Butte County Trustee Deed Form

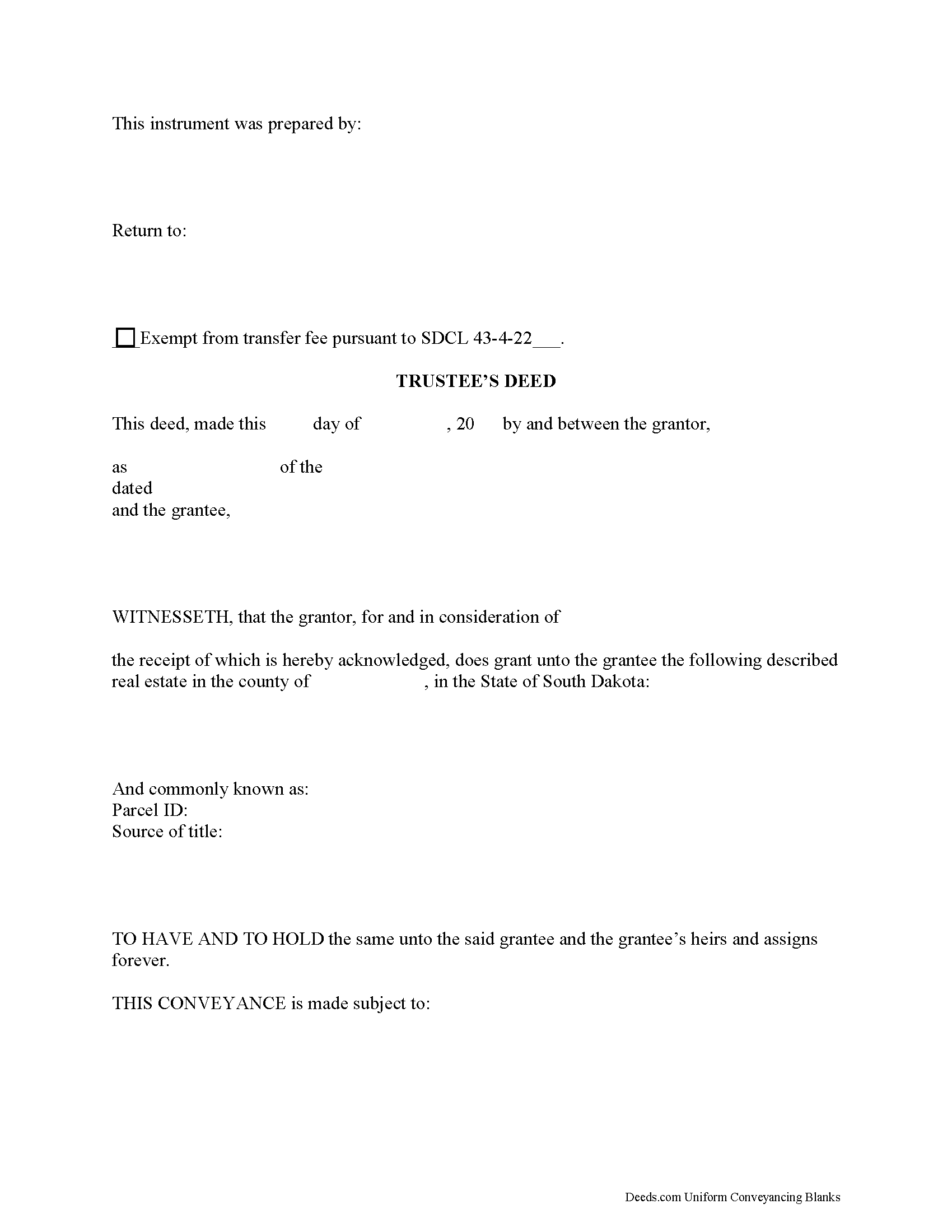

Butte County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

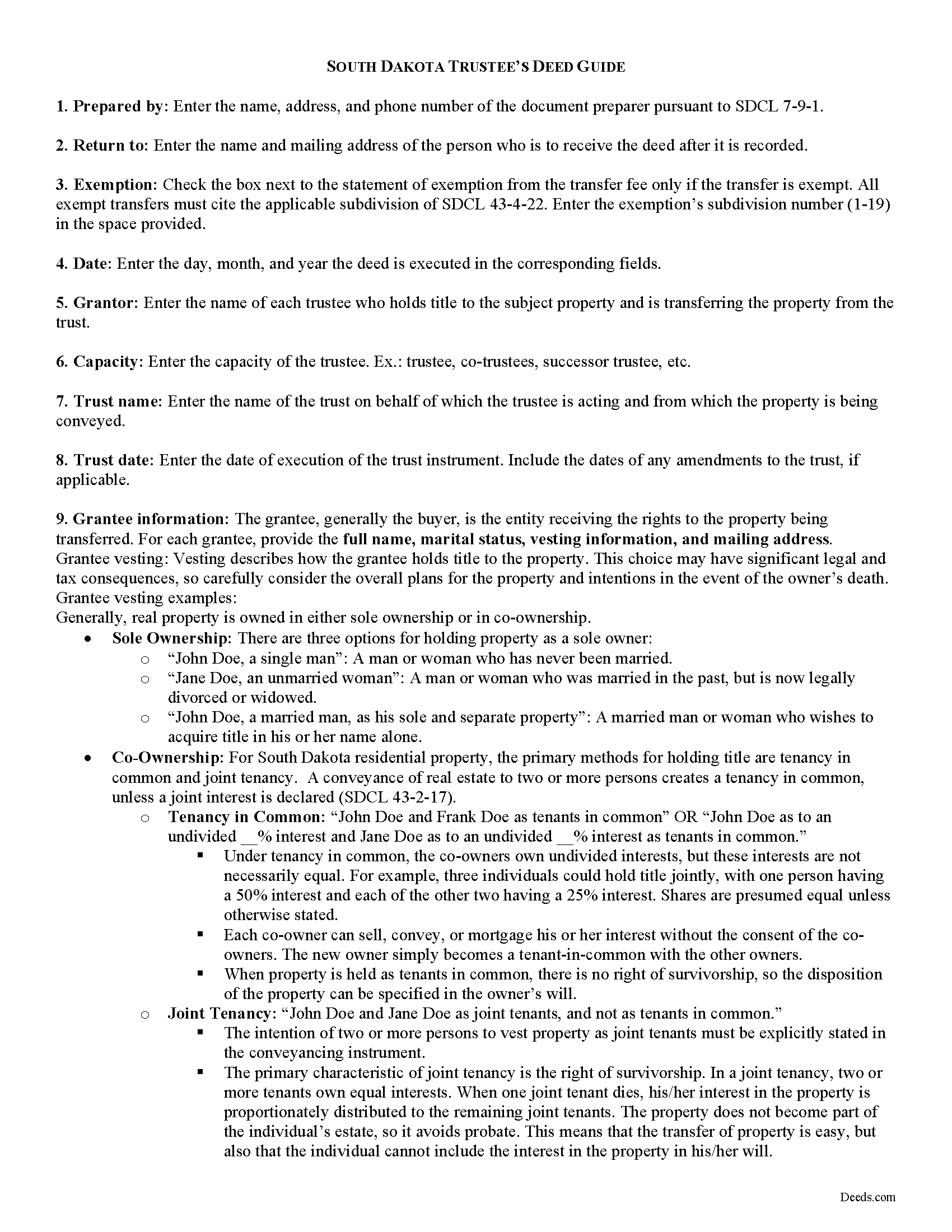

Butte County Trustee Deed Guide

Line by line guide explaining every blank on the form.

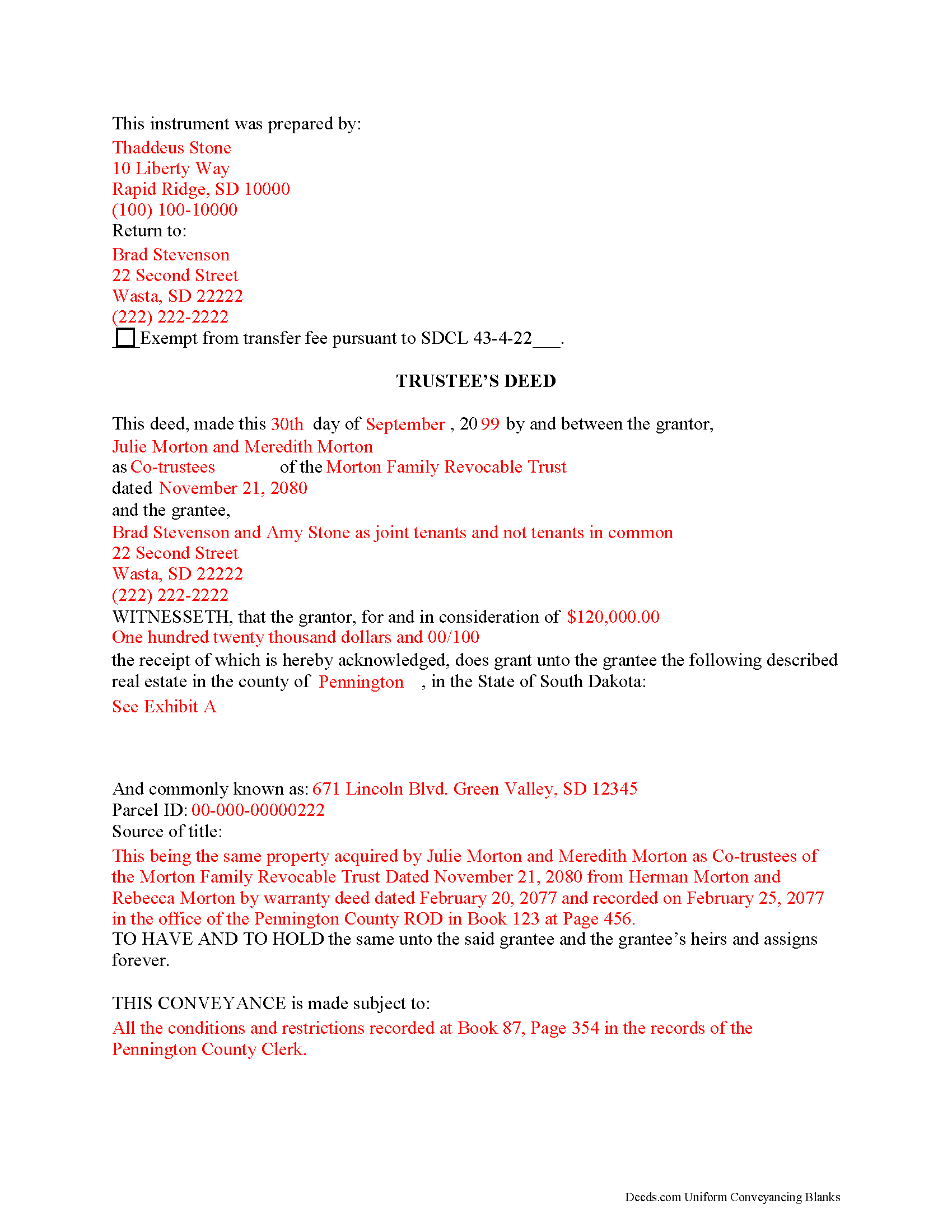

Butte County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Butte County documents included at no extra charge:

Where to Record Your Documents

Butte County Register of Deeds

Belle Fourche, South Dakota 57717-1796

Hours: 8:00am-5:00pm M-F

Phone: (605) 892-2912

Recording Tips for Butte County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Butte County

Properties in any of these areas use Butte County forms:

- Belle Fourche

- Newell

- Nisland

- Vale

Hours, fees, requirements, and more for Butte County

How do I get my forms?

Forms are available for immediate download after payment. The Butte County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Butte County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Butte County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Butte County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Butte County?

Recording fees in Butte County vary. Contact the recorder's office at (605) 892-2912 for current fees.

Questions answered? Let's get started!

Transferring Real Property by Trust in South Dakota

In a trust arrangement, a settlor transfers property (which may include real estate) to another person (called the trustee) for the benefit of another (called the beneficiary). Trusts that take effect during the settlor's lifetime are called living (inter vivos) trusts, and trusts that take effect upon the settlor's (testator's) death through the provisions of a will are called testamentary trusts.

In a living trust, a settlor may serve in all three capacities, as long as he is not the sole beneficiary. Living trusts are estate planning tools that take effect during a settlors' lifetime and allow them to determine how their assets will be managed upon death.

In South Dakota, trusts relating to real property must be created by a written instrument signed by the trustee (SDCL 43-10-4). The trust instrument establishes the trust's provisions, determines how the trust will be managed, designates the trustee and the trustee's powers, and identifies the trust beneficiary. Trust instruments are generally unrecorded in order to maintain the privacy of the settlor's estate plan. Transfers of real property to into trust can either occur concurrently with execution of the trust instrument, or the settlor can execute a later deed titling the property in the name of the trustee on behalf of the trust.

Unless otherwise limited by the terms of the trust, a trustee has a statutory power to "acquire, sell, or otherwise dispose of an asset" (SDCL 55-1A-11). Most trust instruments specifically include a power of sale. Transferring real property from a living trust requires a trustee's deed. A trustee's deed is named for the executing party rather than for the type of warranty conveyed.

In South Dakota, a trustee's deed carries the implied covenants typically associated with a special warranty deed. The word "grant" in the granting clause implies that "the grantor has not conveyed the same estate...to any person other than the grantee" and that "such estate is...free from encumbrances done, made, or suffered by the grantor, or any person claiming under him" (43-25-10).

In titling the property in the name of the grantee, the form of the trustee's deed names each granting trustee and the name and date of the trust on behalf of which the trustee is acting. A valid instrument also includes all requirements for documents relating to real property, such as a legal description of the subject parcel, and compliance with the recording prerequisites established at SDCL 43-28-23. Transfers of property in South Dakota require a certificate of real estate value and payment of applicable transfer fees.

Before recording the deed in the applicable county, it must be signed by each granting trustee in the presence of a notary public. At the time of conveyance, the trustee may also execute a certificate of trust in support of a real property transaction under SDCL 55-4-51.3 to confirm the trust's existence and his authority to convey the property.

Consult a lawyer in the preparation of a trustee's deed in South Dakota. Trust law can quickly become complex, and each situation requires unique attention.

(South Dakota TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Butte County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Butte County.

Our Promise

The documents you receive here will meet, or exceed, the Butte County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Butte County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Beatrice V.

August 27th, 2020

I was in despair as I needed to file two (2) very important documents with the County. Due to Covid the office was closed and my only recourse was to E-Fie with a service provider. I was fortunate enough to hear about Deeds.com. They were specific, courteous, patient and most of all productive. My documents will take awhile for the final filing but that is because the County happens to have a slow turn around time. Otherwise, I am now relieved that this part is over. Thank you Deeds.com. You are awesome.

Thank you for the kinds words Beatrice.

Tom L.

April 18th, 2019

An excellent service that I would be happy to use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Debora E.

August 19th, 2020

I was amazed! This company is so incredibly fast! They promised 10 minutes, it was actually less and I had the exact info I was needing! Definitely worth the cost!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GLENN B.

August 21st, 2023

Great affordable quick service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Noble Mikhail F.

October 2nd, 2020

The system is wonderful, and makes recording and searching simple, thanks a lot

Thank you!

Sylvia Y.

September 2nd, 2020

Fantastic forms! So nice to have them formatted correctly for our county, the recorder here can be very picky with the margins. No issues at all.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

December 28th, 2020

The sample completed form was a big help. While not exactly on point with my situation, it was enough to help me complete it on my own

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David O.

March 5th, 2024

I had overwhelming emotions taking my deceased wife's name off my condo, so it took me a year to steel myself to submit the form. I filed in Multnomah county, OR which also requires a cover sheet documented here: https://www.multco.us/recording/recording-requirements But, I'm totally happy with the service and quality from Deeds.com getting me what I needed to get this done.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Cheryl C.

February 23rd, 2023

my only problem is the cost of the form I downloaded. A bit cheaper would be nice

Thank you for your feedback. We really appreciate it. Have a great day!

Caroline K.

August 16th, 2019

SIMPLE, THAT IS GOOD

Thank you for your feedback. We really appreciate it. Have a great day!

David E.

May 19th, 2023

What a great set of documents, including instructions and examples. Also has a set of bonus documents. Very nice for a do-it-yourselfer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris M.

May 9th, 2024

The personal attention and the ease of use is beyond any other service I have used. Thank you for making my work so much easier.

Thank you for your positive words! We’re thrilled to hear about your experience.

Michael O.

January 9th, 2023

Great experience. Pre-printed forms, line explanations and samples - solve a lot of problems, eliminate many headaches and research. Thank You!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Trace A.

June 3rd, 2023

Deeds.com had much better and fuller information than any other help i found (90% complete vs 60 % complete); they tout how up-to-date they are on all the counties in the country and the idiosyncrasies of each county's forms and procedures; but some minor points of the info i needed were missing or confusing. Including that they sold me on e-Recording my deed through them, only to find out after i had done all the prep for that, that they had failed to tell me upfront (or i missed it somehow) that the county i was dealing with did not yet accept online recording. So, they were by far the best i found, but not 100%.

Thank you for your honest and thorough feedback Trace. We will review your concerns carefully in an effort to improve our services. Hope you have an amazing day.

Michael M.

April 17th, 2024

Great service that satisfied all my needs. Great prices too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!