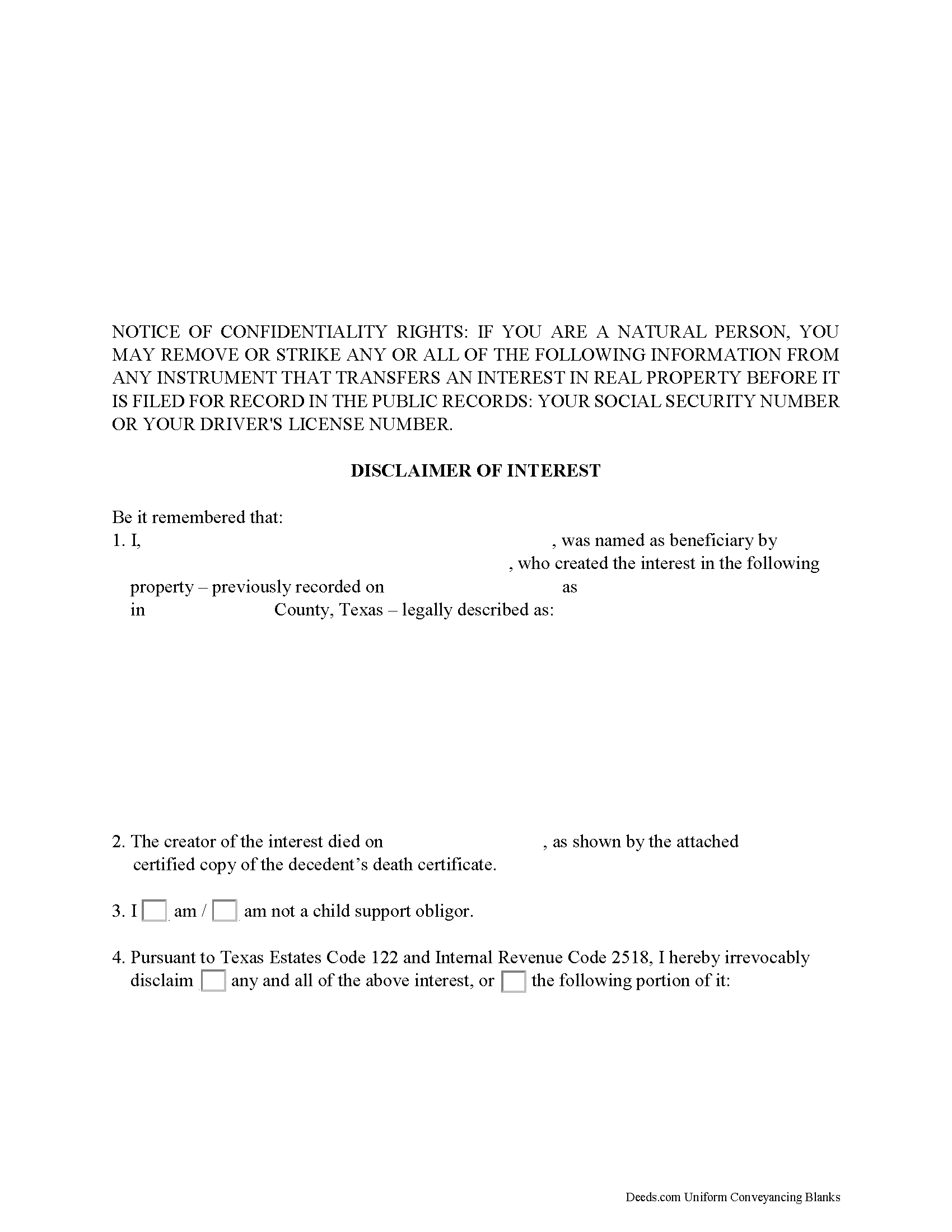

Parker County Disclaimer of Interest Form

Parker County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

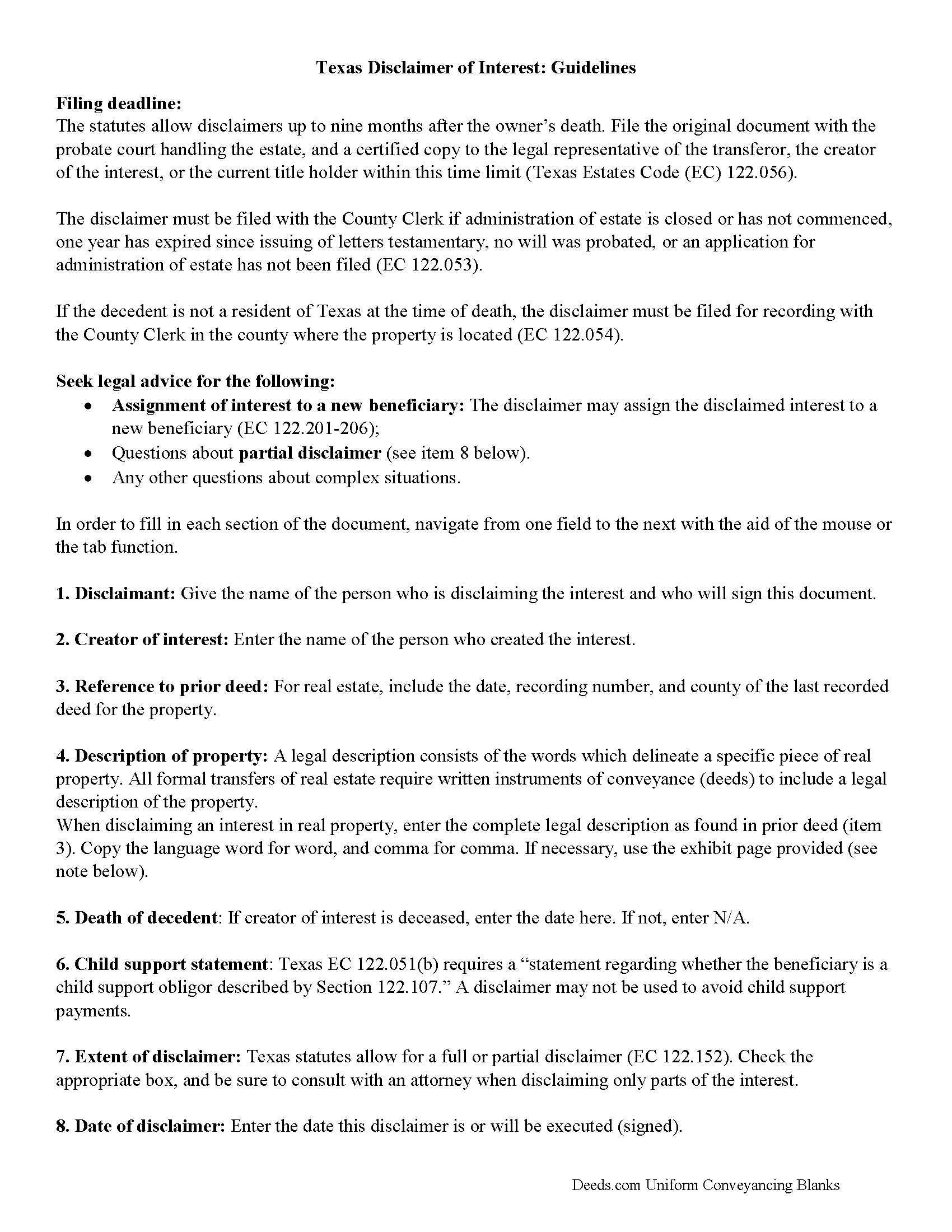

Parker County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

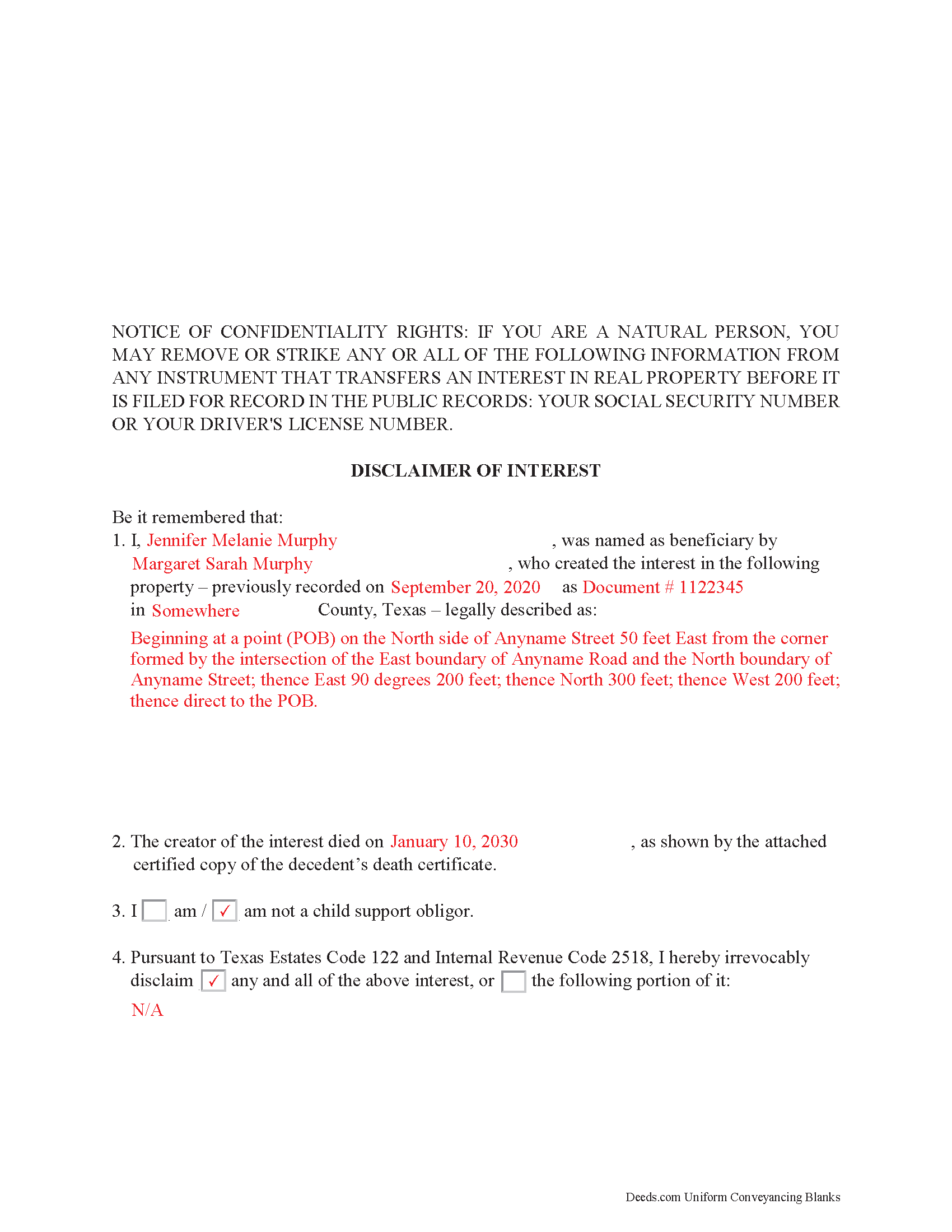

Parker County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Parker County documents included at no extra charge:

Where to Record Your Documents

Parker County Clerk

Weatherford, Texas 76086

Hours: Monday - Friday 8:00am - 4:15pm

Phone: (817) 594-7461

Recording Tips for Parker County:

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Parker County

Properties in any of these areas use Parker County forms:

- Aledo

- Azle

- Dennis

- Millsap

- Peaster

- Poolville

- Springtown

- Weatherford

- Whitt

Hours, fees, requirements, and more for Parker County

How do I get my forms?

Forms are available for immediate download after payment. The Parker County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Parker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Parker County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Parker County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Parker County?

Recording fees in Parker County vary. Contact the recorder's office at (817) 594-7461 for current fees.

Questions answered? Let's get started!

Use the disclaimer to renounce an interest in real property in Texas.

A beneficiary in Texas can disclaim a bequeathed asset or power (Texas Estates Code, Chapter 122). Such a disclaimer, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to renounce his or her interest in the property, either in full or partially (122.151-153). A beneficiary who is a child support obligor, however, must fulfill his obligations prior to any renunciation of an interest (122.107).

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors (122.003-004). Unless the beneficiary is a charitable organization or governmental agency of the state, the document must be received within nine months after the decedent's death, or other qualifying event (122.055), and it is only valid if no actions have indicated prior acceptance of the property (122.104).

The document must be filed with the probate court in the county where the will or estate is being administered, or the county clerk if estate proceedings are closed (122.052-053). If the decedent is not a resident of the state, it must be filed with the county clerk for recording (122.054). It further must be delivered to the representative of the deceased or executor of the estate or the holder of legal title (122.056). When in doubt as to the drawbacks and benefits of renouncing the property, as well as assigning it to a subsequent beneficiary (122.201-206), consult with an attorney.

(Texas Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Parker County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Parker County.

Our Promise

The documents you receive here will meet, or exceed, the Parker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Parker County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Susan S.

May 19th, 2020

Ordered the forms, completed them, had them notarized, then erecorded all in under 2 hours. Would have been faster but had to wait for the bank to open for notary. Might try the online notary next time. Fantastic experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Jennifer H.

February 25th, 2021

Price is too expensive.

Thank you for your feedback Jennifer.

Pamela S.

February 7th, 2025

I love the convenience and professionalism!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

William A.

September 11th, 2019

I was able to get the documents I wanted, and very quickly. Good service.

Thank you!

Karen G.

January 22nd, 2021

Not difficult at all! Which is great for me...

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph N.

April 5th, 2022

Fast download and clear, easy-to-follow directions. A great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michaela D.

February 27th, 2019

I purchased this form to add my boyfriend to the deed of our home. He owns his own business so he cannot be on our mortgage. The guide doesn't clearly explain adding a person rather than focusing on transferring during a purchase or selling of a home. For future, I'd recommend make a few different examples for those who are trying to use this for the other options a Quit Claim Deed is needed for.

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sierra S.

November 30th, 2020

Thank you so much for making this process seemless. We are very pleased with the service.

Thank you!

Mike H.

February 11th, 2021

Great

Thank you!

Amanda M.

December 11th, 2019

Was very easy to use.

Thank you!

Holly M.

October 18th, 2019

This was the simplest method of filing a document that I've ever encountered. I've already recommended it my colleagues, and would highly encourage anyone to use it. Fast, easy, simple.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!