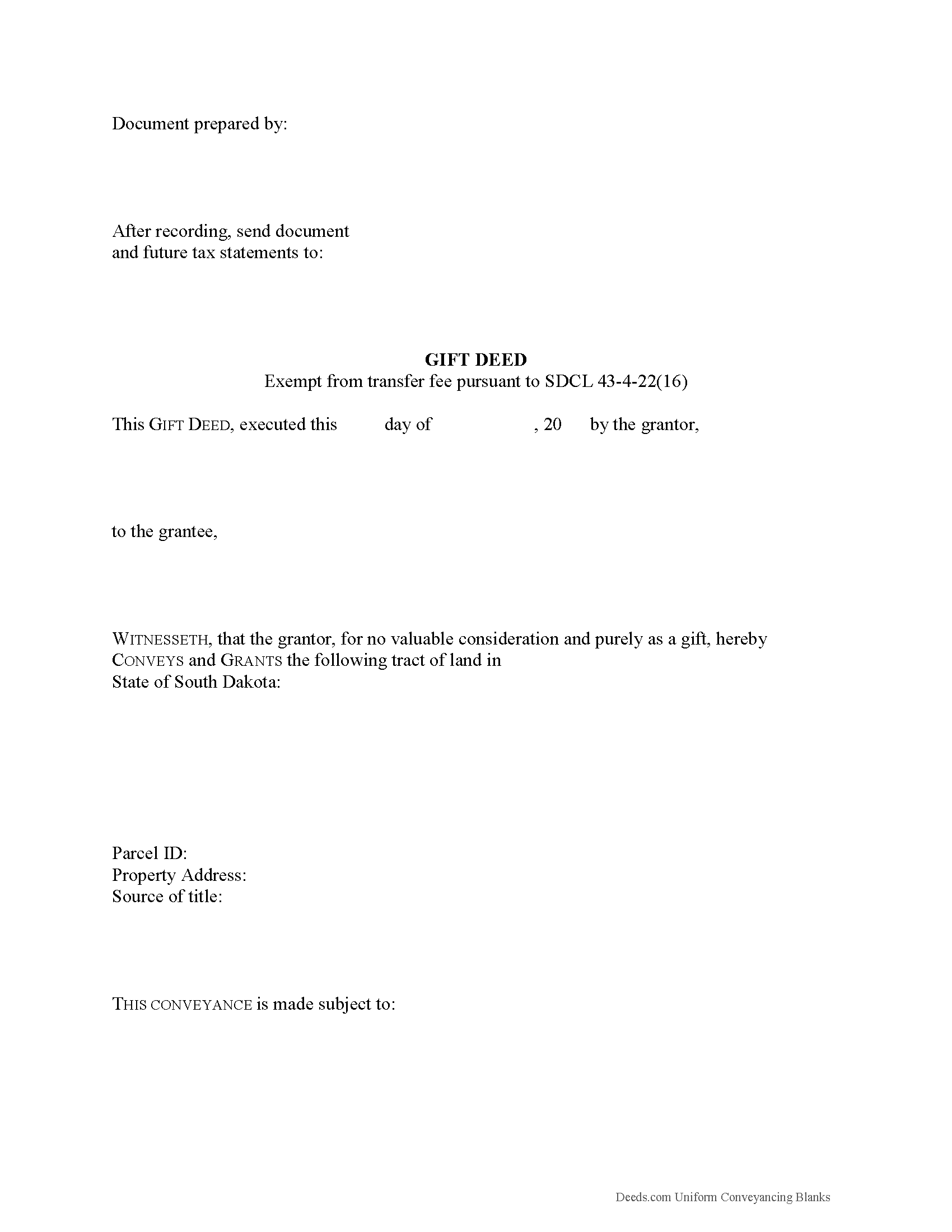

Hamlin County Gift Deed Form

Hamlin County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

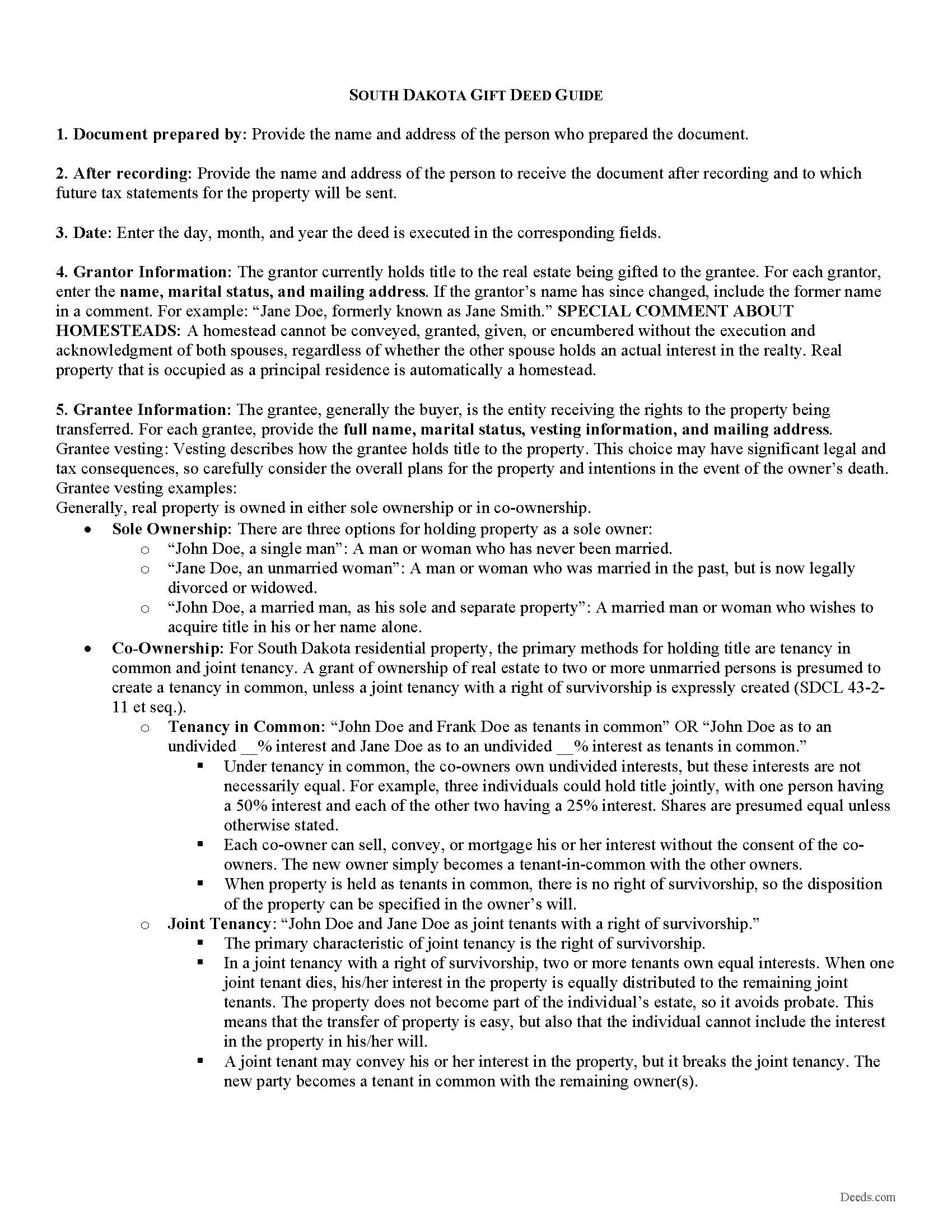

Hamlin County Gift Deed Guide

Line by line guide explaining every blank on the form.

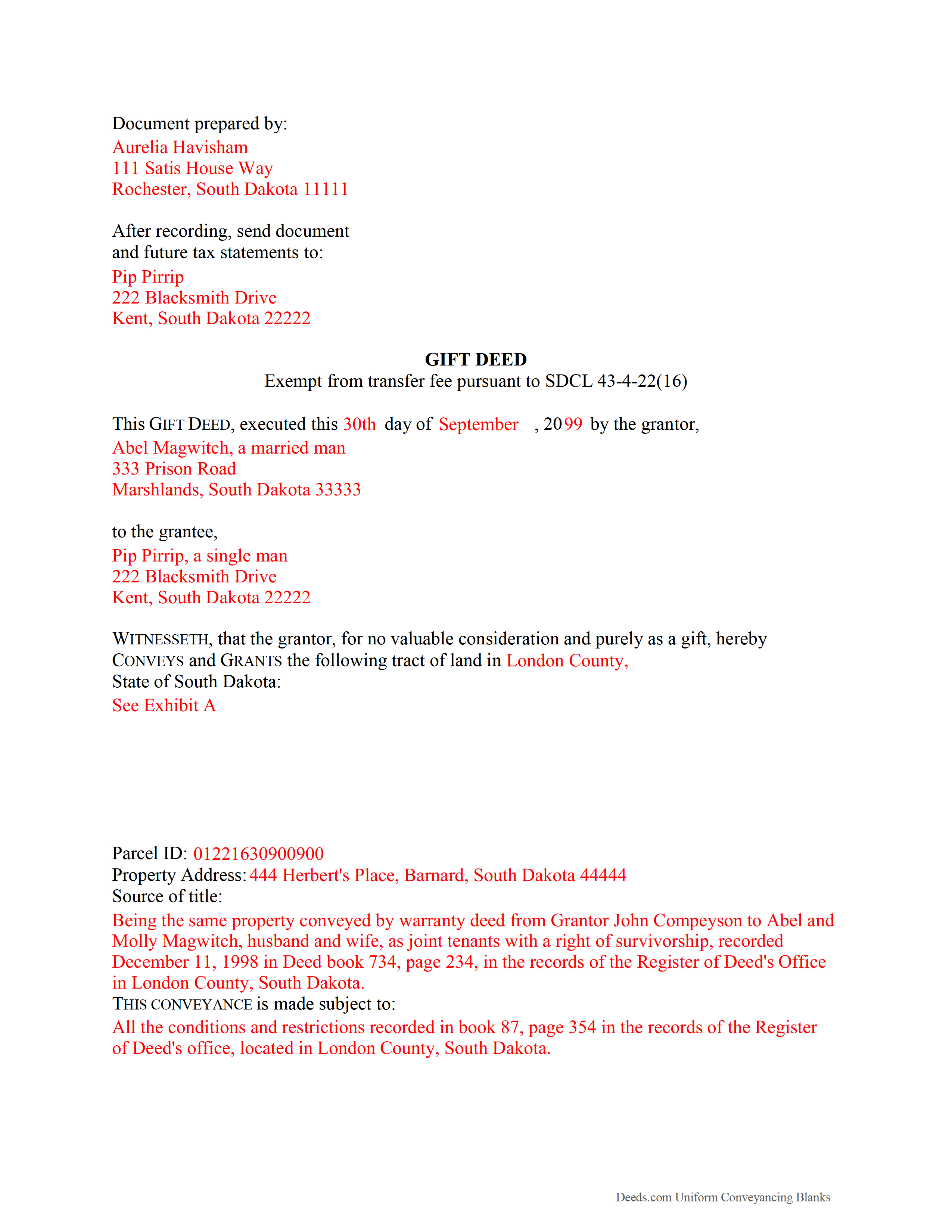

Hamlin County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Hamlin County documents included at no extra charge:

Where to Record Your Documents

Hamlin County Register of Deeds

Hayti, South Dakota 57241-0056

Hours: 8:00am to 4:30pm.M-F

Phone: (605) 783-3206

Recording Tips for Hamlin County:

- Bring your driver's license or state-issued photo ID

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Have the property address and parcel number ready

Cities and Jurisdictions in Hamlin County

Properties in any of these areas use Hamlin County forms:

- Bryant

- Castlewood

- Estelline

- Hayti

- Hazel

- Lake Norden

Hours, fees, requirements, and more for Hamlin County

How do I get my forms?

Forms are available for immediate download after payment. The Hamlin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamlin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamlin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamlin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamlin County?

Recording fees in Hamlin County vary. Contact the recorder's office at (605) 783-3206 for current fees.

Questions answered? Let's get started!

Gifts of Real Property in South Dakota

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. A gift deed must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For South Dakota residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy with a right of survivorship is expressly created (SDCL 43-2-11 et seq.).

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Record the completed deed at the local county Recorder's office, along with a Certificate of Real Estate Value (SDCL 7-9-7(4)). Any conveyance that is an absolute gift without consideration of any kind in return for it is exempt from the fee imposed on any transfer of title (SDCL 43-4-22).

The IRS implements a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a grantor may benefit from filing a Form 709 [2].

In South Dakota, there is no state gift tax. Gifts of real property in South Dakota are, however, subject to the federal gift tax, which the grantor is responsible for paying; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1]

https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(South Dakota Gift Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamlin County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Hamlin County.

Our Promise

The documents you receive here will meet, or exceed, the Hamlin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamlin County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Kevin R.

August 22nd, 2023

I have been using Deeds.com for the last 2 years and find them very easy to use and expedient on all my recordings. Highly recommend.

Thank you for the kind words Kevin. We appreciate you.

ian a.

September 28th, 2022

Your website advertising was somewhat deceptive regarding doing a quitclaim on a name change. "If you are transferring the property to yourself under your new name, all you have to do is update the deed from your former name to your current one." This made this sound easy. But when I downloaded the material for my state, expecting to find an example, there was no example of how to do a name change quitclaim deed! I therefore had to figure this out myself. You might have provided a warning about certain uses that were not covered in the material so that people know ahead of time that the use they needed to know about wasn't covered in the material.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed. Looking forward to working with Deeds.com again. Steve Esler

Thank you for your feedback Steve, glad we could help.

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Robert L.

February 24th, 2021

Very easy to use and I had no issues submitting my deed.

Thank you!

Lorie C.

April 15th, 2023

Easy and effective...surely saved hundreds by avoiding a lawyer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

Jackson J.

April 19th, 2022

Thank you very much for all your help its always a pleasure to continue working with you thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!

Geraldine B.

December 7th, 2019

Top notch real estate forms. Easy to use, printed out nice, and the guide and example are priceless. You're not going to find anything better anywhere.

Thank you for the kind words Geraldine! Have an incredible day!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Annette L.

July 6th, 2023

Wow -- amazingly fast turnaround and excellent customer service and communication. Thank you for saving me hours of time and effort!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!