Franklin County Executor Deed Form

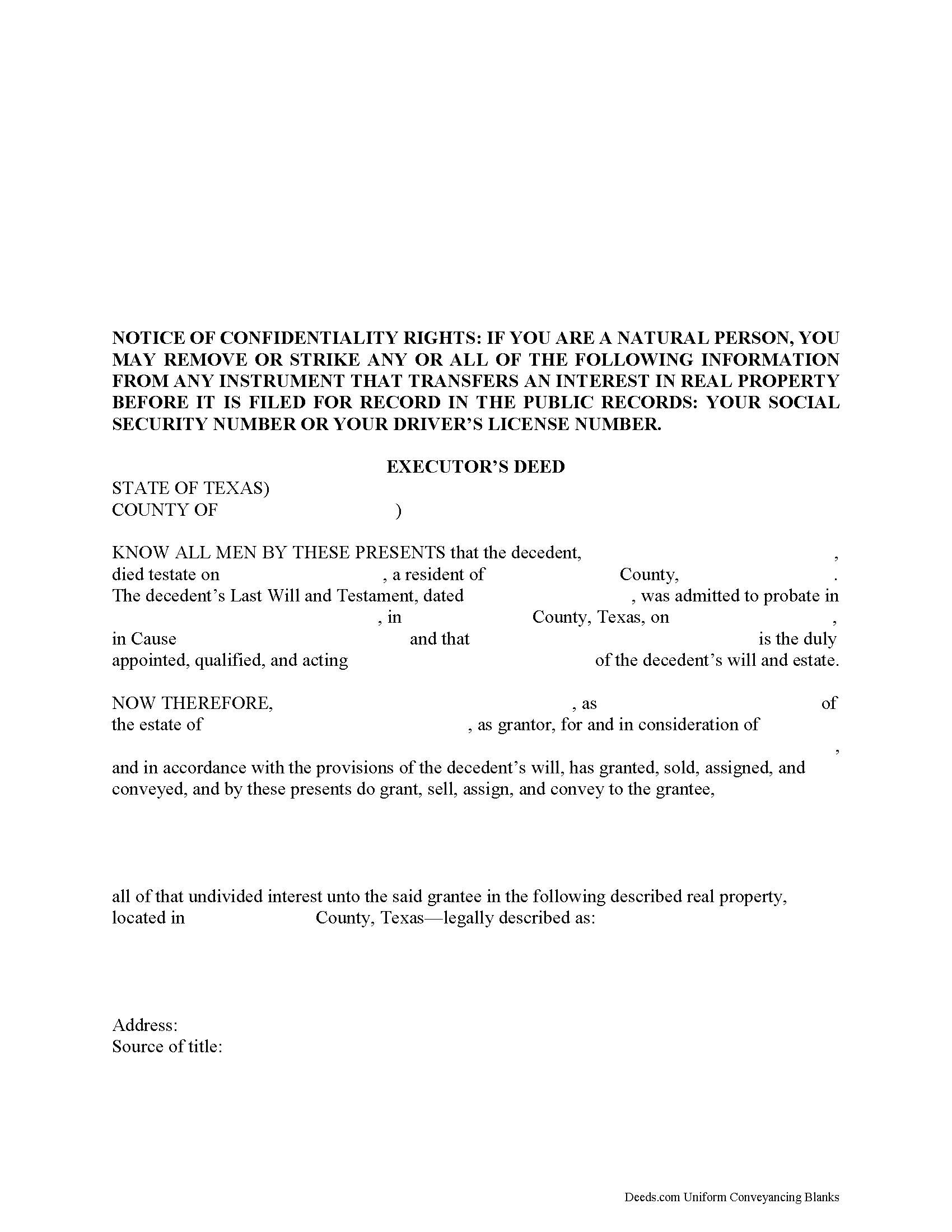

Franklin County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

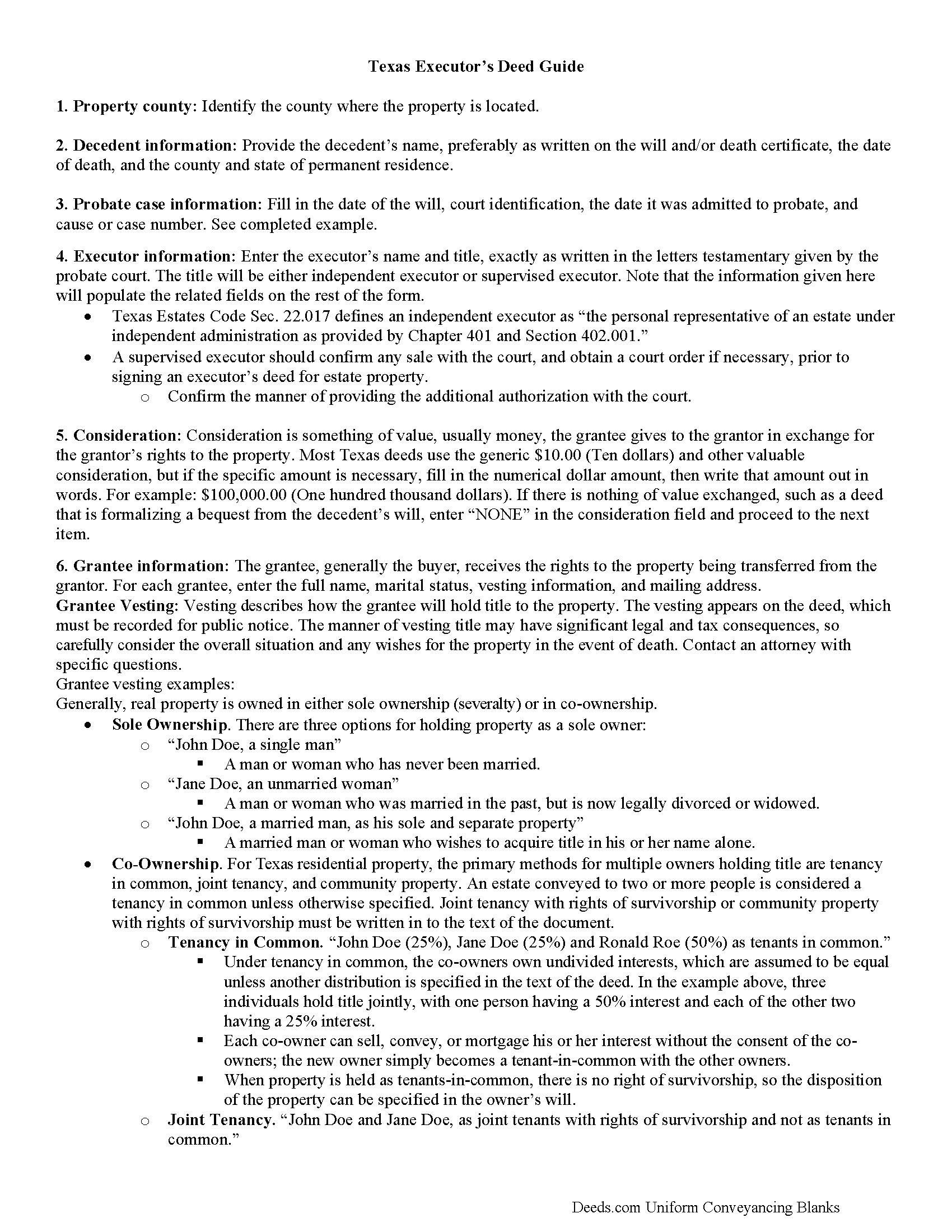

Franklin County Executor Deed Guide

Line by line guide explaining every blank on the form.

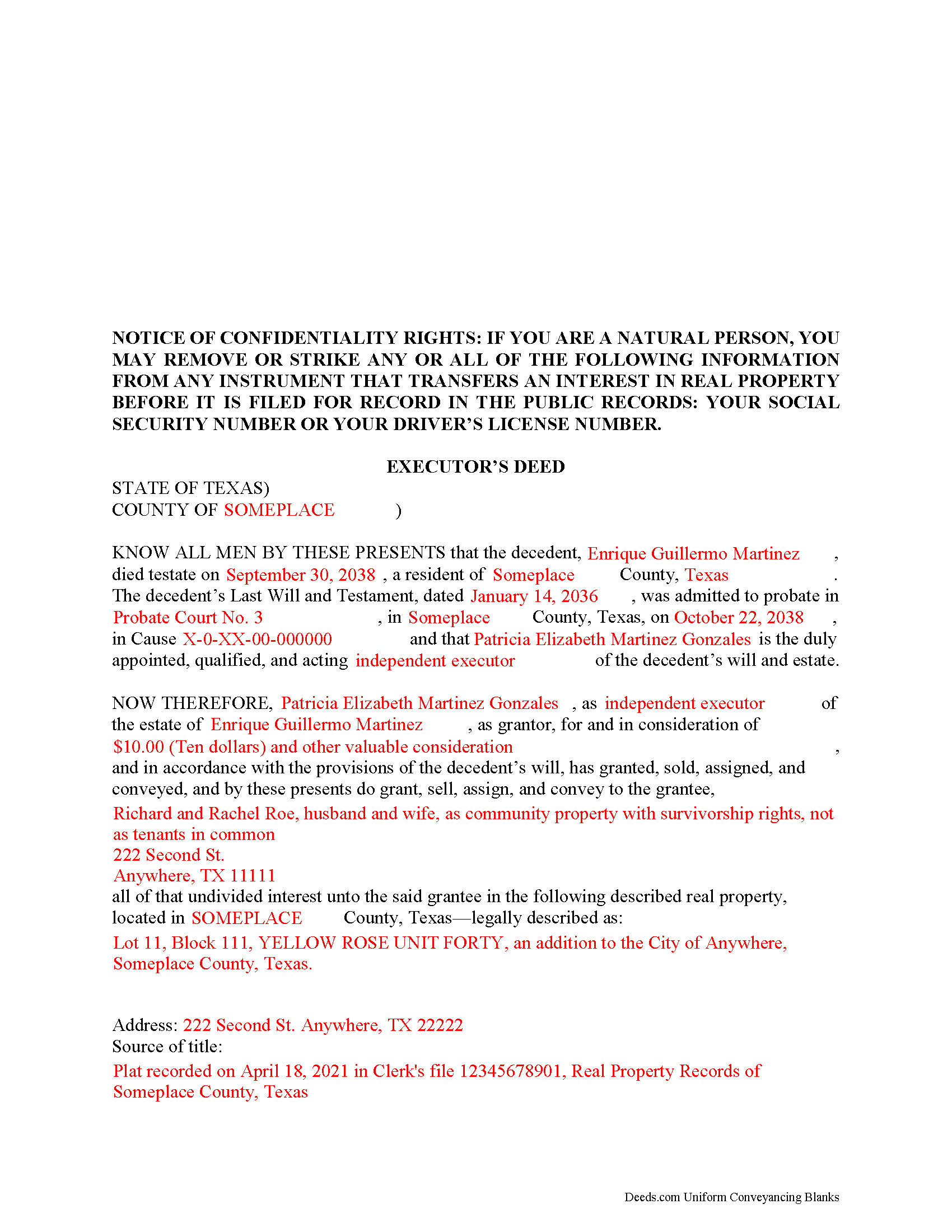

Franklin County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk's Office

Mt Vernon, Texas 75457

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm / Recording until 4:00pm

Phone: (903) 537-2342 Ext 2

Recording Tips for Franklin County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Mount Vernon

- Scroggins

- Talco

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (903) 537-2342 Ext 2 for current fees.

Questions answered? Let's get started!

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Brooksye G.

January 15th, 2019

Very helpful. I live in Arkansas and needed information and documents for a Missouri transaction. I got everything I needed without any hassle.

Thank you Brooksye, we really appreciate your feedback.

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

Diana M.

October 18th, 2020

Awesome service. Quick and easy. Complete directions on how to complete the forms with examples for further assistance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James M.

June 3rd, 2021

Very good experience.

Thank you!

SHANE P.

March 26th, 2021

Easy to use.

Thank you!

Karla L.

September 4th, 2019

Perfect! Recorded my completed deed today with no problems.

Thank you!

George A.

September 4th, 2019

Excellent Service.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristen N.

October 3rd, 2023

Very easy to use, helpful instructions and examples. I also like the chat feature and the erecording. So much better than other DIY law websites out there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark R.

January 10th, 2019

Easy and simple to understand, had no trouble with the transaction or the forms. Recorded on the first try, not something that happens very often.

Great to hear that Mark. have an awesome day!

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Audra P.

March 2nd, 2021

Deeds.com was so easy to use and understand. So fairly priced too in my opinion, worth every penny! Thank you deeds.com and I'm grateful my county uses and encourages using them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cyndi E.

March 25th, 2022

Outstanding service! So efficient and easy! Within 2 hours my document was reviewed, invoiced and forwarded to the DC ROD. This saved me so much time.

Thank you!

William G.

January 11th, 2021

I am very pleased with Deeds.com. They responded back very quickly, checked my forms, gave an example for a correction, and submitted the forms over the weekend. What more could you ask?

Thank you!