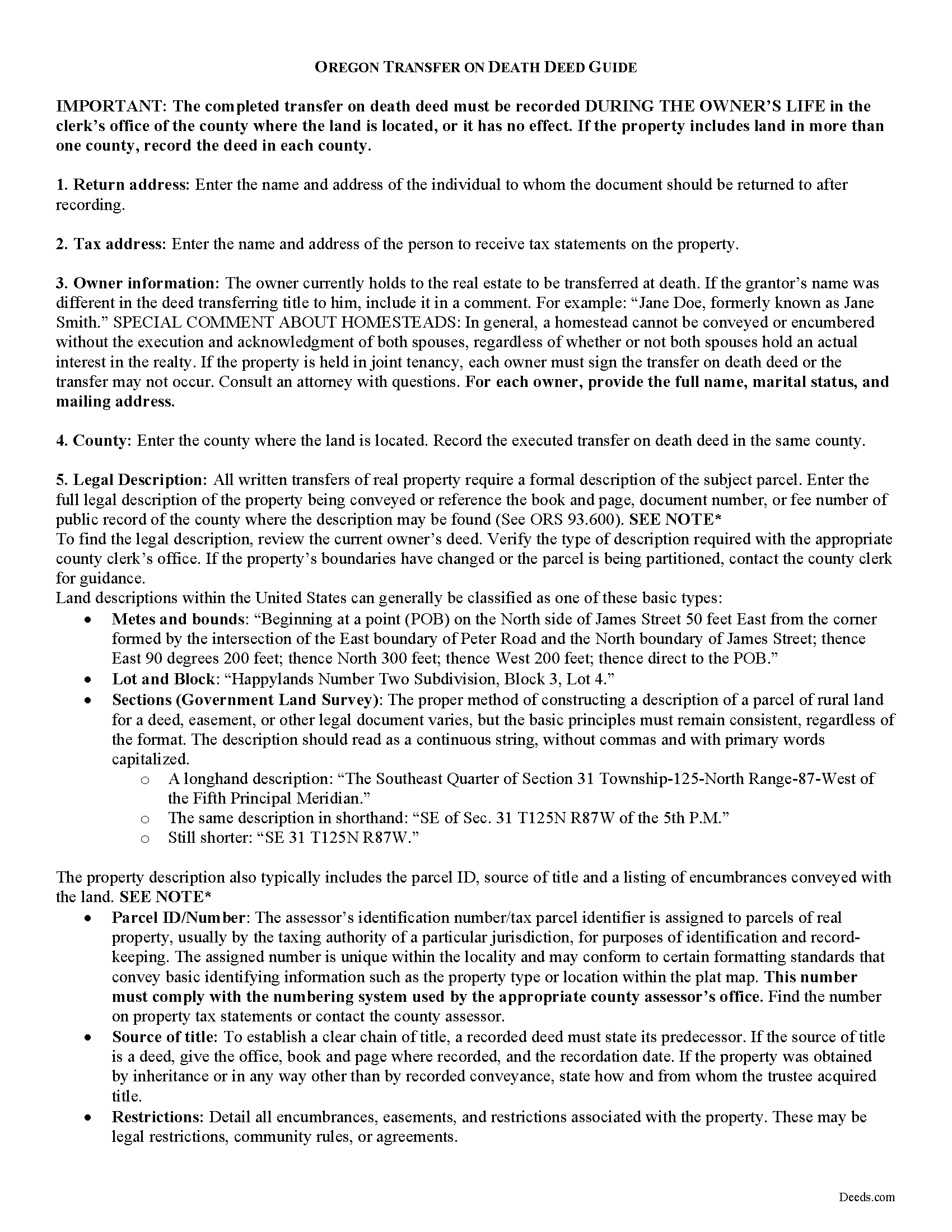

Lincoln County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

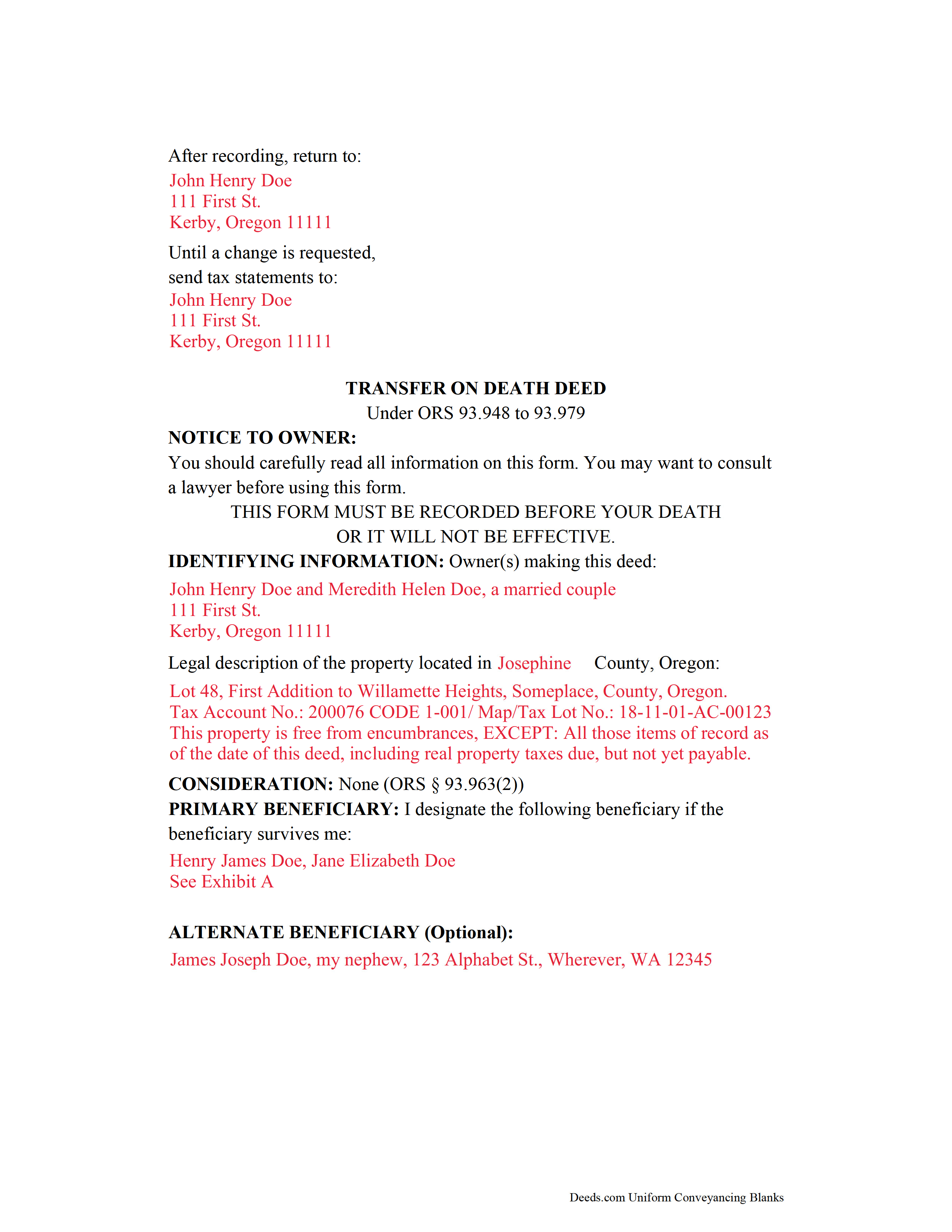

Lincoln County Completed Example of a Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk

Newport, Oregon 97365-3869

Hours: 8:30 to 5:00 M-F / Recording: 9:00 to 4:00

Phone: (541) 265-4131 or 4121

Recording Tips for Lincoln County:

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Depoe Bay

- Eddyville

- Gleneden Beach

- Lincoln City

- Logsden

- Neotsu

- Newport

- Otis

- Otter Rock

- Seal Rock

- Siletz

- South Beach

- Tidewater

- Toledo

- Waldport

- Yachats

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (541) 265-4131 or 4121 for current fees.

Questions answered? Let's get started!

Transfer on death deeds are nontestamentary ( 93.957). This means the property conveyed at death does not become part of the estate, and passes to the beneficiary without the need for probate distribution. Because TODDs deal with disposing assets after death, however, the transferor must meet the same standards for mental capacity as needed to execute a will ( 93.959).

The TODD itself must meet the requirements set forth for a "properly recordable inter vivos deed," except that it must "state that the transfer to the designated beneficiary is to occur at the transferor's death" as well as identifying the primary and alternate beneficiaries by name. Also, it must be recorded, DURING THE OWNER'S LIFE, in the county where the property is located ( 93.961).

In addition to the content requirements, standard (inter vivos) deeds generally transfer a permanent present interest to the grantee (buyer). In the most basic terms, this means that once the deed is executed and recorded, the grantee owns the property. Unlike an inter vivos deed, though, TODDs do not require notice, delivery, acceptance, or consideration ( 93.963). By recording the TODD, the owner declares an intention to convey a potential future interest in the land described in the deed. Since the obligations in favor of the beneficiary (grantee) do not apply, TODDs are revocable.

Land owners who record TODDs retain absolute control over and use of the property while they are living. They may sell, mortgage, or otherwise convey the real estate with no penalty, and no obligation to notify the beneficiary. Transferors may also change, revoke, or otherwise modify the terms of the original transfer on death deed by executing and recording a revocation form; a new TODD with different beneficiary information; or an inter vivos deed transferring the owner's interest to someone else ( 93.965).

Just as some owners may wish to change or revoke a beneficiary designation, some beneficiaries are unable or unwilling to accept the transfer after the owner's death. To address this need, beneficiaries may disclaim the interest in land by following a statutory procedure( 93.971).

Ultimately, TODDs offer a handy, flexible estate planning tool to owners of Oregon real property. Before deciding to use a TODD, consider its potential impact on taxes, access, and eligibility for income-and/or-asset-based benefits. Each situation is unique, so for complex circumstances or with additional questions, contact a local attorney.

Important terms:

Inter vivos: "between the living" Inter vivos deeds, such as warranty deeds or quitclaim deeds, transfer a permanent, present interest in real property during the conveyor's life.

Nontestamentary: After-death plans not included in or affected by the deceased person's will.

Probate: Court-supervised administration of a deceased person's estate.

(Oregon TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiffani D.

February 25th, 2020

The website was very user-friendly. I am glad it was available!

Thank you!

Donald C.

February 22nd, 2019

No review provided.

Thank you!

Stacie S.

June 26th, 2020

This process was very simple once I got the form right! I would definitely utilize this system in the future if I needed to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra P.

July 25th, 2020

Thank so much! It' was pretty easy with the help of my Brother in-law .

Thank you for your feedback. We really appreciate it. Have a great day!

Craig H.

August 18th, 2022

Awesome service! It was so quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

Sue D.

November 28th, 2019

Great program

Thank you!

David N.

August 29th, 2020

It worked well for me. Now I need the actual lien form

Thank you!

Brenda A.

April 22nd, 2020

This company and it's customer service ARE wonderful. GREAT tool to assist you with any situation you may have. I HAVE RECOMMENDED THEM TO MY FRIENDS AND FAMILY.

Thank you!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

Stanley C.

September 11th, 2019

Amazingly simple, easy to download and use. Excellent service, Thank You

Thank you!

Djala C.

November 18th, 2019

my experience was excellent.

Thank you!

Joice W G.

May 5th, 2019

Easy to use and able to individualize, which was important since I needed to print more than one doc. I just wish I had an option for a less expensive purchase - seemed like a lot for just a couple docs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!