Wayne County Certificate of Trust Form (Pennsylvania)

All Wayne County specific forms and documents listed below are included in your immediate download package:

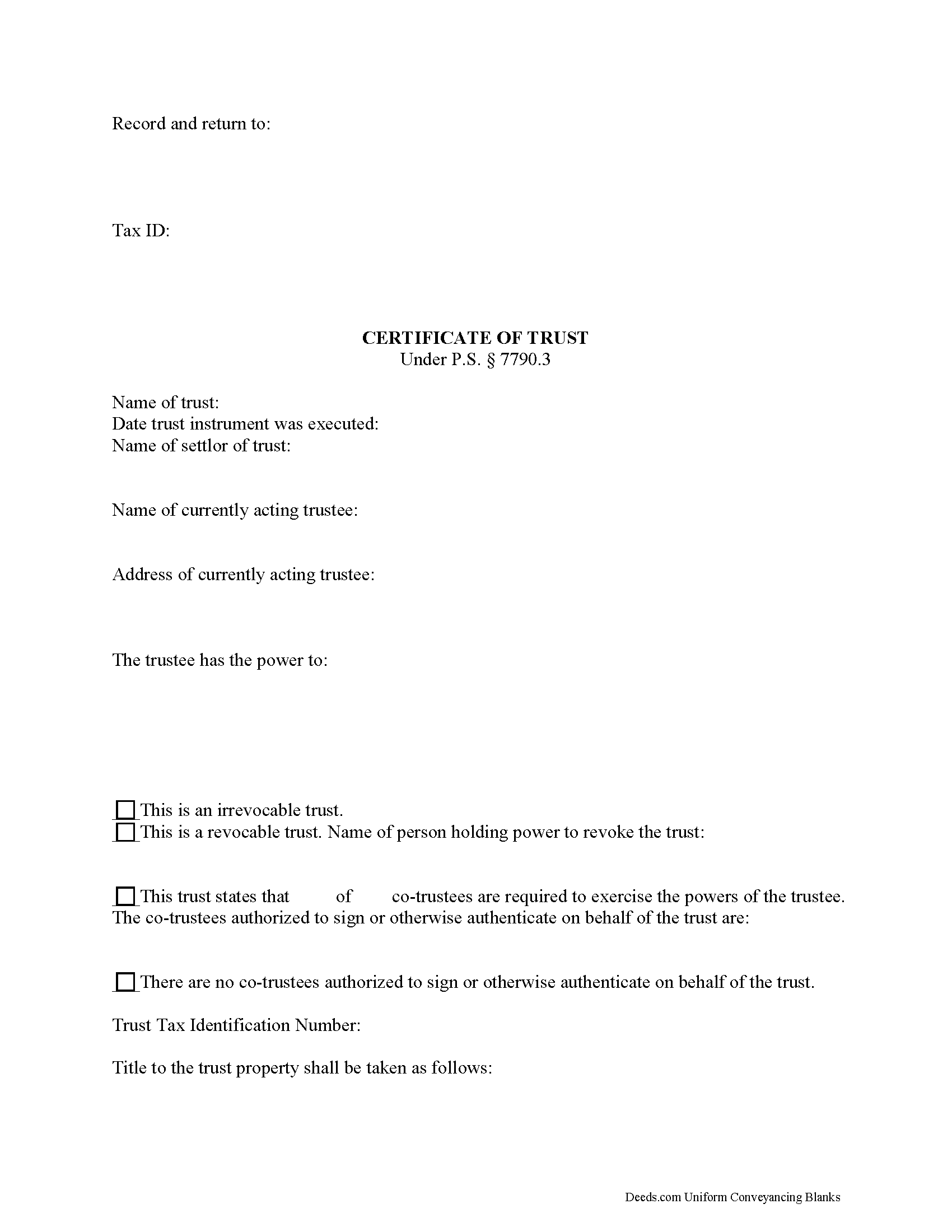

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wayne County compliant document last validated/updated 5/30/2025

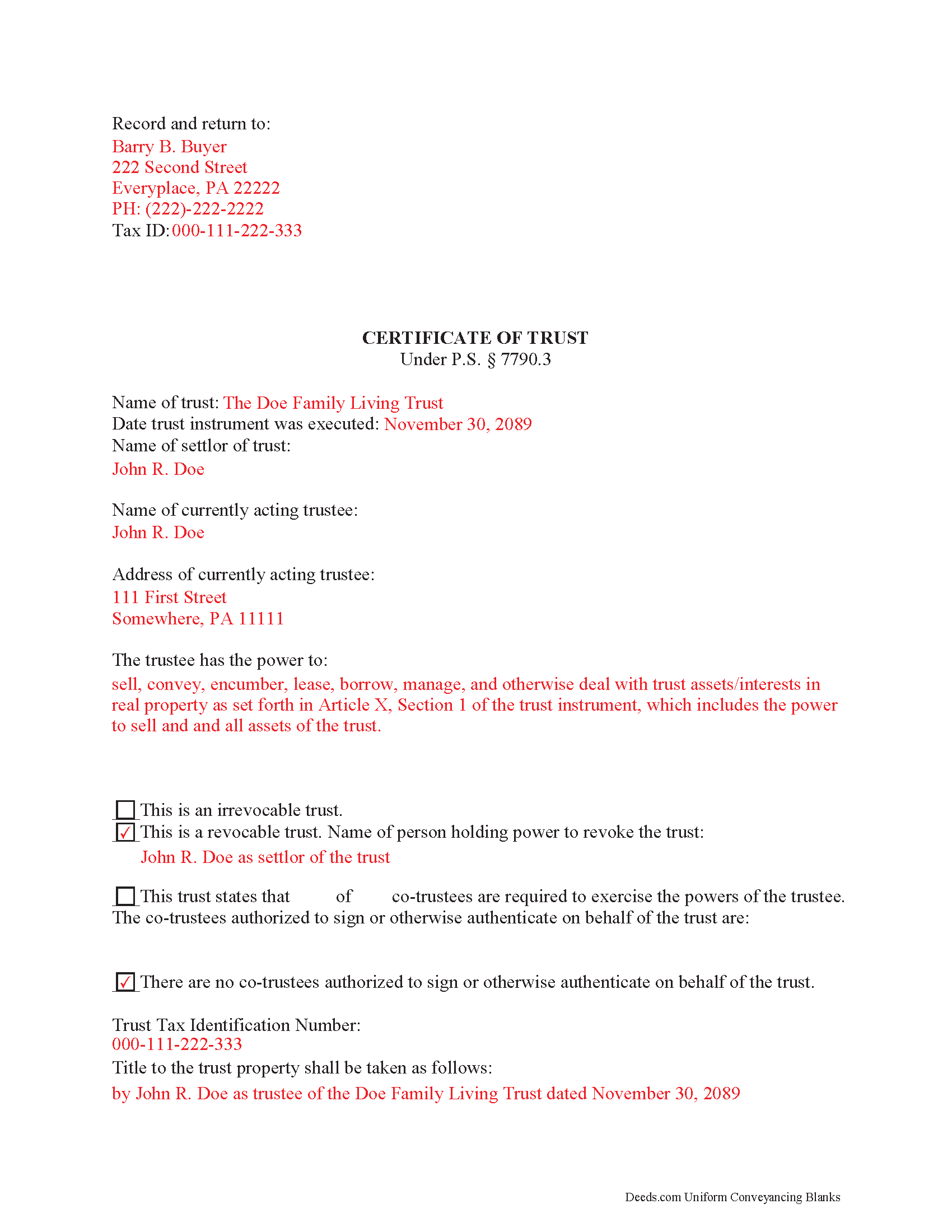

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Wayne County compliant document last validated/updated 6/3/2025

The following Pennsylvania and Wayne County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Wayne County. The executed documents should then be recorded in the following office:

Wayne County Recorder of Deeds

925 Court St, Honesdale, Pennsylvania 18431

Hours: 8:30 to 4:30 Monday through Friday, however no papers will be accepted for recording after 4:00 PM.

Phone: (570) 253-5970 Ext. 4040

Local jurisdictions located in Wayne County include:

- Beach Lake

- Damascus

- Equinunk

- Gouldsboro

- Hamlin

- Honesdale

- Lake Ariel

- Lake Como

- Lakeville

- Lakewood

- Milanville

- Newfoundland

- Orson

- Pleasant Mount

- Poyntelle

- Preston Park

- Prompton

- South Canaan

- South Sterling

- Starlight

- Starrucca

- Sterling

- Tyler Hill

- Waymart

- White Mills

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wayne County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wayne County using our eRecording service.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wayne County that you need to transfer you would only need to order our forms once for all of your properties in Wayne County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Wayne County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wayne County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Find the laws regarding certificates of trust at section 7790.3 of the Pennsylvania Statutes.

A trustee is a person or entity who holds title to a trust's assets on behalf of a settlor. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm their authority to act on its behalf.

In order to facilitate transactions dealing with real property in a trust, lenders may require the trustee to furnish a certificate of trust. Third parties may also request a certificate to confirm the trustee has the authority, for example, to transfer real property out of the trust and to them.

The certificate presents essential information about the (unrecorded) full trust instrument, while protecting the confidentiality of its specific details. A recipient of a certificate may still request copies of certain sections of the trust instrument, particularly those establishing the appointment of a trustee and the trustee's powers, as well as amendments to the trust, but the request opens up certain liabilities, as enumerated in P.S. 7790.3(e),(h).

Section 7790.3 governs the contents and effect of the certificate. Requirements of the certificate include basic information such as the name of the settlor of the trust, the type of trust, the taxpayer identification number assigned to the trust, the acting trustee's name, and the relevant powers of the trustee. The trustee executes and signs the certificate and submits it for recording in the county in which the real property with which the trust is concerned is located.

(Pennsylvania COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah C.

April 30th, 2022

I just printed out my documents and they are so helpful. Now I will sit and fill out my documents and submit them to the PG County deed Office.

Thanks for having this infomation online.

Regards,

Thank you!

Teresa H.

March 14th, 2019

I loved that there was a sample with the downloads. It made it much easier to fill out the document correctly.

Thank you Teresa, have a great day!

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia J.

September 17th, 2020

Easy quick process to download at a reasonable price. Some good info provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia H.

October 15th, 2020

The process was so easy and result was excellent and expedient. I will definitely recommend your company for future recording needs.

Thank you!

Kenneth D.

July 23rd, 2023

I was very pleased with the service and the product. All the extras were a nice addition to my order. With the example and instructions, I was able to fill out my correction deed correctly. I filed it and it was accepted with zero reservations by my clerk and recorder's office. The expected result (which was to remove a name from the current deed) happened almost immediately. I definitely recommend deeds.com .

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karin G.

January 28th, 2021

All went well. Forms easy to download and instructions were super. Very pleased with the service.

Thank you!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda M.

December 26th, 2018

It was quick and easy to obtain the document I needed

Thanks so much for your feedback Brenda, we really appreciate it. Have a great day!

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. rnThank you.

We are delighted to have been of service. Thank you for the positive review!