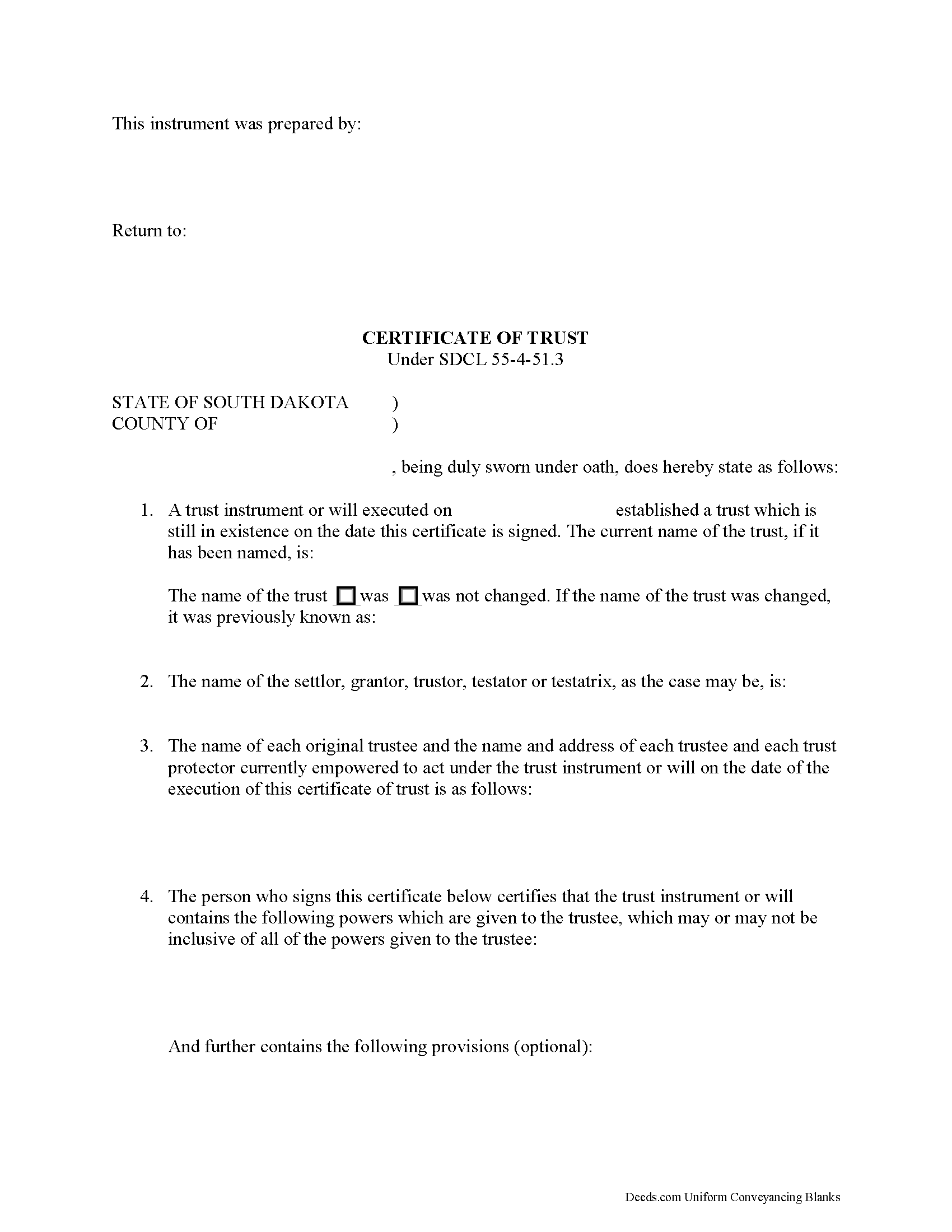

Kingsbury County Certificate of Trust Form

Kingsbury County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

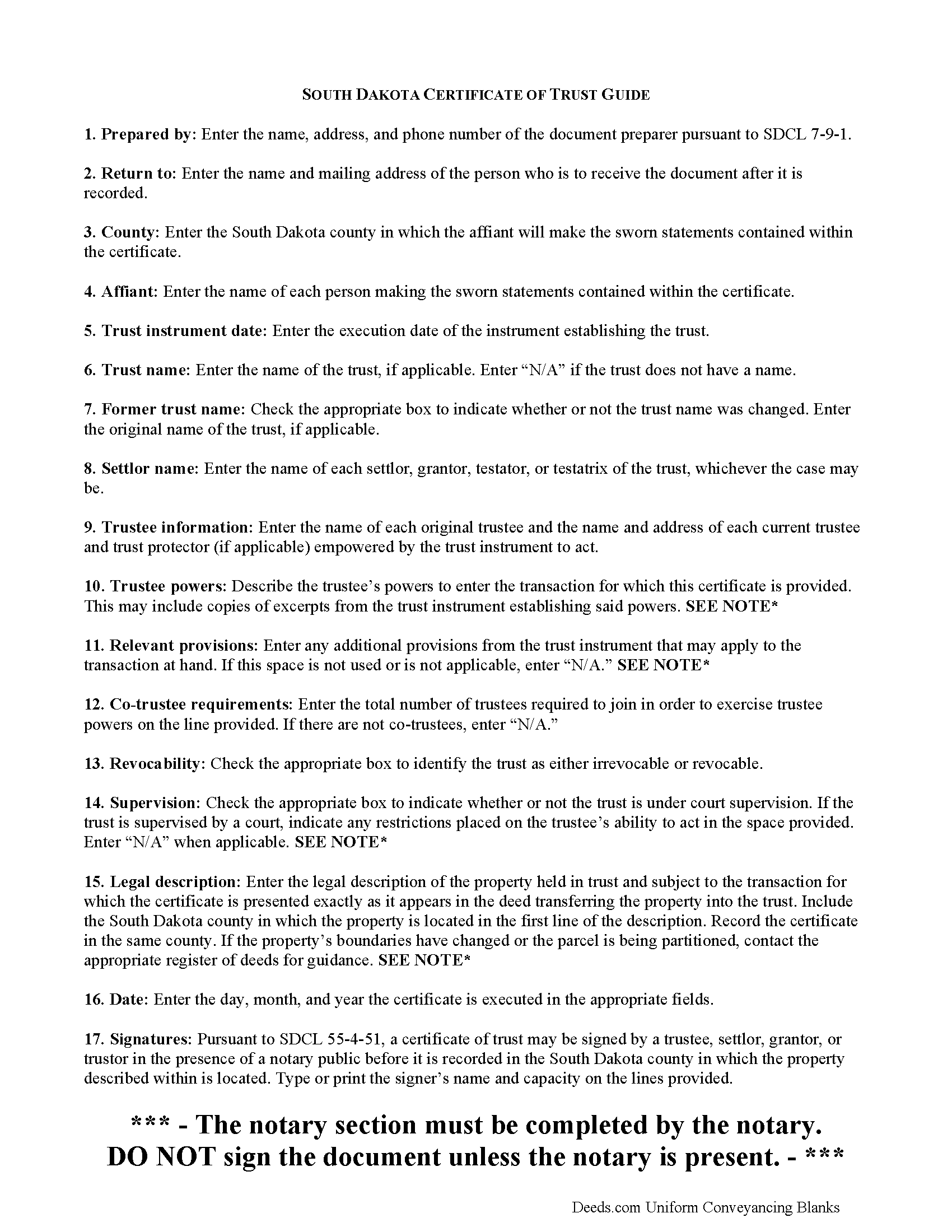

Kingsbury County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

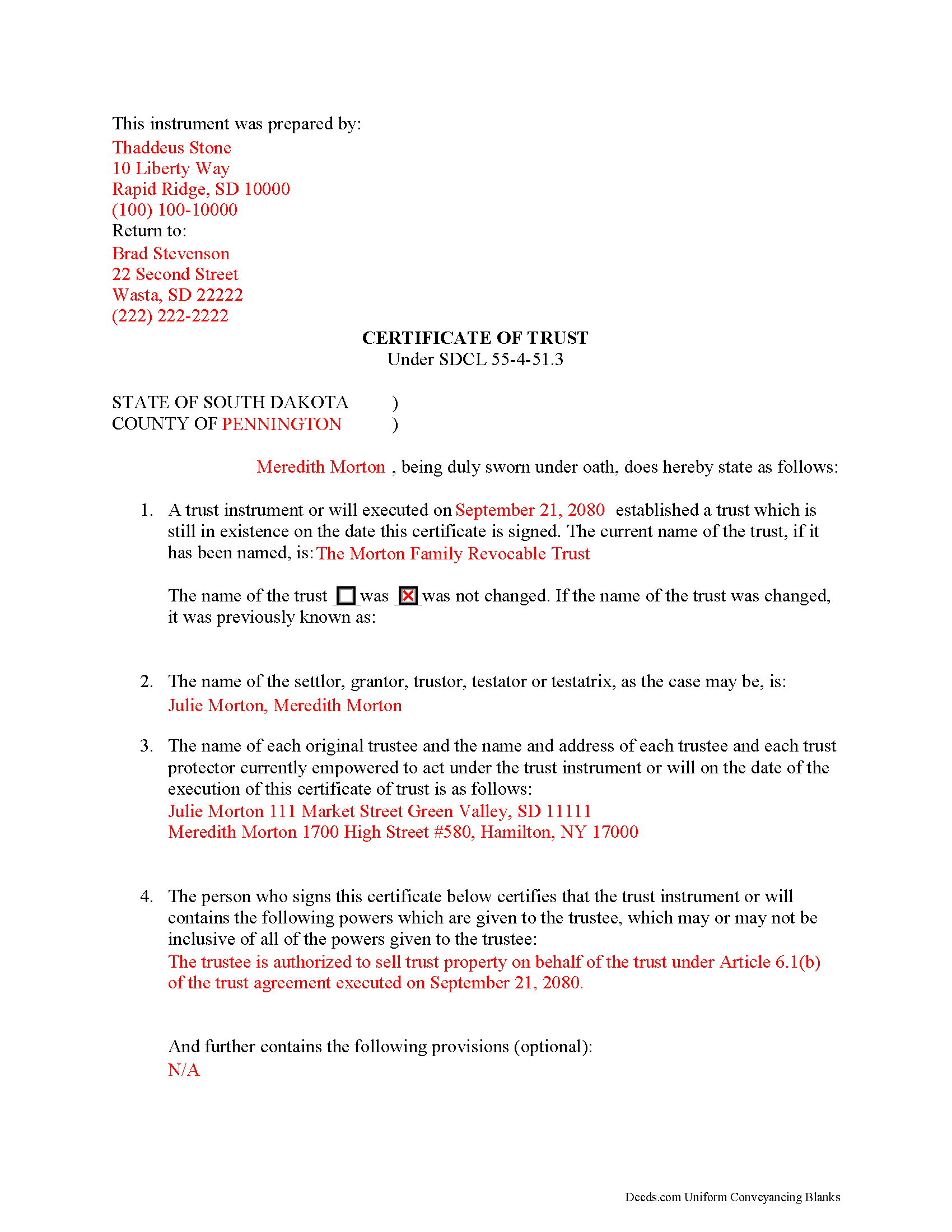

Kingsbury County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Kingsbury County documents included at no extra charge:

Where to Record Your Documents

Kingsbury County Register of Deeds

De Smet, South Dakota 57231

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 854-3591

Recording Tips for Kingsbury County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Kingsbury County

Properties in any of these areas use Kingsbury County forms:

- Arlington

- Badger

- De Smet

- Erwin

- Iroquois

- Lake Preston

- Oldham

Hours, fees, requirements, and more for Kingsbury County

How do I get my forms?

Forms are available for immediate download after payment. The Kingsbury County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kingsbury County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kingsbury County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kingsbury County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kingsbury County?

Recording fees in Kingsbury County vary. Contact the recorder's office at (605) 854-3591 for current fees.

Questions answered? Let's get started!

Codified at SDCL 55-4-51.3 as part of the Uniform Trusts Act, the certificate of trust "in support of a real property transaction" is recorded in the South Dakota county where the subject property is located and "serves to document the existence of the trust...and other matters...as though the full trust instrument had been recorded" (SDCL 55-4-51.3, 55-4-51.1).

In a trust relationship, a settlor transfers property to another person (trustee), who holds it for the benefit of a third (beneficiary). In the course of their fiduciary duties, trustees may present a certificate to parties who are not beneficiaries of the trust in lieu of providing the entire trust instrument. The trust instrument, executed by the settlor, establishes the trust and sets forth directions for its administration, including designating the trustee, the trustee's powers, and identifying a trust beneficiary. The certificate of trust allows the settlor's estate plan to remain off-record by providing only the information about the trust relevant to the transaction at hand.

The document names the trust, its settlor, and each trustee empowered to act for the trust. Aside from certifying the existence of the trust and confirming it has not been revoked or modified in a way that would invalidate the statements contained within, the certificate also confirms the trustee's role and authority to act on behalf of the trust by identifying powers relevant to the transaction, how many trustees are required to carry out those powers (if there are multiple trustees) and any restrictions imposed by a court on those powers (if applicable).

When used in transactions involving real property, the certificate requires a legal description of the subject property. The document must be recorded in the South Dakota county where the subject property is located and in compliance with the recording requirements established at SDCL 43-28-23.

Pursuant to SDCL 55-4-51, the document should be signed by a trustee or settlor (grantor or trustor, as the case may be) in the presence of the notary public witnessing the sworn statements made in the certificate. Recipients may request parts of the trust instrument establishing the trustee and the relevant powers (55-4-52). Persons entering transactions may rely on the statements within the certificate without further inquiry (55-4-53).

Consult a lawyer with questions about South Dakota trusts and certificates of trust, as each situation is unique.

(South Dakota COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Kingsbury County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Kingsbury County.

Our Promise

The documents you receive here will meet, or exceed, the Kingsbury County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kingsbury County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Cathern S.

January 23rd, 2020

Thanks much for your good help. Was a pleasure to use your help and was simple to use. Thanks much.

Thank you!

Patricia W.

September 12th, 2020

Had to have help because unable to put phone number in your format. Daughter figured a way around the problem. I am 80 years old but capable of filling out simple forms but not when the format creates problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

L. Candace H.

April 29th, 2021

So far it's been good & informative. I have not chosen forms for download but I like the site. Thanks

Thank you!

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

victor h.

February 26th, 2022

Easy to use and just what I was looking for

Thank you!

DAVID H.

March 13th, 2020

perfect. follow examples. no problem at court house. good deed layout.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruby C.

April 27th, 2019

very easy to use this site as I live out of state.

Tanks Ruby, glad we could help.

Will O.

May 2nd, 2020

Saved me so much time and $!!

Thank you!

Janna V.

December 2nd, 2020

Very easy process!

Thank you!

Karl L.

January 30th, 2025

Excellent Service Terrific Follow Up and Follow Throught

Your appreciative words mean the world to us. Thank you.

Delroy S.

July 2nd, 2019

Simple and complete. I found all the forms and Instructions I was looking for. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rajashree S.

January 2nd, 2019

Deed was easy to download and complete. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!