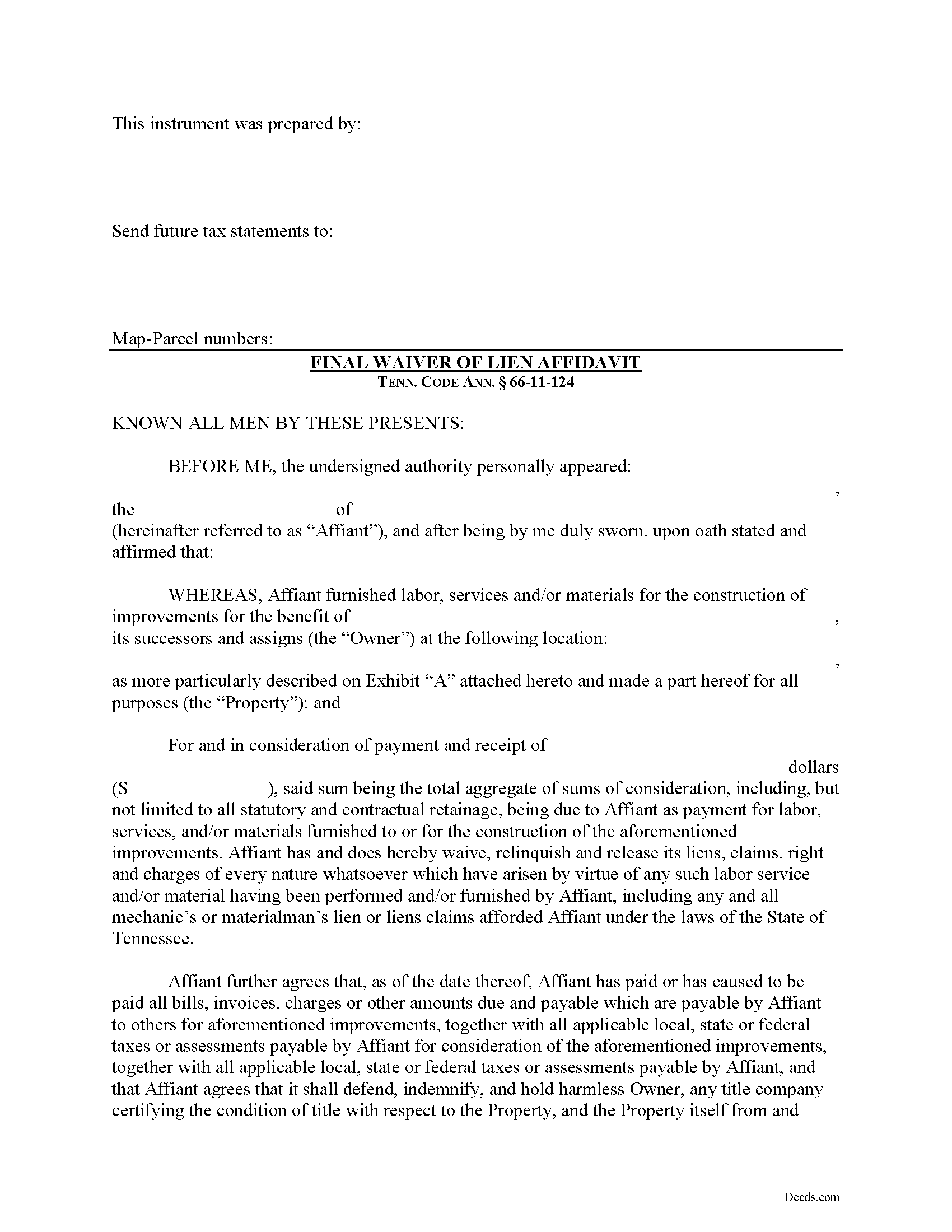

Lincoln County Final Lien Waiver Form

Lincoln County Final Lien Waiver Form

Fill in the blank Final Lien Waiver form formatted to comply with all Tennessee recording and content requirements.

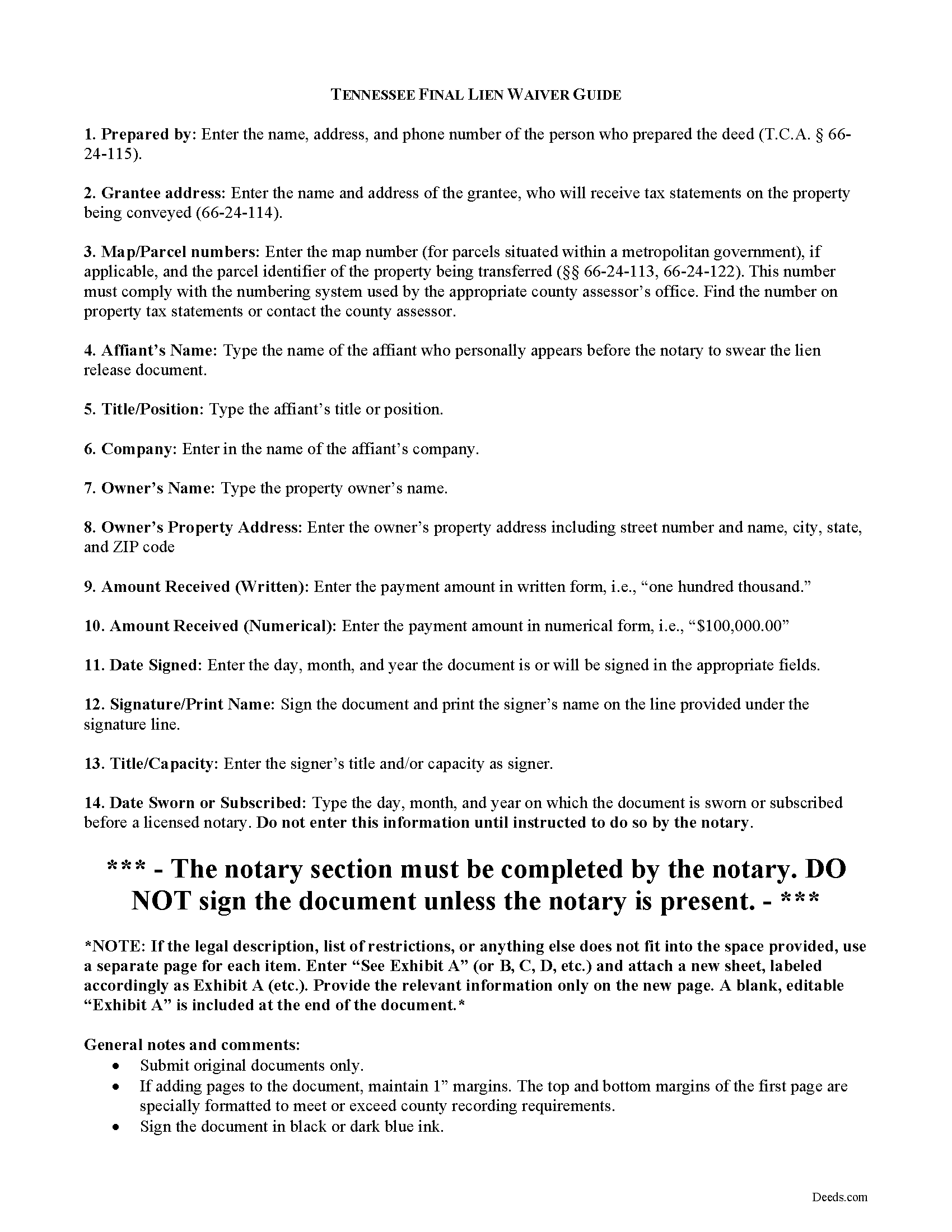

Lincoln County Final Lien Waiver Guide

Line by line guide explaining every blank on the form.

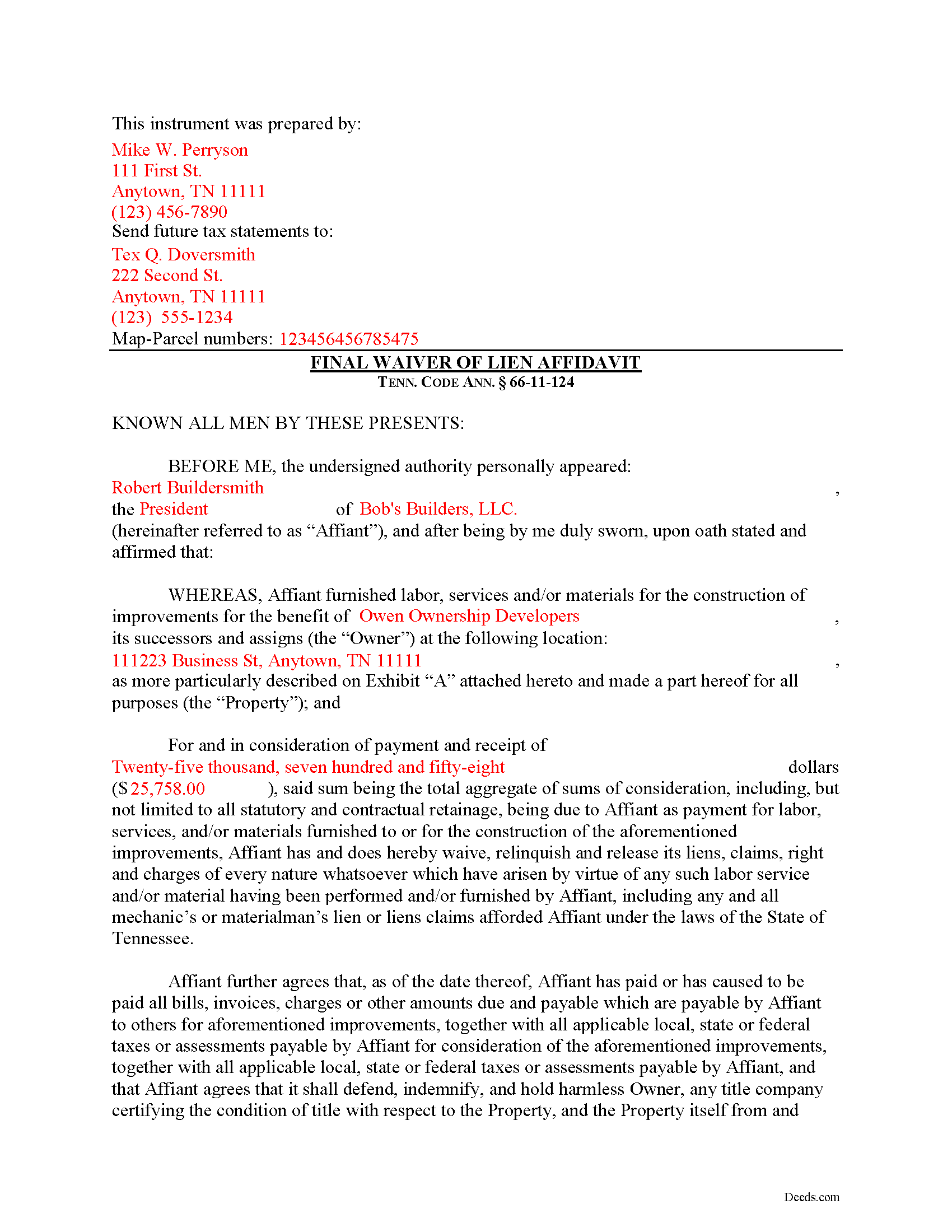

Lincoln County Completed Example of the Final Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Register of Deeds

Fayetteville, Tennessee 37334

Hours: 8:00am to 4:00pm M-F

Phone: (931) 433-5366

Recording Tips for Lincoln County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Dellrose

- Elora

- Fayetteville

- Flintville

- Frankewing

- Kelso

- Mulberry

- Petersburg

- Taft

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (931) 433-5366 for current fees.

Questions answered? Let's get started!

Executing a Final Lien Waiver in Tennessee

"Waiver" is a legal term which means giving up a right. A waiver can be written or oral. It can also be expressed by a formal agreement or implied through conduct of the parties. When discussing mechanic's liens, a waiver refers to a written document granted by a lien claimant to a property owner. This document usually confirms a partial or final payment and states that the lien claimant is waiving a right to claim a lien for the partial or full amount. Waivers help ease feelings of distrust between parties dealing at arms-length and give peace of mind for the laborer that he or she will get paid and for the property owner that his or her property won't be burdened by any mechanic's liens.

In Tennessee, lien waivers are governed under 66-11-124 of the Tennessee Property Code. Lien waivers in Tennessee must be explicit and are never implied. The acceptance by the lienor of a note or notes for all or any part of the amount of the lienor's claim shall not constitute a waiver of the lienor's lien, unless expressly so agreed in writing, nor shall it in any way affect the period for serving or recording the notice of lien under this chapter. Tenn. Prop. Code 66-11-124(a). Further, any contract term that purports to waive any right of lien under this chapter is void and unenforceable as against the public policy of this state. Tenn. Prop. Code 66-11-124(b). In fact, if a contractor solicits any person to sign a contract requiring the person to waive a right of lien, the person shall notify the state board for licensing contractors of that fact. Tenn. Prop. Code 66-11-124(b)(2)(A). Upon receiving the information, the executive director of the board shall notify the contractor within a reasonable time after receiving the information that the contract is against the public policy of the state and in violation of this section.

Use a final lien waiver only when the responsible party makes full payment on the balance due. For instance, if the entire contract is for $100,000 and the owner makes a $10,000 progress payment, a partial waiver is appropriate because it allows the contractor to retain lien rights for the remaining amount owed. If a full and final payment of the entire $100,000 or the final $10,000 payment is tendered, then a final lien waiver is appropriate.

A valid waiver is in the form of an affidavit (sworn statement). It identifies the parties, the location of the work, relevant dates and amounts paid, and any other information necessary for the specific situation. Record the completed and notarized document in the records of the county where the property is situated.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Final Lien Waiver meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Final Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela C.

October 5th, 2022

It was easy to download. And your guide was informative as was the completed form for an example. But I wish that I had been able to edit the forms online and then print. My handwritten info is just not as crisp.

Thank you for your feedback. We really appreciate it. Have a great day!

Theadore L.

January 4th, 2024

Bought a transfer on death deed form and it worked great. Easy to fill out and record with the County. Got some helpful information from the county recorders office before filling out the form. I found out that I could use one deed for 2 properties. Saved me money not having to pay fees for 2 deeds.

We are delighted to have been of service. Thank you for the positive review!

Melissa H.

August 10th, 2021

Amazing forms! Order the quitclaim deed forms, got the form and lots of extra forms which is good because I needed a few of them and didn't even know it. Very happy, will be back if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry B.

May 18th, 2021

Poor quality document. Deed did not contain space for mandatory rax info required.

Thank you for your feedback Larry. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Jenny B.

October 30th, 2019

Thank you! Will use you again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karina C.

March 27th, 2020

The process was very convenient, fast, and efficient. I appreciated the messaging feature which provided real-time communication. I would certainly recommended this service to anyone needing it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher G.

August 20th, 2020

thank you - your service is awesome - i sent documents to the county - after 2 plus weeks they returned them with 'errors' - i went to your site - signed up - uploaded documents and submitted in less than 3 minutes - had it approved by the county in under 12 hours - THANK YOU - great service!!!!

Thank you Christopher, glad we could help. Have a great day!

Nancy O.

July 27th, 2023

Outstanding forms and service. Liked that the main deed forms were PDF so I could fill them out on my laptop, in my own time, instead of some online Q/A auto populate system. Guide was helpful, as was the completed sample. Used the erecording service to file the deed, amazing.

Thank you for your wonderful review Nancy! Our team takes pride in providing helpful resources, and we are pleased that the guide and completed sample were beneficial to you throughout the process. Making the deed filing journey smoother for our users is always our top priority.

Wilburn R.

July 23rd, 2023

absolutely great

Thank you!

Norman K.

March 2nd, 2021

It wasn't really what I needed I read and read and read and read and I thought I was to do with for filing for probate or probate executor but instead it was for the property if you are executor and but it wasn't very clear on that so it didn't work for me so I was kind of wasted money

Sorry to hear that Norman. We've gone ahead and canceled your order and payment.

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen C.

October 23rd, 2019

Legal documents that served the purpose nothing too exciting.

Thank you Karen. Have a great day!

Norman J.

October 3rd, 2023

I really enjoyed your service. It was great.

Thank you!

Debra P.

October 7th, 2020

Looked everywhere to find what I needed. Found your website and there it was. Very pleased with the speed that I received my documents in. Will definitely keep you in my go to.

Thank you!