Brooks County Executor Deed Form

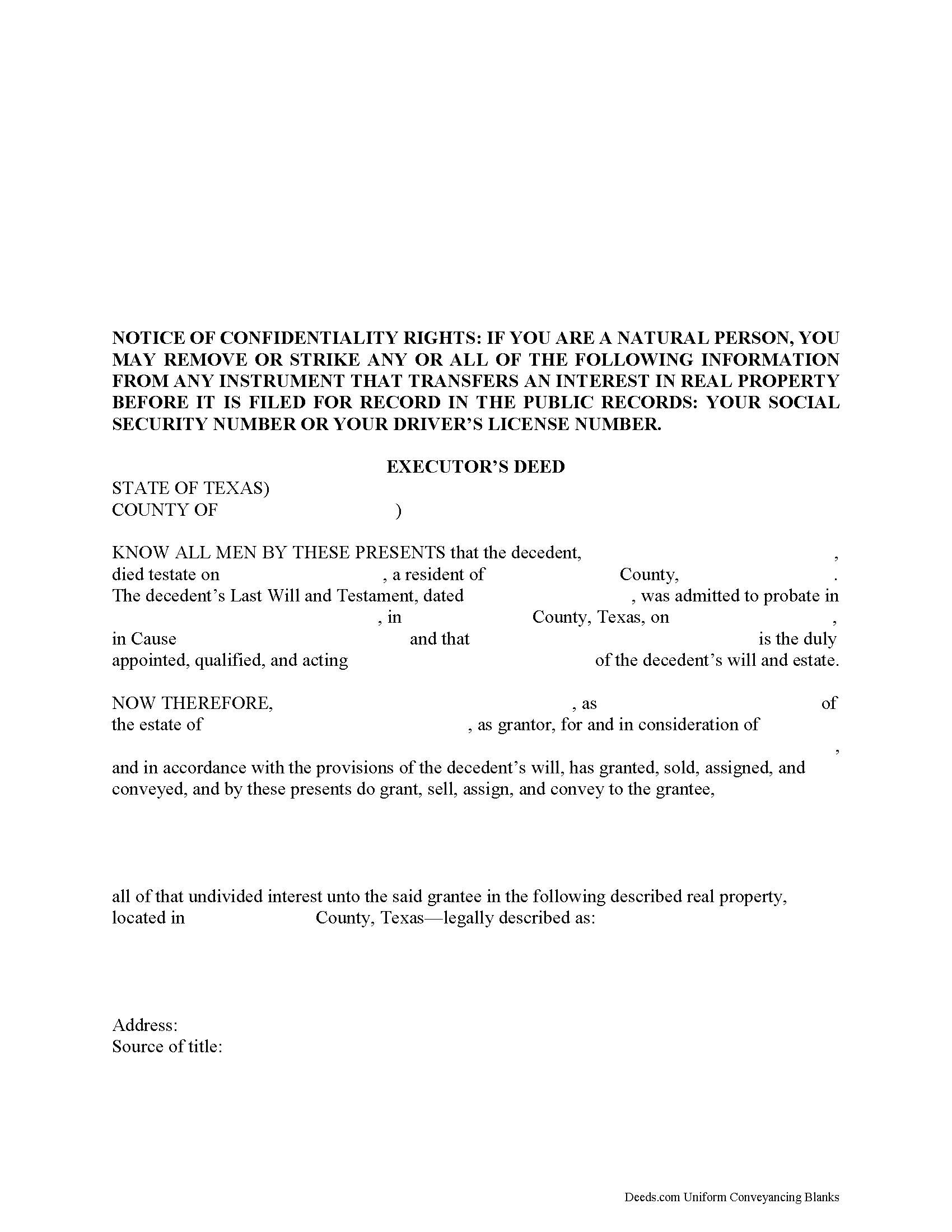

Brooks County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

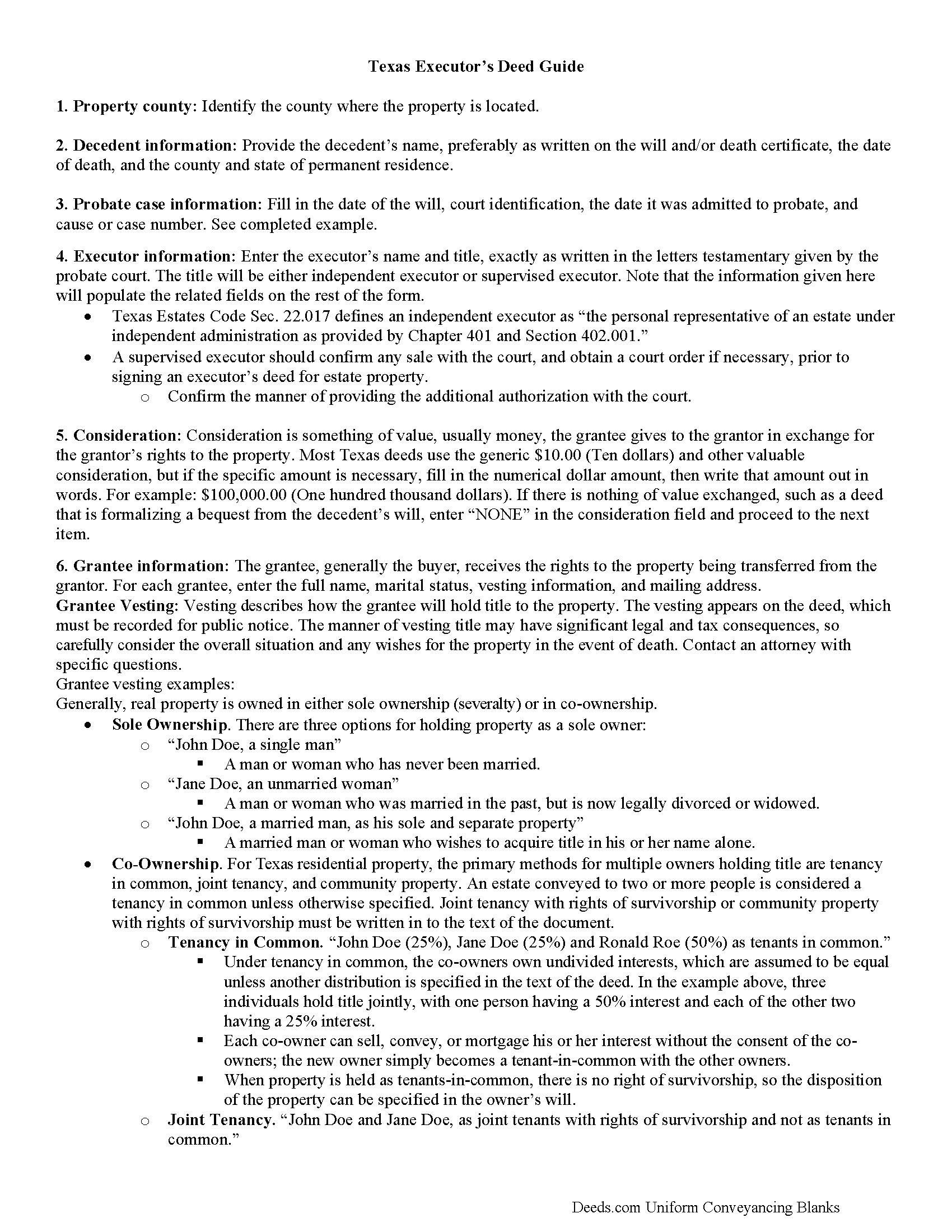

Brooks County Executor Deed Guide

Line by line guide explaining every blank on the form.

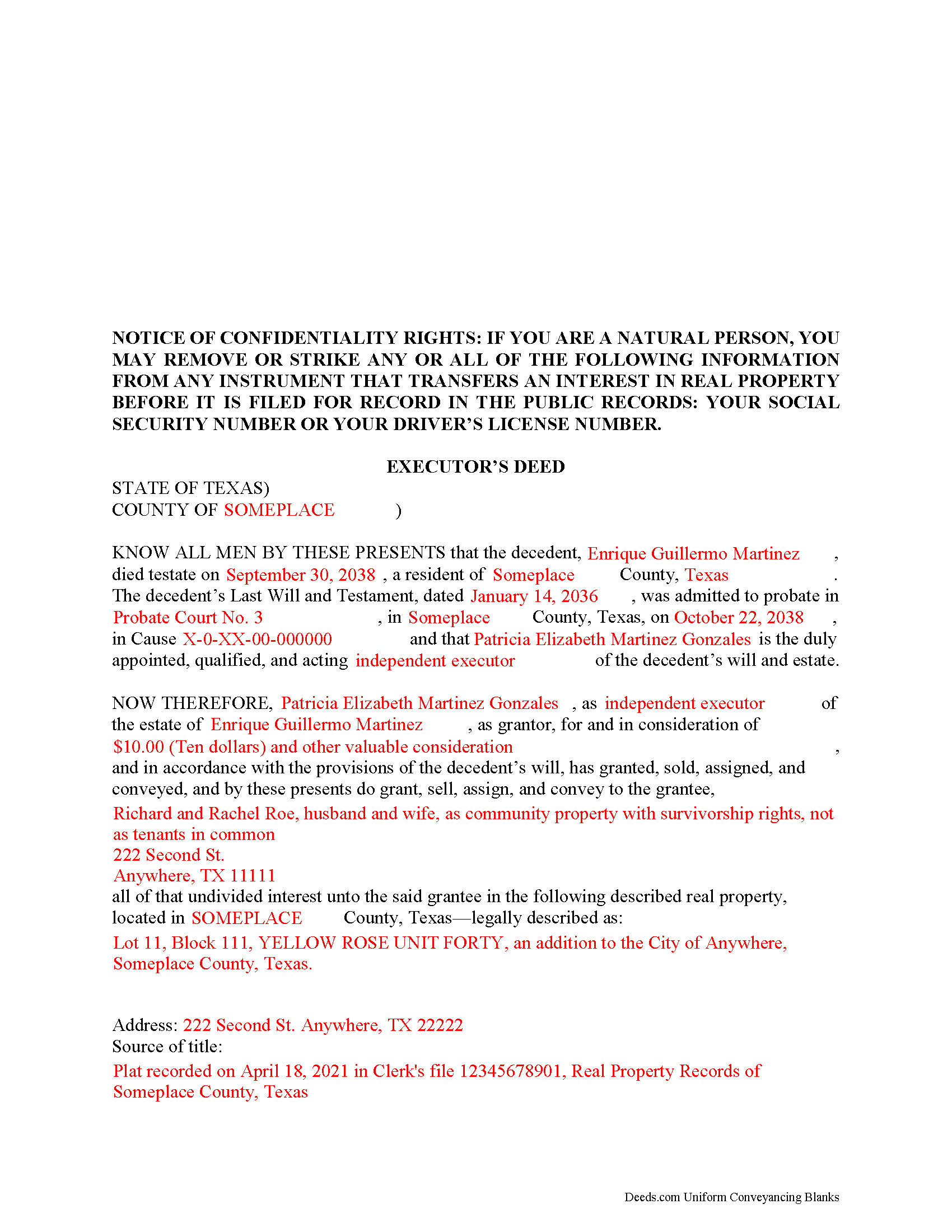

Brooks County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Brooks County documents included at no extra charge:

Where to Record Your Documents

Brooks County Clerk - Courthouse

Falfurrias, Texas 78355

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: (361) 325-5604

Recording Tips for Brooks County:

- Bring your driver's license or state-issued photo ID

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Brooks County

Properties in any of these areas use Brooks County forms:

- Encino

- Falfurrias

Hours, fees, requirements, and more for Brooks County

How do I get my forms?

Forms are available for immediate download after payment. The Brooks County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Brooks County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brooks County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Brooks County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Brooks County?

Recording fees in Brooks County vary. Contact the recorder's office at (361) 325-5604 for current fees.

Questions answered? Let's get started!

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Brooks County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Brooks County.

Our Promise

The documents you receive here will meet, or exceed, the Brooks County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brooks County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

Philippe B.

September 23rd, 2020

I purchased a Quit Claim Deed package a couple weeks ago. The included guide unfortunately didn't answer all the questions about my specific case of how to fill it out, so I sent them a couple questions on Sept 8. It's now the 23rd, and still no reply. The form is a useless waste of money if I don't know how to fill it out in a legally-accurate way.

We certainly do not want you to waste your money Philippe, to that end your order and payment has been canceled. We do hope that you seek the advice of a legal professional familiar with your specific situation. It should go without saying but just to be clear, our do it yourself forms do not include legal representation for $19. Have a wonderful day.

Wayne T.

February 2nd, 2021

I was skeptical when I first came upon this website. Not sure why I had such a negative feeling, but after I received the printed deed I felt relieved and completely satisfied. This is a great website for everyone who wouldn't want to retrieve their deed in person and worth the reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Merry K.

January 5th, 2024

I am a WA State Attorney and just made my first purchase. The experience was flawless, and I appreciate the sample and the guide, too. The price was extremely reasonable. This was a huge time-saver for me - thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lew B.

April 28th, 2025

The forms look great, but I received an Error message when downloading.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Rick L.

May 26th, 2022

I love it! Very convenience.

Thank you!

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

Shari S.

May 3rd, 2022

Deeds.com is a wonderful resource providing helpful information, forms, examples, and instructions. Thank you for your service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Taylor Z.

January 1st, 2021

I was frustrated by Orange County and all the other options they gave me to submit my paperwork. Deeds.com was the easiest to sign up for and I was impressed with how smoothly everything went. The price is well worth the convenience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Santos V.

March 18th, 2023

Great and easy to understand.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Denise P.

April 19th, 2021

Seamless transaction. Was pleased with the additional information that was provided. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

John B.

December 23rd, 2020

Thorough. Thanks!

Thank you!