Baker County Trust Deed and Promissory Note Form (Oregon)

All Baker County specific forms and documents listed below are included in your immediate download package:

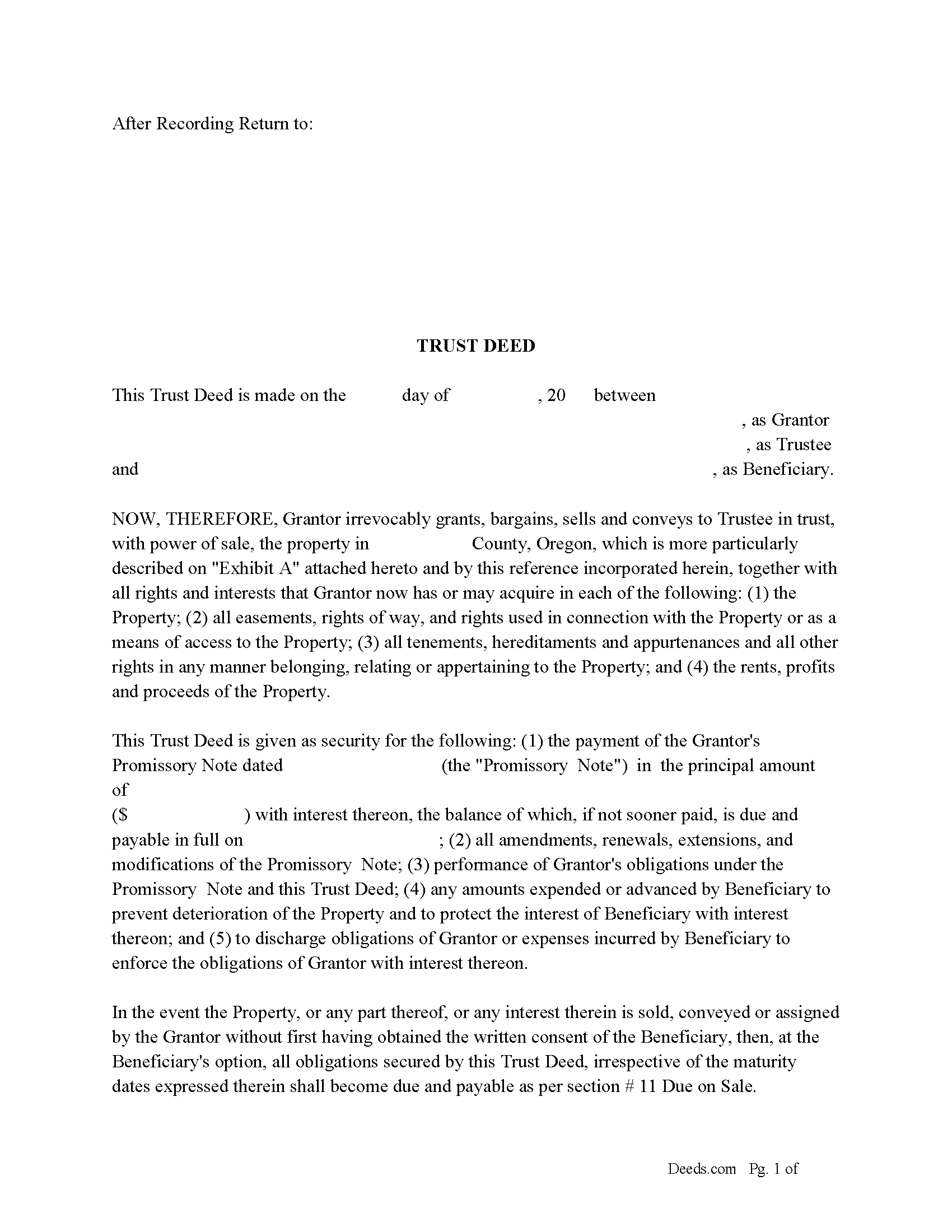

Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Baker County compliant document last validated/updated 4/3/2025

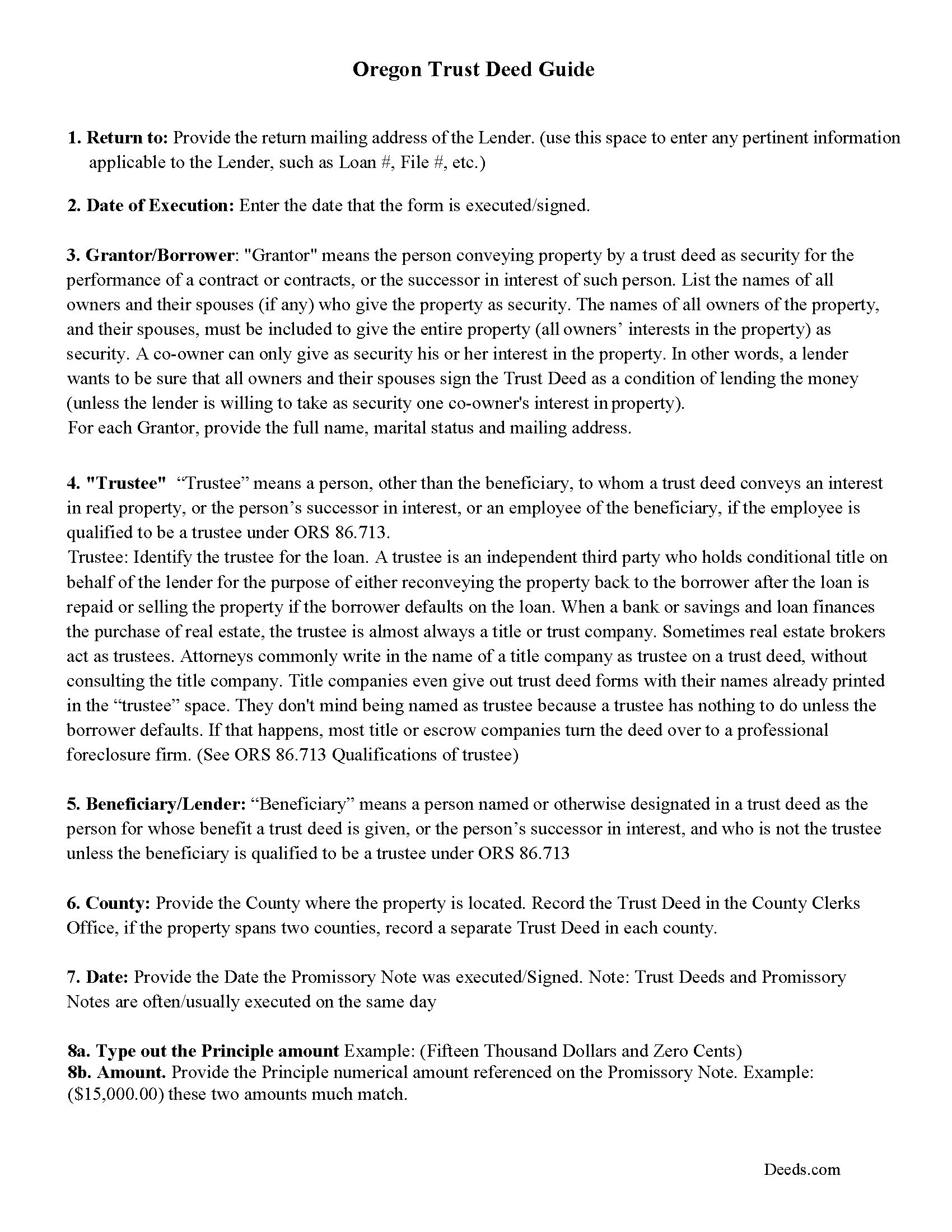

Trust Deed Guidelines

Line by line guide explaining every blank on the form.

Included Baker County compliant document last validated/updated 6/2/2025

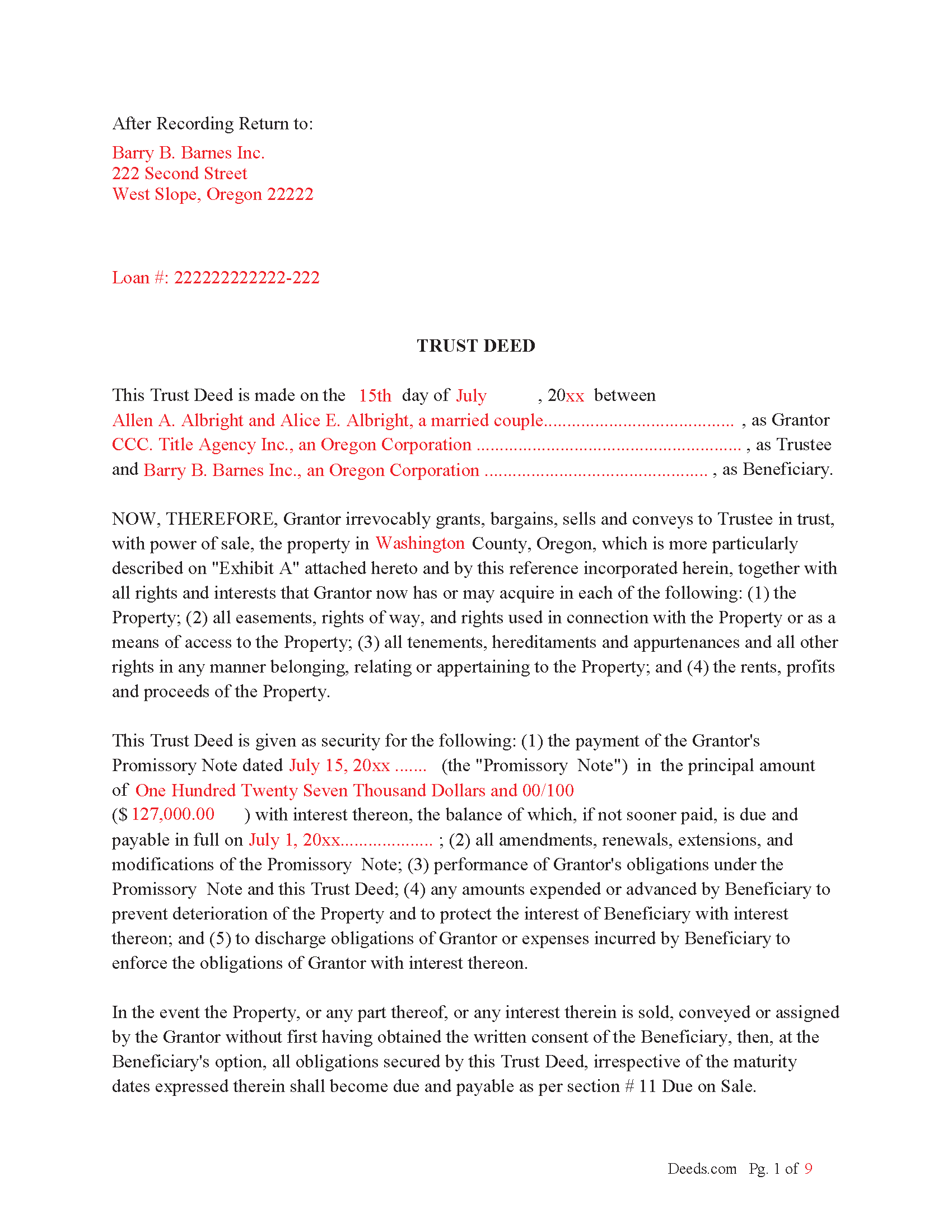

Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

Included Baker County compliant document last validated/updated 7/11/2025

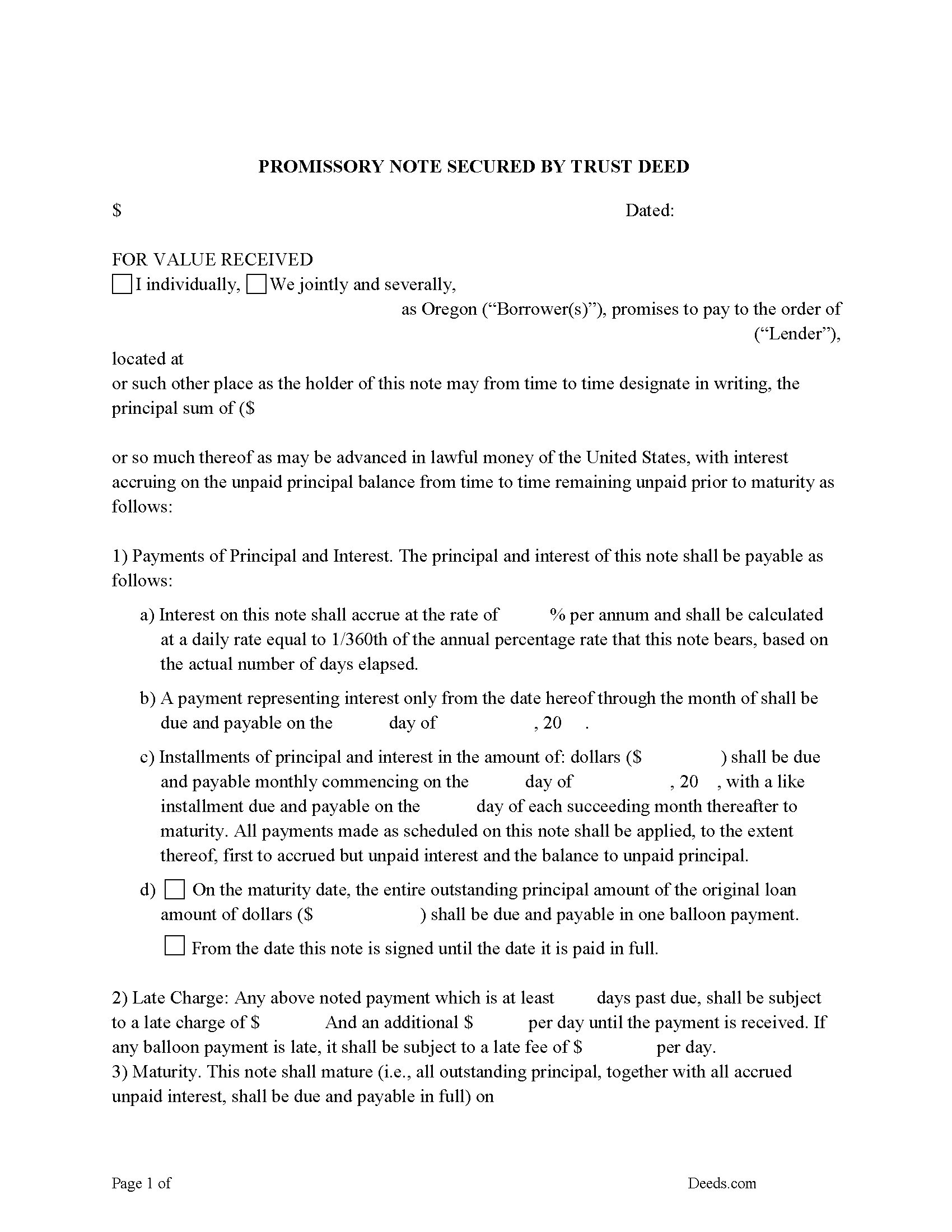

Promissory Note Form

Promissory Note secured by Trust Deed.

Included Baker County compliant document last validated/updated 7/11/2025

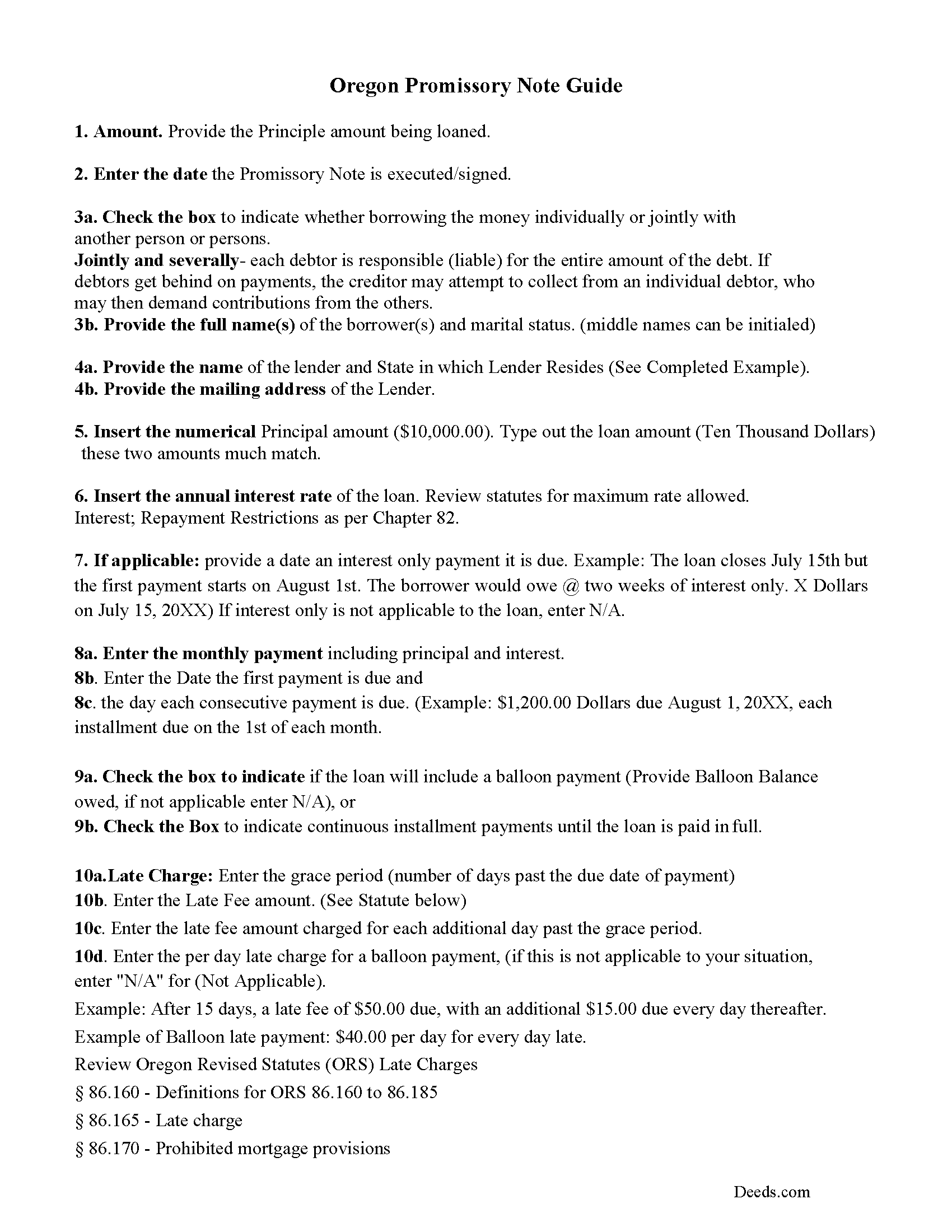

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Baker County compliant document last validated/updated 3/18/2025

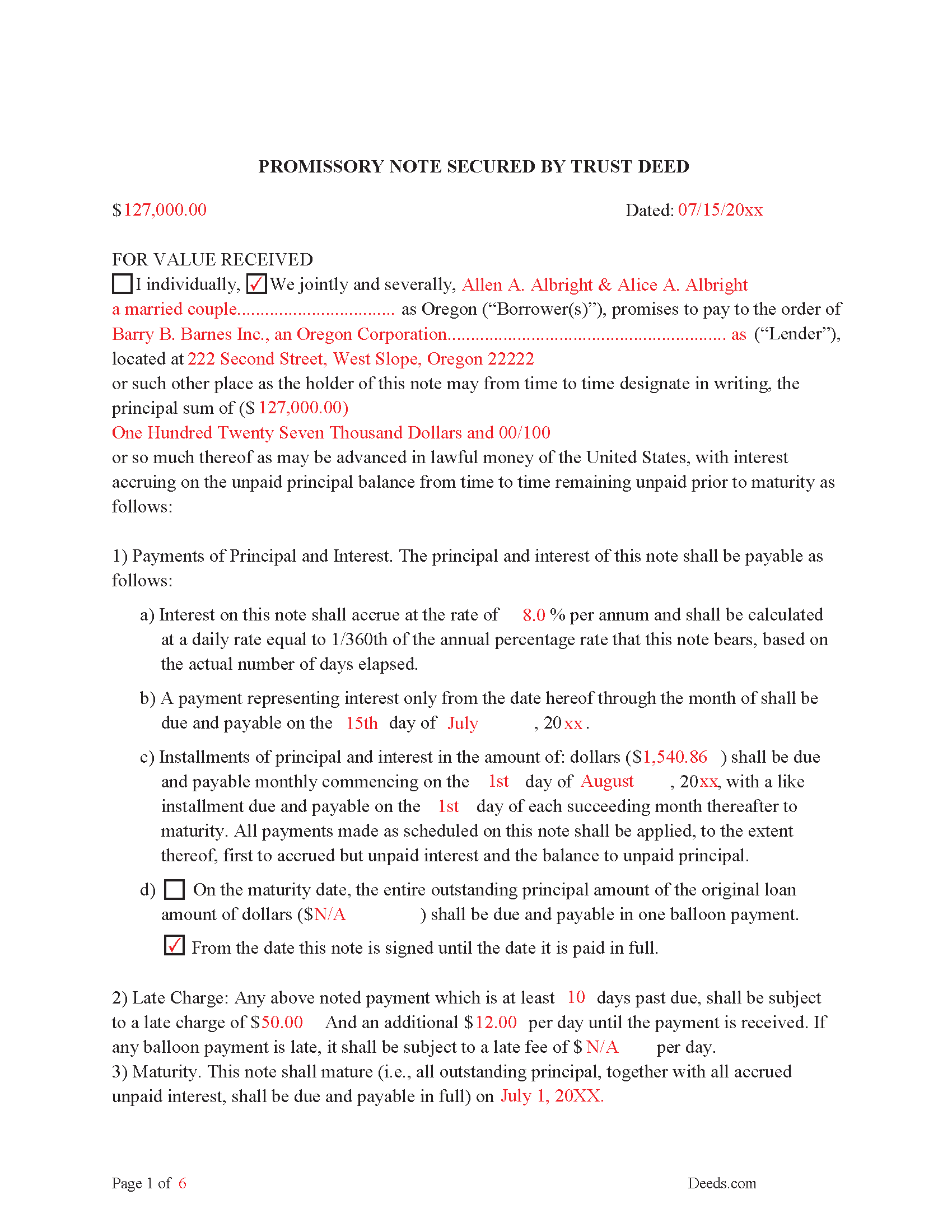

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Baker County compliant document last validated/updated 6/25/2025

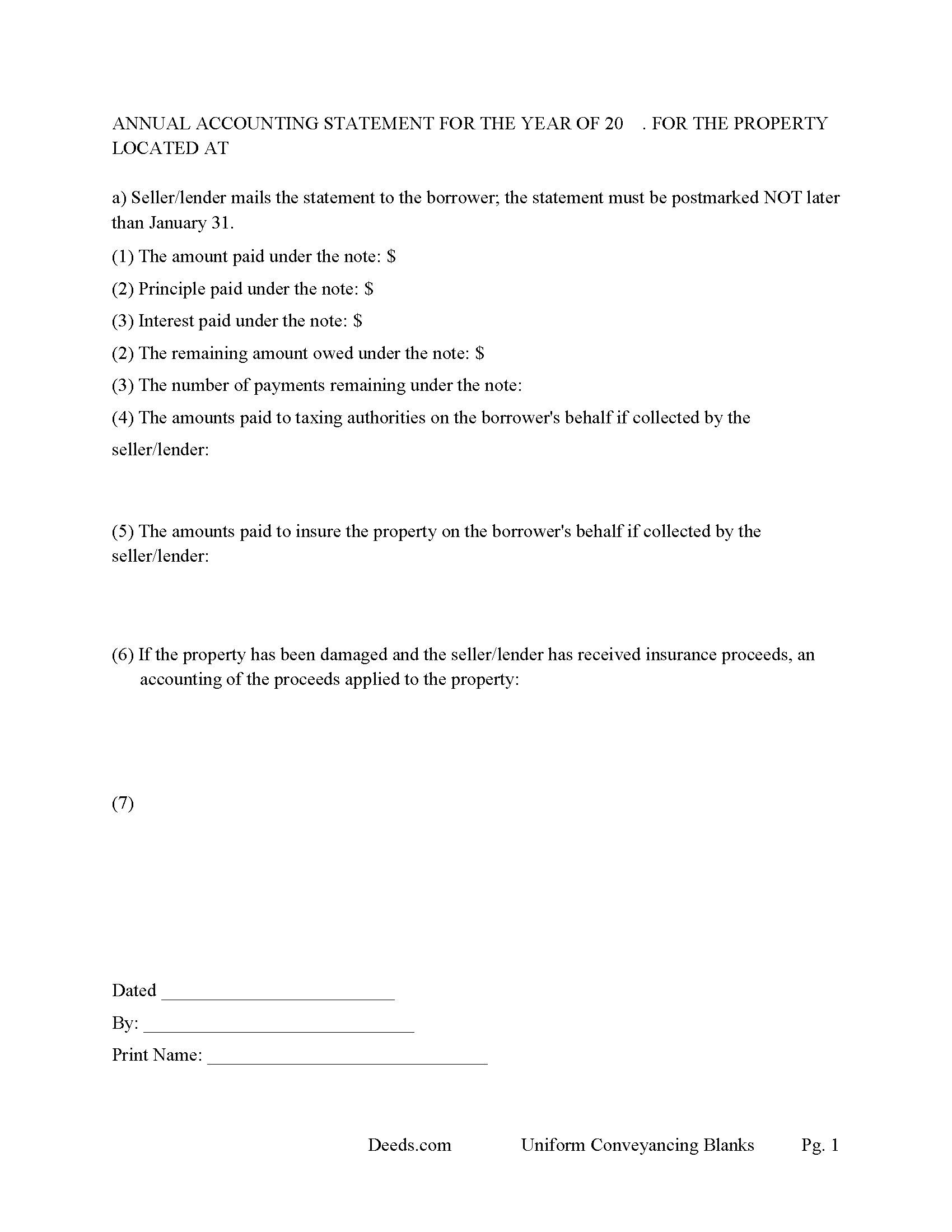

Annual Accounting Statement Form

Lender sends to borrower for fiscal year reporting.

Included Baker County compliant document last validated/updated 2/6/2025

The following Oregon and Baker County supplemental forms are included as a courtesy with your order:

When using these Trust Deed and Promissory Note forms, the subject real estate must be physically located in Baker County. The executed documents should then be recorded in the following office:

Baker County Clerk

1995 Third St, Suite 150, Baker City, Oregon 97814

Hours: 8:00am to 4:30pm.M-F

Phone: (541) 523-8207

Local jurisdictions located in Baker County include:

- Baker City

- Bridgeport

- Durkee

- Haines

- Halfway

- Hereford

- Huntington

- Oxbow

- Richland

- Sumpter

- Unity

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Baker County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Baker County using our eRecording service.

Are these forms guaranteed to be recordable in Baker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Baker County including margin requirements, content requirements, font and font size requirements.

Can the Trust Deed and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Baker County that you need to transfer you would only need to order our forms once for all of your properties in Baker County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Baker County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Baker County Trust Deed and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

There are three parties in a Trust Deed in which the Grantor/Borrower (conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Grantor" means the person that conveys an interest in real property by a trust deed as security for the performance of an obligation.) ( ORS 86.705(4))

("Beneficiary")/ Lender (means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713) ( ORS 86.705(2))

("Trustee" means a person, other than the beneficiary, to whom a trust deed conveys an interest in real property, or the person's successor in interest, or an employee of the beneficiary, if the employee is qualified to be a trustee under ORS 86.713) ( ORS 86.705(9)) The guidelines provided explain how to easily choose a trustee.

Trust Deeds are considered advantageous for lenders, foreclosure is done non-judicially (saving time and expense), the process is called "Foreclosure by Advertisement and Sale" defined in ORS 86.735. If the Grantor/Borrower defaults the Beneficiary/Lender can choose to have the Trustee foreclose on the Trust Deed.

This Trust Deed and Promissory Note contain strong default terms. Use these forms for residential property, rental property (up to 4 units), vacant land, condominiums, and planned unit developments.

(Oregon TD Package includes forms, guidelines, and completed examples) For use in Oregon only.

Our Promise

The documents you receive here will meet, or exceed, the Baker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Baker County Trust Deed and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Camille L.

January 20th, 2022

very user friendly!

Thank you!

Karin H.

September 18th, 2021

Awesome same-day service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

XIN Y.

June 14th, 2022

Great e-Recording service. Fast and convenient! All done in the comfort of my home. Love it!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly H.

December 17th, 2021

Exceptional Service all Year~

I wish Deeds.com A Happy Holidays & A Happy New Year.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Diane P.

July 22nd, 2022

Form was very easy to use and was processed/ recorded with no issue. Thank you it saved me from having to contact an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

linda l.

August 10th, 2020

I was very impressed with the Mineral Deed form, especially with the instructions to fill it out AND a copy of a completed for to compare against. This definitely saved me money for an attorney.

The one thing I don't understand, though, is why I could not save the completed Deed to my hard drive. I did have to change a few things after the fact and I had to re-type the entire page to make the corrections.

If not for this, I would definitely rate the forms and instructions as a 5 star.

Thank you for your feedback. We really appreciate it. Have a great day!

walter m.

March 17th, 2019

directions and getting to forms, printing good, but I wish it could be more simply and clearly presented. We'll see how it finally works out

Thank you for your feedback. We really appreciate it. Have a great day!

Koko H.

July 12th, 2019

Five star. Prompt and easy way to obtain information. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

anthony r.

November 19th, 2020

Fast and easy

Thank you!

Mary H.

June 15th, 2020

I have downloaded all the forms and the guidelines. The information provided is very helpful and easy to access.

Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

August 30th, 2022

Just what I needed to help clear ownership of what has been deeded to be by inheritance

We appreciate your business and value your feedback. Thank you. Have a wonderful day!