Carbon County Certificate of Trust Form (Pennsylvania)

All Carbon County specific forms and documents listed below are included in your immediate download package:

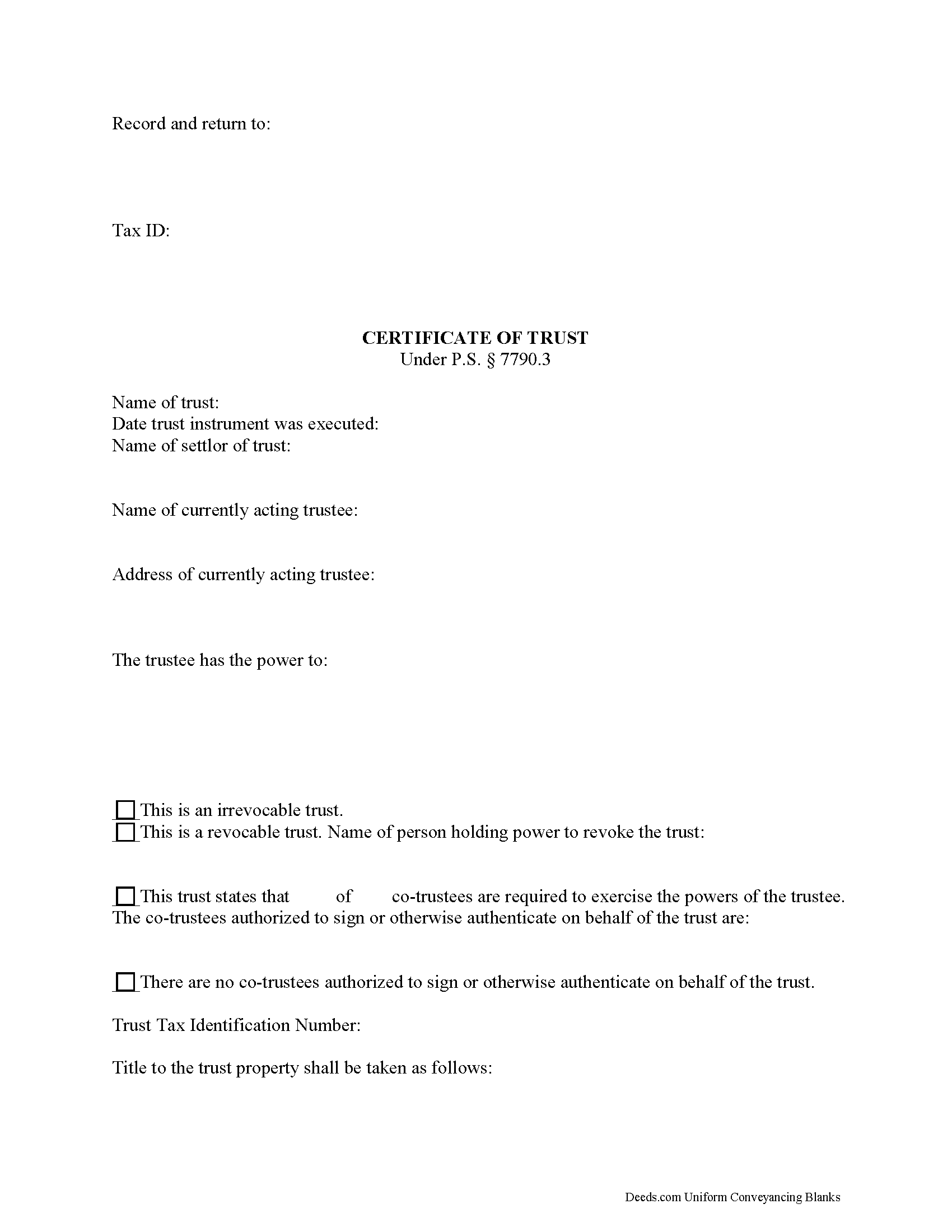

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carbon County compliant document last validated/updated 5/30/2025

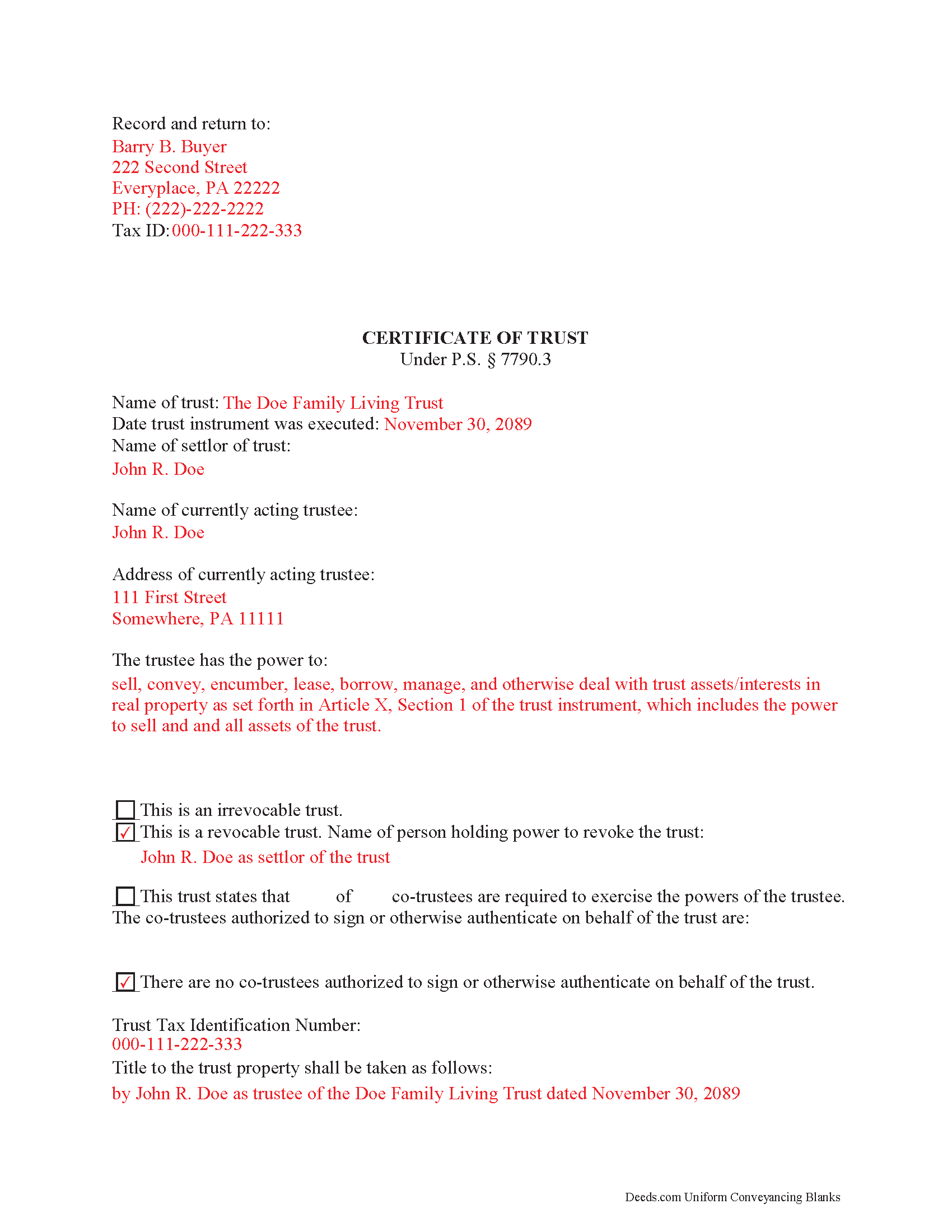

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Carbon County compliant document last validated/updated 6/3/2025

The following Pennsylvania and Carbon County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Carbon County. The executed documents should then be recorded in the following office:

Recorder of Deeds - Courthouse Annex

2 Hazard Square / PO Box 89, Jim Thorpe, Pennsylvania 18229

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (570) 325-2651

Local jurisdictions located in Carbon County include:

- Albrightsville

- Aquashicola

- Ashfield

- Beaver Meadows

- Bowmanstown

- Jim Thorpe

- Junedale

- Lake Harmony

- Lansford

- Lehighton

- Nesquehoning

- Palmerton

- Parryville

- Summit Hill

- Tresckow

- Weatherly

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carbon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carbon County using our eRecording service.

Are these forms guaranteed to be recordable in Carbon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carbon County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carbon County that you need to transfer you would only need to order our forms once for all of your properties in Carbon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Carbon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carbon County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Find the laws regarding certificates of trust at section 7790.3 of the Pennsylvania Statutes.

A trustee is a person or entity who holds title to a trust's assets on behalf of a settlor. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm their authority to act on its behalf.

In order to facilitate transactions dealing with real property in a trust, lenders may require the trustee to furnish a certificate of trust. Third parties may also request a certificate to confirm the trustee has the authority, for example, to transfer real property out of the trust and to them.

The certificate presents essential information about the (unrecorded) full trust instrument, while protecting the confidentiality of its specific details. A recipient of a certificate may still request copies of certain sections of the trust instrument, particularly those establishing the appointment of a trustee and the trustee's powers, as well as amendments to the trust, but the request opens up certain liabilities, as enumerated in P.S. 7790.3(e),(h).

Section 7790.3 governs the contents and effect of the certificate. Requirements of the certificate include basic information such as the name of the settlor of the trust, the type of trust, the taxpayer identification number assigned to the trust, the acting trustee's name, and the relevant powers of the trustee. The trustee executes and signs the certificate and submits it for recording in the county in which the real property with which the trust is concerned is located.

(Pennsylvania COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Carbon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carbon County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

April M.

May 1st, 2020

It was a very easy and quick site to use. Not to big of a fan price wise. But it gave me what I needed in a hurry. So all and all I'd definitely use this site again. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

Timothy P.

February 2nd, 2019

Straightforward, easy to navigate, saves time and gas = a real value for the price!

Thank you for your feedback. We really appreciate it. Have a great day!

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

Jason B.

July 19th, 2022

KVH provided excellent customer service (great communication was provided). I would differently use this service if needed in the further.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James H.

January 14th, 2020

Very satisfied. Download was easy, completing the form was easy, got our signatures notarized and submitted it to the register of deeds.

The only item was that the register of deeds did not immediately recognize the TOD deed form as the usual form they receive. After carefully reviewing all the information and wording on the deed she accepted it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barry B.

November 19th, 2020

I was very impressed on how simple the process was to record the documents I needed recorded. Thank you for all of your help.

Thank you!

Nathan M.

April 6th, 2020

It had the info, but when I would type into the document the items I needed in adobe all that would print out was the info I typed and none of the document information.

Thank you!

Charles D.

November 17th, 2020

Very easy to download, very easy to use. Good examples to answer questions.

Thank you!

Robert B.

September 28th, 2021

Excellent service. Unbelievably rapid and detailed responses. Was not happy to have to pay the fee but totally worth it.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy W.

April 29th, 2020

It's fine

Thank you!