Stewart County Notice of Spousal Non-Responsibility Form (Tennessee)

All Stewart County specific forms and documents listed below are included in your immediate download package:

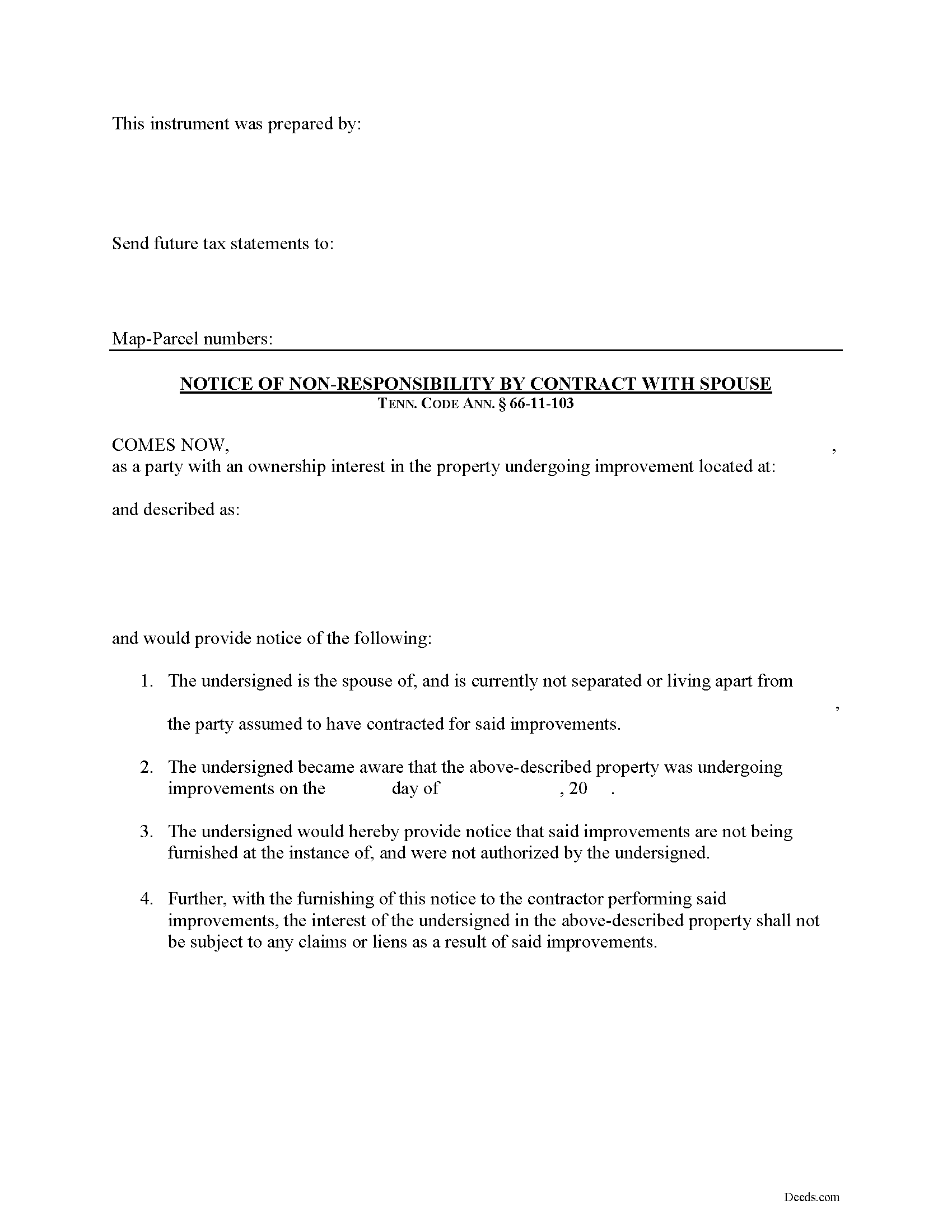

Notice of Spousal Non-Responsibility Form

Fill in the blank Notice of Spousal Non-Responsibility form formatted to comply with all Tennessee recording and content requirements.

Included Stewart County compliant document last validated/updated 1/28/2025

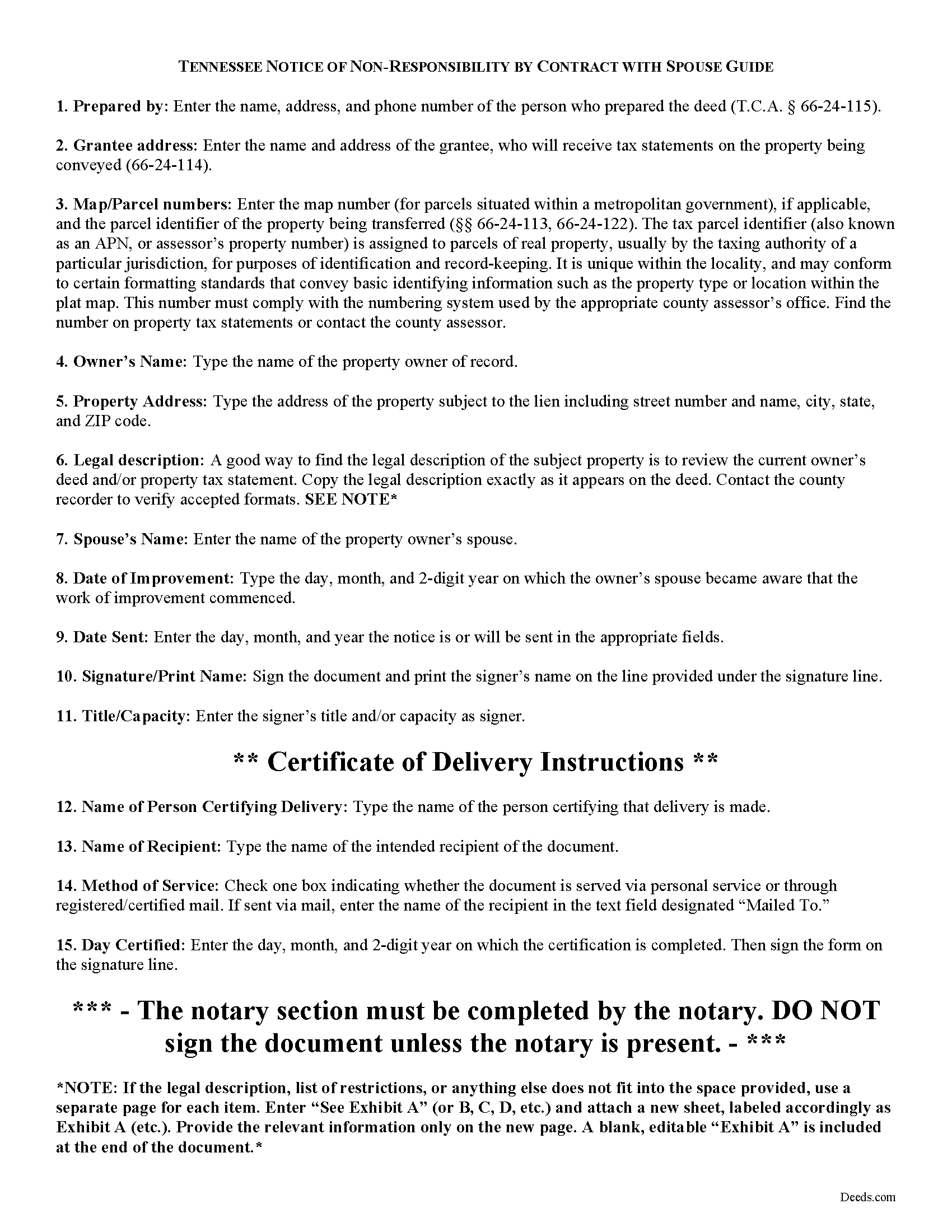

Notice of Non-Responsibility Guide

Line by line guide explaining every blank on the form.

Included Stewart County compliant document last validated/updated 5/16/2025

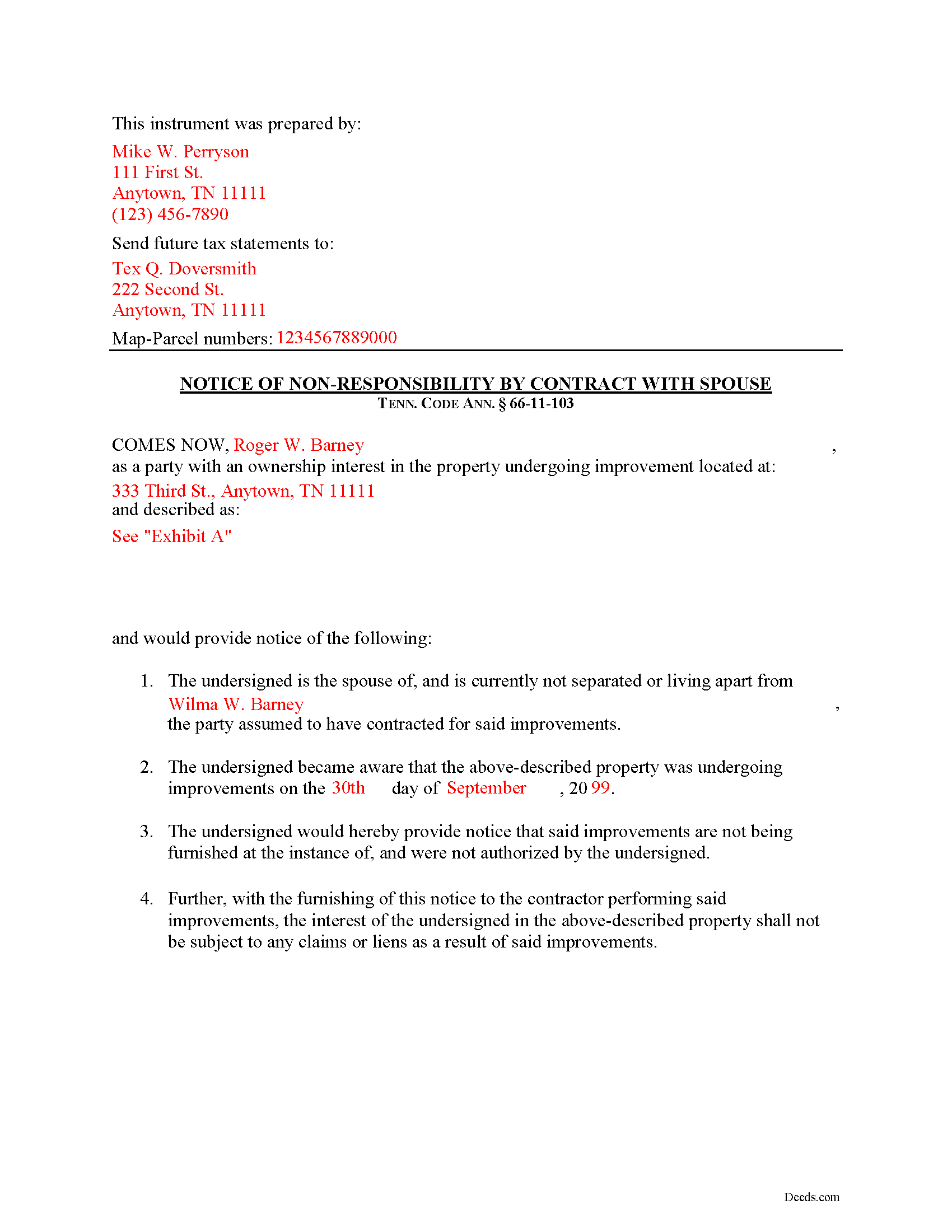

Completed Example of the Notice of Non-Responsibility Document

Example of a properly completed form for reference.

Included Stewart County compliant document last validated/updated 4/2/2025

The following Tennessee and Stewart County supplemental forms are included as a courtesy with your order:

When using these Notice of Spousal Non-Responsibility forms, the subject real estate must be physically located in Stewart County. The executed documents should then be recorded in the following office:

Stewart County Register of Deeds

Courthouse - 225 Donelson Parkway / PO Box 57, Dover, Tennessee 37058

Hours: 8:00am to 4:30pm M-F

Phone: (931) 232-5990

Local jurisdictions located in Stewart County include:

- Big Rock

- Bumpus Mills

- Cumberland City

- Dover

- Indian Mound

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Stewart County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Stewart County using our eRecording service.

Are these forms guaranteed to be recordable in Stewart County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stewart County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Spousal Non-Responsibility forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Stewart County that you need to transfer you would only need to order our forms once for all of your properties in Stewart County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Stewart County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Stewart County Notice of Spousal Non-Responsibility forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Non-Responsibility or for any other issues regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Stewart County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stewart County Notice of Spousal Non-Responsibility form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i

s invaluable. Worked perfectly.

Thank you!

Lora N.

April 11th, 2023

Excellent, easy to use! Awesome system. Loved it.

Thank you!

Martha V.

August 30th, 2020

Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger E.

August 30th, 2019

I have not yet used the product, but am confident that I will like it, because of this prompt request for a product review.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

November 24th, 2022

So far so good. Had an issue and customer service responded very fast by email.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Gary S.

January 24th, 2021

Excellent service! Incorrectly ordered a document and order was immediately canceled when I requested. Was then able to order and download correct document and complete with no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan L.

May 31st, 2024

The only suggestion I have is to include sample of putting quitclaim into a revocable trust.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Nancy B.

August 6th, 2020

This was the easiest, quickest, most understandable way I've seen yet to retrieve deeds from various counties.

The government websites are "clunky" and each one seems different than the other.

I like this service and will use them again in the future.

NANCY

Thank you for your feedback. We really appreciate it. Have a great day!

Deanna S.

May 6th, 2020

I loved the fact that the forms came with examples of the required info. That was helpful and made filling out the forms so much easier.

Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ray L.

February 8th, 2019

Thank you, I am very satisfied with the process and will provide a final review after the documents are completed and accepted by the state.

Thank you for your feedback. We really appreciate it. Have a great day!

Ginger L.

May 29th, 2022

Excellent full set of documents with example and guidelines on how to do it ourselves without paying a lawyer. Or, we save legal fees by completing it ourselves and having a lawyer review it. Love that I can save the pdf and fill it out whenever I want. Thank you for having this available!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!