Trinity County Contract for Deed Form

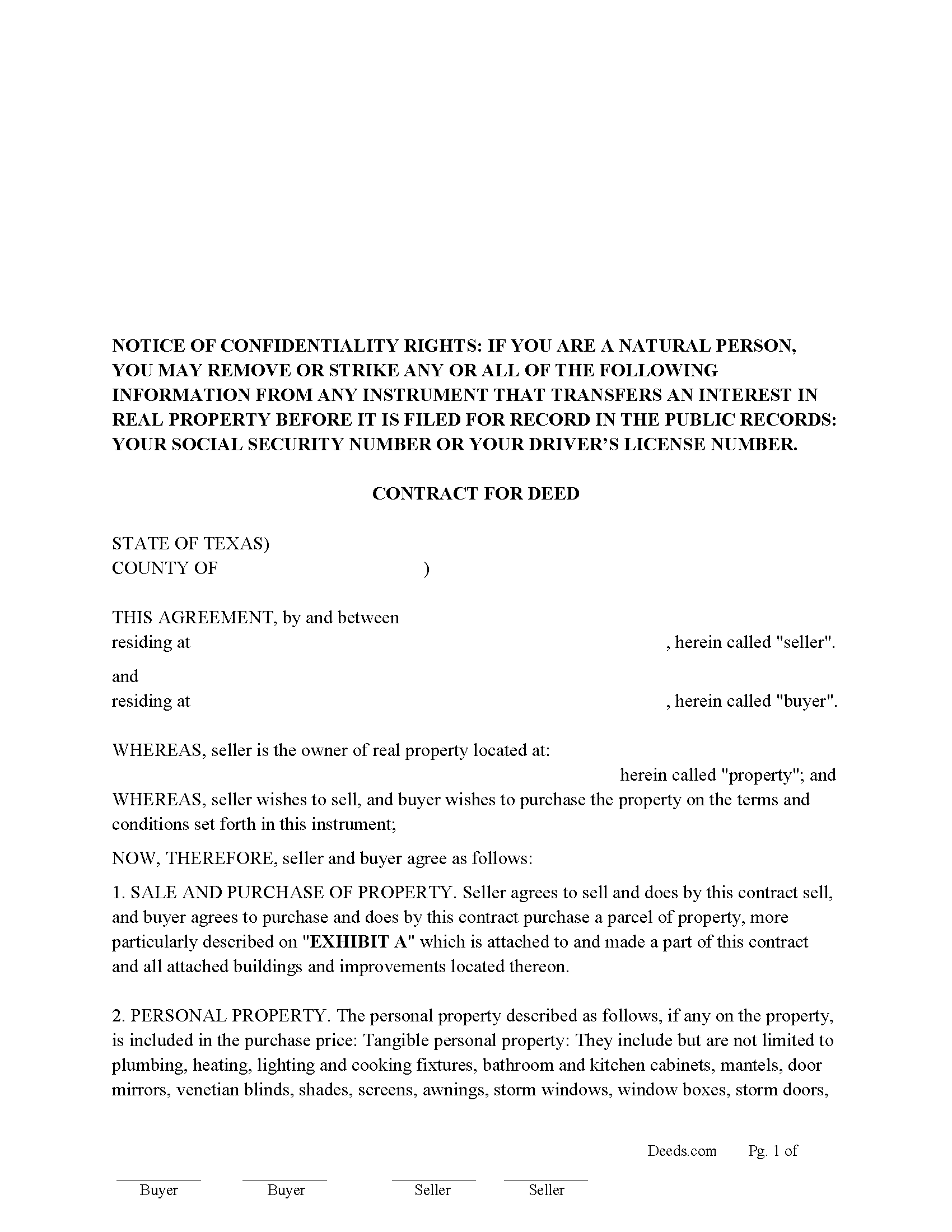

Trinity County Contract for Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

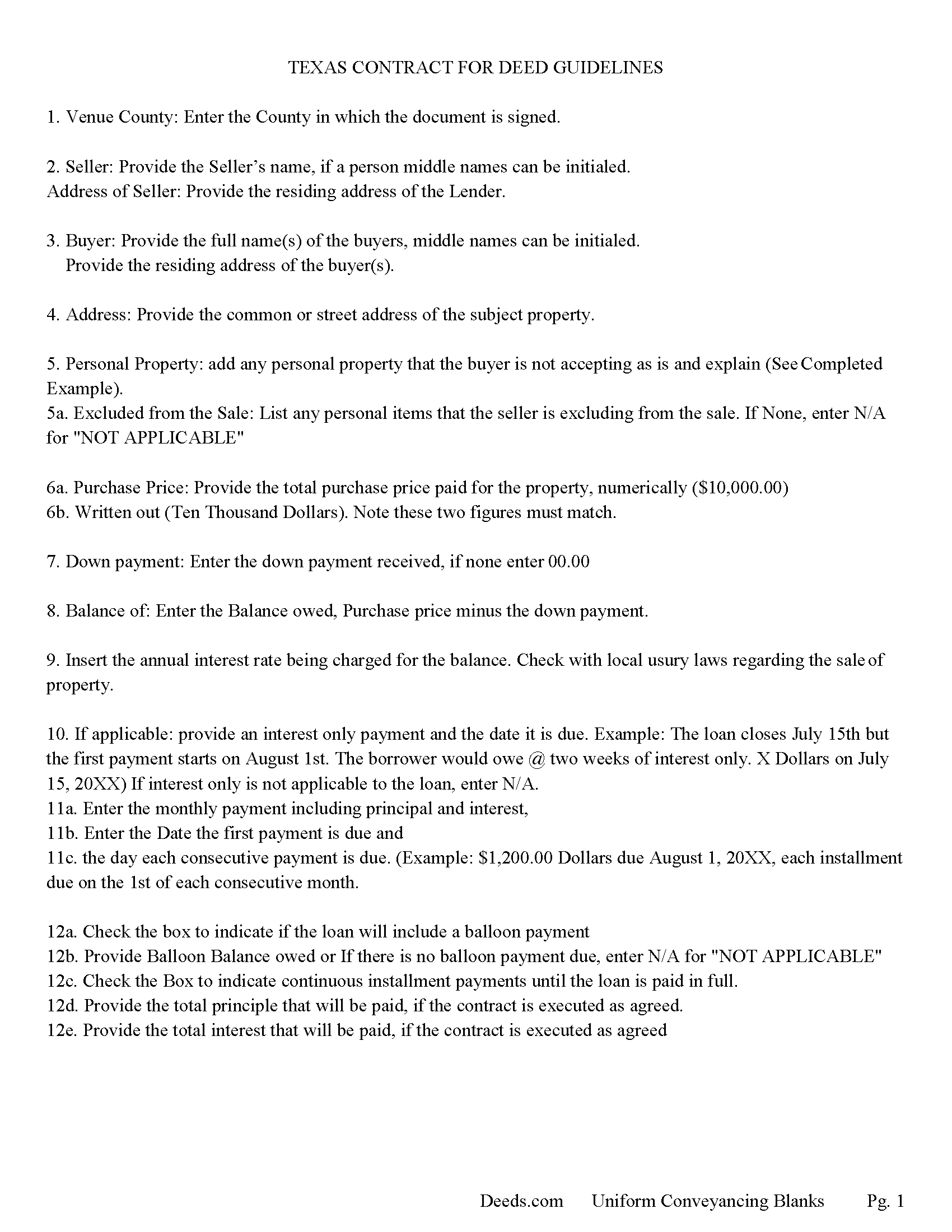

Trinity County Contract for Deed Guidelines

Line by line guide explaining every blank on the form.

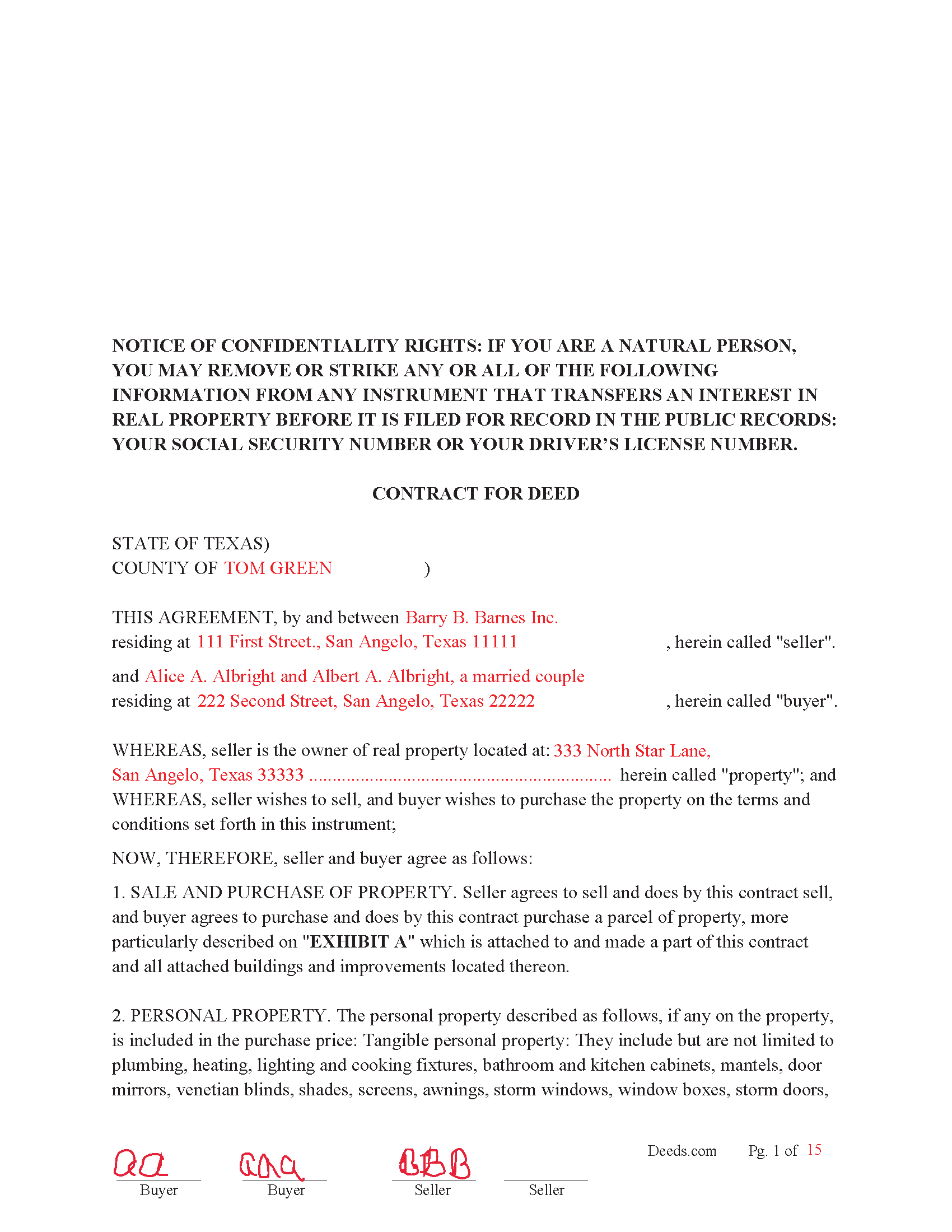

Trinity County Completed Example of the Contract for Deed

Example of a properly completed form for reference.

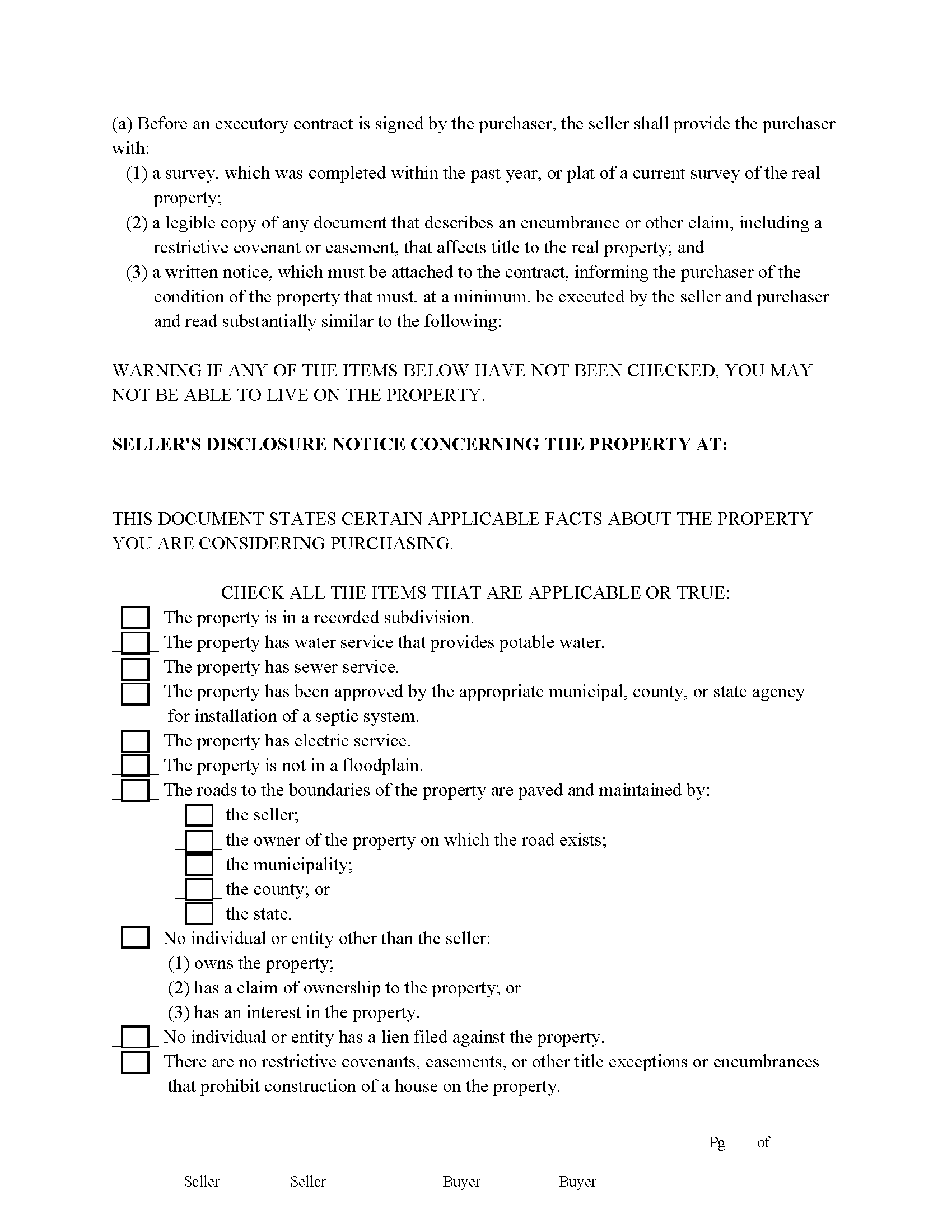

Trinity County Property Disclosure Form

Fill in the blank form

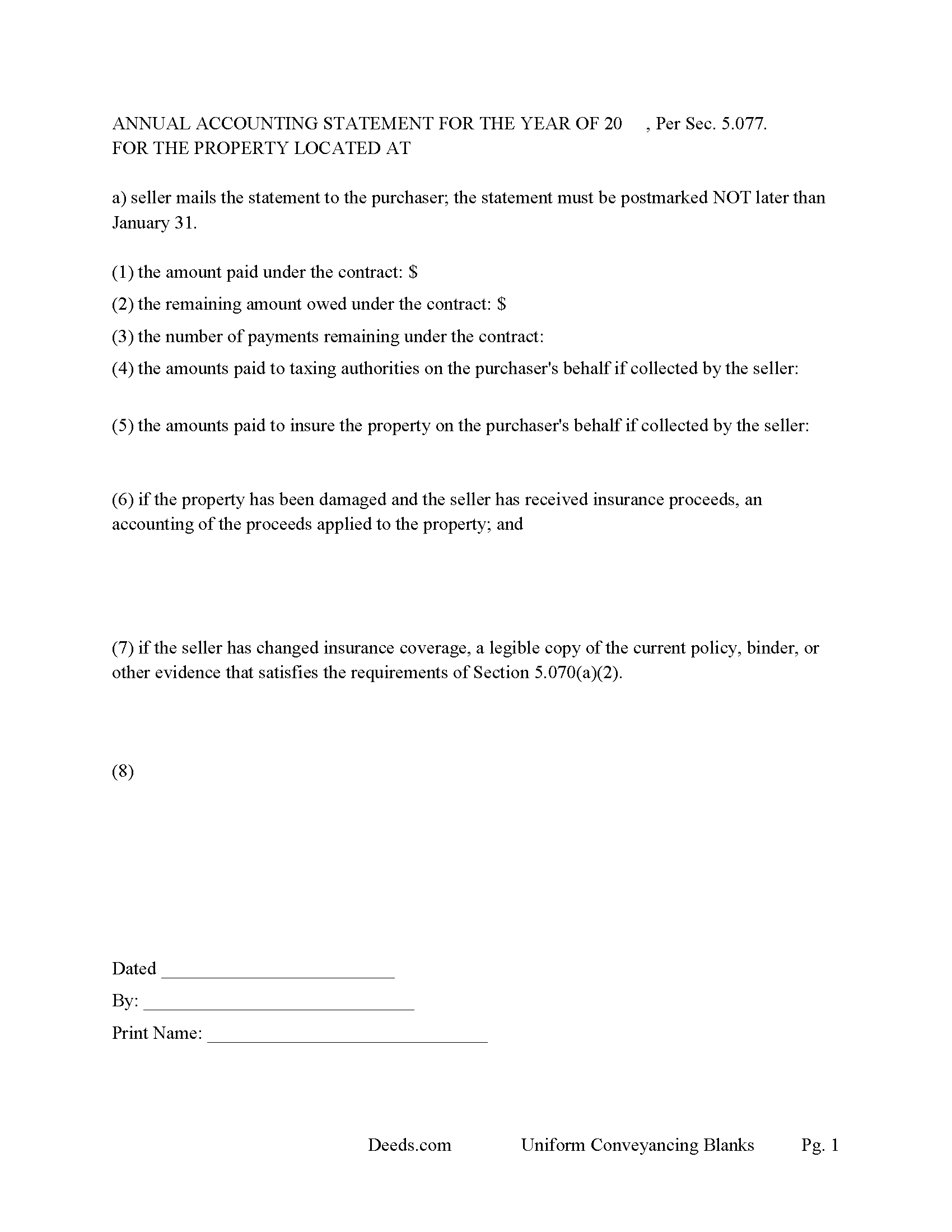

Trinity County Annual Accounting Statement Form

As required by Texas Property Code.

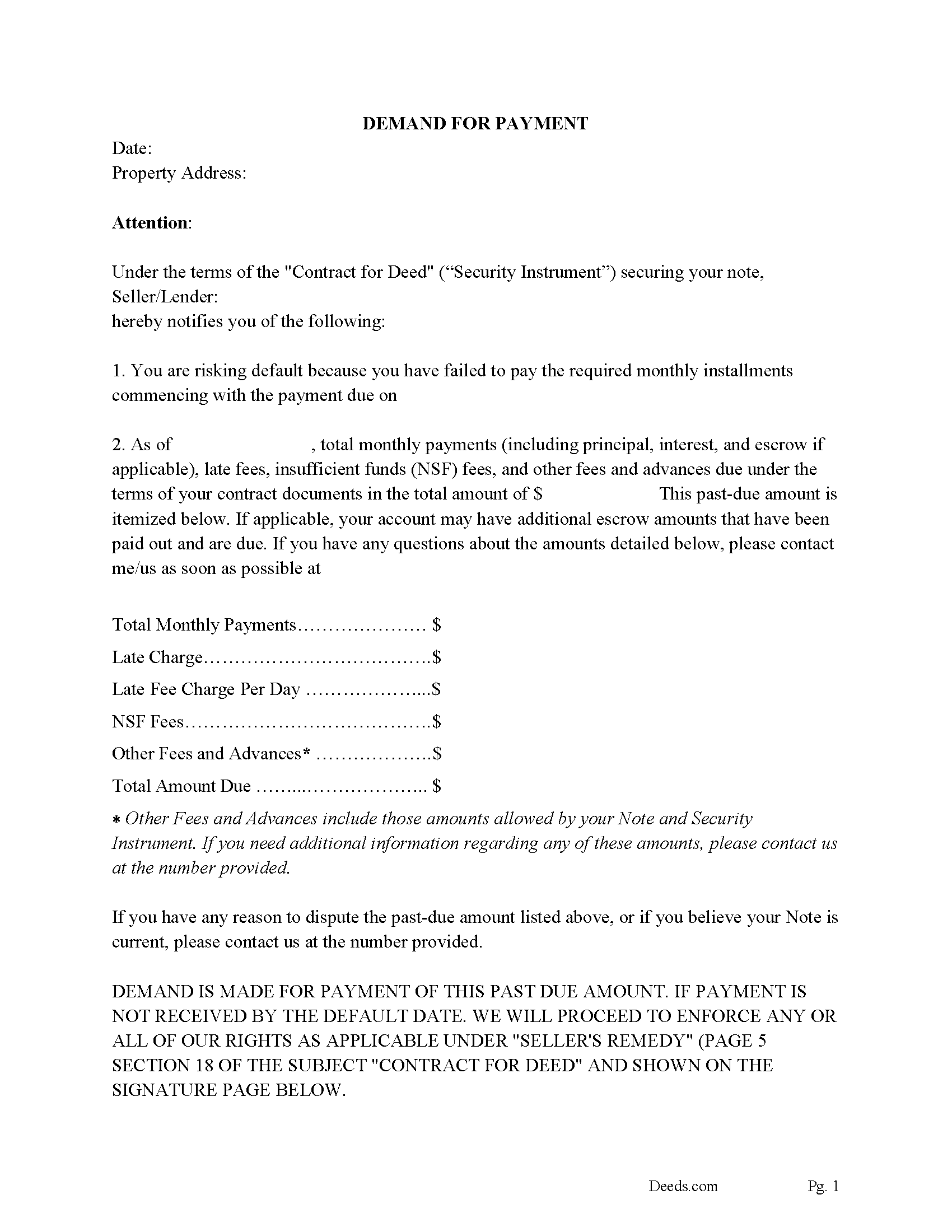

Trinity County Demand for Payment

Use for payments past due, if needed.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Trinity County documents included at no extra charge:

Where to Record Your Documents

Trinity County Clerk

Groveton, Texas 75845

Hours: 8:00am to 4:30pm M-F

Phone: (936) 642-1208

Recording Tips for Trinity County:

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Trinity County

Properties in any of these areas use Trinity County forms:

- Apple Springs

- Centralia

- Groveton

- Pennington

- Trinity

- Woodlake

Hours, fees, requirements, and more for Trinity County

How do I get my forms?

Forms are available for immediate download after payment. The Trinity County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Trinity County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Trinity County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Trinity County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Trinity County?

Recording fees in Trinity County vary. Contact the recorder's office at (936) 642-1208 for current fees.

Questions answered? Let's get started!

Contract for Deed also known as a Land Contract

Use for Seller financing of a home, condominium, rental property (up to 4 units), planned unit development, and land.

Financing can be conventional installment payments or installments followed by a balloon payment. This is often used with owner financing. 3 years of payments followed by a balloon payment. This gives the buyer time to build equity and credit. Buyer has the right to prepay any additional sums to reduce the principal at any time without penalty.

This form includes the following as per [Texas Code 5.071-Seller's Disclosure of Financing Terms]

[(1) the purchase price of the property;

(2) the interest rate charged under the contract;

(3) the dollar amount, or an estimate of the dollar amount if the interest rate is variable, of the interest charged for the term of the contract;

(4) the total amount of principal and interest to be paid under the contract;

(5) the late charge, if any, that may be assessed under the contract; and

(6) the fact that the seller may not charge a prepayment penalty or any similar fee if the purchaser elects to pay the entire amount due under the contract before the scheduled payment date under the contract.]

Oral Agreements Prohibited.

(d) The seller shall include in a separate document or in a provision of the contract a statement printed in 14-point boldfaced type or 14-point uppercase typewritten letters that reads substantially similar to the following:

THIS EXECUTORY CONTRACT REPRESENTS THE FINAL AGREEMENT BETWEEN THE SELLER AND PURCHASER AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES. (Texas Property Code 5.072)

This form can also be used if there are one or more existing liens on the property, includes the warning statement:

WARNING: ONE OR MORE RECORDED LIENS HAVE BEEN FILED THAT MAKE A CLAIM AGAINST THIS PROPERTY AS LISTED BELOW. IF A LIEN IS NOT RELEASED AND THE PROPERTY IS CONVEYED WITHOUT THE CONSENT OF THE LIENHOLDER, IT IS POSSIBLE THE LIENHOLDER COULD DEMAND FULL PAYMENT OF THE OUTSTANDING BALANCE OF THE LIEN IMMEDIATELY. YOU MAY WISH TO CONTACT EACH LIENHOLDER FOR FURTHER INFORMATION AND DISCUSS THIS MATTER WITH AN ATTORNEY. (Texas Statute 5.016)

A purchaser has the right to cancel a contract without cause within 14 days after execution. This form contains this clause and the "Cancellation Notice" form.

(YOU, THE PURCHASER, MAY CANCEL THIS CONTRACT AT ANY TIME DURING THE NEXT TWO WEEKS. THE DEADLINE FOR CANCELING THE CONTRACT IS (date). THE ATTACHED NOTICE OF CANCELLATION EXPLAINS THIS RIGHT.) (Statute 5.074 Purchaser's Right to Cancel Contract Without Cause)

SELLER'S DISCLOSURE OF PROPERTY CONDITION form provided as per Texas Property Code Statute Sec. 5.069.

a written notice, which must be attached to the contract, informing the purchaser of the condition of the property that must, at a minimum, be executed by the seller and purchaser and read substantially similar to the following: (See Statute 5.069)

Annual Accounting Statement Form included

Yearly no later than January 31, seller must provide an accounting statement that includes

[(1) the amount paid under the contract;

(2) the remaining amount owed under the contract;

(3) the number of payments remaining under the contract;

(4) the amounts paid to taxing authorities on the purchaser's behalf if collected by the seller;

(5) the amounts paid to insure the property on the purchaser's behalf if collected by the seller;

(6) if the property has been damaged and the seller has received insurance proceeds, an accounting of the proceeds applied to the property; and

(7) if the seller has changed insurance coverage, a legible copy of the current policy, binder, or other evidence that satisfies the requirements of Section 5.070(a)(2)]. [Statute5.077 Annual Accounting Statement]

Oral Agreements Prohibited, this form includes the following clause as per statute.

(THIS EXECUTORY CONTRACT REPRESENTS THE FINAL AGREEMENT BETWEEN THE SELLER AND PURCHASER AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.) (Texas Property Code Statute 5.072)

Demand for Payment Form included.

This form itemizes all payments, fees, late charges due upon delinquency.

DEMAND IS MADE FOR PAYMENT OF THIS PAST DUE AMOUNT. IF PAYMENT IS NOT RECEIVED BY THE DEFAULT DATE. WE WILL PROCEED TO ENFORCE ANY OR ALL OF OUR RIGHTS AS APPLICABLE UNDER "SELLER'S REMEDY" (PAGE 5 SECTION 18 OF THE SUBJECT "CONTRACT FOR DEED" AND SHOWN ON THE SIGNATURE PAGE BELOW.

(Texas Contract for Deed Package includes forms, guidelines, and completed example)

Important: Your property must be located in Trinity County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Trinity County.

Our Promise

The documents you receive here will meet, or exceed, the Trinity County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Trinity County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jo G.

November 8th, 2021

The form was easy enough to purchase but I ended up not needing it. No fault of Deeds.com, but it was of no value to me.

Thank you for your feedback. We really appreciate it. Have a great day!

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

David S.

September 2nd, 2020

It was as I suspected. Very useful.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda M L.

September 7th, 2023

Easy to use, documents look good, but pretty expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Eldridge S.

August 5th, 2019

very pleased to attain this important document

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

OLGA R.

October 30th, 2020

Excellent Service for E-Recording. They work with you and guide you on every aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Gale W.

August 30th, 2025

Haven't filled them out yet, but extremely pleased with the beneficiary deed forms, including the instructions and a completed sample. 5-stars.

Thank you, Gale! Glad to hear you’re happy with the beneficiary deed package. We appreciate your feedback and wish you the best as you complete your forms.

Susan M.

March 15th, 2022

Loved my experience with deeds.com! Easy and simple to fill in the form, plus the extra instructions were helpful! I will use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan K.

May 26th, 2022

First time using DEEDS.COM and very helpful with documents to fill out. I highly recommend this company for all your needs .Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Jaime H.

October 20th, 2020

quick and easy

Thank you!