Hansford County Disclaimer of Interest Form

Hansford County Disclaimer of Interest Form

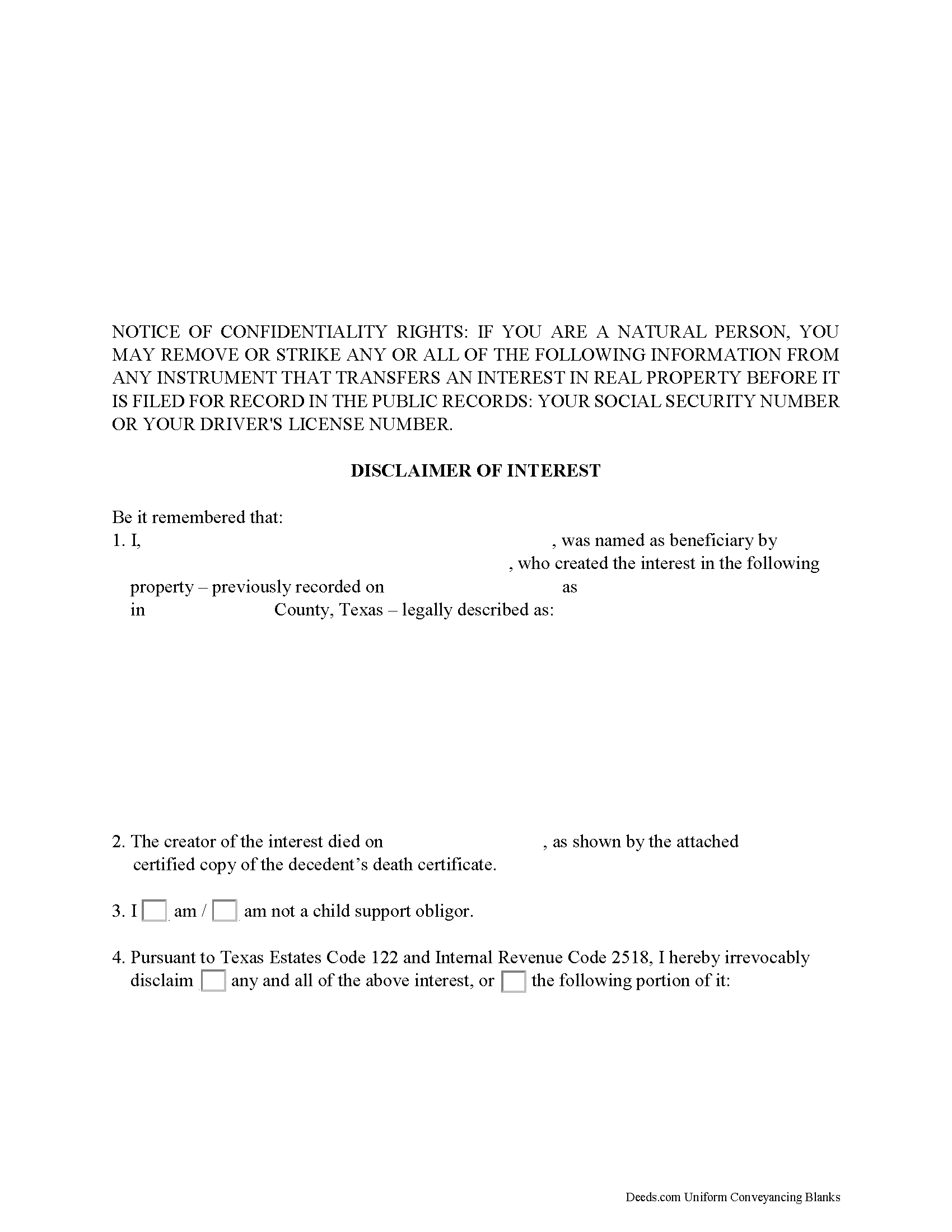

Fill in the blank form formatted to comply with all recording and content requirements.

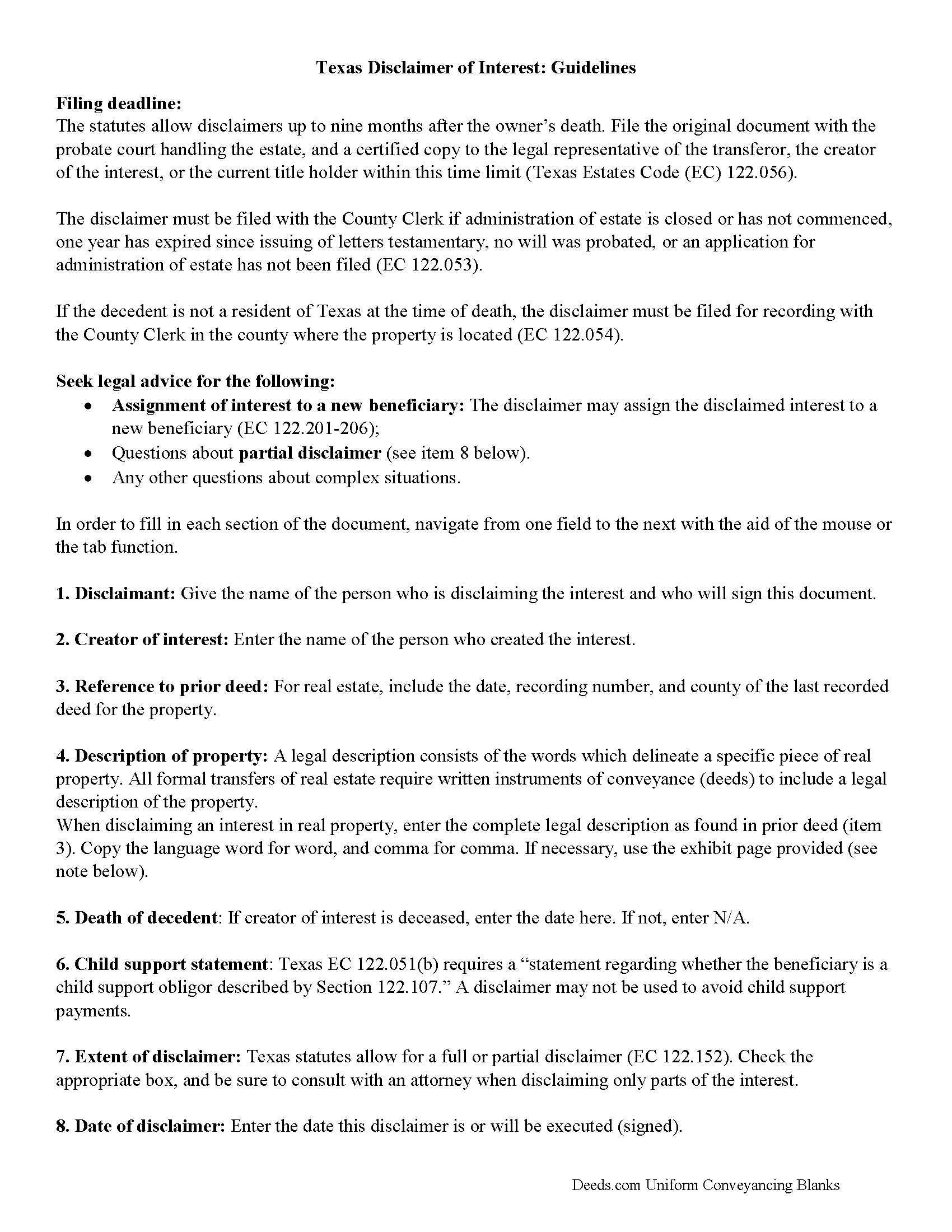

Hansford County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

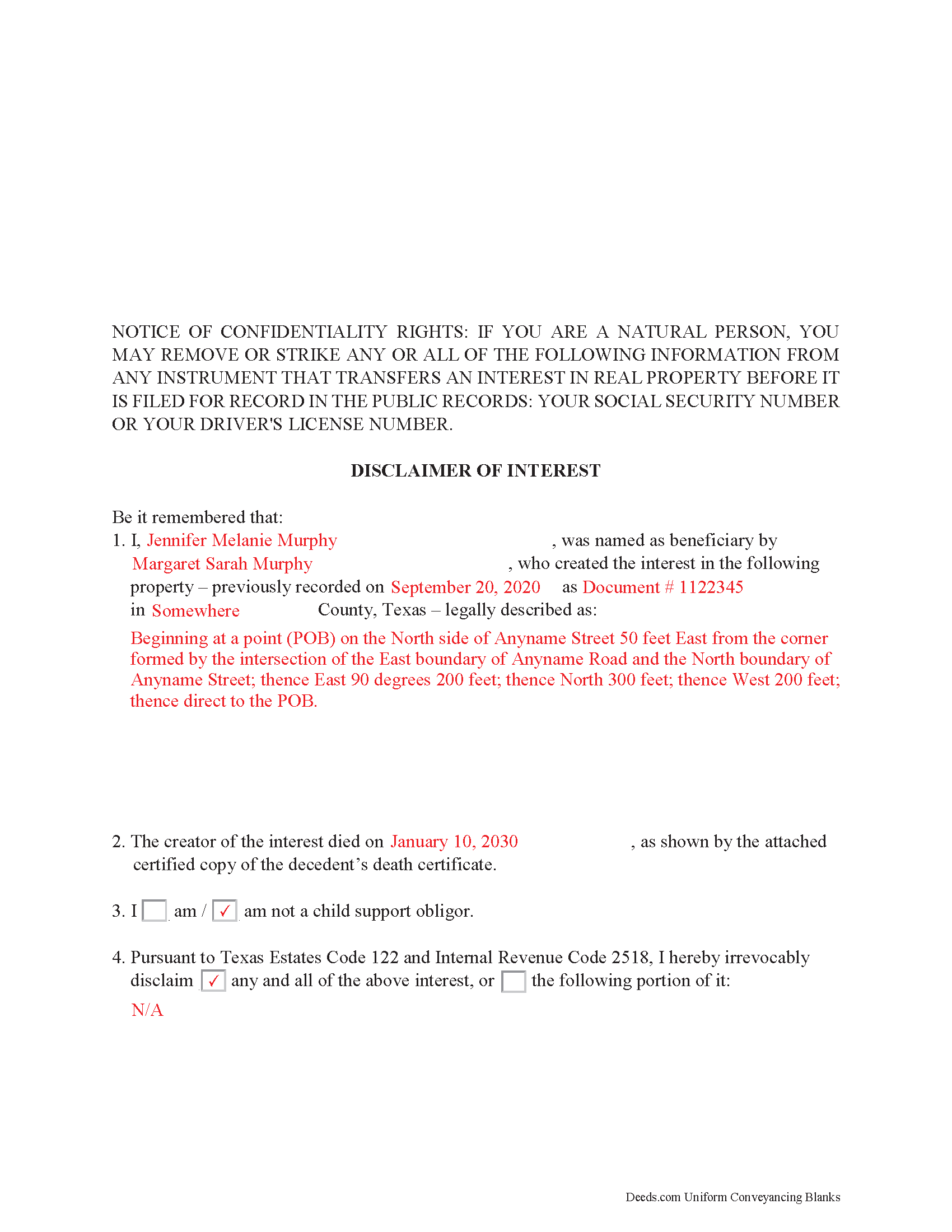

Hansford County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hansford County documents included at no extra charge:

Where to Record Your Documents

Hansford County Clerk

Spearman, Texas 79081

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (806) 659-4110

Recording Tips for Hansford County:

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Some documents require witnesses in addition to notarization

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Hansford County

Properties in any of these areas use Hansford County forms:

- Gruver

- Morse

- Spearman

Hours, fees, requirements, and more for Hansford County

How do I get my forms?

Forms are available for immediate download after payment. The Hansford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hansford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hansford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hansford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hansford County?

Recording fees in Hansford County vary. Contact the recorder's office at (806) 659-4110 for current fees.

Questions answered? Let's get started!

Use the disclaimer to renounce an interest in real property in Texas.

A beneficiary in Texas can disclaim a bequeathed asset or power (Texas Estates Code, Chapter 122). Such a disclaimer, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to renounce his or her interest in the property, either in full or partially (122.151-153). A beneficiary who is a child support obligor, however, must fulfill his obligations prior to any renunciation of an interest (122.107).

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors (122.003-004). Unless the beneficiary is a charitable organization or governmental agency of the state, the document must be received within nine months after the decedent's death, or other qualifying event (122.055), and it is only valid if no actions have indicated prior acceptance of the property (122.104).

The document must be filed with the probate court in the county where the will or estate is being administered, or the county clerk if estate proceedings are closed (122.052-053). If the decedent is not a resident of the state, it must be filed with the county clerk for recording (122.054). It further must be delivered to the representative of the deceased or executor of the estate or the holder of legal title (122.056). When in doubt as to the drawbacks and benefits of renouncing the property, as well as assigning it to a subsequent beneficiary (122.201-206), consult with an attorney.

(Texas Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Hansford County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Hansford County.

Our Promise

The documents you receive here will meet, or exceed, the Hansford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hansford County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Gary M.

February 13th, 2024

This was such an easy experience

We are grateful for your feedback and looking forward to serving you again. Thank you!

Jon B.

April 27th, 2021

The information and documents received are great. But the communication with customer service is not good at all. I've been waiting three days for them to respond to a question. I don't think they are going too.

Thank you for your feedback. We really appreciate it. Have a great day!

Roger W.

August 3rd, 2020

worked very good or me

Thank you Roger, have a great day!

Robin G.

July 3rd, 2020

Very responsive and helpful.

Thank you!

Eileen S.

November 6th, 2019

It seems fast.

Thank you!

Amy C.

September 23rd, 2020

Easy enough to use the forms. Will probably get them reviewed before recording just to be sure.

Thank you for your feedback. We really appreciate it. Have a great day!

Doris M M.

March 30th, 2022

EXCELLENT SERVICE. WILL MAINTAIN CONTACT FOR FUTURE REFERENCE. THANK YOU!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Novella M T.

January 5th, 2022

Amazing forms, nice to have something specific and not generic like some other sites. Getting the other required forms included is a nice bonus.

Great to hear Novella. We appreciate you taking the time to leave your feedback.

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Carmen C.

August 23rd, 2021

Hassle free, easy access to form and instructions include on how to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann K.

March 4th, 2020

I ordered a Quit Claim Deed for my county. Once I read the detailed instructions and filled it out I submitted it to the local Register of Deeds and it was filed on the spot while I waited! Thank you, you made a difficult and expensive task easy (for a laymen with no knowledge) at little expense. Highly recommend your site!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Carol T.

February 26th, 2020

Very east process. Good job!

Thank you for your feedback. We really appreciate it. Have a great day!

Amy S.

May 4th, 2023

Fast and easy access.

Thank you!

Javoura G.

January 31st, 2021

Great was not hard at all to do and process only wished it told how much it cost to actually submit the forms

Thank you for your feedback. We really appreciate it. Have a great day!

Richard R.

November 14th, 2019

Very straightforward, and fair-enough pricing.

Thank you!