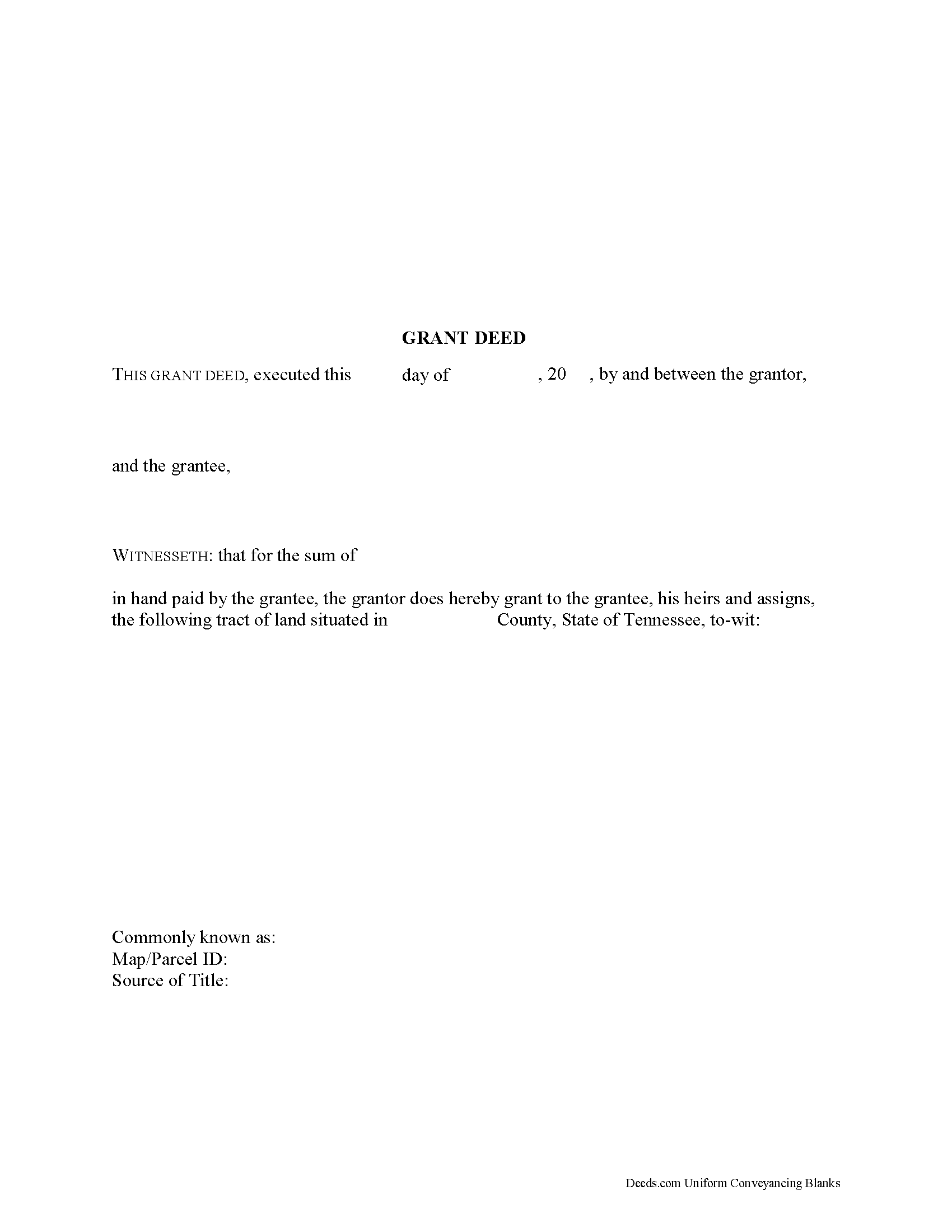

Marion County Grant Deed Form

Marion County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

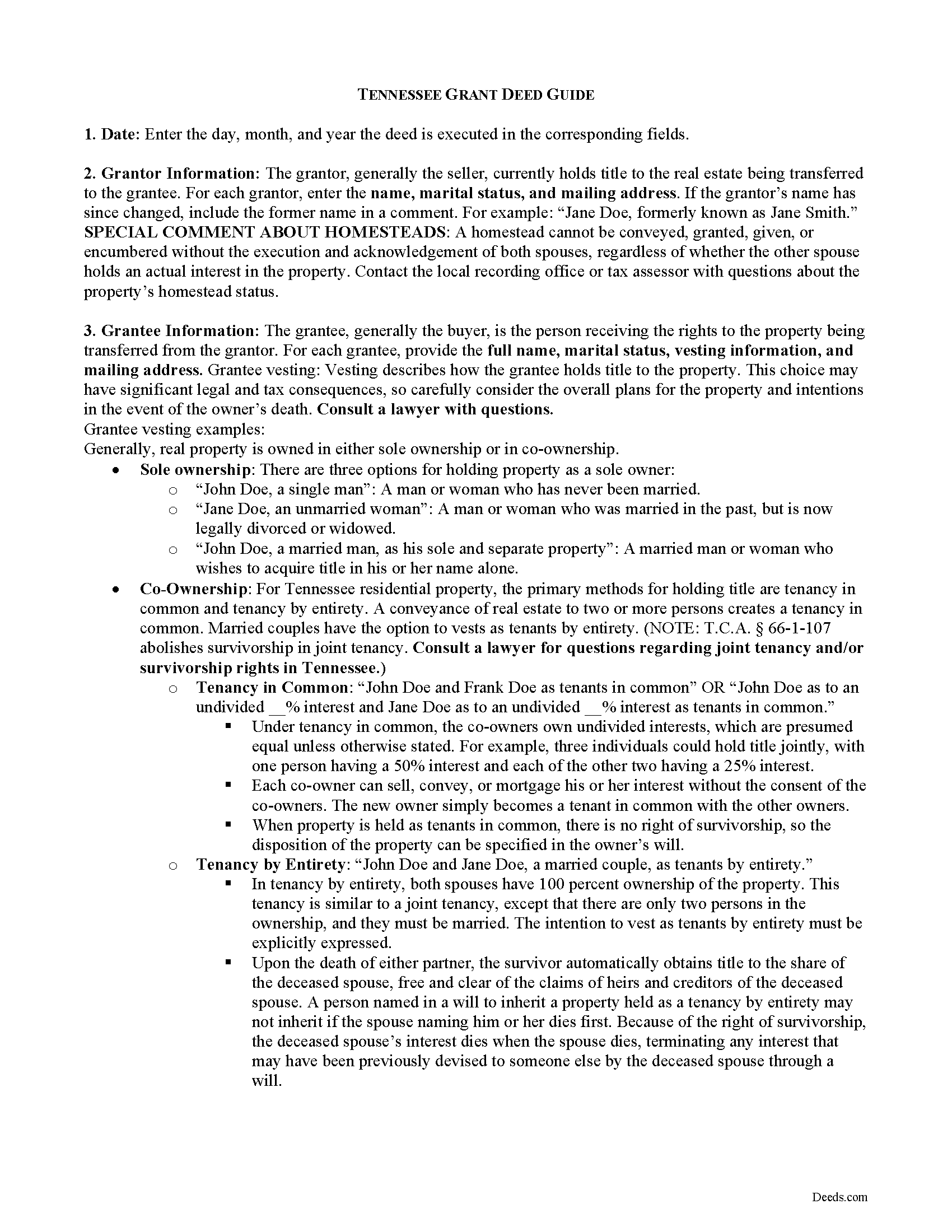

Marion County Grant Deed Guide

Line by line guide explaining every blank on the form.

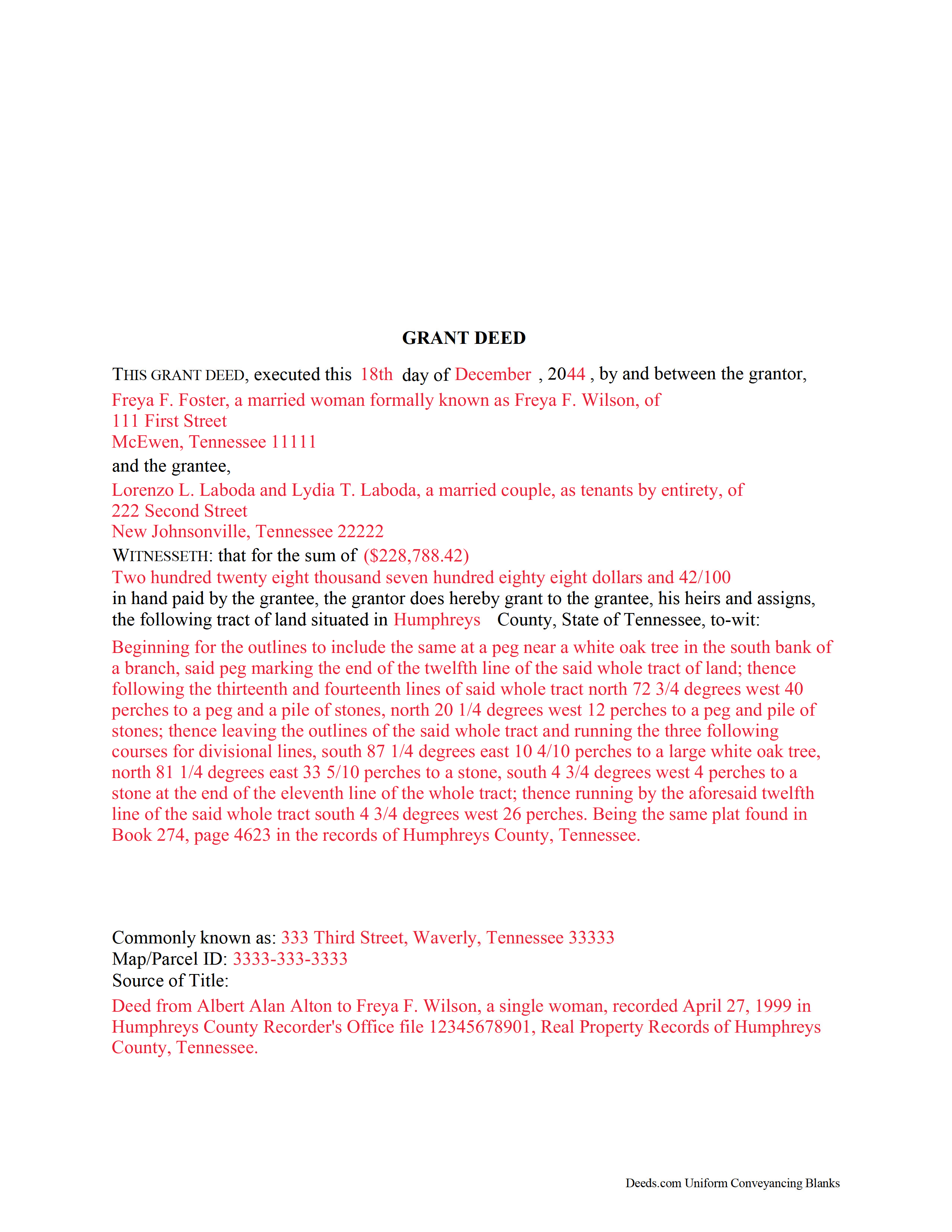

Marion County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Register of Deeds

Jasper, Tennessee 37347

Hours: 8:00am to 4:00 M-F Central

Phone: (423) 942-2573

Recording Tips for Marion County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Guild

- Jasper

- Sequatchie

- South Pittsburg

- Whiteside

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (423) 942-2573 for current fees.

Questions answered? Let's get started!

In Tennessee, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with some covenants of title. The word "grant" in the conveyancing clause typically signifies a grant deed, but it is not a statutory form in Tennessee.

Grant deeds offer the grantee (buyer) more protection than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. Grant deeds contain implied covenants that the grantor holds an interest in the property and is free to convey it. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Tennessee residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons creates a tenancy in common. Married couples have the option to vests as tenants by entirety. T.C.A. 66-1-107 abolishes survivorship in joint tenancy. Consult a lawyer for questions regarding joint tenancy and/or survivorship rights in Tennessee.

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, the deed must meet all state and local standards for recorded documents.

Record the original completed deed, along with any additional materials, at the recorder's office in the county where the property is located. Recordation taxes are due upon recording. See 67-4-409 for exemptions. Refer to the same statute and contact the appropriate recorder's office for information on recordation taxes and up-to-date fees.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Tennessee lawyer with any questions related to the transfer of real property.

(Tennessee Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Michelle M.

July 3rd, 2020

The website was easy to navigate and great communication on every step of the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie P.

October 16th, 2021

Fantastic deed forms, formatting was spot on, nice not to have to worry about it considering how picky our clerk is. Great job you guys and gals!

Thank you for the kind words Leslie!

Sheilah C.

November 24th, 2020

So far very good. I will know more when I complete the forms and submit them.

Thank you!

Nicole M.

June 3rd, 2020

This is my very first use with your company. I submitted my package and within the hour you had responded with an Invoice for me to pay so you could proceed with my recording. So far I am very impressed! Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald D.

July 15th, 2022

very quick and easy to find, confirm, pay, and download documents, well worth the money for peace of mind.

Thank you!

Burr A.

November 7th, 2020

So far so good. Prompt and responsive. Thank you.

Thank you!

Dennis M.

November 26th, 2020

Very quick and easy to use. Deeds.com saved me a lot of money!

Thank you!

Joe B.

August 29th, 2022

Fantastic service -- very clear

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mike H.

February 11th, 2021

Great

Thank you!

Jill M.

January 12th, 2019

This service gave me the information and guide I needed to file a Quitclaim Deed. I went through the process with no problems at all.

Thank you Jill, we appreciate your feedback.

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Barbara A.

April 25th, 2024

Always helpful!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Tim R.

May 9th, 2019

Quick and efficient

Thank you Tim, we appreciate your feedback.

Robert J D.

December 19th, 2018

I accidentally ordered 2 forms for the affidavit of death. I only need one.

Thanks for your feedback. Looking at your account we do not see any duplicate orders. Our system does stop duplicate orders before they are processed in many cases. Have a great day.

Aubrey M.

May 31st, 2020

I am an attorney who was trying to draft some deeds in arizona. The deed templates coupled with the document instructions saved me hours work. At 1st I was skeptical, so spent hours figuring out how to draft the documents, but could have saved so much time If I had just spend the $20 sooner. Would use again is needed a deed format as a basis for my drafting.

Thank you for your feedback. We really appreciate it. Have a great day!