Perry County Notice of Completion Form (Tennessee)

All Perry County specific forms and documents listed below are included in your immediate download package:

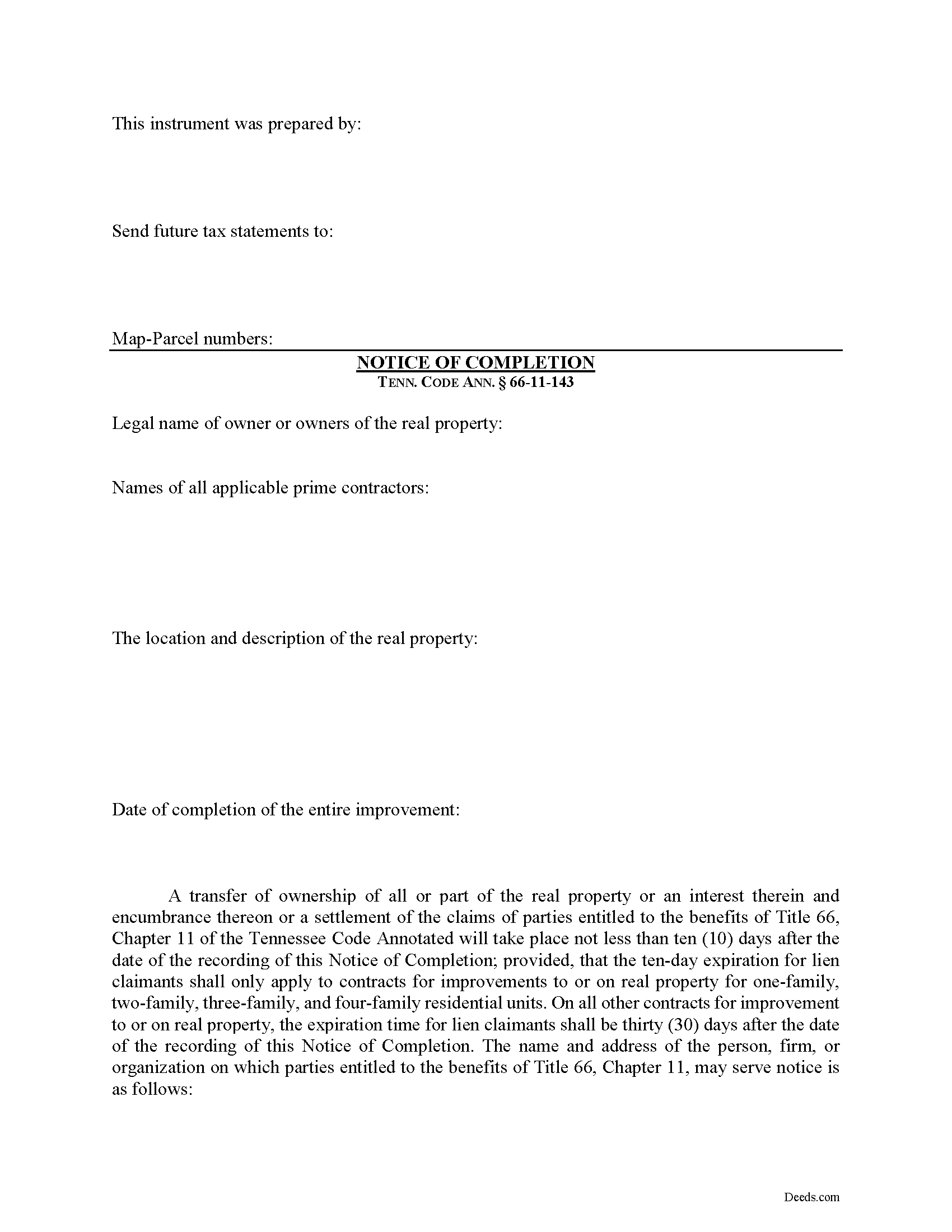

Notice of Completion Form

Fill in the blank Notice of Completion form formatted to comply with all Tennessee recording and content requirements.

Included Perry County compliant document last validated/updated 7/11/2025

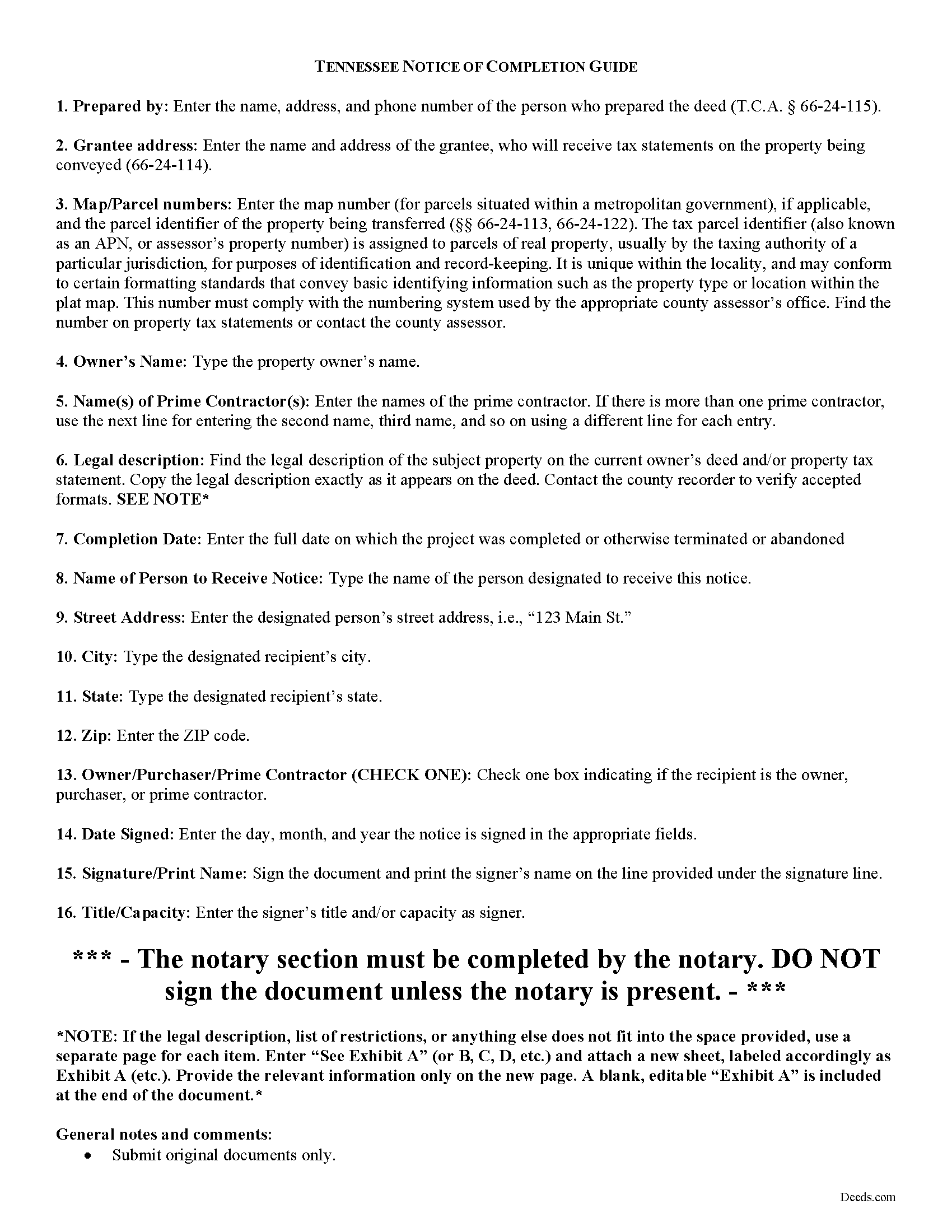

Notice of Completion Guide

Line by line guide explaining every blank on the form.

Included Perry County compliant document last validated/updated 7/9/2025

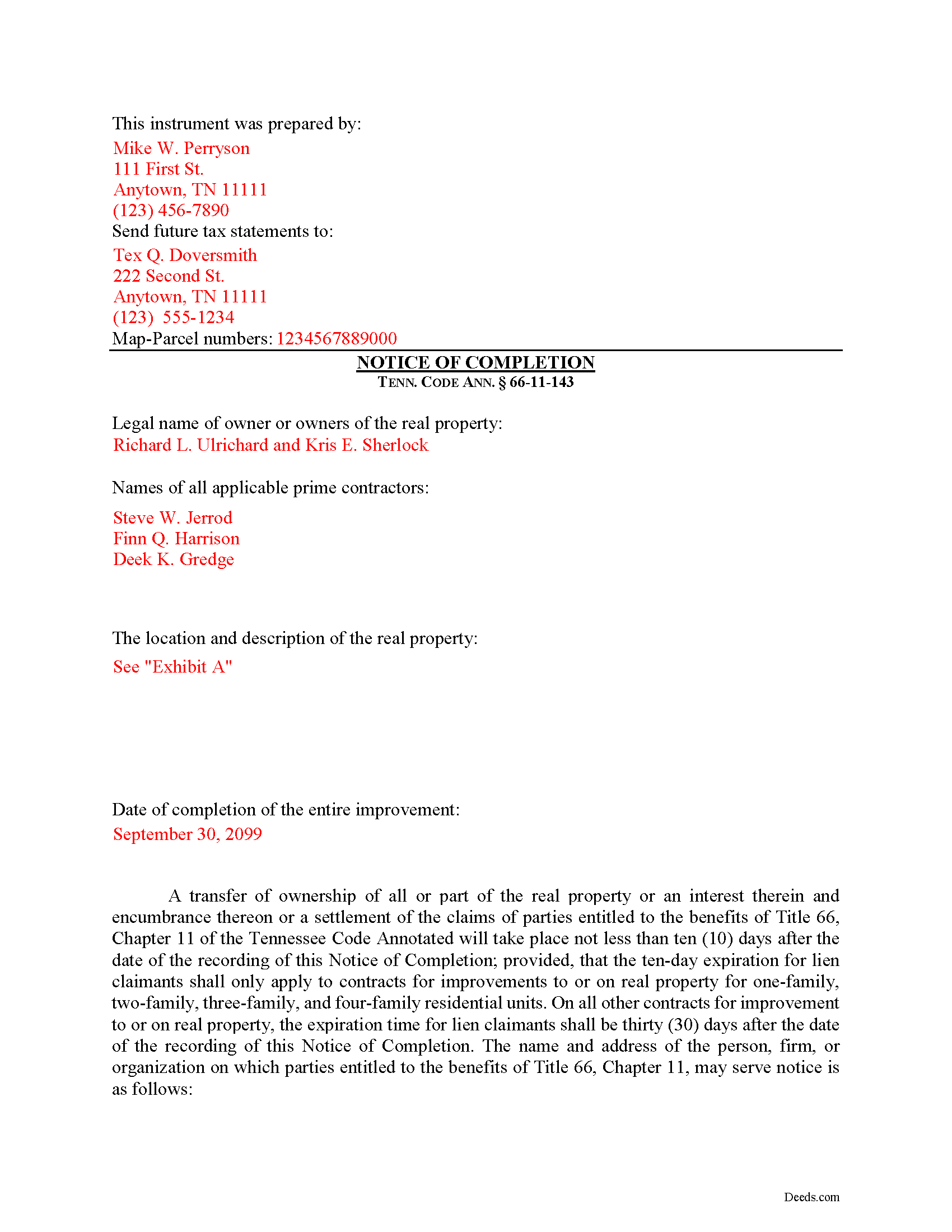

Completed Example of the Notice of Completion Document

Example of a properly completed form for reference.

Included Perry County compliant document last validated/updated 5/28/2025

The following Tennessee and Perry County supplemental forms are included as a courtesy with your order:

When using these Notice of Completion forms, the subject real estate must be physically located in Perry County. The executed documents should then be recorded in the following office:

Perry County Register of Deeds

412 West Linden / PO Box 62, Linden, Tennessee 37096

Hours: 8:30am to 4:00pm.M-F

Phone: (931) 589-2210

Local jurisdictions located in Perry County include:

- Linden

- Lobelville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Perry County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Perry County using our eRecording service.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Completion forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Perry County that you need to transfer you would only need to order our forms once for all of your properties in Perry County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Perry County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Perry County Notice of Completion forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Protecting Your Property against Lien Claims in Tennessee with a Notice of Completion

Property owners must vigilantly protect against lien claims, especially from a lower-tiered claimant with whom they may not have directly contracted, or even been aware of their participation on the job for which the claim arose.

Tennessee's Property Code 66-11-143(a) offers a tool for this purpose. The owner or purchaser of improved real property, or their agent or attorney may, upon the completion of the improvement, record a Notice of Completion in the office of the register of deeds in the county where the real property is located. The owner or purchaser may also require a person or organization with whom the owner or purchaser has contracted for the improvement to record a notice of completion as well, upon the completion of the improvement. Id.

Along with recording, the owner or purchaser of improved real property or any other authorized party must simultaneously serve a copy of the notice of completion recorded with the register of deeds on the prime contractor and any other entitled parties. Id. Otherwise, the lien rights of the prime contractor who is not served a copy shall not be affected by the notice of completion. Id. The point of this is to make sure all relevant parties understand the status of their lien rights.

Service should be accomplished by registered or certified mail that allows for a return receipt. However, the notice requirement does not apply when the owner, or an entity controlled by the owner, also acts as the general contractor, in furtherance of the improvement to the property. Id.

The notice of completion contains: (1) The legal name of the owner or owners of the real property; (2) The name of the prime contractor or prime contractors; (3) The location and description of the real property; (4) Date of the completion of the improvement; (5) A statement that a transfer of ownership of all or a part of the real property or an interest in the real property and encumbrance on the real property, or a settlement of the claims of parties entitled to the benefits of this part, will take place not less than ten (10) days after the date of the recording of the notice of completion; provided, that the ten-day expiration for lien claimants shall only apply to contracts for improvement to or on real property, for one-family, two-family, three-family and four-family residential units. On all other contracts for improvement to or on real property, the expiration time for lien claimants shall be thirty (30) days after the date of the recording of the notice of completion in the register's office; (6) The name and address of the person, firm, or organization on which parties entitled to the benefits of this chapter may serve notice of claim; (7) Acknowledgment by the person filing the notice, or by that person's agent or attorney; and (8) The name and address of the preparer of the instrument in compliance with Tenn. Prop. Code 66-24-115. Tenn. Prop Code 66-11-143(b).

The register of deeds shall make a permanent record of all notices of completion filed in the office of the register and the records shall be available for public examination. Tenn. Prop Code 66-11-143(c). The register of deeds is also entitled to the fees for the register's services in receiving and maintaining notices of completion. Id. Check with the local office where the notice will be filed to inquire about any fees.

If a remote contractor has served a required notice of nonpayment pursuant to 66-11-145, then any party recording a notice of completion shall simultaneously serve a copy of the notice on the remote contractor. Tenn. Prop Code 66-11-143(d). The remote contractor shall have thirty (30) days from the date of the recording of the notice of completion to serve a written notice in response. Id. The lien rights of a remote contractor who has not been served a copy, shall not be affected by the notice of completion. Id.

Any prime contractor or remote contractor claiming a lien on the property described in the notice of completion, who has not previously registered the person's contract as provided in 66-11-111, or registered a sworn statement as provided in 66-11-112 and served a copy of the registration to the owner, shall serve written notice, to the person, firm or organization and at the address designated for receiving notice of claim, stating the amount of the claim and certifying that the claim does not include any amount owed to the claimant on any other job or under any other contract. Tenn. Prop Code 66-11-143(e)(1).

For improvements to or on real property for one-family, two-family, three-family and four-family residential units, the written notice shall be served not more than ten (10) days from the date of the recording of the notice of completion in the register's office. If the notice is not served within that time, the lien rights of the claimant shall expire. Tenn. Prop Code 66-11-143(e)(2)(A). For all other contracts for improvements to or on real property, the written notice shall be served not more than thirty (30) days from the date of the recording of the notice of completion in the register's office, and if notice is not served within that time, the lien rights of the claimant shall expire. Tenn. Prop Code 66-11-143(e)(2)(B).

The notice is only effective after completion has occurred. Any notice of completion recorded before the completion of the improvement or the demolition is void and of no effect whatsoever. Tenn. Prop Code 66-11-143(f).

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County Notice of Completion form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Julia M.

June 26th, 2024

I live in AZ and have an existing beneficiary deed on my property. I needed to know the process of revoking a beneficiary deed. Your site was very helpful by providing the correct form and instructions for recording it. Thank you!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

Rafael R.

May 9th, 2019

This was my first time using Deed.com. It was easier than I expected. The service is more convenient than filing documents in person or by mail. The response from Deeds.com upon the submission of my order was almost instantaneous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol D.

January 17th, 2019

No review provided.

Thank you!

Judith A.

January 14th, 2022

Excellent

Thank you!

Noal S.

May 18th, 2025

The download package is very thorough and complete for the Corrective Deed I needed to file. The material is state/county specific and includes a completed example. The price is reasonable compared to an attorney fee from $400 to $600

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Alan C.

December 10th, 2020

I thought the instructions could have been a little better. I didn't know how to do this if the spouses are married but living in separate residences. Also I didn't understand the "Prior Instrument Reference". That should be explained better. Very sketchy instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy A S.

October 15th, 2022

Great do it yourself forms (I used the Quitclaim deed). If you think you're going to need a lot of hand holding you might consider hiring an attorney. The guide and general information provided by deeds.com will help if you have some idea of what you are doing and you are willing to research a little. Your mileage may vary but for me, this was a very efficient and economical way to get my quitclaim deed done.

Thank you for your feedback. We really appreciate it. Have a great day!

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Steve M.

January 24th, 2020

I was only able to download the QC form. Had to print the other docs

Thank you for your feedback. We really appreciate it. Have a great day!

Toni M.

June 24th, 2019

I liked having the forms. Some may need to know they can look at the legal Description from online county records, then type up in Word document line by line, the degree sign in Word program is achieved by using alt and 248 on number pad. Then on the form page one write SEE Exibit A and title your Word program description as Exibit A. Goes without saying the legal description should be looked over many times and it is easier to do so if you format your Word the same lineage as the legal description online which is usually not text which is why you have to retype it.

Thank you for your feedback. We really appreciate it. Have a great day!