Sully County Affidavit of Deceased Joint Tenant Form (South Dakota)

All Sully County specific forms and documents listed below are included in your immediate download package:

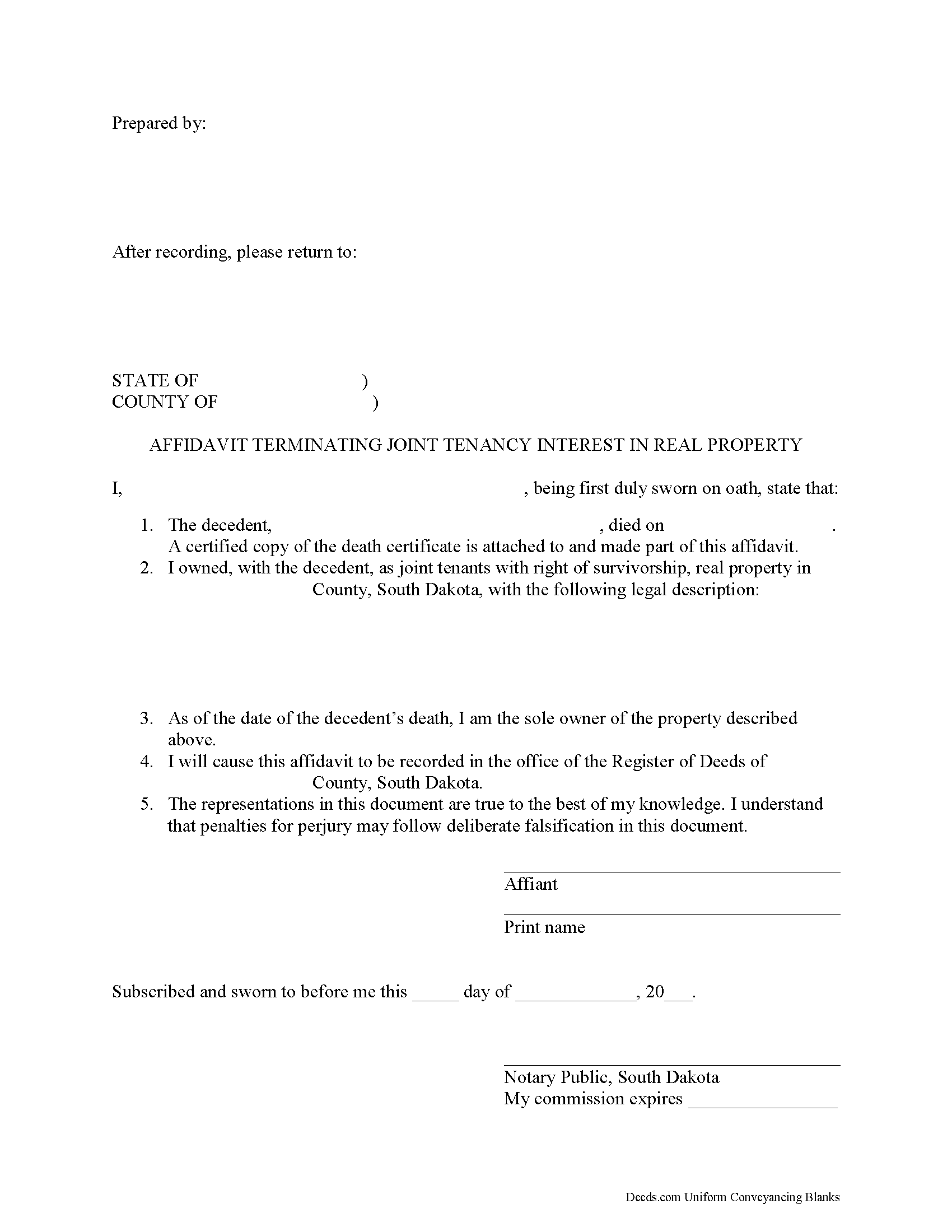

Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Sully County compliant document last validated/updated 4/16/2025

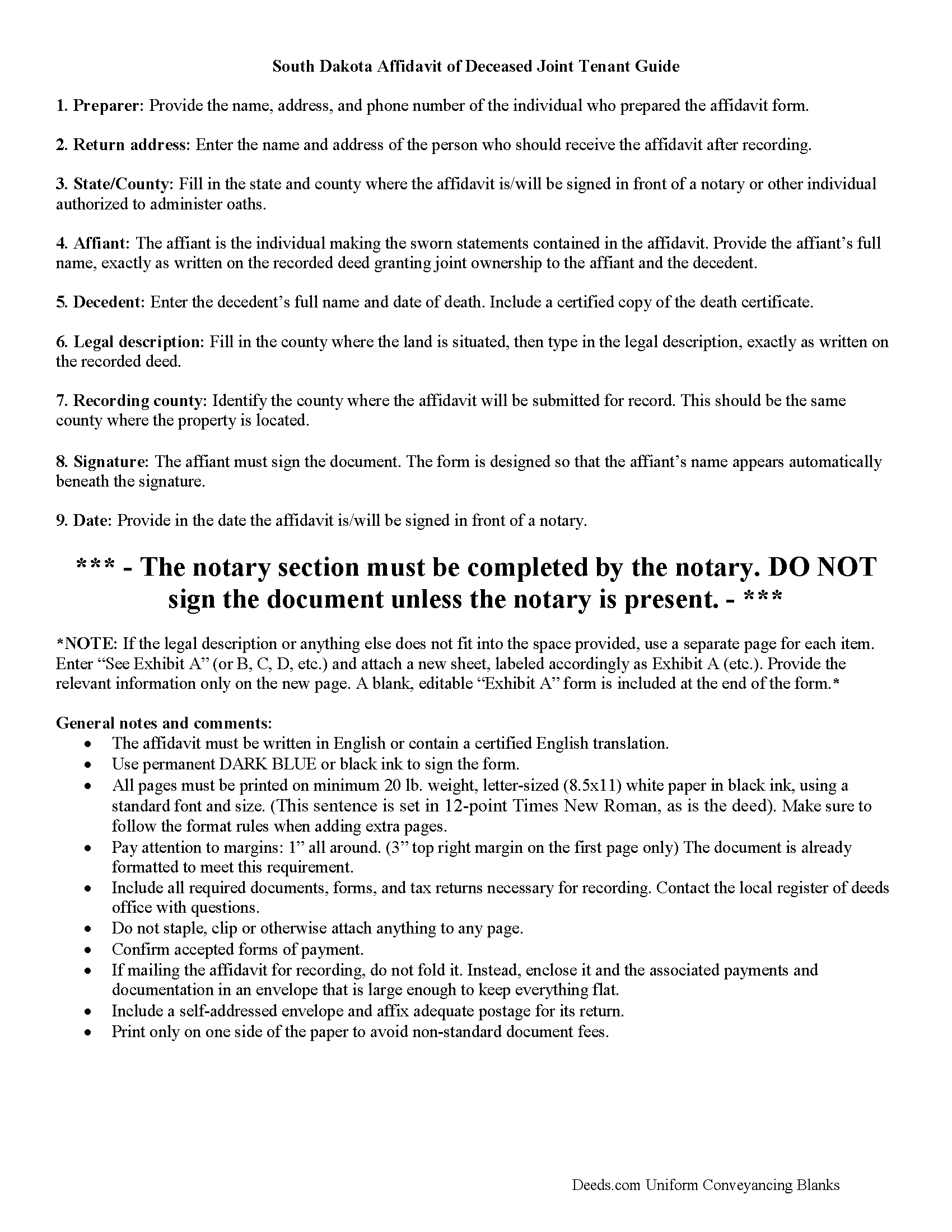

Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

Included Sully County compliant document last validated/updated 5/20/2025

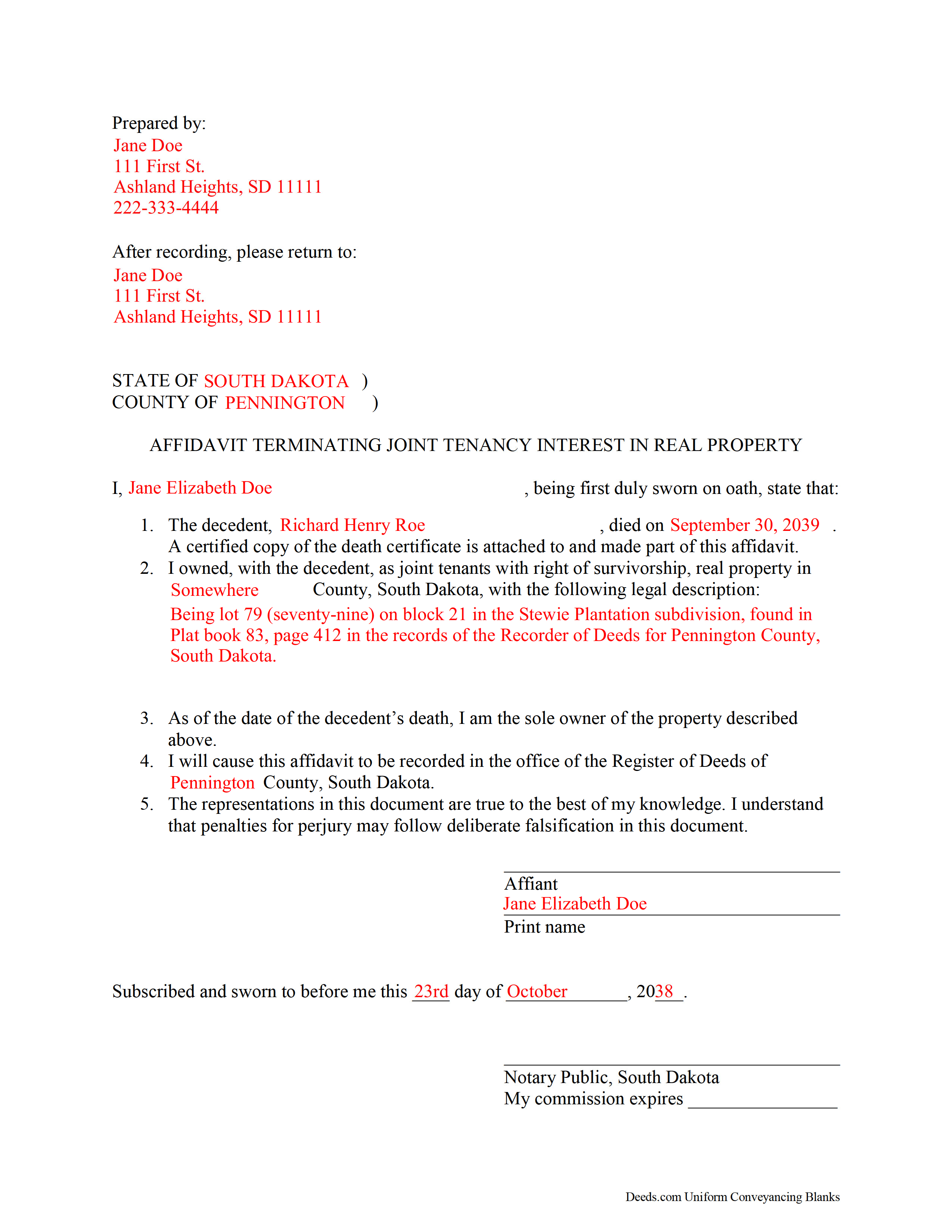

Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

Included Sully County compliant document last validated/updated 1/20/2025

The following South Dakota and Sully County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Deceased Joint Tenant forms, the subject real estate must be physically located in Sully County. The executed documents should then be recorded in the following office:

Sully County Register of Deeds

700 Ash Ave / PO Box 265, Onida, South Dakota 57564

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 258-2331

Local jurisdictions located in Sully County include:

- Agar

- Onida

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Sully County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Sully County using our eRecording service.

Are these forms guaranteed to be recordable in Sully County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sully County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Deceased Joint Tenant forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Sully County that you need to transfer you would only need to order our forms once for all of your properties in Sully County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Dakota or Sully County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Sully County Affidavit of Deceased Joint Tenant forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Clearing the Title on South Dakota Real Estate after a Joint Tenant Dies

In South Dakota, land owned by two or more people can be held as a tenancy in common, a partnership, or a joint tenancy (SDCL 43-2-11).

Joint tenancy, as defined at 43-2-12, is a property interest "owned by several persons in equal shares, by a title created by a single will or transfer, when expressly declared in the will or transfer to be a joint tenancy, or when granted or devised to personal representatives or trustees as joint tenants." South Dakota's joint tenancy includes the right of survivorship, meaning that if one of the co-owners dies, that person's share is distributed equally among the remaining owners. This distribution is identified as a nonprobate transfer under 29A-2-205(ii).

Nonprobate transfers are not included in the deceased owner's estate; instead, they cause the property to descend to the survivors as a function of law. Still, it makes sense, especially with real estate titles, to formalize and update the changed status. One way to accomplish this is by executing and recording an affidavit stating the relevant facts, attach a certified copy of the decedent's death certificate, and file it with the register of deeds for the county where the property is located.

Each circumstance is unique. Contact an attorney with specific questions or for complex situations.

(South Dakota AODJT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Sully County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sully County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

Dave W.

November 7th, 2023

Very handy when clueless about filling out a form. Saved hours of research.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Evelyn R.

July 16th, 2020

Filing my deed through your service was great. All directions were clear and specific; it was very easy to upload the documents and most of all feedback from your office was professional and very timely. You service was excellent. Thank you!! Thank you so very much!!

Thank you for your feedback. We really appreciate it. Have a great day!

David D.

January 28th, 2021

Forms were quick to receive and appear to be what I need to complete our task.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

Glenn H.

January 15th, 2022

Searched online 3 hours until I found Deeds.com, afterwards smooth sailing definitely 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald T.

February 6th, 2020

very user friendly. includes an example you can reference, and explanation of terms, which helps greatly in understanding.

Thank you!

Margaret G.

April 5th, 2022

Easy to navigate.

Thank you!

tim g.

May 3rd, 2019

that is what I was looking for thanks

Thanks Tim, glad we could help.

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!