Clark County Personal Representative Deed of Distribution Form

Clark County Personal Representative Deed of Distribution Form

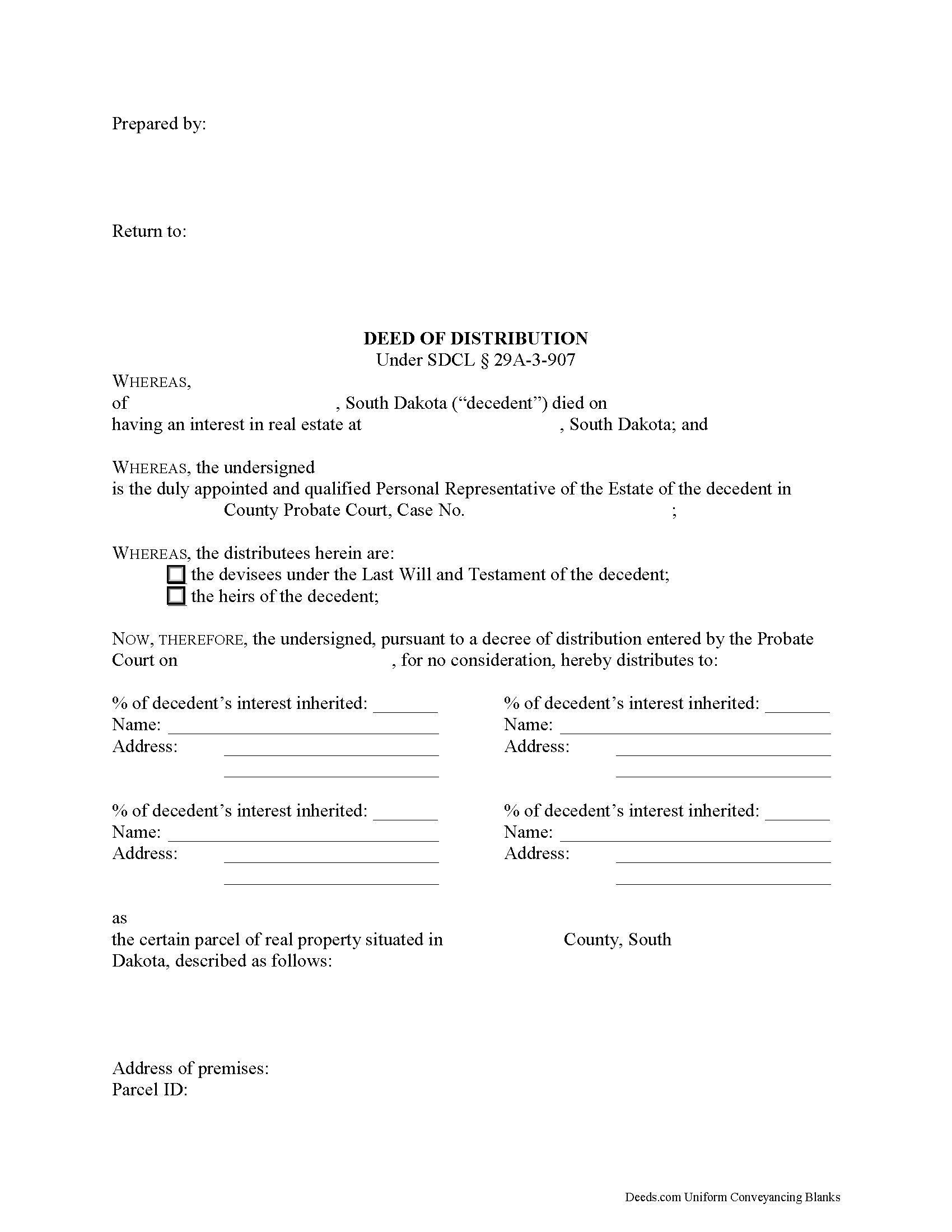

Fill in the blank form formatted to comply with all recording and content requirements.

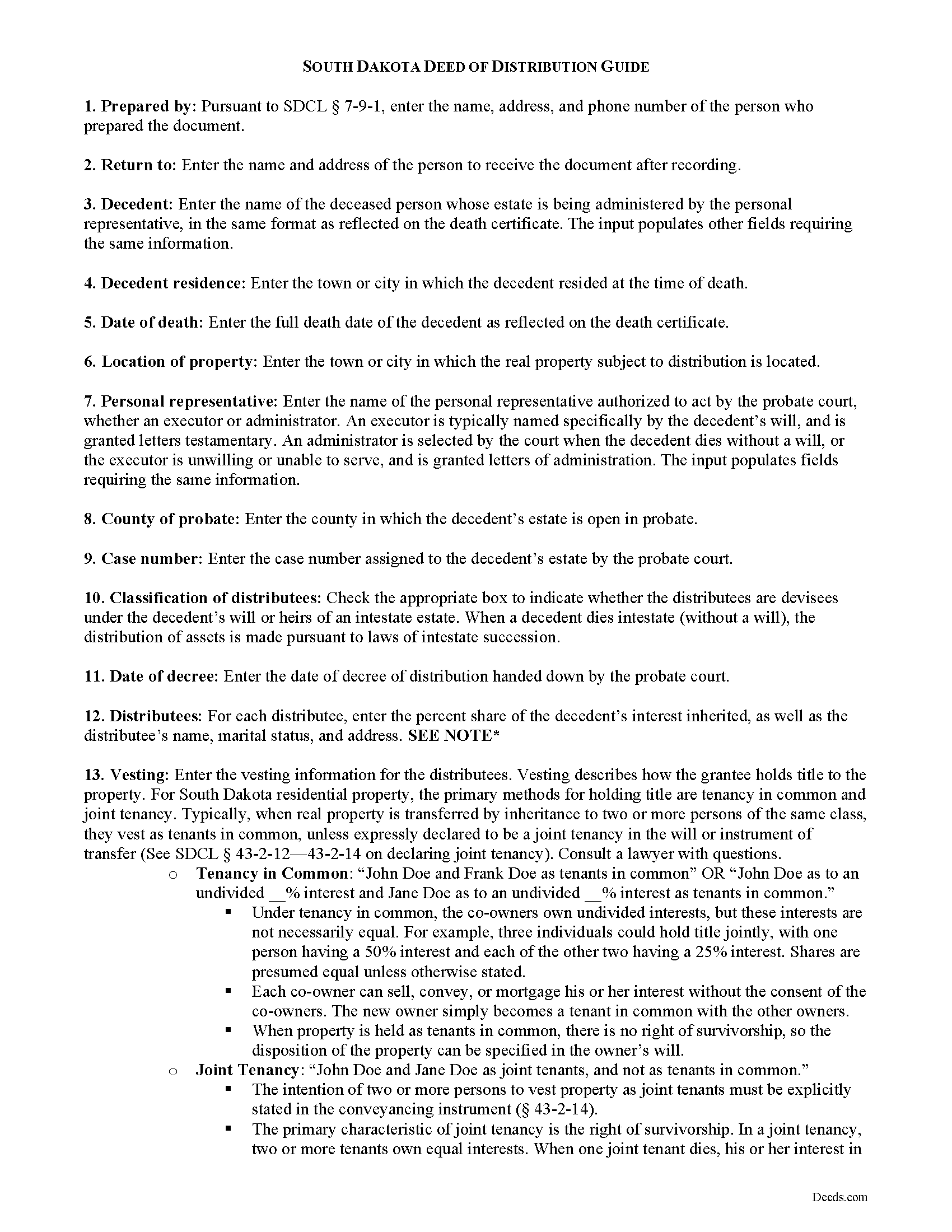

Clark County Personal Representative Deed of Distribution Guide

Line by line guide explaining every blank on the form.

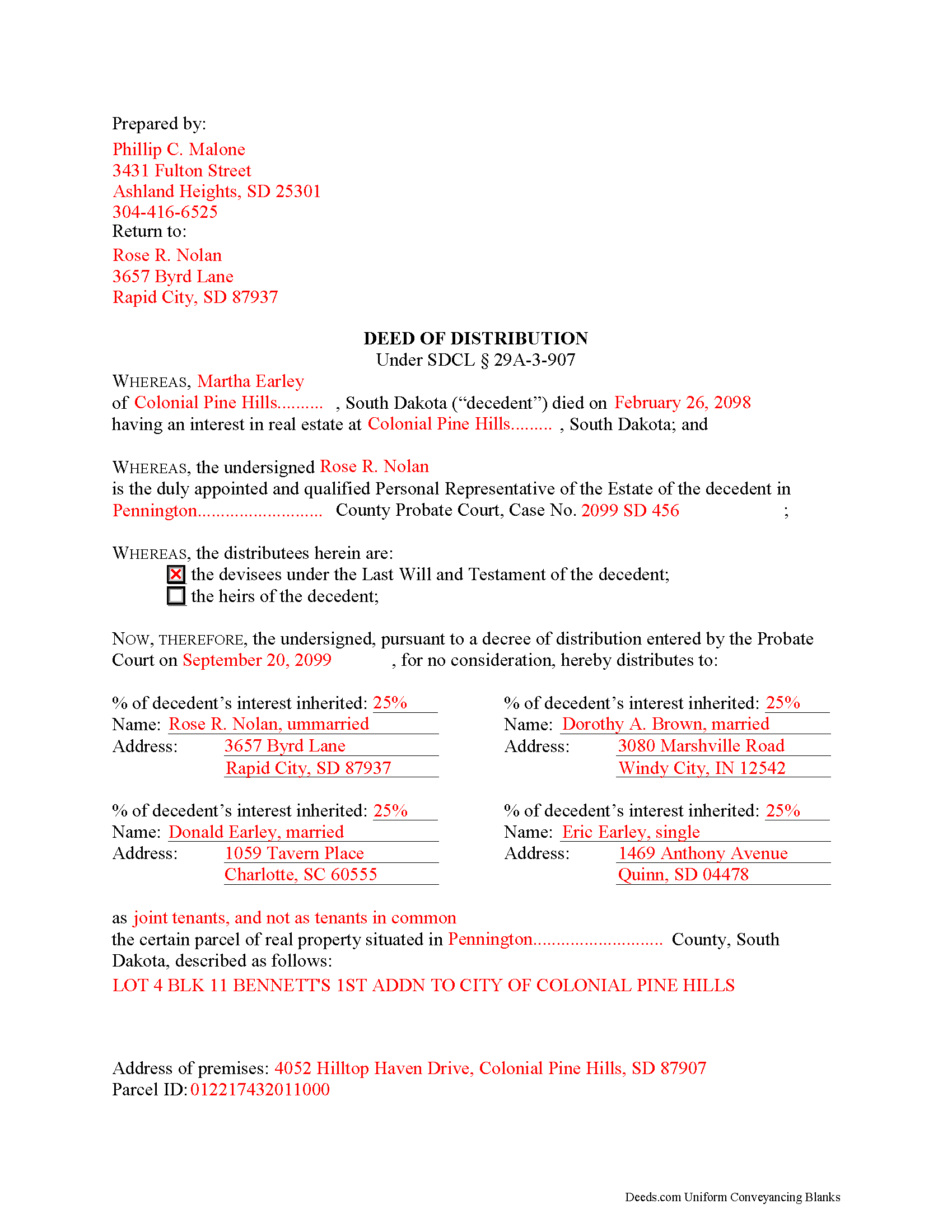

Clark County Completed Example of the Personal Representative Deed of Distribution Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Register of Deeds

Clark, South Dakota 57225-0294

Hours: 7:30 to 5:00 Mon-Fri

Phone: (605) 532-5363

Recording Tips for Clark County:

- Ask if they accept credit cards - many offices are cash/check only

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Bradley

- Carpenter

- Clark

- Garden City

- Raymond

- Vienna

- Willow Lake

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (605) 532-5363 for current fees.

Questions answered? Let's get started!

In South Dakota, title to a decedent's real property devolves upon death to the decedent's devisees (for testate estates) and heirs (for intestate estates) (SDCL 29A-3-101). Though the title transfers by operation of law, the estate is still subject to administration in probate. Probate is the legal process of settling the decedent's estate and distributing assets to those entitled to receive them.

In probate proceedings, governed by Title 29A of the South Dakota Codified Laws, a personal representative (PR) is appointed to the estate by the probate court to act as the estate's fiduciary. After paying valid claims on the estate, applicable taxes, and expenses of administration, the PR is responsible for making distributions of property. Any part of the estate not disposed of by will is transferred by South Dakota's laws of intestate succession, located at SDCL 29A-2.

The PR executes a deed of distribution "as evidence of the distributee's title" (29A-3-907). A recorded deed of distribution is "conclusive evidence that the distributee has succeeded to the interest of the decedent...as against all persons interested in the estate," though the PR may recover the assets in case of improper distribution (SDCL 29A-3-908, Title Standard 15-06). Since title devolves by process of law, a deed of distribution simply evidences that the distributee is the rightful owner, and maintains an accurate chain of title.

The document recites information concerning the probated estate, including the decedent's name, date of death, county of probate, and the case number assigned to the estate by the court. In addition, the deed names the duly qualified and acting personal representative. The deed should identify the classification of the named distributees (either devisees under a will or heirs in an intestate estate), and name each distributee and the percent of the decedent's interest in the subject property he or she is inheriting, along with each distributee's address.

As with any conveyance of an interest in real property, a full legal description of the subject parcel is required. Any restrictions of title should be noted on the face of the deed. Distributions from an estate are exempt from transfer fees pursuant to SDCL 43-4-22(10). Finally the form must meet all state and local standards for recorded documents.

The PR must sign the deed in the presence of a notary public before recording in the Register of Deeds office in the county where the property is situated.

Consult an attorney with questions regarding deeds of distribution, or for any other issues related to probate in South Dakota, as each situation is unique.

(South Dakota PRDOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed of Distribution meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Personal Representative Deed of Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Anthony P.

May 16th, 2025

I was able to easily navigate the interface and purchase the forms that I needed. I was then able to prepare the forms with assistance from the reference documents provided with the deed. This was simple, easy, and user friendly. Great job!

Thanks, Anthony! We're glad to hear the process was simple and user-friendly for you. Appreciate the great feedback!

Gabriel R.

August 24th, 2022

So far the service seems good, simple to use. One criticism, the password change feature should require the user to re-enter their old password, new password, and re-enter the new password to make sure there is no typos. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone. Sincerely, Lori G.

Thank you!

Pamela P.

April 10th, 2021

Access to all the necessary forms was easy. The detailed guide very helpful for ensuring a customer can fill out the documents accurately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maree W.

August 5th, 2022

I am so impress with the forms that is needed for your state. It makes your task so easy and no worries. This was a big help in taking care of business. Thank you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly H.

March 27th, 2020

Very fast and easy to use!

Thank you Kimberly. Have a fantastic day.

Christine R.

February 8th, 2019

Ordering and directions were easy. The only thing missing in the instructions was how to record by mail. Thanks!

Thank you Christine. We'll work on making it more clear that one can find mailing information in our recording section. Have a great day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave M.

March 10th, 2020

Service as needed. A bit expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Brett B.

July 12th, 2022

easy to use

Thank you!

Virginia W.

March 14th, 2021

Easy instructions and a example on how to fill out the form.

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

John P.

December 8th, 2019

Working with one document at a time every thing was great, but the program will not let multiple documents save independently. When I saved a document and created another document the changes I made on the second document were on the 1st document. No big deal if your printing, but if your saving to email later, its an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

Dee S.

July 18th, 2019

This was easy and much cheaper than getting a lawyer. Thanks! - From alabama

We appreciate your business and value your feedback. Thank you. Have a wonderful day!