Lawrence County Final Lien Waiver Form (Tennessee)

All Lawrence County specific forms and documents listed below are included in your immediate download package:

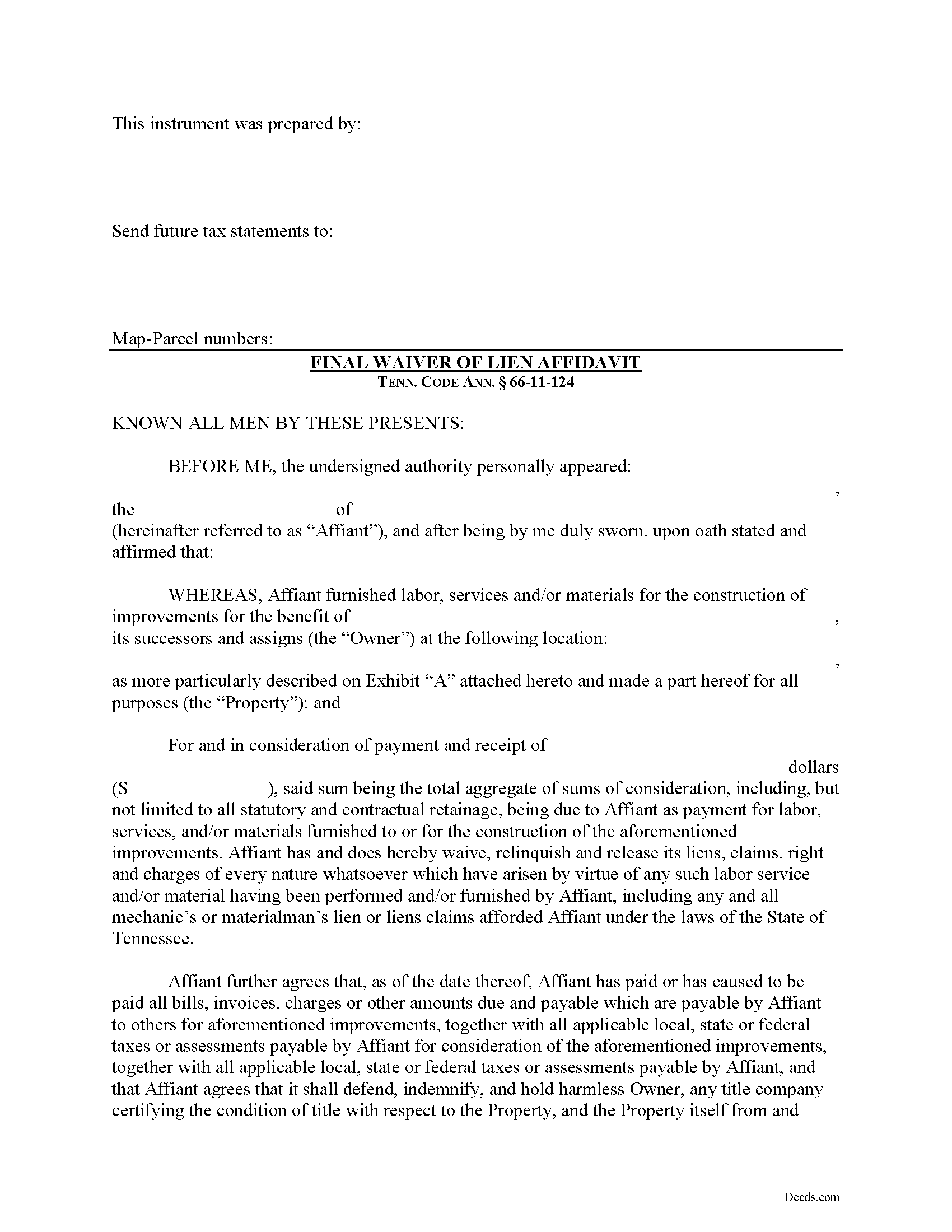

Final Lien Waiver Form

Fill in the blank Final Lien Waiver form formatted to comply with all Tennessee recording and content requirements.

Included Lawrence County compliant document last validated/updated 6/4/2025

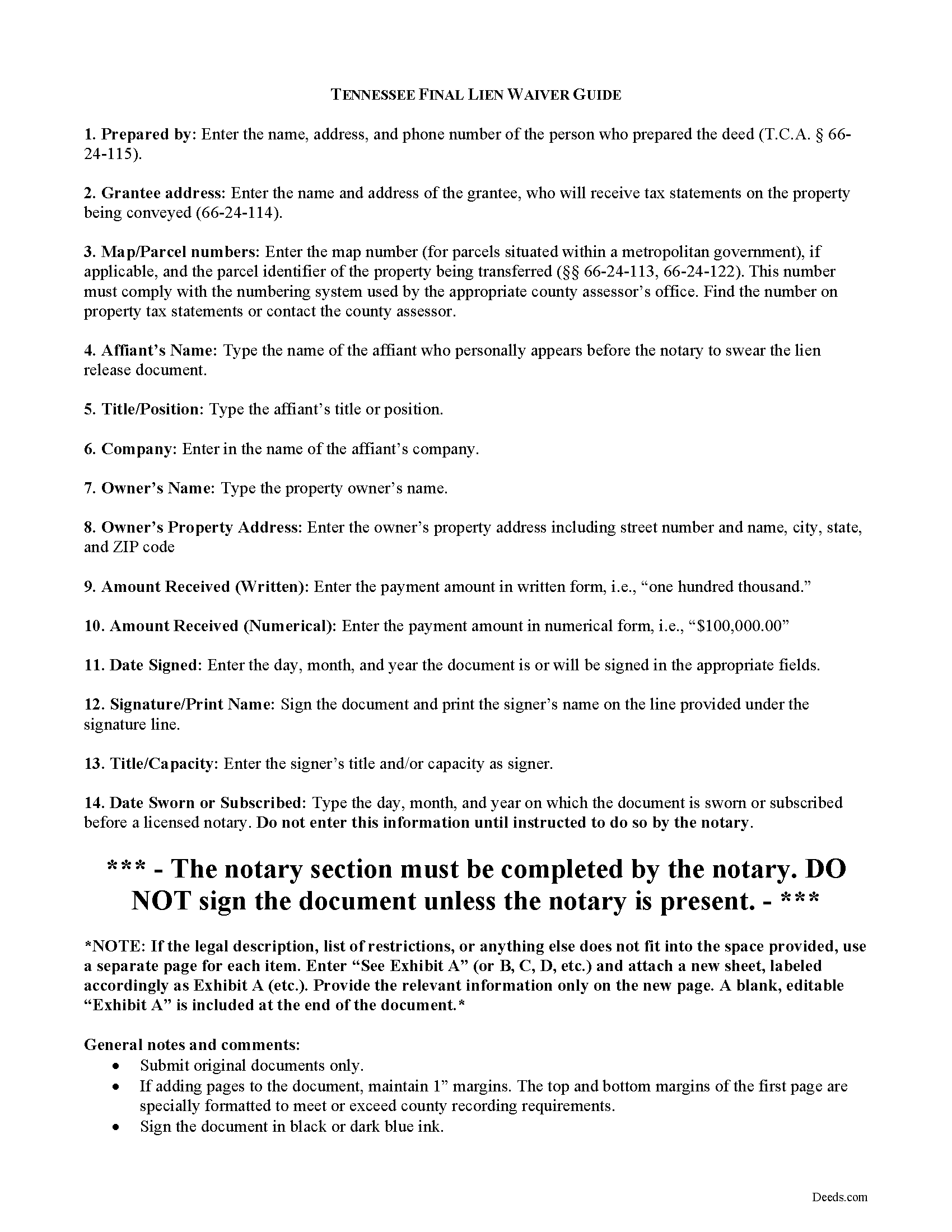

Final Lien Waiver Guide

Line by line guide explaining every blank on the form.

Included Lawrence County compliant document last validated/updated 5/21/2025

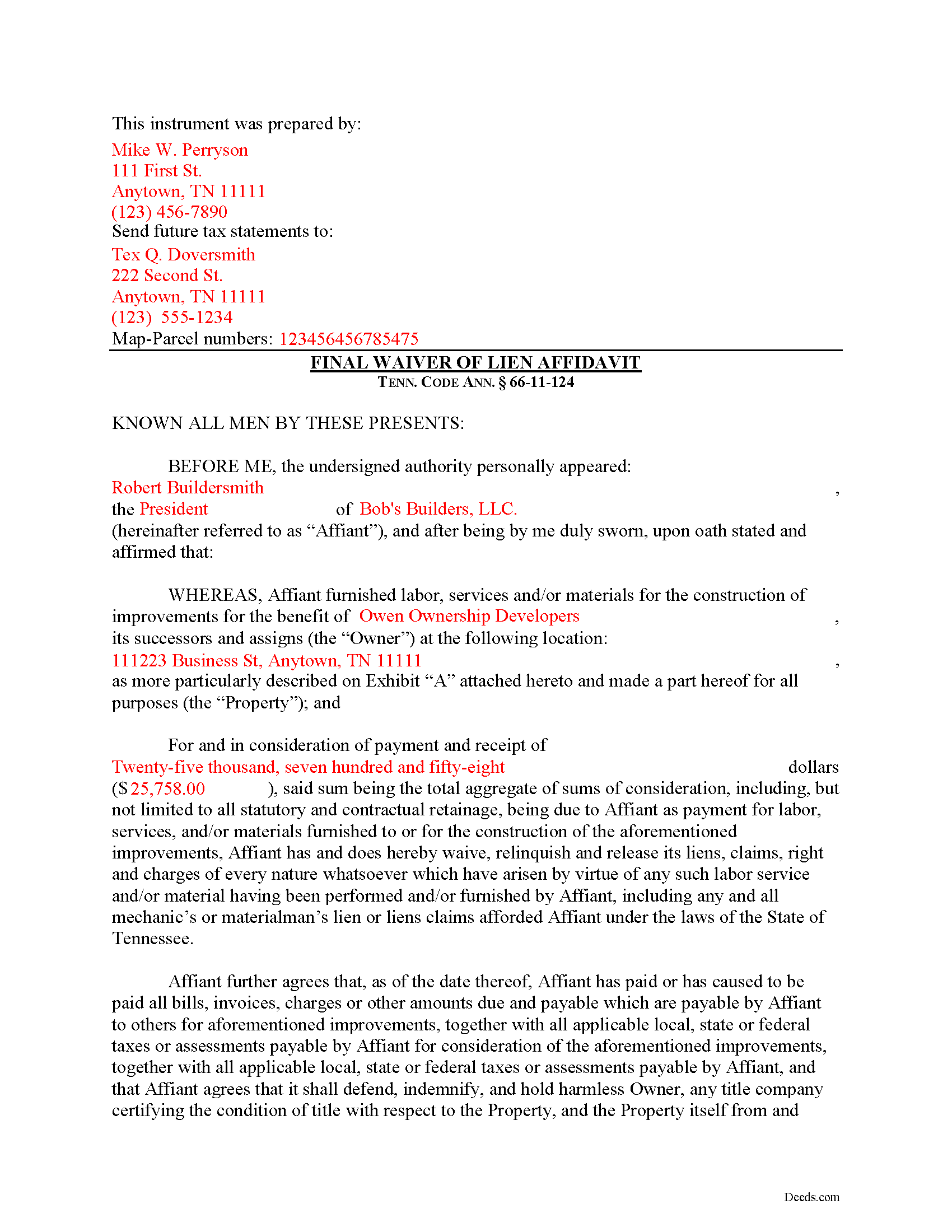

Completed Example of the Final Lien Waiver Document

Example of a properly completed form for reference.

Included Lawrence County compliant document last validated/updated 1/20/2025

The following Tennessee and Lawrence County supplemental forms are included as a courtesy with your order:

When using these Final Lien Waiver forms, the subject real estate must be physically located in Lawrence County. The executed documents should then be recorded in the following office:

Lawrence County Register of Deeds

200 West Gaines St, Suite 104, Lawrenceburg, Tennessee 38464

Hours: 8:30 to 4:30 M-F

Phone: (931) 766-4180

Local jurisdictions located in Lawrence County include:

- Ethridge

- Five Points

- Iron City

- Lawrenceburg

- Leoma

- Loretto

- Saint Joseph

- Summertown

- Westpoint

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lawrence County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lawrence County using our eRecording service.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can the Final Lien Waiver forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lawrence County that you need to transfer you would only need to order our forms once for all of your properties in Lawrence County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Lawrence County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lawrence County Final Lien Waiver forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Executing a Final Lien Waiver in Tennessee

"Waiver" is a legal term which means giving up a right. A waiver can be written or oral. It can also be expressed by a formal agreement or implied through conduct of the parties. When discussing mechanic's liens, a waiver refers to a written document granted by a lien claimant to a property owner. This document usually confirms a partial or final payment and states that the lien claimant is waiving a right to claim a lien for the partial or full amount. Waivers help ease feelings of distrust between parties dealing at arms-length and give peace of mind for the laborer that he or she will get paid and for the property owner that his or her property won't be burdened by any mechanic's liens.

In Tennessee, lien waivers are governed under 66-11-124 of the Tennessee Property Code. Lien waivers in Tennessee must be explicit and are never implied. The acceptance by the lienor of a note or notes for all or any part of the amount of the lienor's claim shall not constitute a waiver of the lienor's lien, unless expressly so agreed in writing, nor shall it in any way affect the period for serving or recording the notice of lien under this chapter. Tenn. Prop. Code 66-11-124(a). Further, any contract term that purports to waive any right of lien under this chapter is void and unenforceable as against the public policy of this state. Tenn. Prop. Code 66-11-124(b). In fact, if a contractor solicits any person to sign a contract requiring the person to waive a right of lien, the person shall notify the state board for licensing contractors of that fact. Tenn. Prop. Code 66-11-124(b)(2)(A). Upon receiving the information, the executive director of the board shall notify the contractor within a reasonable time after receiving the information that the contract is against the public policy of the state and in violation of this section.

Use a final lien waiver only when the responsible party makes full payment on the balance due. For instance, if the entire contract is for $100,000 and the owner makes a $10,000 progress payment, a partial waiver is appropriate because it allows the contractor to retain lien rights for the remaining amount owed. If a full and final payment of the entire $100,000 or the final $10,000 payment is tendered, then a final lien waiver is appropriate.

A valid waiver is in the form of an affidavit (sworn statement). It identifies the parties, the location of the work, relevant dates and amounts paid, and any other information necessary for the specific situation. Record the completed and notarized document in the records of the county where the property is situated.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Final Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process.

TL

Thank you for your feedback. We really appreciate it. Have a great day!

Noelle V.

December 31st, 2024

I requested a copy of some documents and within the hour, they were waiting for me in PDF form. It was easy and helped a great deal to have this service available.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda R.

April 30th, 2019

I was happy to have my payment cancelled when no information was found. And I was given a link to contact the deed office directly.

Thank you!

Belinda B.

June 22nd, 2022

Very difficult navigating this site.

Sorry to hear of your struggle. Thank you for your feedback.

Phoenix D.

August 17th, 2020

I was looking for the proper quit claim deed for my state. I found it on deeds.com along with instructions and a sample. I couldn't have filed without them.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

March 1st, 2019

The service was very helpful and fast saving me time. I am sure I will use it again.

Thank you

Thanks Stephen! Have a fantastic day.

Brian R.

May 12th, 2020

Your website is very informative, and easy to use.The purchase and download process was clear and went well. I would add that your Virginia Quitclaim Deed Guide is very comprehensive and informative. This combined with the example form you provide is most helpful.

Thank You. Brian R

Thank you for your feedback. We really appreciate it. Have a great day!

Jacinto A.

April 22nd, 2019

The forms are exactly what was needed. But wish I was able to click on the preview form to make sure it was the correct forms

Thank you for your feedback Jacinto.

Lisa C.

December 5th, 2023

Thank you. Very easy!

We are delighted to have been of service. Thank you for the positive review!

Brandi P.

December 9th, 2020

The service itself is great, but the deed sample I ordered wasn't as accurate as I'd hoped. I needed to correct and resubmit. Not a huge deal, but a bit of an inconvenience.

Thank you for your feedback. We really appreciate it. Have a great day!