Download Pennsylvania Unconditional Lien Waiver on Final Payment Legal Forms

Pennsylvania Unconditional Lien Waiver on Final Payment Overview

In Pennsylvania, a contractor or subcontractor may waive his right to file a claim against residential property by a written instrument signed by him or by any conduct which operates equitably to estop such contractor from filing a claim. 49 P.S. 401(a).

Contractors use lien waivers to forfeit or give up their right to claim a mechanic's lien. Usually, the purpose of a waiver is to alleviate concerns by a property owner or other contractor that a lien will be levied on the property. In return for waiving lien rights, the owner or other party makes a full or partial payment. The type of waiver used depends on the type of payment made.

Use a conditional waiver when payment hasn't been made at the time of the waiver or the payment method takes time to clear (such as a check or bank draft). Unconditional waivers are appropriate when a full or final payment has been made and evidence of the payment can be verified. Within each of these two categories, waivers can be granted for a full payment or a partial (or progress) payment.

In regard to subcontractors, a waiver by a subcontractor of lien rights is against public policy, unlawful and void, unless given in consideration for payment for the work, services, materials or equipment provided and only to the extent that such payment is actually received, or unless the contractor has posted a bond guaranteeing payment for labor and materials provided by subcontractors. 49 P.S. 401(c).

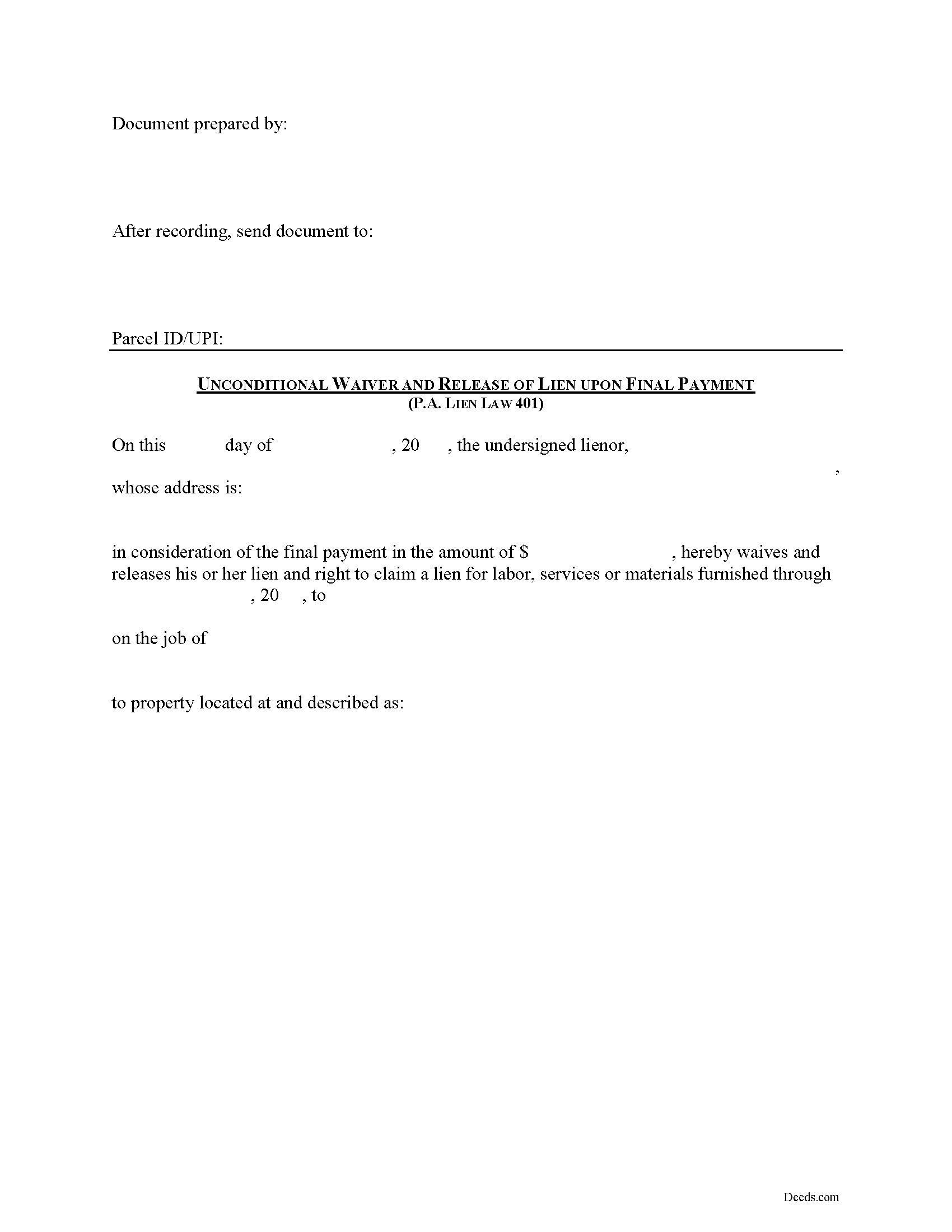

Use the Unconditional Waiver and Release of Lien on Final Payment when a final payment is made for the amount due and in return for the payment, the contractor agrees to waive a lien right towards the final amount. Because the waiver is unconditional, it should only be used when the final payment has been made and after verification of such payment.

A valid waiver identifies the parties, the location where the work or improvement took place, relevant dates, and amounts paid. In addition, the form must meet state and local standards for recorded documents. Submit the completed waiver to the recording office for the county where the property is situated.

Mechanic's Liens are governed by Title 49 of the Pennsylvania Consolidated Statutes.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Pennsylvania attorney familiar with lien laws for questions regarding lien waivers or any other issues with mechanic's liens.