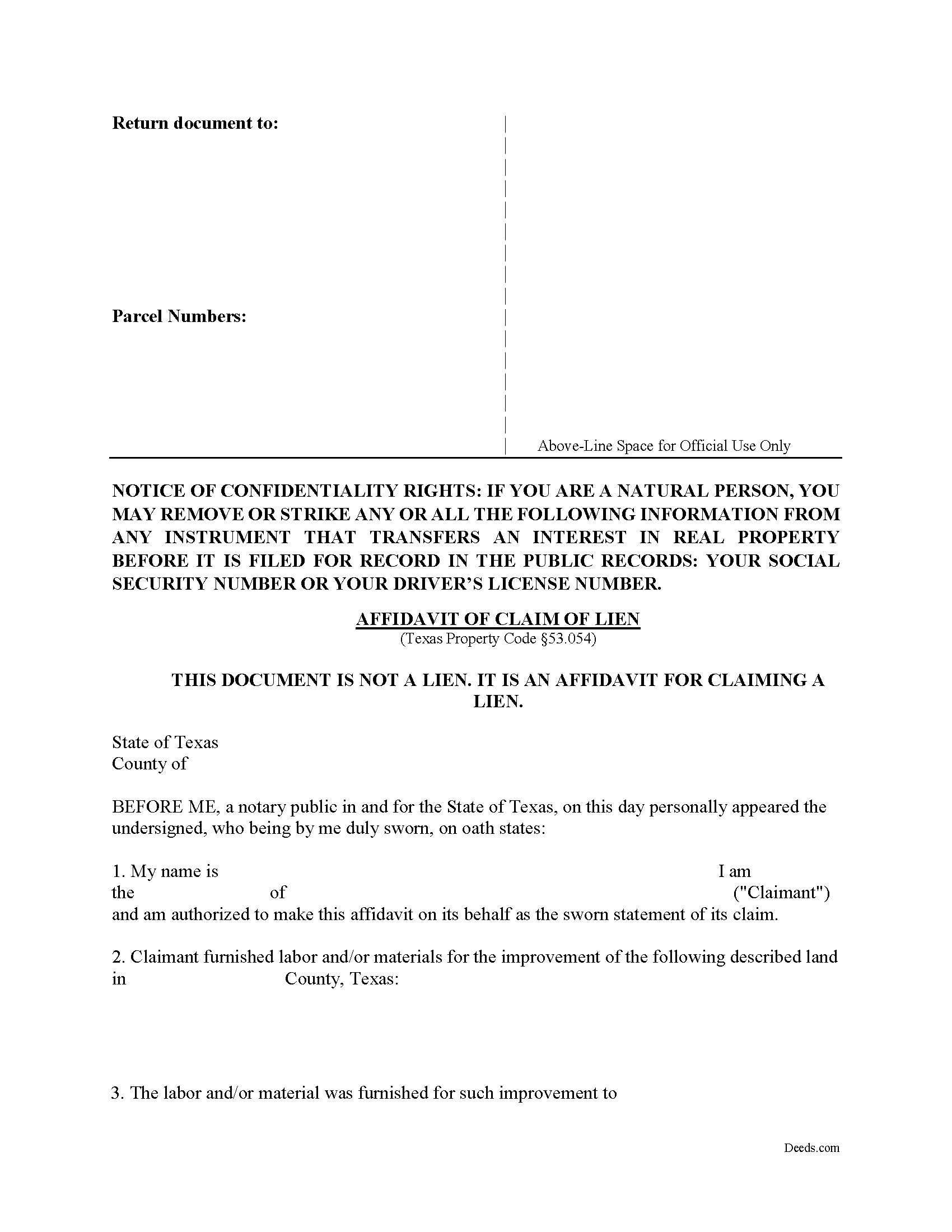

Frio County Affidavit of Lien Form

Frio County Affidavit of Lien Form

Fill in the blank Affidavit of Lien form formatted to comply with all Texas recording and content requirements.

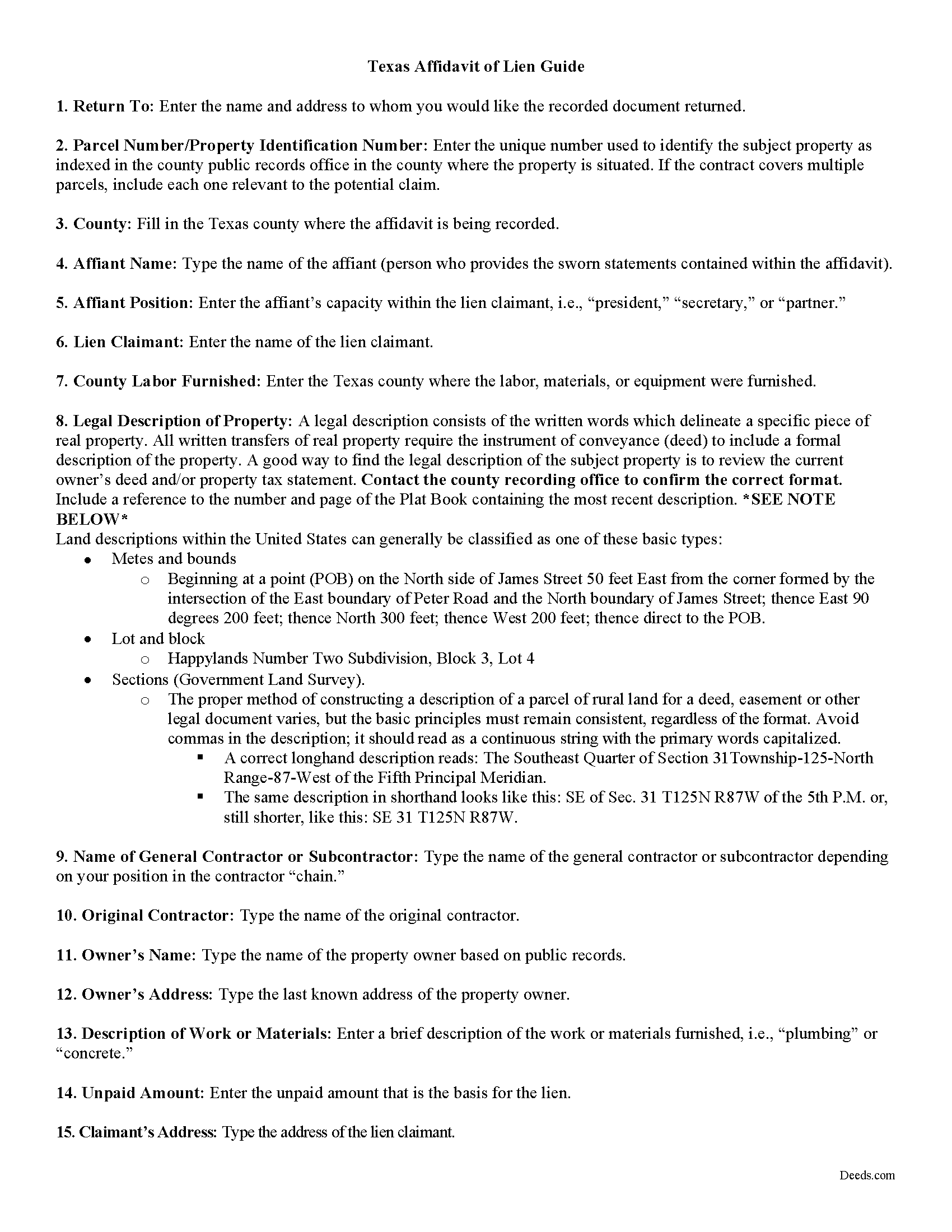

Frio County Affidavit of Lien Guide

Line by line guide explaining every blank on the form.

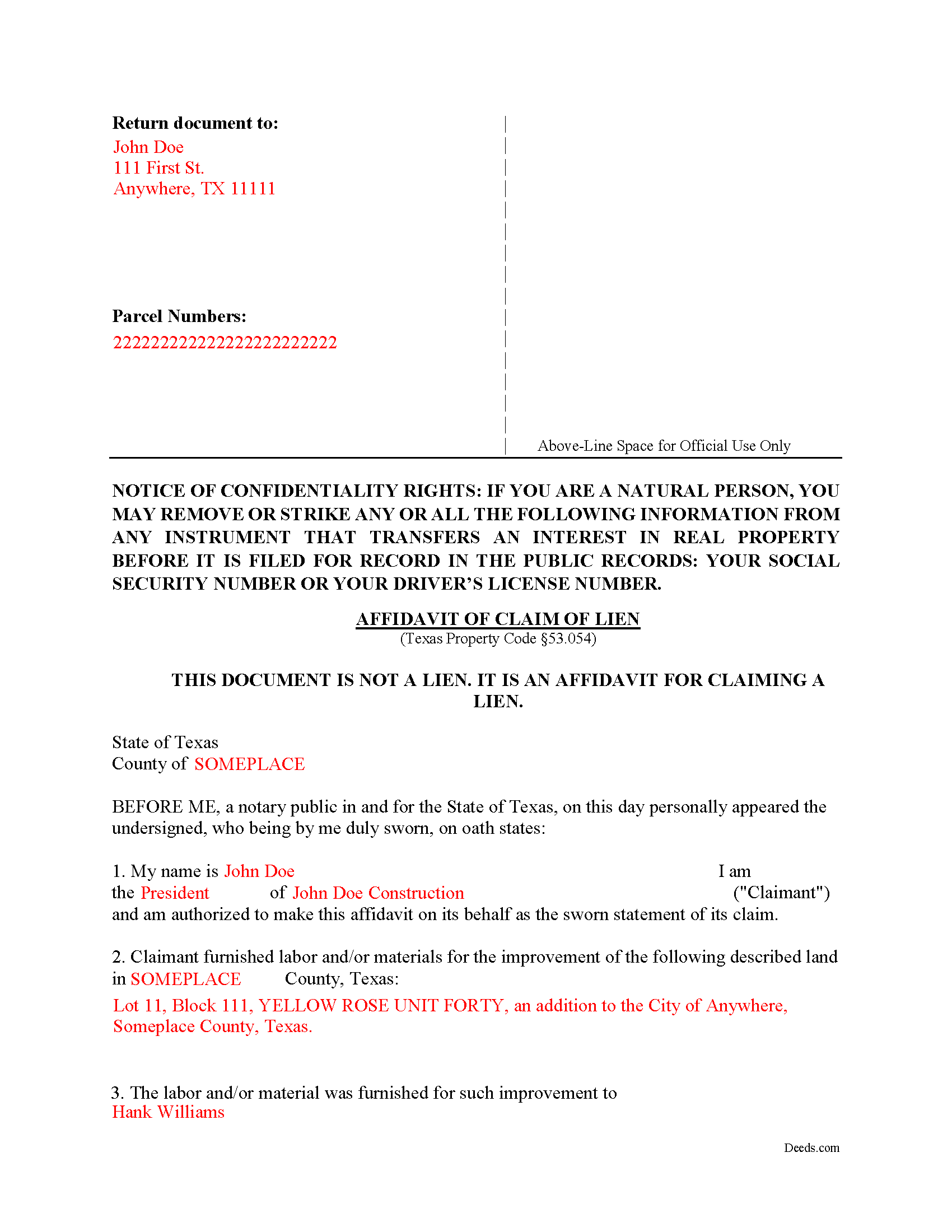

Frio County Completed Example of the Affidavit of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Frio County documents included at no extra charge:

Where to Record Your Documents

Frio County Clerk Office

Pearsall, Texas 78061

Hours: Mon - Thu 8:00am - 12:00 & 1:00 - 5:00pm, Fri until 4:30pm

Phone: 830-334-2214

Recording Tips for Frio County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Frio County

Properties in any of these areas use Frio County forms:

- Bigfoot

- Dilley

- Moore

- Pearsall

Hours, fees, requirements, and more for Frio County

How do I get my forms?

Forms are available for immediate download after payment. The Frio County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Frio County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Frio County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Frio County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Frio County?

Recording fees in Frio County vary. Contact the recorder's office at 830-334-2214 for current fees.

Questions answered? Let's get started!

An affidavit is a sworn statement of fact, in writing, made by an affiant under oath or affirmation, administered by a person lawfully authorized (such as a notary public). In this case, the affiant states that labor or equipment was furnished by the lien claimant and the balance owed remains unpaid. The affidavit is not a lien, but sets out sworn facts based on personal knowledge, that when recorded, will later become the lien. It is a necessary step to perfect (make effective against third parties) the lien.

To claim a lien for a commercial job, the affiant must file an affidavit with the county clerk of the county in which the property is located, not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. TEX. PROP. CODE 53.052(a).

Note that for residential construction projects, the claimant must file the affidavit with the county clerk no later than the 15th day of the THIRD (3rd) calendar month after non-payment of the invoice. TEX. PROP. CODE 53.052(b).

The affidavit must substantially comply with the Texas Property Code. Therefore, the it must contain: 1) a signature by the person claiming the lien or by another person on the claimant's behalf; 2) a sworn statement of the amount of the claim; 3) the name and last known address of the owner or reputed owner; 4) a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested; 5) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor; 6) the name and last known address of the original contractor; 7) legally sufficient description of the property to be charged with the lien; 8) the claimant's name, mailing address, physical address (if different); and 9) for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent. TEX. PROP. CODE 53.054(a). Leave out amounts not related to the value of materials or labor furnished (such as attorney's fees), as these can void the entire lien claim.

When recording the affidavit, attach a copy of any applicable written agreement or contract and a copy of each notice sent to the owner. TEX. PROP. CODE 53.054(b). This is good practice and can help prove the claim by creating a paper trail. The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated and the affiant may use any abbreviations or symbols that are customary in your trade. TEX. PROP. CODE 53.054(c).

After the affidavit is properly recorded it must be served. Send a copy of the affidavit by registered or certified mail to the owner (or reputed owner) at the owner's last known business or residence address not later than the fifth (5th) day after the date the affidavit is filed with the county clerk. TEX. PROP. CODE 53.055(a). If the claimant is not an original contractor, they must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. TEX. PROP. CODE 53.055(b).

Each case is unique, and the Texas lien law is complex, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Frio County to use these forms. Documents should be recorded at the office below.

This Affidavit of Lien meets all recording requirements specific to Frio County.

Our Promise

The documents you receive here will meet, or exceed, the Frio County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Frio County Affidavit of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lana B.

February 5th, 2021

Website is easy to use. I ordered the form, filled it out and uploaded it for recording. My only critique is that you can't preview the form before ordering and paying for it. I ordered a Deed of Full Reconveyance form only to find out I needed the Substitution of Trustee and Deedn of Reconveyance form instead. So I wasted $22 on the wrong form.

Thank you for your feedback. Order and payment for the incorrect order has been canceled. Have a wonderful day.

Lynn T.

June 16th, 2021

great service, thank you

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Carmen R.

November 14th, 2021

I was able to get the form I needed but it would not adjust properly on the page.

Thank you!

Scotty A.

October 2nd, 2021

A great time and money saver that also has a money back guarantee. I received all the pertinent forms and instructions for less than a family eating a fast food dinner.

Thank you!

Jason B.

July 19th, 2022

KVH provided excellent customer service (great communication was provided). I would differently use this service if needed in the further.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tammie S.

February 8th, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Alana G.

March 26th, 2021

I was very pleased. It was the form I needed. I was getting discouraged by companies that wanted me to sign up for monthly payments just to get the one form I needed. I prefer your system of paying for what I get. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Rechantell A.

August 1st, 2020

It was quick and easy. Trust worthy. Very satisfied and would recommend. Thank you for your services.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!