Potter County Unconditional Lien Waiver on Progress Payment Form (Pennsylvania)

All Potter County specific forms and documents listed below are included in your immediate download package:

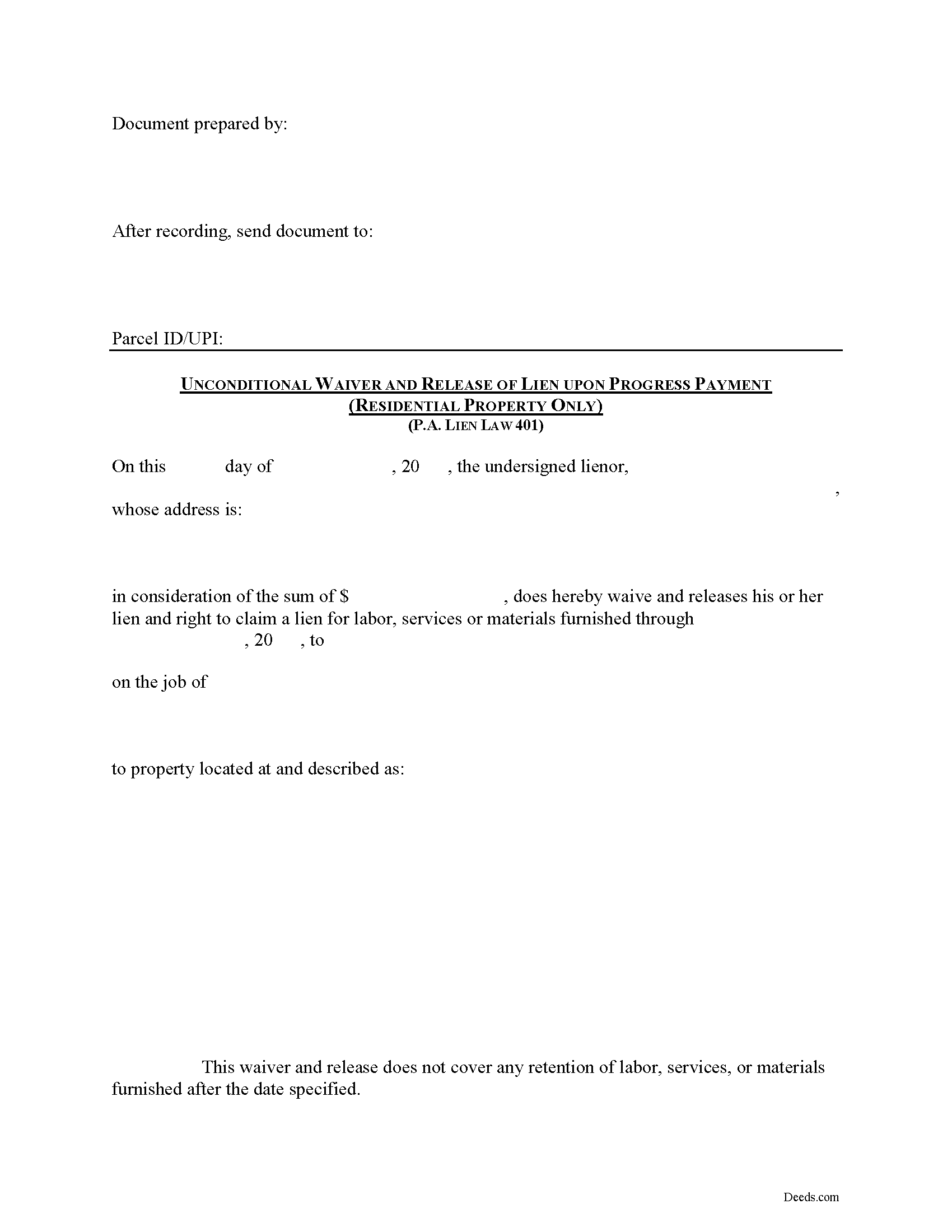

Unconditional Lien Waiver on Progress Payment Form

Fill in the blank Unconditional Lien Waiver on Progress Payment form formatted to comply with all Pennsylvania recording and content requirements.

Included Potter County compliant document last validated/updated 6/12/2025

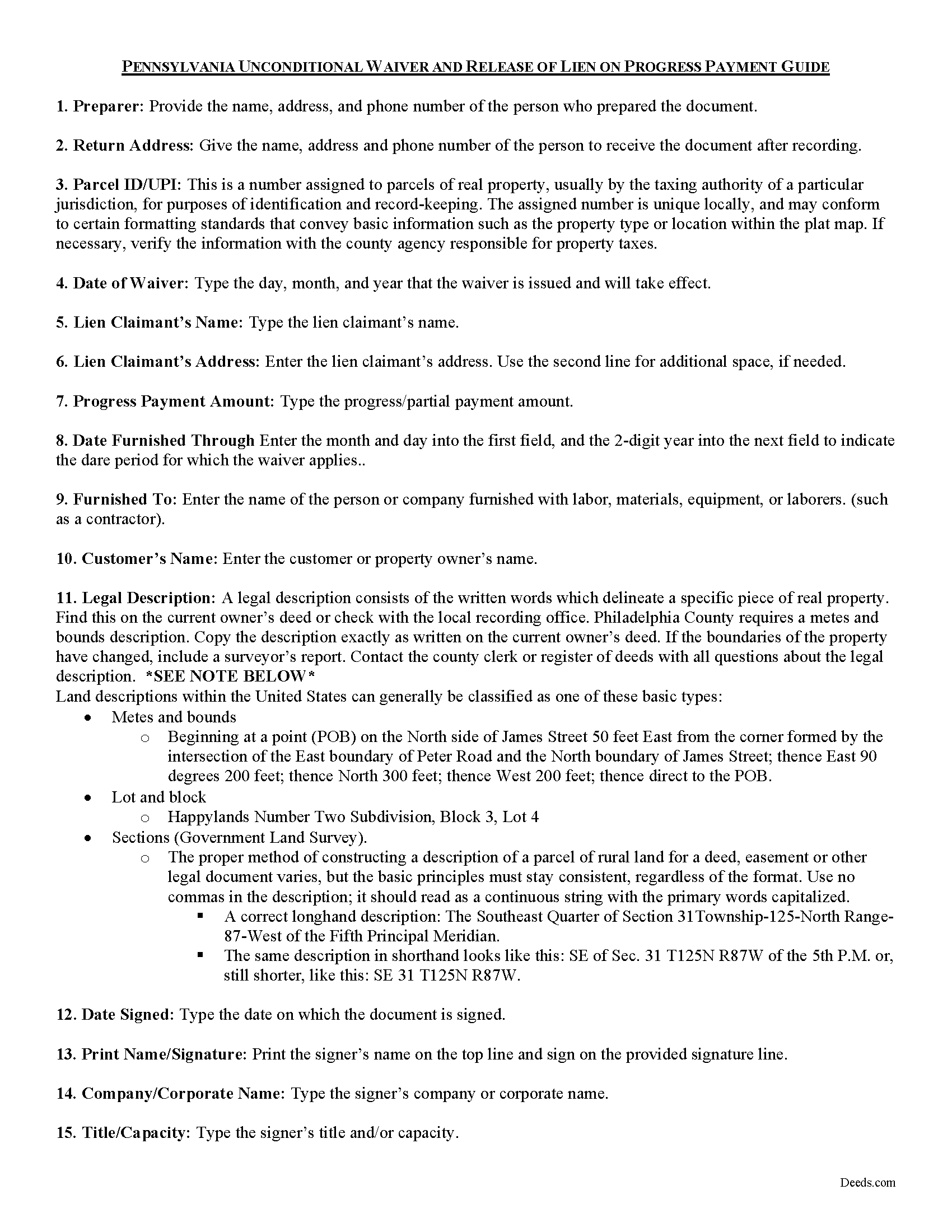

Unconditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

Included Potter County compliant document last validated/updated 6/24/2025

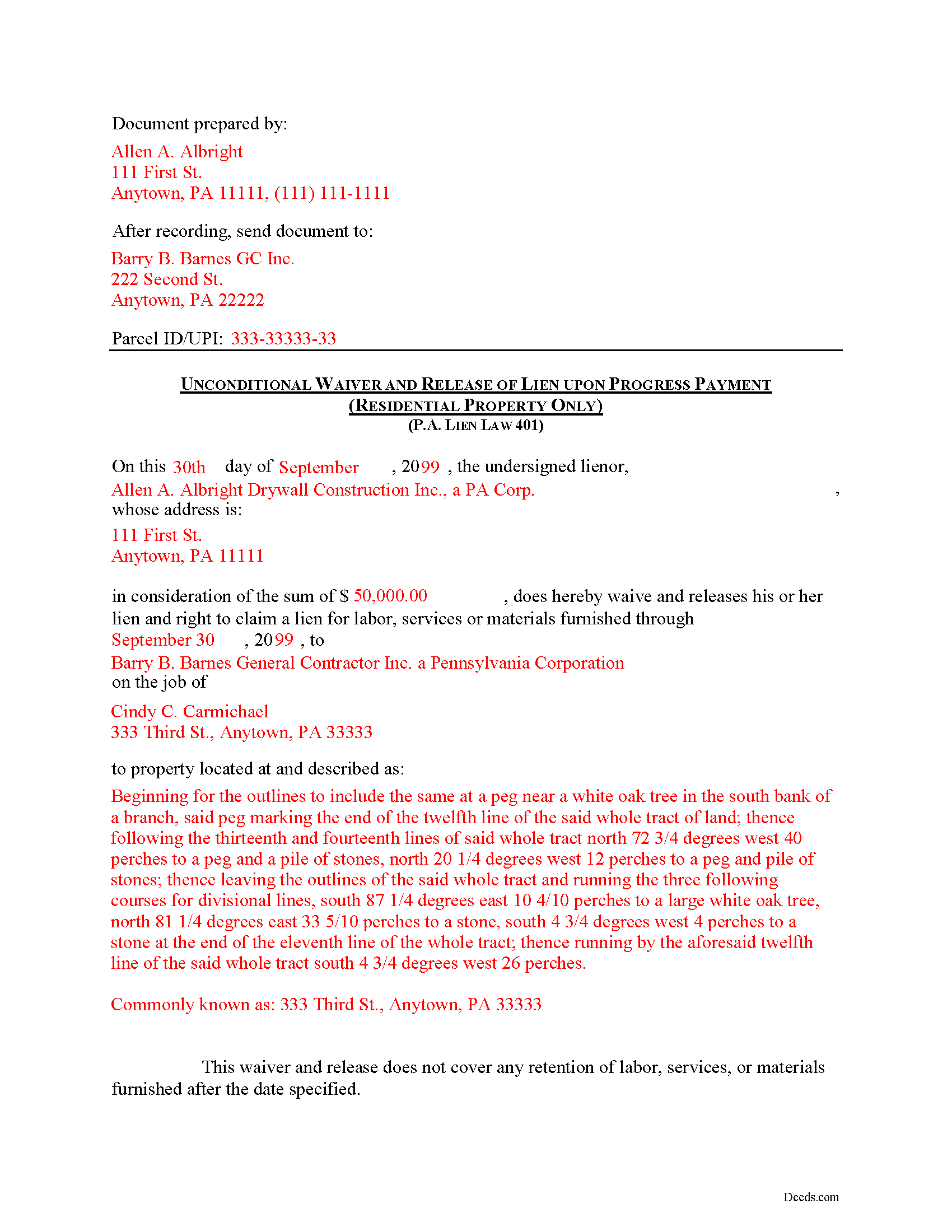

Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

Included Potter County compliant document last validated/updated 6/9/2025

The following Pennsylvania and Potter County supplemental forms are included as a courtesy with your order:

When using these Unconditional Lien Waiver on Progress Payment forms, the subject real estate must be physically located in Potter County. The executed documents should then be recorded in the following office:

Potter County Recorder of Deeds

1 N Main St, 1st fl, Coudersport, Pennsylvania 16915

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (814) 274-8370

Local jurisdictions located in Potter County include:

- Austin

- Coudersport

- Cross Fork

- Galeton

- Genesee

- Harrison Valley

- Mills

- Roulette

- Shinglehouse

- Ulysses

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Potter County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Potter County using our eRecording service.

Are these forms guaranteed to be recordable in Potter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Potter County including margin requirements, content requirements, font and font size requirements.

Can the Unconditional Lien Waiver on Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Potter County that you need to transfer you would only need to order our forms once for all of your properties in Potter County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Potter County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Potter County Unconditional Lien Waiver on Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Pennsylvania, a contractor or subcontractor may waive his right to file a claim against residential property by a written instrument signed by him or by any conduct which operates equitably to estop such contractor from filing a claim. 49 P.S. 401(a).

Contractors use lien waivers to forfeit or give up their right to claim a mechanic's lien. Usually, the purpose of a waiver is to alleviate concerns by a property owner or other contractor that a lien will be levied on the property. In return for waiving lien rights, the owner or other party makes a full or partial payment. The type of waiver used depends on the type of payment made.

Use a conditional waiver when payment hasn't been made at the time of the waiver or the payment method takes time to clear (such as a check or bank draft). Unconditional waivers are appropriate when a full or final payment has been made and evidence of the payment can be verified. Within each of these two categories, waivers can be granted for a full payment or a partial (or progress) payment.

In regard to subcontractors, a waiver by a subcontractor of lien rights is against public policy, unlawful and void, unless given in consideration for payment for the work, services, materials or equipment provided and only to the extent that such payment is actually received, or unless the contractor has posted a bond guaranteeing payment for labor and materials provided by subcontractors. 49 P.S. 401(c).

This Unconditional Waiver and Release of Lien on Progess Payment should be used when a partial or progress payment is made for any amount due on a residential job only and in return for the payment, the contractor agrees to waive a lien right towards the partial amount. Because the waiver is unconditional, it should only be used when the partial payment has been made and after verification of such payment.

A valid waiver identifies the parties, the location where the work or improvement took place, relevant dates, and amounts paid. In addition, the form must meet state and local standards for recorded documents. Submit the completed waiver to the recording office for the county where the property is situated.

Mechanic's Liens are governed by Title 49 of the Pennsylvania Consolidated Statutes.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Pennsylvania attorney familiar with lien laws for questions regarding lien waivers or any other issues with mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Potter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Potter County Unconditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Gary S.

November 4th, 2022

Thank you! Quick, timely and excellent quality document!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

November 2nd, 2020

I found this site to be very easy to use . I found and printed what I needed in just a few minutes after getting on the sit . Good work setting up this site . Thank you .

Thank you!

Kimberly F.

October 27th, 2021

Wow! This process was incredibly easy and no commitments to monthly memberships.

Thanks for the kind words Kimberly. Have an amazing day!

Doris S.

September 12th, 2021

Pleased with efficiency and expediency of website. Added value is the respective county requirements for Florida. I needed a quitclaim deed between family members. Highly recommended. We hope to record signed and executed document next week in Florida. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round.

Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly F.

April 22nd, 2020

Ordered and received the quitclaim form. Exactly what I expected, perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa M.

August 30th, 2023

Awesome and so easy to use!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come.

My justification for rating 5/5

1. Provide intuitive method for requesting property records.

2. Cost for records *seems reasonable.

3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty.

*I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. rnrnThe mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had.rnrnHad it not been for deeds.com I don’t think I would have been able to complete this process. rnrnI hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

lorali V.

February 12th, 2020

Not easy to fill in and the finished product looked awful when printed.

Thank you for your feedback. We really appreciate it. Have a great day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!