Harding County Mortgage Security Agreement and Promissory Note Form

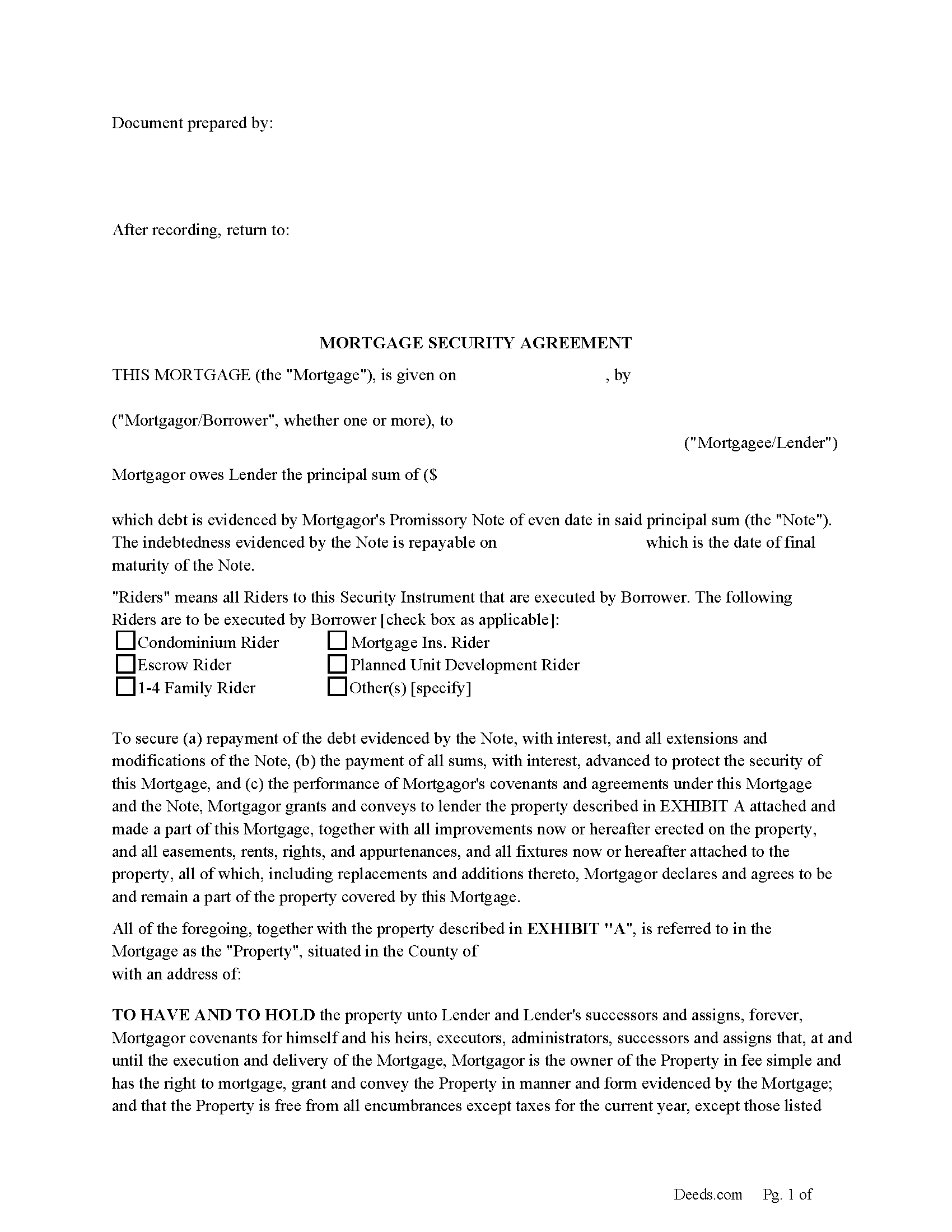

Harding County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

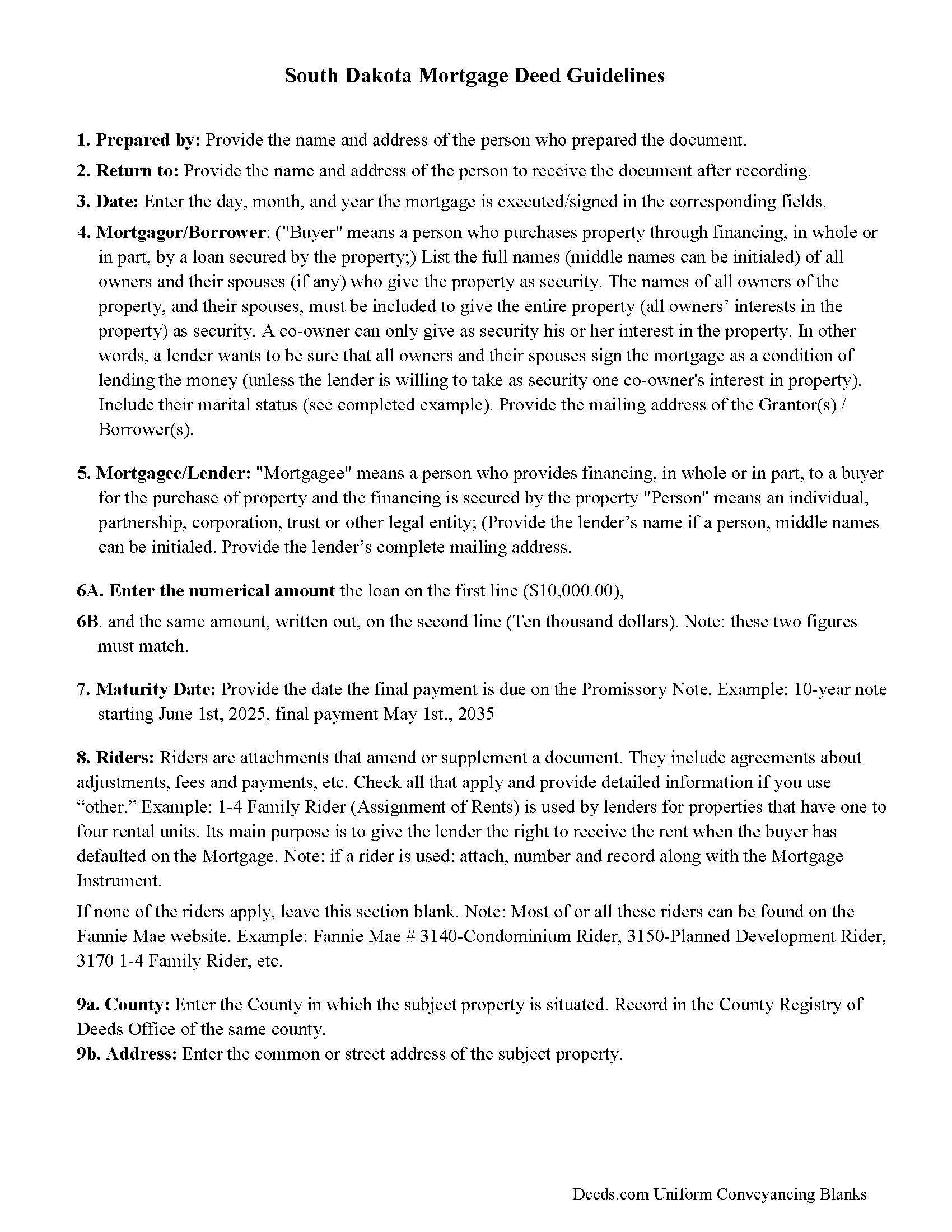

Harding County Mortgage Guidelines

Line by line guide explaining every blank on the form.

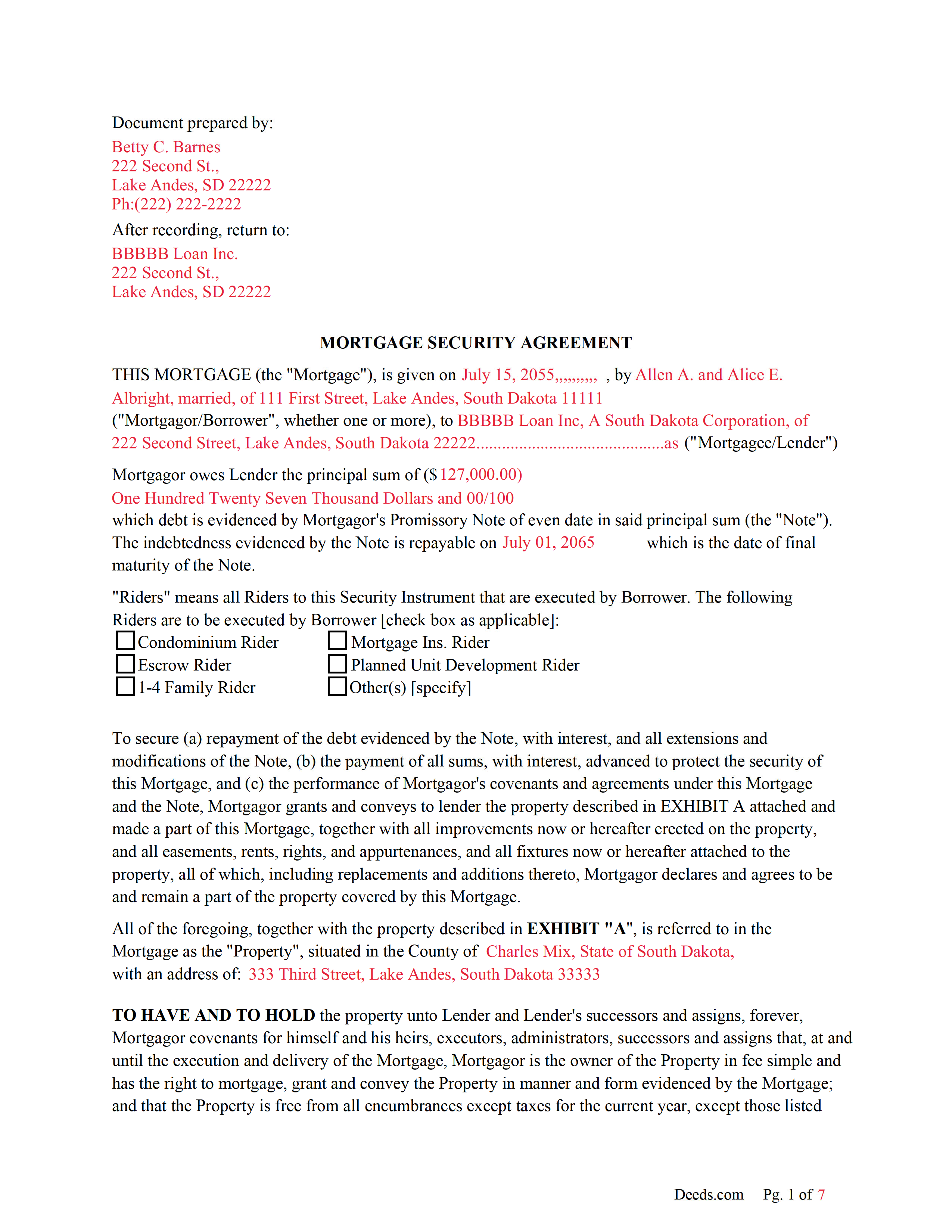

Harding County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

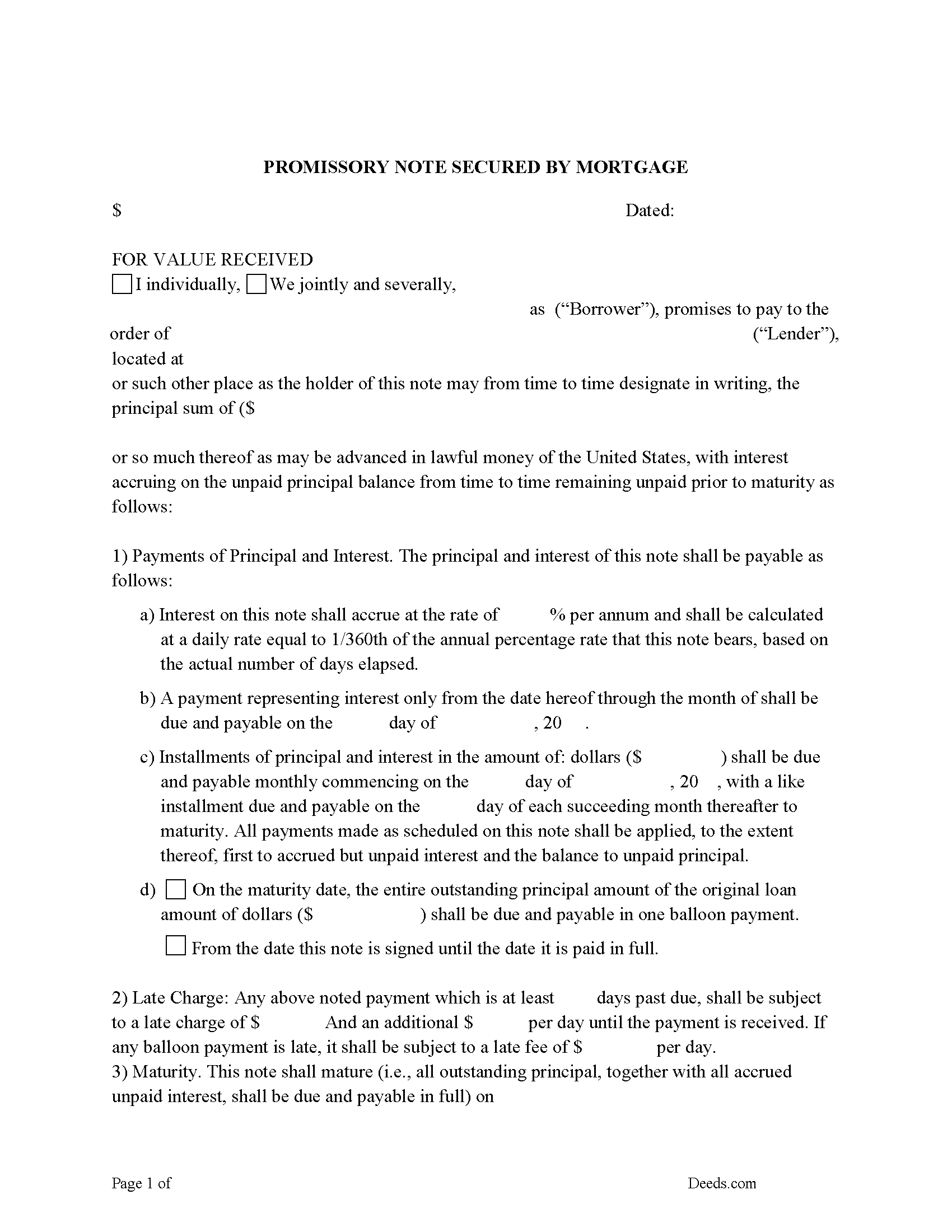

Harding County Promissory Note Form

Note that is secured by the Mortgage Agreement.

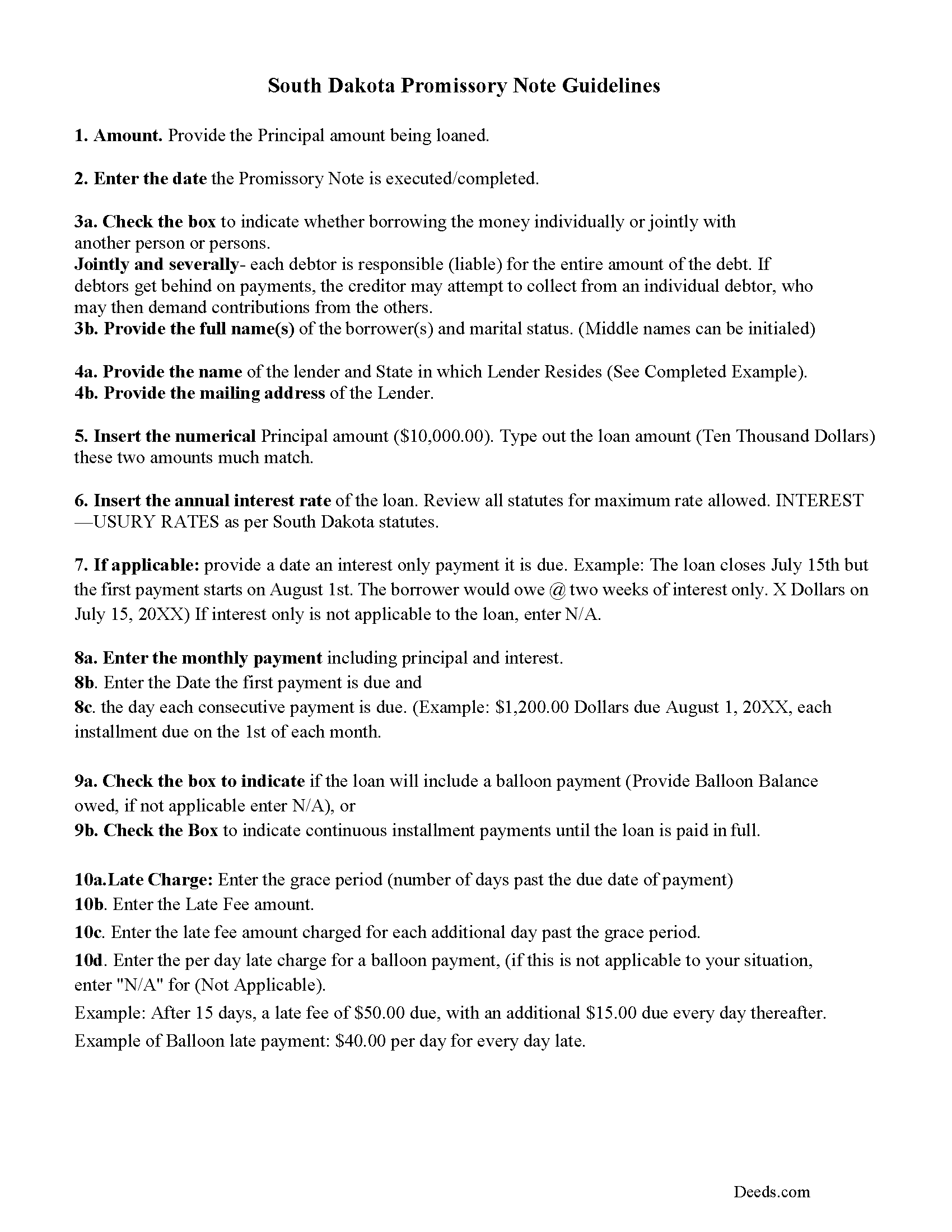

Harding County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

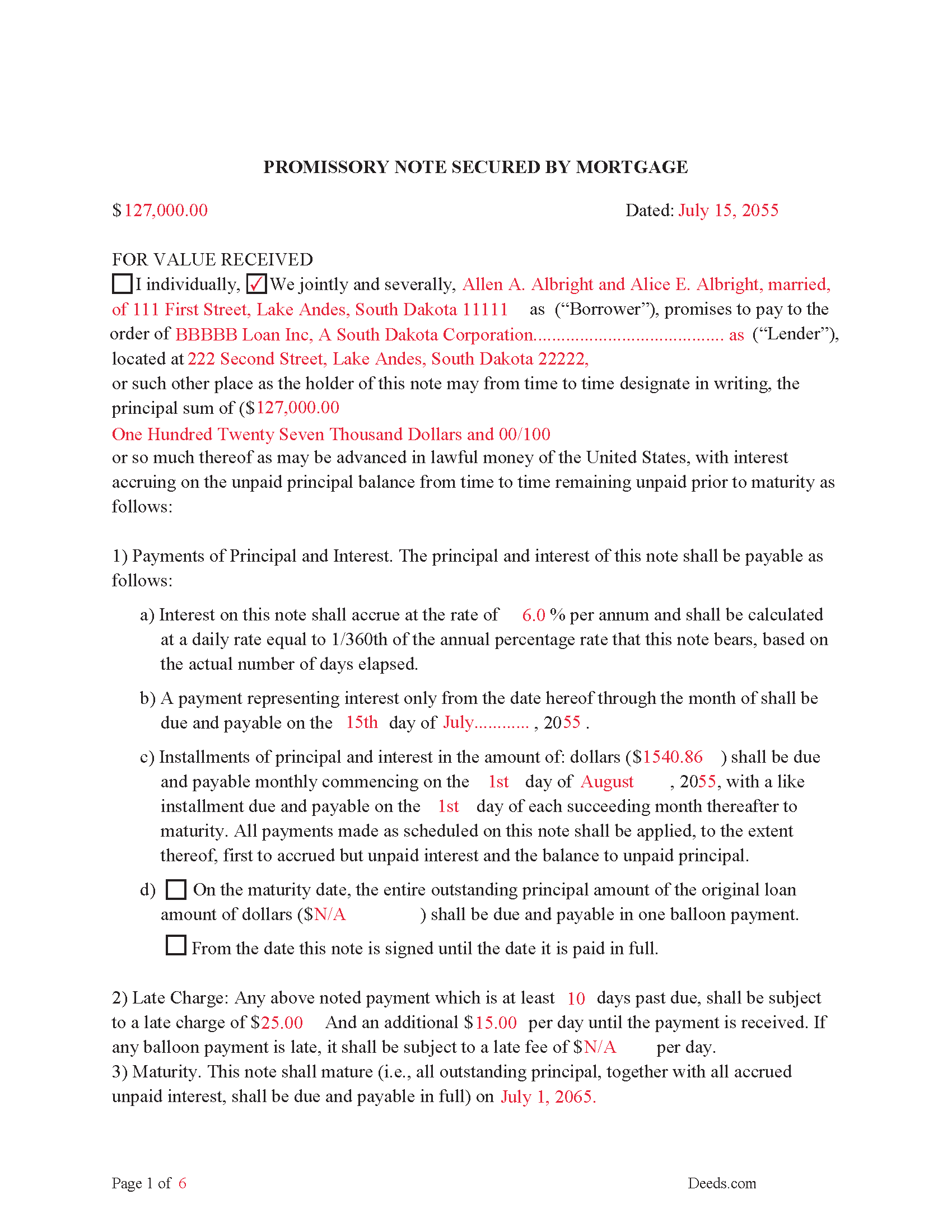

Harding County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

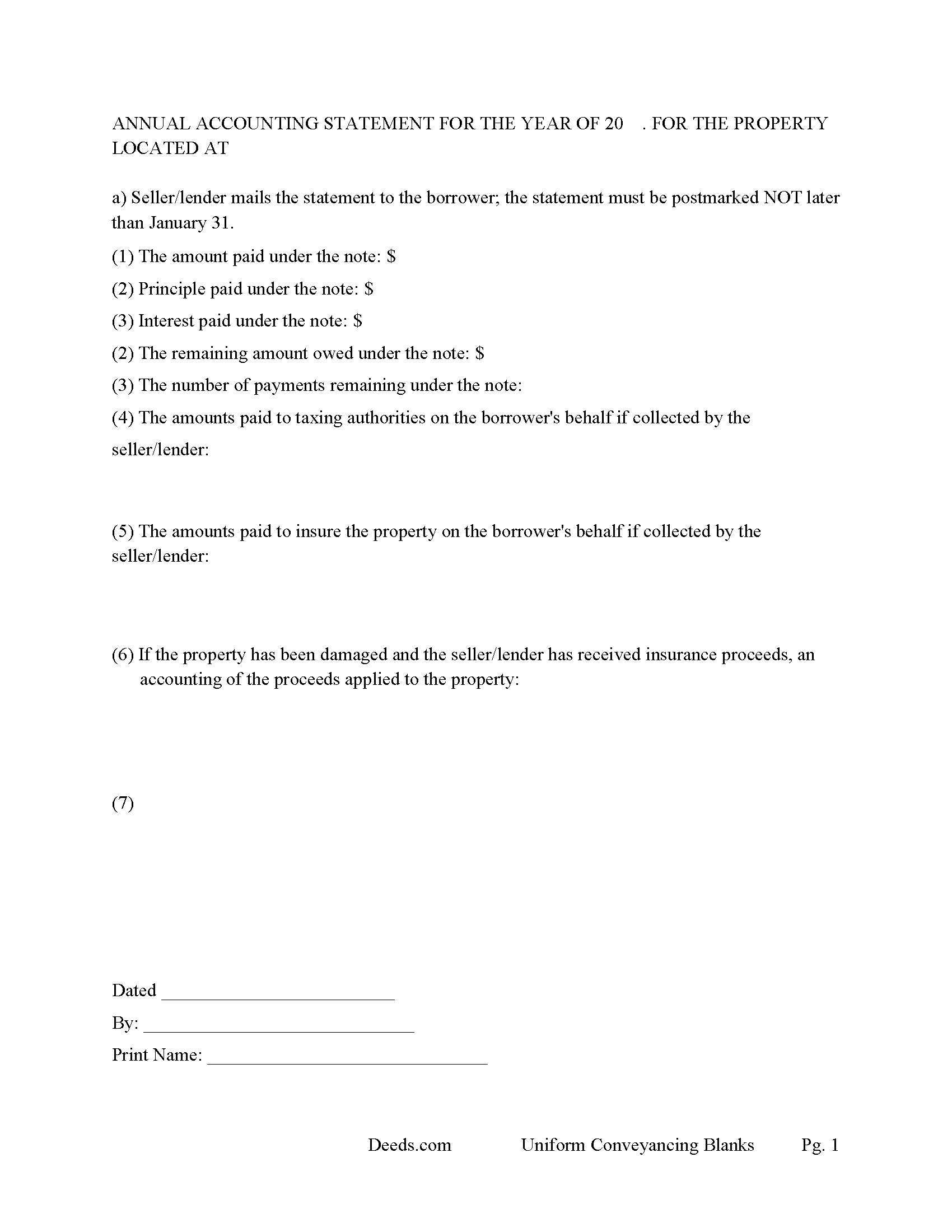

Harding County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Harding County documents included at no extra charge:

Where to Record Your Documents

Harding County Register of Deeds

Buffalo, South Dakota 57720-0101

Hours: 8:00 to12:00 & 1:00 to 5:00 MT M-F

Phone: (605) 375-3321

Recording Tips for Harding County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

Cities and Jurisdictions in Harding County

Properties in any of these areas use Harding County forms:

- Buffalo

- Camp Crook

- Ludlow

- Ralph

- Redig

- Reva

Hours, fees, requirements, and more for Harding County

How do I get my forms?

Forms are available for immediate download after payment. The Harding County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harding County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harding County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harding County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harding County?

Recording fees in Harding County vary. Contact the recorder's office at (605) 375-3321 for current fees.

Questions answered? Let's get started!

This is a recordable mortgage that serves (as notice to all subsequent purchasers and encumbrancers.) (44-8-10) Included is a Power of Sale clause, considered more favorable to lenders because it uses a non-judicial foreclosure, saving time and expense. [In case of default in the payment of said principal sum of money or any part thereof, or interest thereon at the time or times above specified for payment thereof, or in case of nonpayment of any taxes, assessments, or insurance as aforesaid, or of breach of any covenant or agreement herein contained, then and in either case, the whole, principal and interest, of said note -- shall at the option of the holder thereof, immediately become due and payable, and this mortgage may be foreclosed by action, or by advertisement as provided by statute or the rules of practice relating thereto, and this paragraph shall be deemed as authorizing and constituting a power of sale as mentioned in said statutes or rules, and any amendatory thereof.] [44-8-3]

This mortgage contains a (due-on-sale clause) which (is a provision of a real estate mortgage which requires that the note secured by the mortgage be paid at the time the property is transferred and no assumption of the original note is permitted.) (44-8-27). This is done because [No lender may enforce a due-on-sale clause unless the real estate mortgage includes such clause.] [44-8-28]

44-8-21. Mortgage securing note for purchase price of real estate--No negotiability--Enforcement of liability--Endorsement of note. In all cases where a note given by the purchaser and grantee of real estate to the vendor and grantor thereof to secure payment of all or any part of the purchase price is secured by a mortgage on such real estate, such note shall bear an endorsement upon its face to the effect that it is given for such purpose, and thereafter the same shall not be negotiable, nor shall any liability of any kind be enforced upon it either by action at law, or by set-off, or counterclaim, or otherwise, excepting by foreclosure of the mortgage. The rights of any party to said note, or of any assignee, or purchaser thereof, shall not be affected by the absence of such endorsement but shall be the same as though such note had been properly endorsed. Nothing herein contained shall apply to such note given prior to July 1, 1933.

44-8-22. Rights of payee of note given in payment of purchase price--Deficiency judgment prohibition inapplicable unless note secured by real estate mortgage.

Nothing contained in 44-8-20 or 44-8-21 shall affect the rights of a payee or other owner of a note given in payment of all or part of the purchase price of real estate unless such note is secured by a real estate mortgage.

A mortgage and promissory note secured, including stringent default terms can be beneficial to the lender. Use these forms for residential, commercial, rental property, condominiums, vacant land and planned unit developments.

(South Dakota Mortgage Package includes forms, guidelines, and completed examples) For use in South Dakota only.

Important: Your property must be located in Harding County to use these forms. Documents should be recorded at the office below.

This Mortgage Security Agreement and Promissory Note meets all recording requirements specific to Harding County.

Our Promise

The documents you receive here will meet, or exceed, the Harding County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harding County Mortgage Security Agreement and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Joey D.

July 29th, 2019

Great product delivered immediately at very reasonable price. Highly recommend !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kyle K.

May 3rd, 2022

Deeds is extremely helpful and cost effective for small and large businesses. Saves me time to do more valuable tasks.

Thank you for your feedback. We really appreciate it. Have a great day!

JAY W.

June 17th, 2021

ok

Thank you!

Jon G.

June 26th, 2021

Excellent service and professionalism

Thank you!

VALETA J.

April 15th, 2022

Easy to navigate

Thank you!

Dyanna B.

April 23rd, 2024

Got what I needed. Easy access.

Thank you for your positive words! We’re thrilled to hear about your experience.

Alicia S.

August 17th, 2021

It's been a difficult time during my divorce. Glad I was able to get the house related documents easily here.

Thank you!

randy j.

December 15th, 2018

the deed format and fill-in language are very specific to one type of easement and are not generally applicable to any other type; in other words it is not useful in a majority of situations and i would recommend against purchase unless you are creating an easement for an appurtenant landowner ONLY

Thank you for your feedback. We really appreciate it. Have a great day!

laura w.

March 7th, 2021

I found Deeds to be okay except I was hoping it would give me a title or deed to my house if I would have known I would have just got a warranty deed I probably would not have pay the money but it's still worth it

Thank you for your feedback. We really appreciate it. Have a great day!

Brenn C.

April 11th, 2022

These products would be more useful if they final deed could be copied and pasted into a word document for proper formatting. Because most of the document is protected against selecting and copying, I did not find it useful. I would not purchase again.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine P.

January 2nd, 2019

I got what I needed and you provided great templates.

Thank you!

Vickey W.

February 5th, 2021

Your company was great, you all walked me through every step of the process. With the pandemic and the inability to go into the DC Recorder of Deeds office. I look forward to working with you in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

KELLY S.

June 12th, 2021

very happy. I will use you for all my needed documents thanks for being here

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon H.

April 28th, 2020

I was able to print the deed and follow the instructions and sample deed quite easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lindsey W.

March 7th, 2019

The service was great but after I did all my work and uploaded the documents they canceled my stuff because the county they had on the list doesnt take/or have set up e-recording yet. It was a bit disappointing because thats the only reason I was on here is because it brought me here from that countys sight.

Thank you for your feedback, sorry we were not able to provide the service for you. Hope you have a great day.