Warren County Grant Deed Form (Tennessee)

All Warren County specific forms and documents listed below are included in your immediate download package:

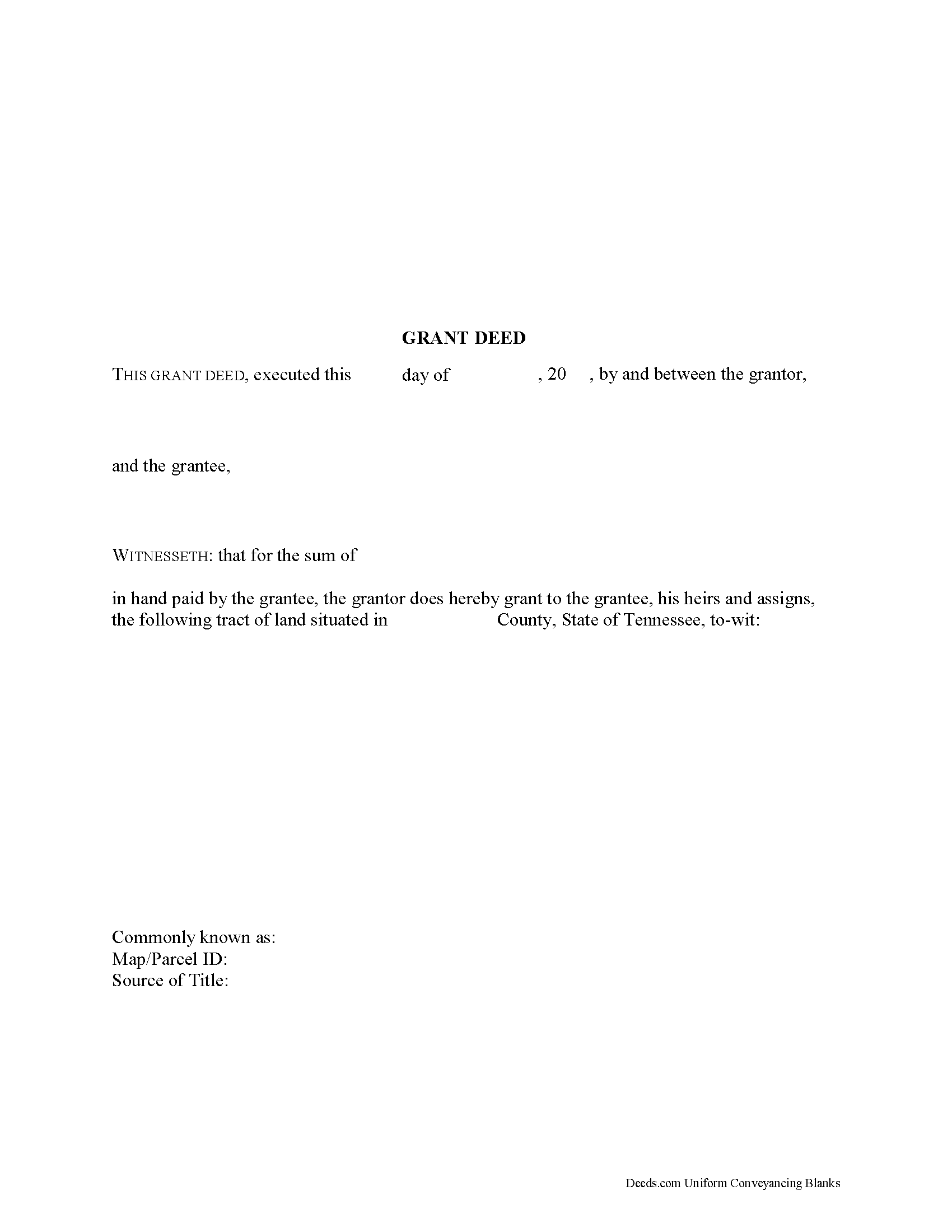

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Warren County compliant document last validated/updated 7/11/2025

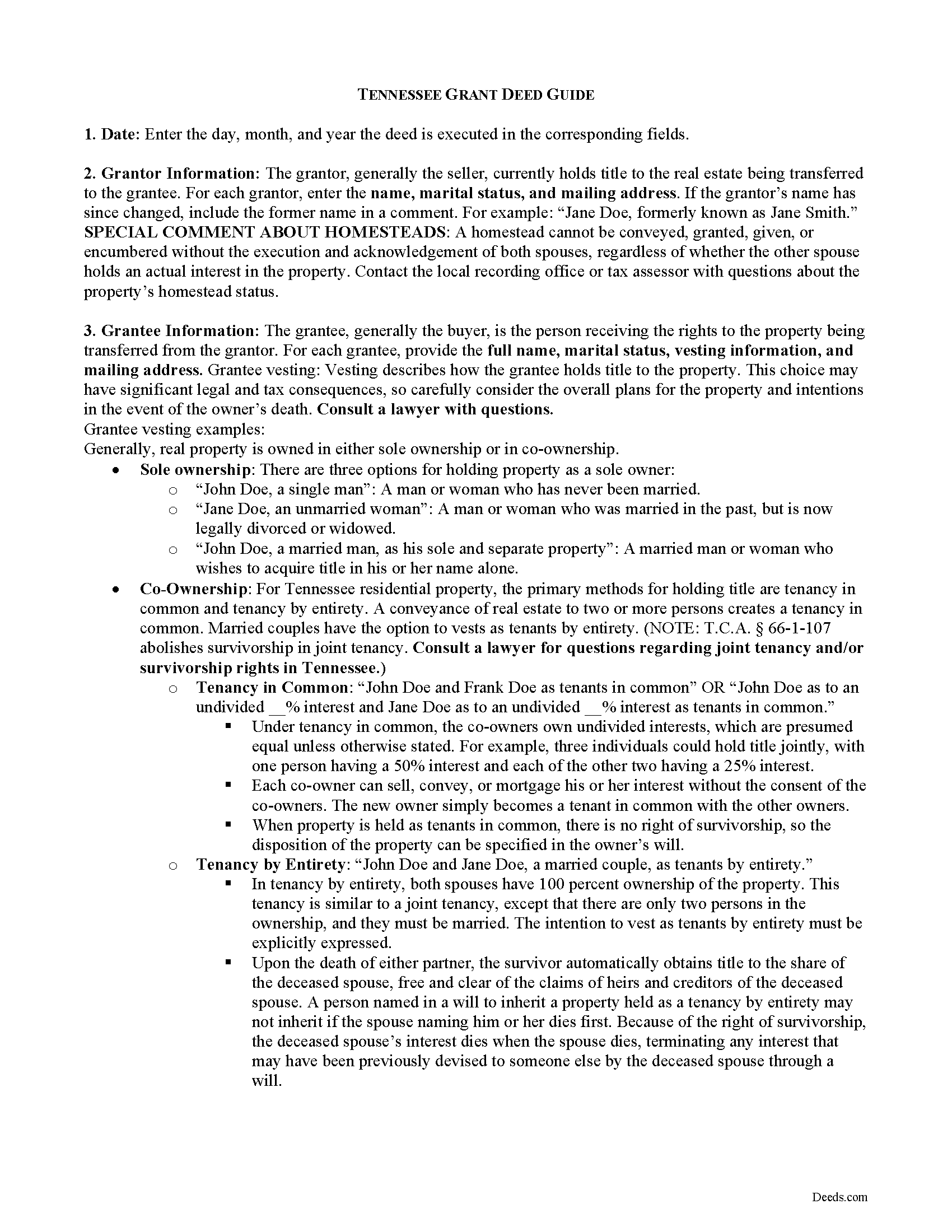

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Warren County compliant document last validated/updated 3/12/2025

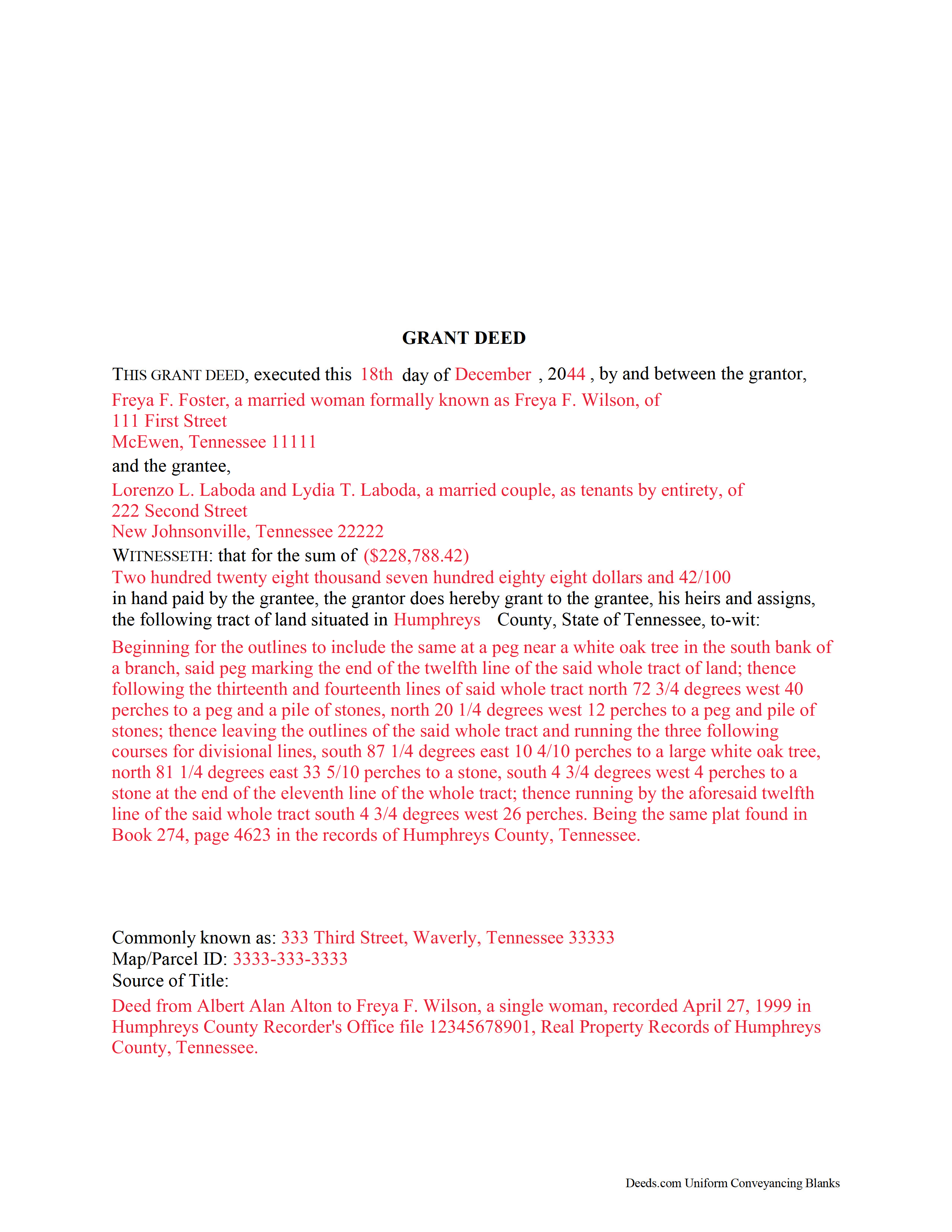

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Warren County compliant document last validated/updated 4/16/2025

The following Tennessee and Warren County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Warren County. The executed documents should then be recorded in the following office:

Warren County Register Of Deeds

201 Locust St, Suite 4, McMinnville, Tennessee 37110

Hours: Monday - Thursday 8 AM to 4:30 PM; Friday 8 AM to 5 PM

Phone: (931) 473-2926

Local jurisdictions located in Warren County include:

- Campaign

- Mc Minnville

- Morrison

- Rock Island

- Smartt

- Viola

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Warren County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Warren County using our eRecording service.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Warren County that you need to transfer you would only need to order our forms once for all of your properties in Warren County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Warren County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Warren County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Tennessee, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with some covenants of title. The word "grant" in the conveyancing clause typically signifies a grant deed, but it is not a statutory form in Tennessee.

Grant deeds offer the grantee (buyer) more protection than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. Grant deeds contain implied covenants that the grantor holds an interest in the property and is free to convey it. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Tennessee residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons creates a tenancy in common. Married couples have the option to vests as tenants by entirety. T.C.A. 66-1-107 abolishes survivorship in joint tenancy. Consult a lawyer for questions regarding joint tenancy and/or survivorship rights in Tennessee.

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, the deed must meet all state and local standards for recorded documents.

Record the original completed deed, along with any additional materials, at the recorder's office in the county where the property is located. Recordation taxes are due upon recording. See 67-4-409 for exemptions. Refer to the same statute and contact the appropriate recorder's office for information on recordation taxes and up-to-date fees.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Tennessee lawyer with any questions related to the transfer of real property.

(Tennessee Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda J.

December 8th, 2021

I was referred to you by a recording service for Walton County, Florida. I registered on your website, and 48 hours later I received a copy of a recorded deed. Easy and Fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darrell P.

February 23rd, 2019

My legal description exceeds the avaiable space in the one page Exhibit A...any way to add a second page as 'Exhibit A (continued)'?

It is not required to use the included exhibit page. Simply label your printed legal description as the appropriate exhibit.

Melissa S.

March 24th, 2024

Simple & easy to navigate. At time of writing this, guide & example of purchased deed is included. Plus lots of extra information to help secure your property. Would recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jean S.

July 2nd, 2019

Service was outstanding. I had the results very quickly. Definitely will use this service again

Thank you!

Tonya J.

December 14th, 2019

User friendly and fast response time!!

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Colleen P.

May 4th, 2020

It was frustrating to get the scans done but that might have been due to a learning curve. After 4 tries they were accepted. I couldn't figure out how to delete or close the failed attempts. Waiting to see if Recorder office has changed the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Judi W.

May 24th, 2022

Great website! Well organized, easy to navigate and put to practical use. Would use again.

Thank you!

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

Philip F.

August 2nd, 2024

Quick, user-friendly, and complete! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

Bernard H.

February 1st, 2019

The site is clear and easy to submit requests. I will be using again when needed. No problems and a pleasure to deal with.

Thank you for your feedback. We really appreciate it. Have a great day!