Hamlin County Transfer on Death Revocation Form

Hamlin County Transfer on Death Revocation Form

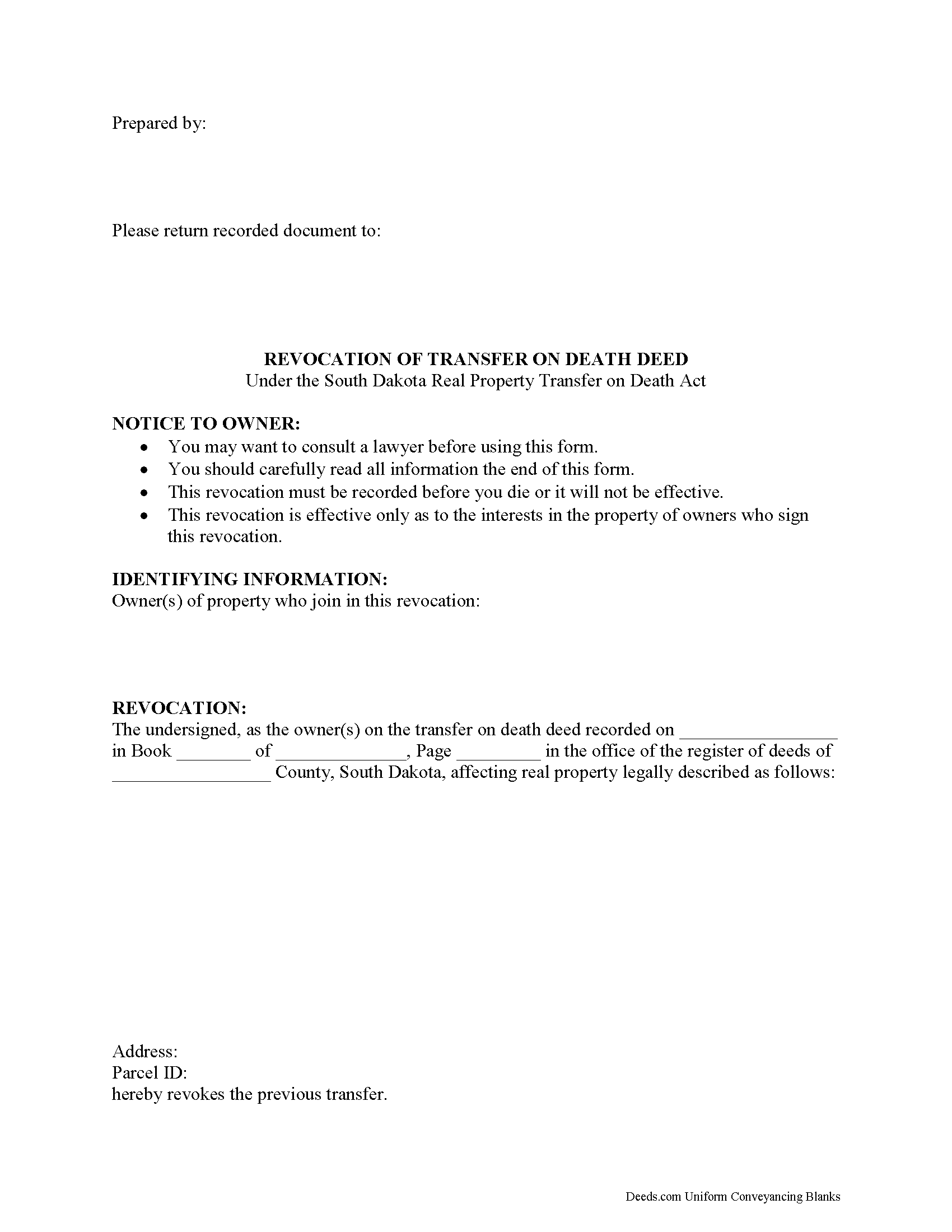

Fill in the blank form formatted to comply with all recording and content requirements.

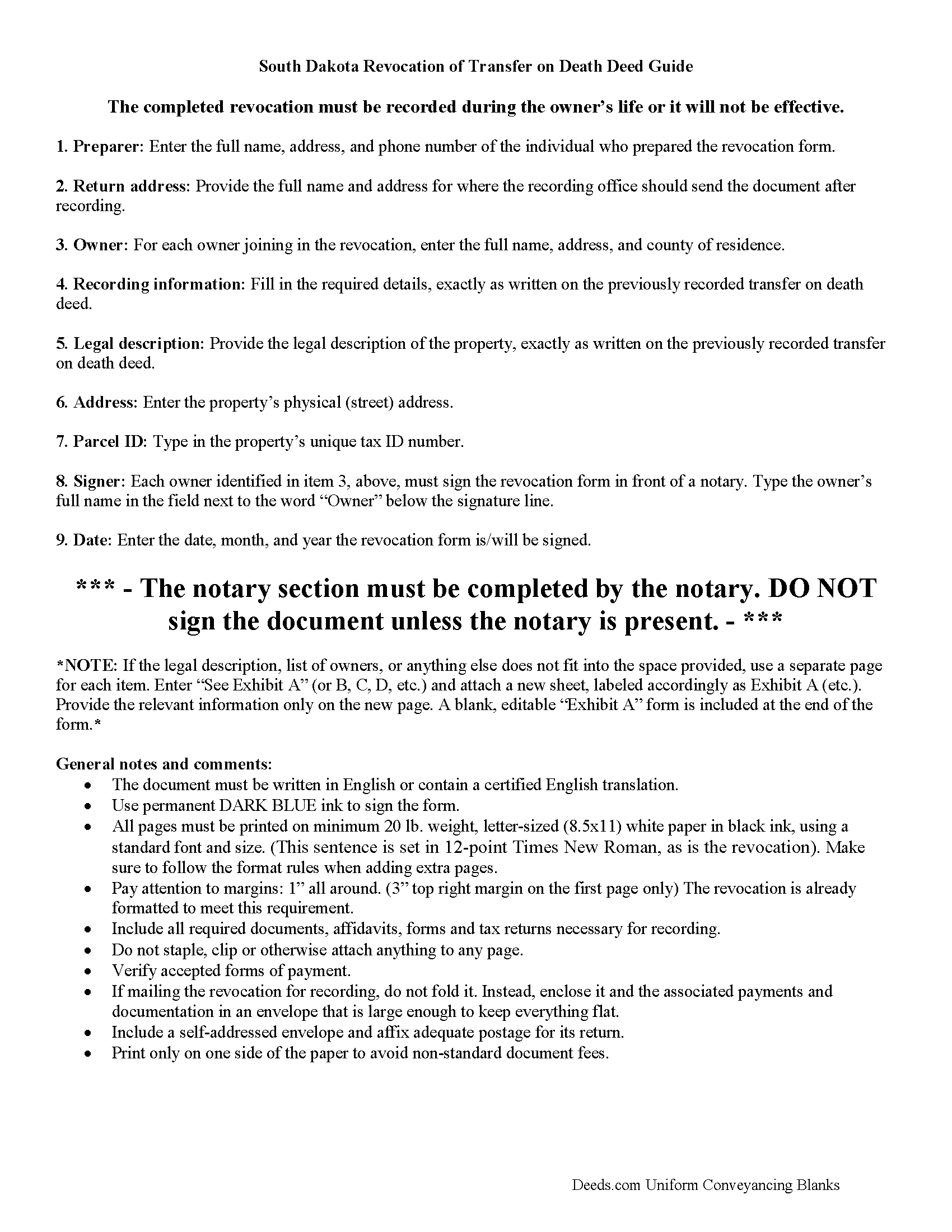

Hamlin County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

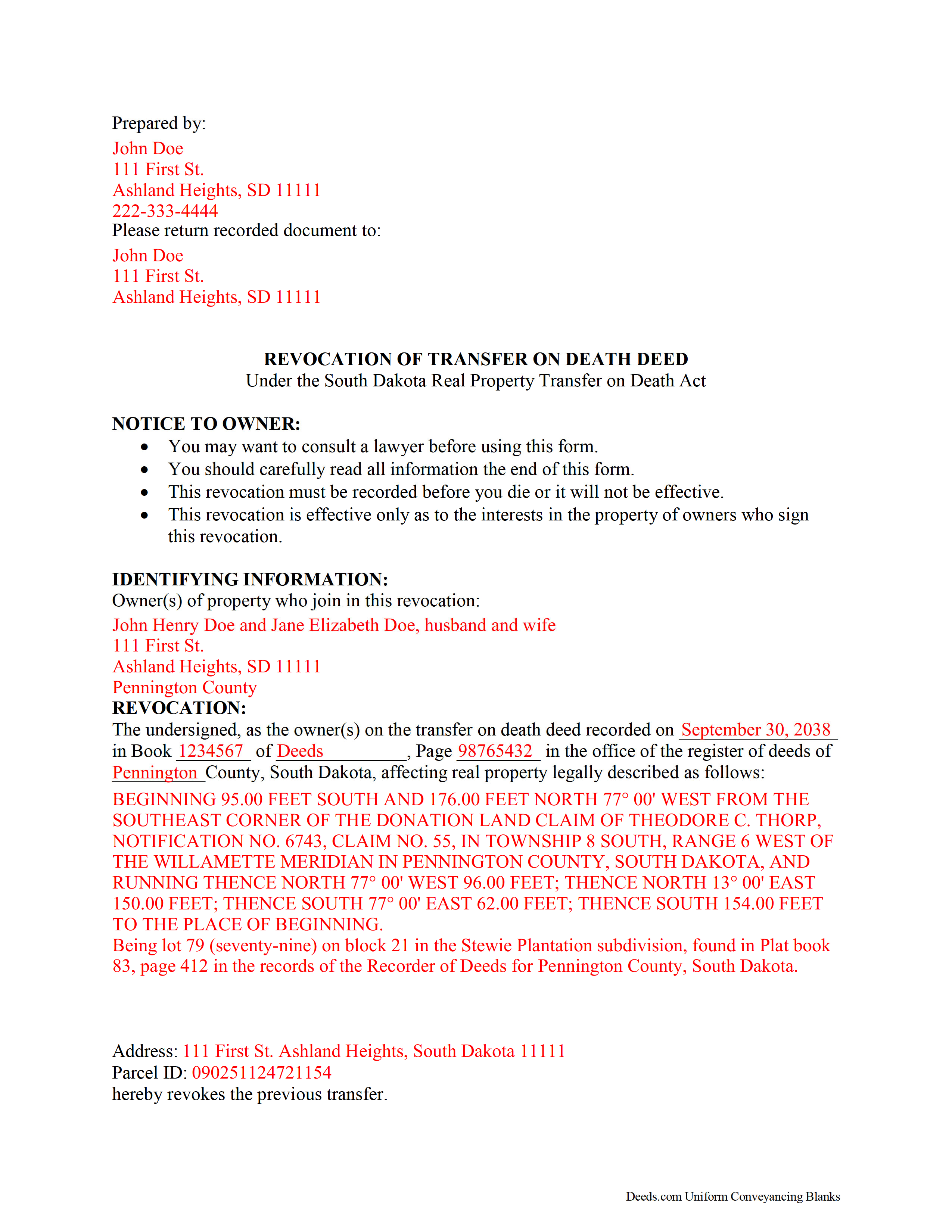

Hamlin County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Hamlin County documents included at no extra charge:

Where to Record Your Documents

Hamlin County Register of Deeds

Hayti, South Dakota 57241-0056

Hours: 8:00am to 4:30pm.M-F

Phone: (605) 783-3206

Recording Tips for Hamlin County:

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Hamlin County

Properties in any of these areas use Hamlin County forms:

- Bryant

- Castlewood

- Estelline

- Hayti

- Hazel

- Lake Norden

Hours, fees, requirements, and more for Hamlin County

How do I get my forms?

Forms are available for immediate download after payment. The Hamlin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamlin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamlin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamlin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamlin County?

Recording fees in Hamlin County vary. Contact the recorder's office at (605) 783-3206 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in South Dakota

The South Dakota Real Property Transfer on Death Act (SDCL 29A-6-401 et seq) went into effect on July 1, 2014. It offers owners of real estate in South Dakota an option for distributing their land after death by recording a transfer on death deed (TODD). They retain absolute control over and use of the land during their lives. The transferors may even modify or revoke the future transfer without penalty, and there is no need to update their wills or subject the property to probate.

This revocability is one of the most useful features about transfer on death deeds (TODDs) under the new law is (29A-6-405). It states that a TODD "is revocable even if the deed or another instrument contains a contrary provision." This is possible for two main reasons:

<ul><li>there is no obligation for consideration from or notice to any named beneficiaries (29A-6-409); and </li>

<li>until the owner's death, the beneficiaries have no actual, or present, interest in the property (29A-6-414).</li></ul>

Find the rules for revoking a previously recorded TODD at 29A-6-410. Subject to 29A-6-411, there are three primary ways to revoke or change the future transfer: Execute and record<ul>

<li>a new transfer on death deed that revokes the earlier TODD;</li>

<li>an instrument of revocation that expressly revokes the deed or part of the deed; or</li>

<li>an "standard" deed, such as a warranty or quitclaim deed that expressly revokes the transfer on death deed or part of the deed.</li></ul>

Note that, just as with the original transfer on death deed, any instrument of revocation must be recorded before the transferor's death in the public records in the office of the register of deeds in the county where the deed is recorded. See 29A-6-411 for information about joint owners.

Life is uncertain, and the flexibility of TODDs helps landowners respond to changes in circumstances with relative ease. Each case is unique, so contact an attorney with specific questions or for complex situations.

(South Dakota TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamlin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Hamlin County.

Our Promise

The documents you receive here will meet, or exceed, the Hamlin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamlin County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Bonnie A.

March 3rd, 2020

I little struggle downloading the forms at first but support helped. After that it was a breeze, happy with everything.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!

Richard W.

December 18th, 2020

I found that the product wasn't what I was looking for. But ordering the product was smooth and easy and when I notified them it wasn't the right product for my situation, they promptly refunded my credit card. If looking for docs again, I will try deeds.com again.

Thank you!

Elizabeth B.

February 3rd, 2020

Excellent product! Easy to fill out, complete directions. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

terrence h.

October 14th, 2023

Professional

Thank you!

Heather F.

January 13th, 2019

Quality forms and information. Everything went smoothly.

Great to hear Heather. Have a fantastic day!

Robert S.

January 23rd, 2019

The cost was well worth it. It was very easy to download, fill in the necessary information and then print the deed. I filed my need deed today and everything was complete and accurate because of the example you provided.

Thanks Robert, we appreciate your feedback!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Gladys F.

September 21st, 2020

The process was very friendly and easy to use. I appreciated the status updates as well as clear instructions on what was needed to get the file ready for recording.

Thank you!

GAYNELL G.

August 9th, 2022

THANKS

Thank you!

Alison B.

March 17th, 2021

The Deed of trust form was fine but the promissory note was less user friendly since I needed to change a few things that were fixed in the template. I ended up using white-out after I got no response when I emailed the help site that was provided in one of your emails, so it looks a little odd but should be usable

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret V.

August 6th, 2019

It was easy to follow the instructions, the sample pages were a great help.

Thank you!

Julie D S.

January 24th, 2020

thank you for all the forms

Thank you!

Anita A.

February 10th, 2019

No review provided.

Thank you!