Hood County Deed of Trust and Promissory Note Form

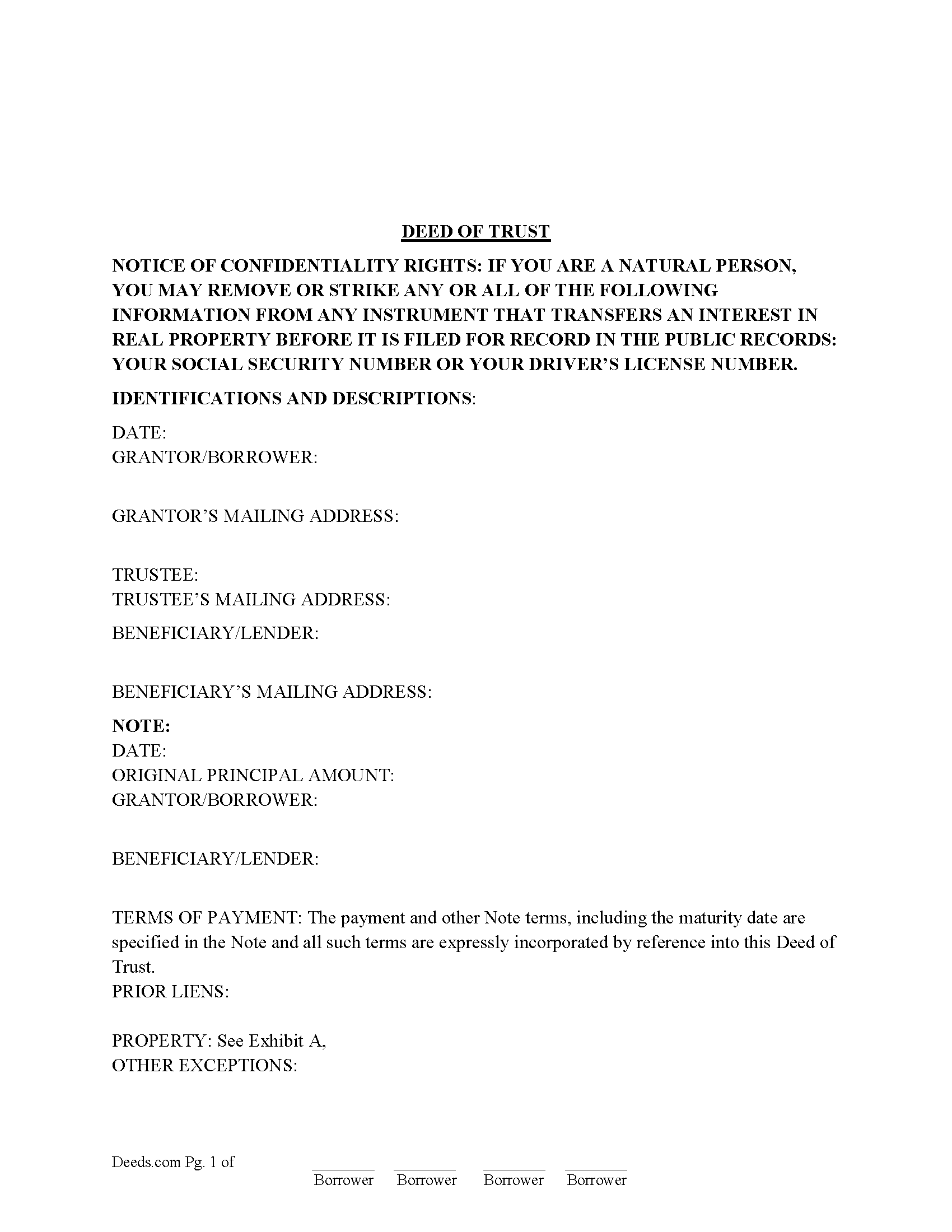

Hood County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

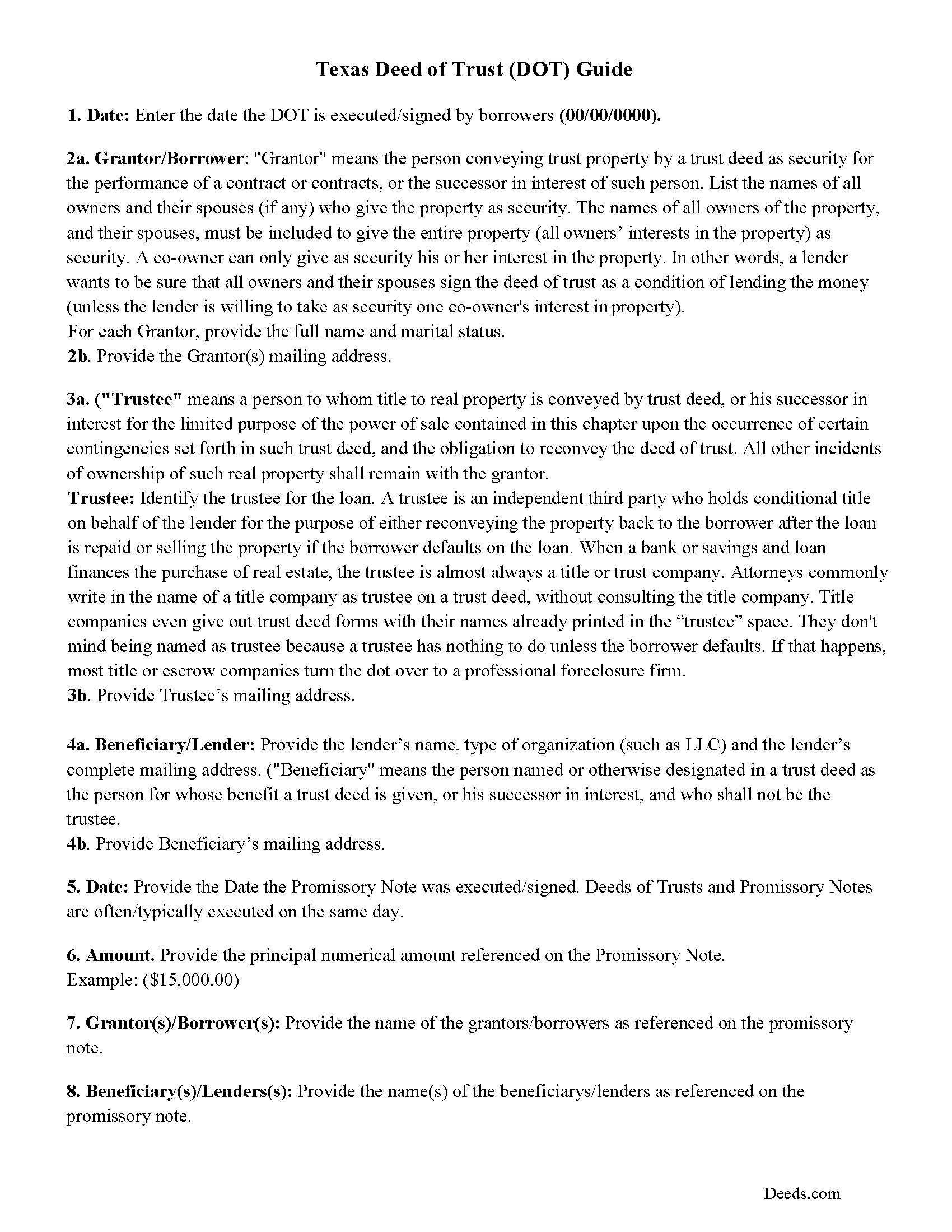

Hood County Texas Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

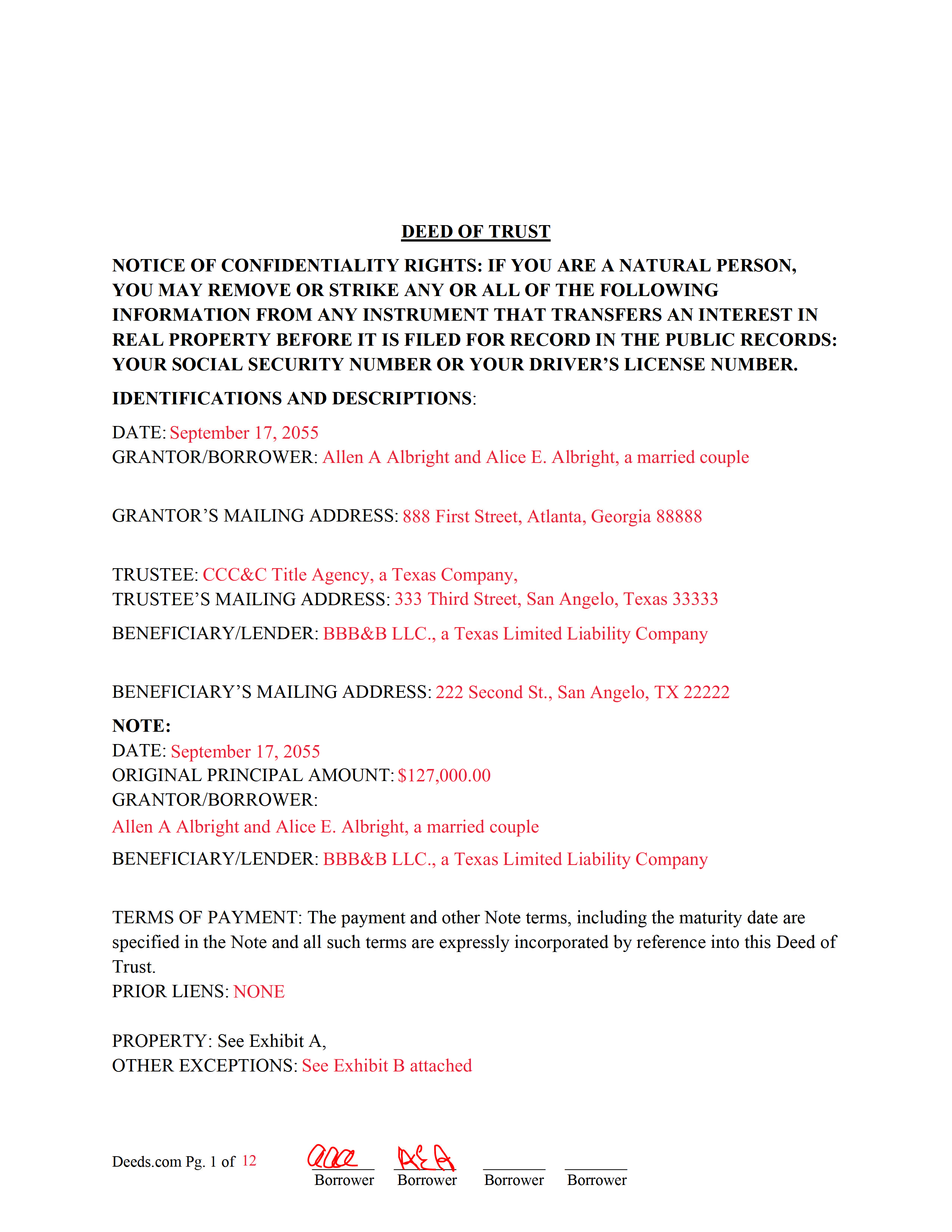

Hood County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

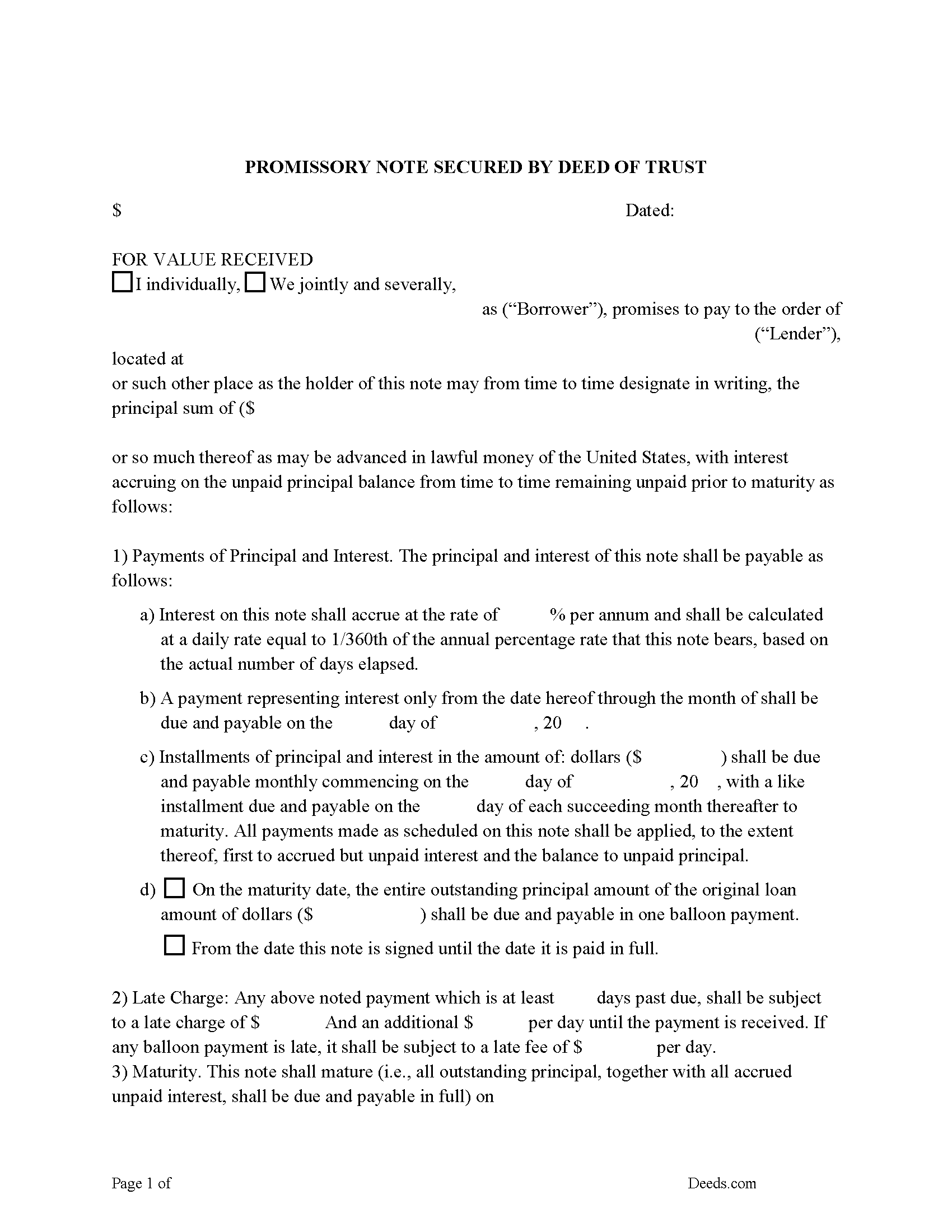

Hood County Promissory Note Form

Note secured by Deed of Trust, fill in the blank.

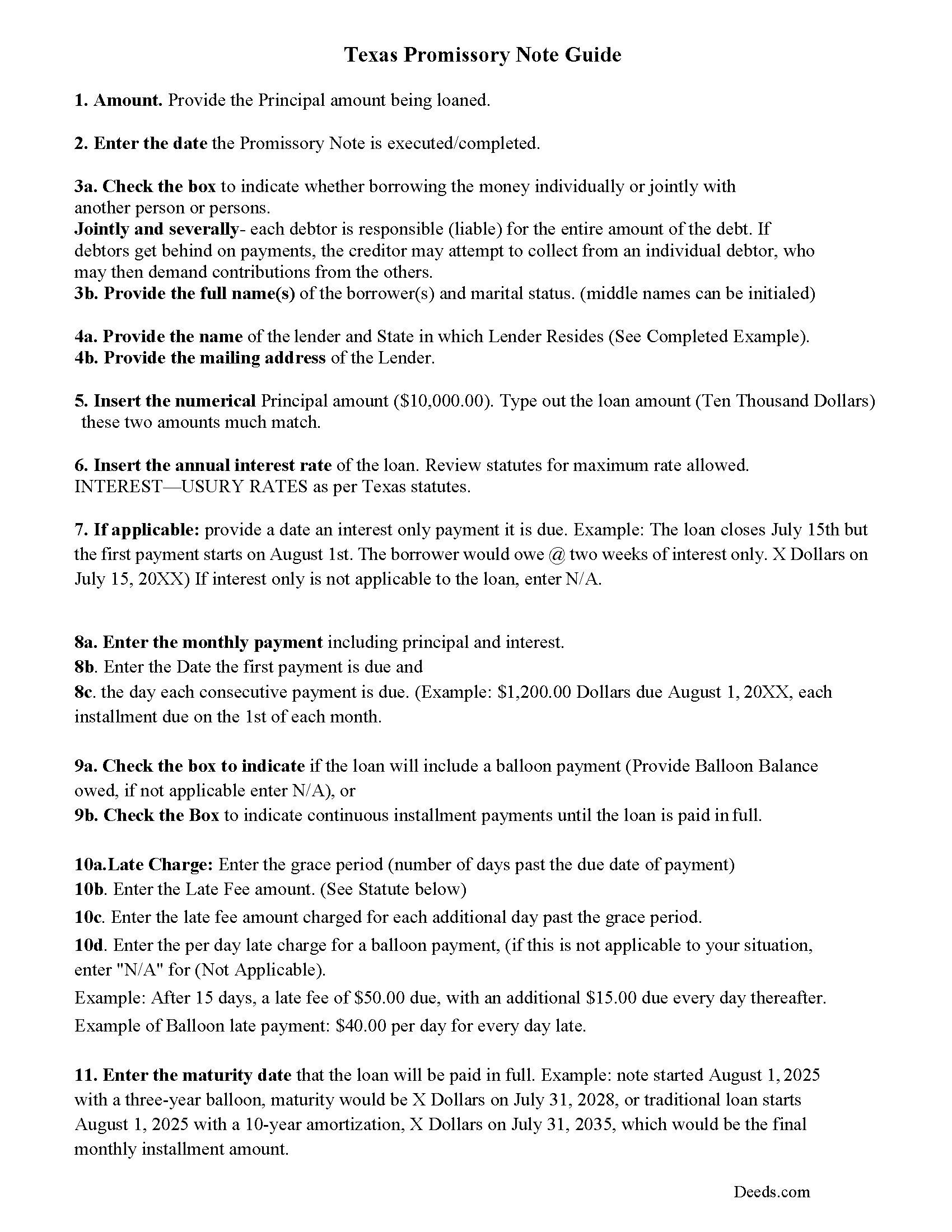

Hood County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

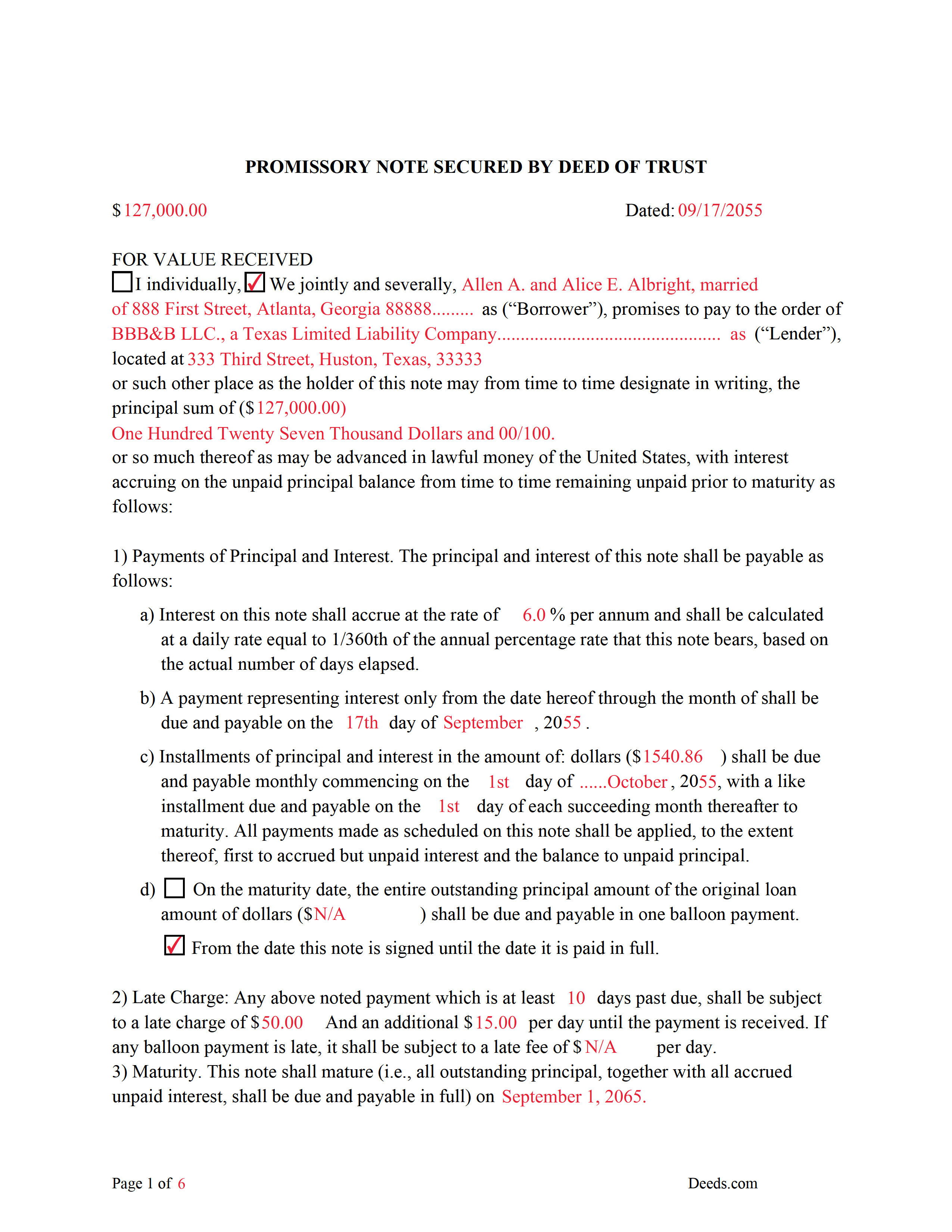

Hood County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

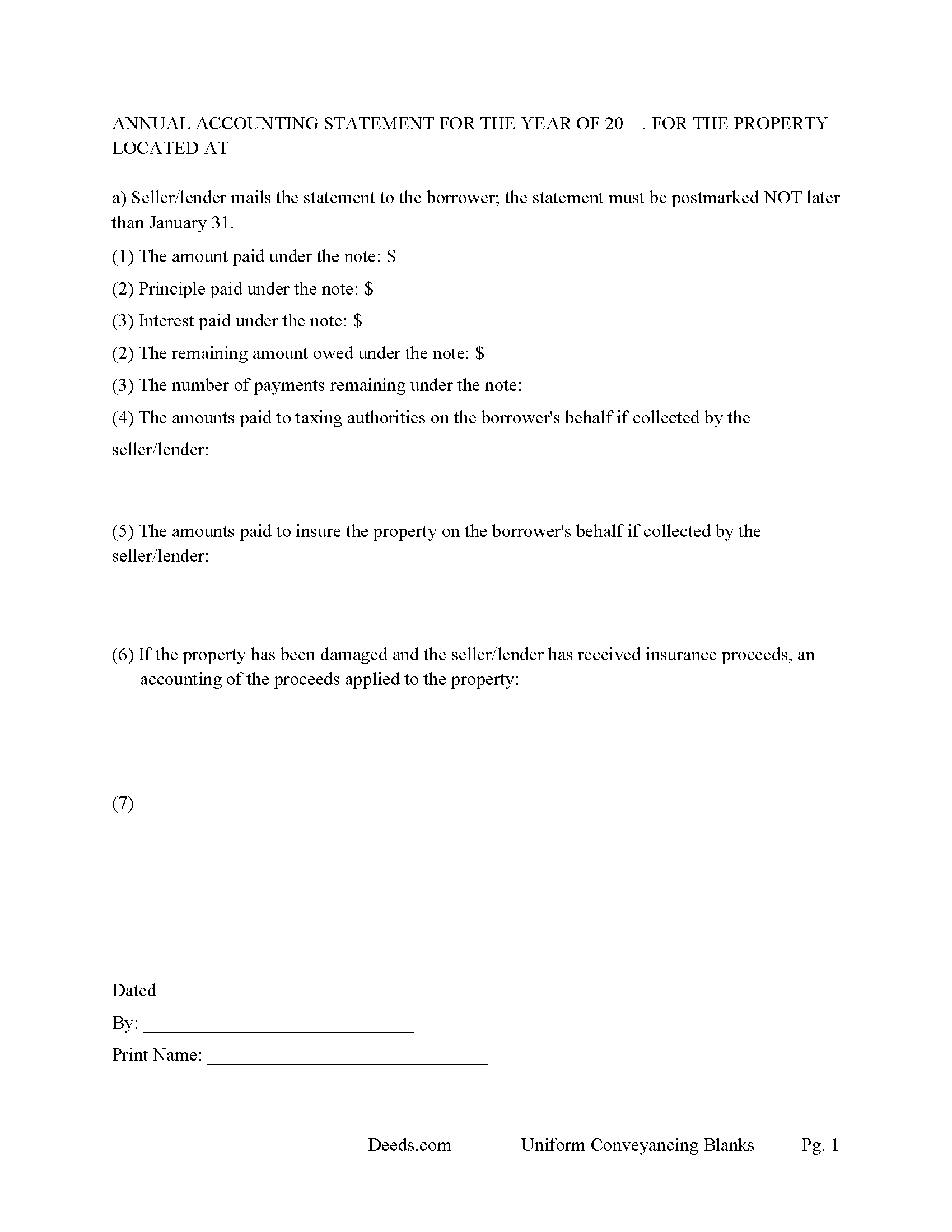

Hood County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hood County documents included at no extra charge:

Where to Record Your Documents

Hood County Clerk

Granbury, Texas 76048

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (817) 579-3222

Recording Tips for Hood County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Hood County

Properties in any of these areas use Hood County forms:

- Cresson

- Granbury

- Lipan

- Paluxy

- Tolar

Hours, fees, requirements, and more for Hood County

How do I get my forms?

Forms are available for immediate download after payment. The Hood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hood County?

Recording fees in Hood County vary. Contact the recorder's office at (817) 579-3222 for current fees.

Questions answered? Let's get started!

A deed of trust (DOT) is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in a promissory note. It's similar to a mortgage but differs - mortgages only include two parties (borrower and lender). In Texas a Deed of Trust is the preferred lending instrument.

There are three parties to a deed of trust: the borrower (grantor), the lender (beneficiary), and the trustee. The trustee, typically a title agency or other disinterested party, serves two purposes: to initiate the foreclosure process for the lender if the borrower defaults on the loan, and to transfer (reconvey) the property back to the borrower after the debt is paid in full.

This DOT includes a power of sale clause, this can be beneficial to the lender, saving time and expense in the case of a foreclosure. Sec.51.0074. DUTIES OF TRUSTEE.

(a) One or more persons may be authorized to exercise the power of sale under a security instrument.

(b) A trustee may not be:

(1) assigned a duty under a security instrument other than to exercise the power of sale in accordance with the terms of the security instrument; or

(2) held to the obligations of a fiduciary of the mortgagor or mortgagee.

Use these forms to finance real property; residential, rental, condominiums, vacant land, and planned unit developments. A promissory note secured by a deed of trust, that include stringent default terms can be beneficial to the lender, typical of owner financing, investor financing, etc.

(Texas Deed of Trust Package includes forms, guidelines, and completed example)

For use in Texas only.

Important: Your property must be located in Hood County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Hood County.

Our Promise

The documents you receive here will meet, or exceed, the Hood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hood County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Lowell R.

July 29th, 2020

Awesome. Quick informative and very easy. I made a mistake the first time, emailed you and was able to get it fixed quickly and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Trace A.

June 3rd, 2023

Deeds.com had much better and fuller information than any other help i found (90% complete vs 60 % complete); they tout how up-to-date they are on all the counties in the country and the idiosyncrasies of each county's forms and procedures; but some minor points of the info i needed were missing or confusing. Including that they sold me on e-Recording my deed through them, only to find out after i had done all the prep for that, that they had failed to tell me upfront (or i missed it somehow) that the county i was dealing with did not yet accept online recording. So, they were by far the best i found, but not 100%.

Thank you for your honest and thorough feedback Trace. We will review your concerns carefully in an effort to improve our services. Hope you have an amazing day.

Suzy I.

June 5th, 2019

I was overwhelmed with information about what forms I needed to complete the probate process, and this site was very helpful! Everything was in one place to download. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda B.

March 4th, 2023

Disappointed. Did not get the information requested.

Sorry we were unable to pull the documents you requested. We do hope that you found what you were looking for elsewhere. Have a wonderful day.

Tracy H.

January 14th, 2021

Deeds.com was an amazing experience. They made it so easy and stress free. The agent I worked with was fantastic and communicated quickly to make it a very positive experience. I will be using them from now on. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

joni e.

October 25th, 2019

It was everything that I needed. The county clerk's office kept telling me to get a lawyer for this form, but I didn't need one. Saved myself hundreds of dollars. I've used them many times.

Thank you for your feedback. We really appreciate it. Have a great day!

Ken D.

August 17th, 2021

The service was easy, fast, and worked well. I will be back.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 16th, 2022

Great service. Comprehensive. Reasonably priced.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet M.

February 9th, 2024

Deed.com is an amazing site. After calling many places and going on many websites to figure out what I needed to submit (most counties cannot help with questions and the place I needed to turn the documents into could not help either, they are not allowed to give legal advice) I came across Deeds.com. It has been so helpful and I was able to research what documents I needed. I purchased one document and after more research I realized I needed a different document. Deed.com refunded my first purchase. I then purchased an Affidavit of Death and a Deed for the county and state I needed them for. Both the example and guide were very helpful and I will be submitting my documents after I have them notarized. I give five stars

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately. However I asked a question via the "Contact Us" link and days later I get a survey but no reply. I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer. What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Jan C.

May 20th, 2020

Wow - finding your service was a lifesaver! I know my forms, but I don't have the time right now to draft them from "scratch". So once I found this site it was a couple of quick clicks and VOILA!! almost a done deal. Thanks for the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!