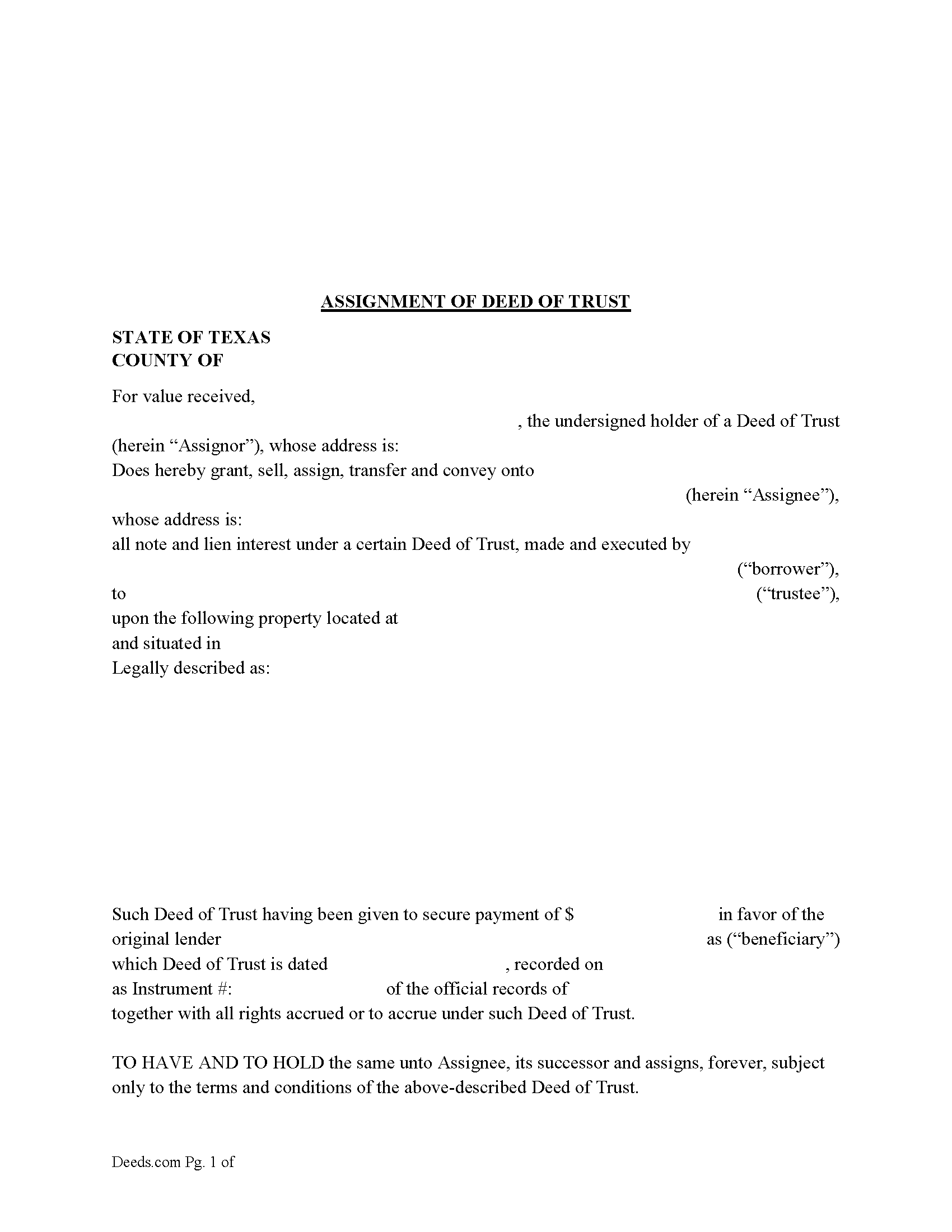

Mcmullen County Assignment of Deed of Trust Form

Mcmullen County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

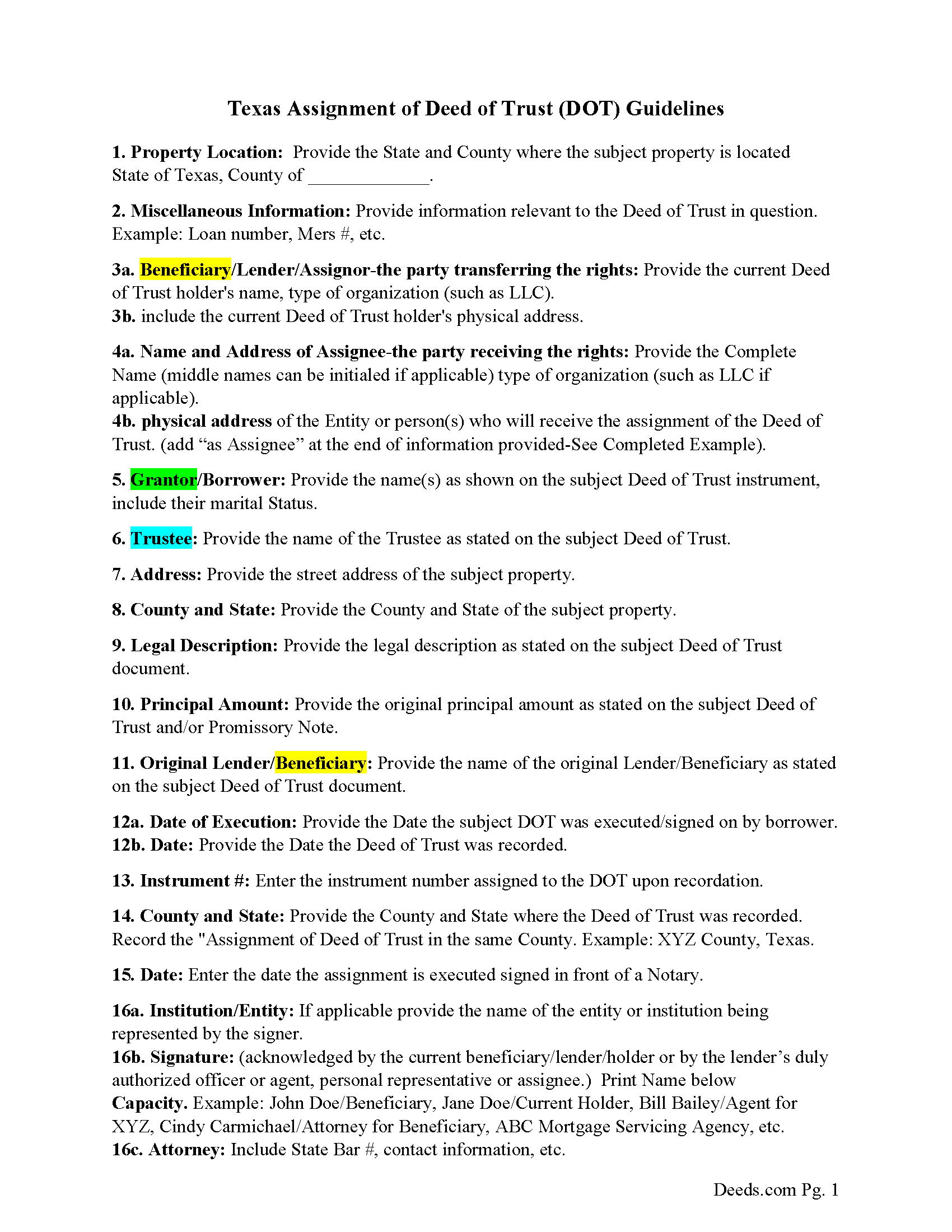

Mcmullen County Guidelines-Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

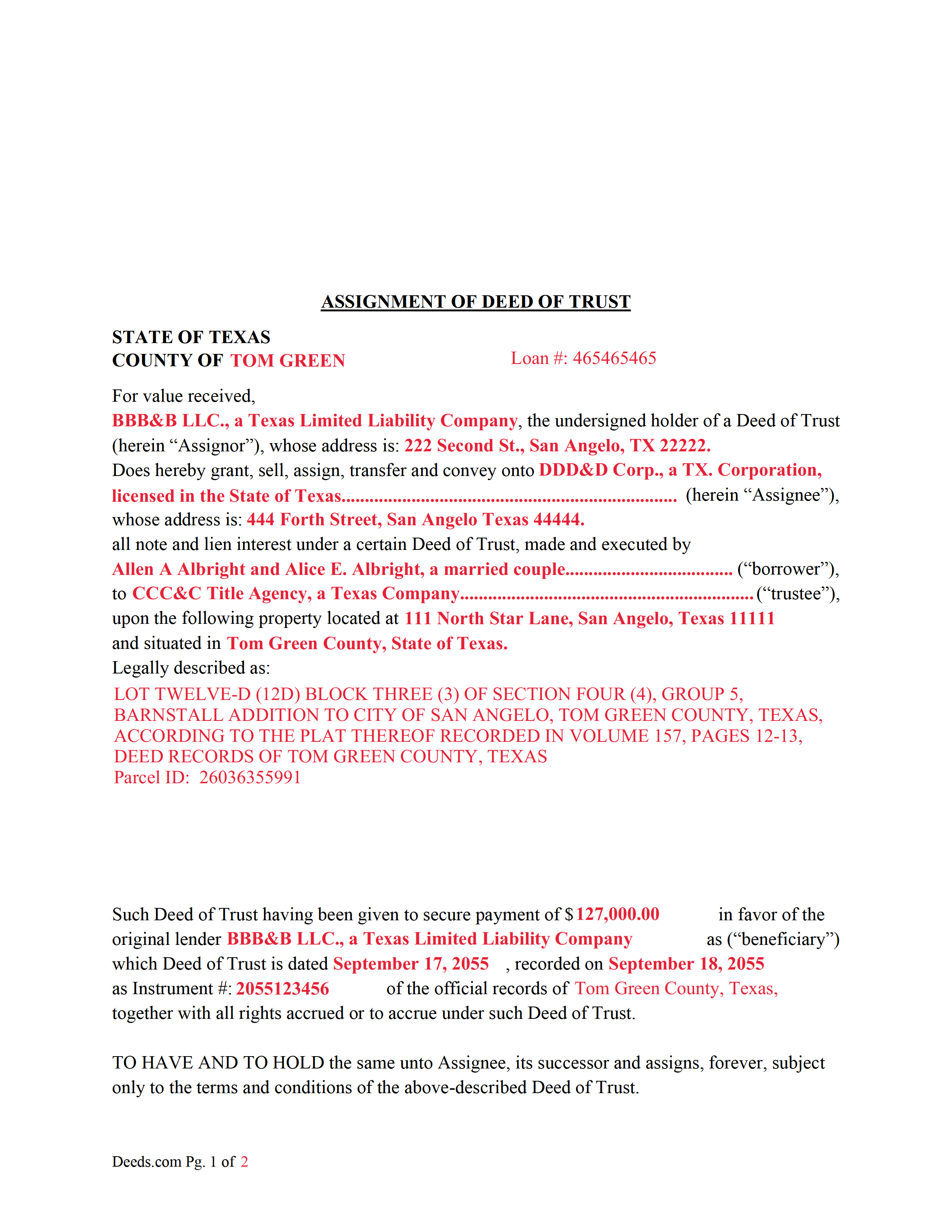

Mcmullen County Completed Example of an Assignment of Deed of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Mcmullen County documents included at no extra charge:

Where to Record Your Documents

McMullen County Clerk

Tilden, Texas 78072

Hours: Monday - Friday 8:00am - 4:00pm

Phone: (361) 274-3215 ‎

Recording Tips for Mcmullen County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Mcmullen County

Properties in any of these areas use Mcmullen County forms:

- Calliham

- Tilden

Hours, fees, requirements, and more for Mcmullen County

How do I get my forms?

Forms are available for immediate download after payment. The Mcmullen County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mcmullen County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcmullen County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mcmullen County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mcmullen County?

Recording fees in Mcmullen County vary. Contact the recorder's office at (361) 274-3215 ‎ for current fees.

Questions answered? Let's get started!

This form is used by the current holder/lender or representative to assign a recorded Deed of Trust and Promissory Note to another entity. This is common when a Deed of Trust has been sold.

(Texas Assignment of Deed of Trust Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Mcmullen County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Mcmullen County.

Our Promise

The documents you receive here will meet, or exceed, the Mcmullen County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcmullen County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Keri C.

June 10th, 2020

It was confusing at first, but the customer service was excellent and fast and I got everything taken care of right away. I'll use Deeds.com even after the recorder's office is open to the public.

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Adriana V.

July 2nd, 2020

Excellent and a very fast way to release important documents. Thank you very much.

Thank you!

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed. Looking forward to working with Deeds.com again. Steve Esler

Thank you for your feedback Steve, glad we could help.

Jennifer R.

January 8th, 2022

The recording service has been very easy to use. It is efficient and no hassle.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alison L.

February 16th, 2021

Wonderful and easy to use platform. I was using a more complicated platform that wouldn't load half the time. Makes for filing deeds in the pandemic quick and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beata K.

November 14th, 2019

Loved it! Extremely easy to use. Quick and efficient. I was able to officially record my documents within a day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert F.

July 11th, 2023

This service is excellent. I submitted a Quickclaim Deed so my home would be in the name of a Living Trust I had just created. This was my first attempted at any of this and the staff person, KVH, who reviewed my Deed was extremely helpful and quick to respond to any questions I had and to make sure the Deed had the correct information before submittal to the county for recording. I started the process one afternoon and by the next day, the Deed was submitted to, and recorded in, my county. I will use them again whenever needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian M.

March 7th, 2024

The document had all the information needed but could have been presented with a more professional look for the price.

We appreciate you highlighting the balance between compliance and presentation. While our main focus is on the legal correctness and statutory compliance of the documents, we also strive to present this information in a clear and accessible manner.

ed c.

May 24th, 2022

real easy and fast

Thank you!

Kathy R.

October 8th, 2022

I was very pleased with the quick turn around on a response to my inquiry. Further guidance was direct and I appreciate the professionalism from deeds.com.

Thank you!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

January 16th, 2019

easy to use, no problems except in beneficiary box. Need to make the box bigger because I have 4 beneficiaries to list. how do I enlarge the box.

Thanks for reaching out. All available space on the document is being used. As is noted in the guide, if you have information that does not fit in the available space the included exhibit page should be used.

Melissa H.

August 10th, 2021

Amazing forms! Order the quitclaim deed forms, got the form and lots of extra forms which is good because I needed a few of them and didn't even know it. Very happy, will be back if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!