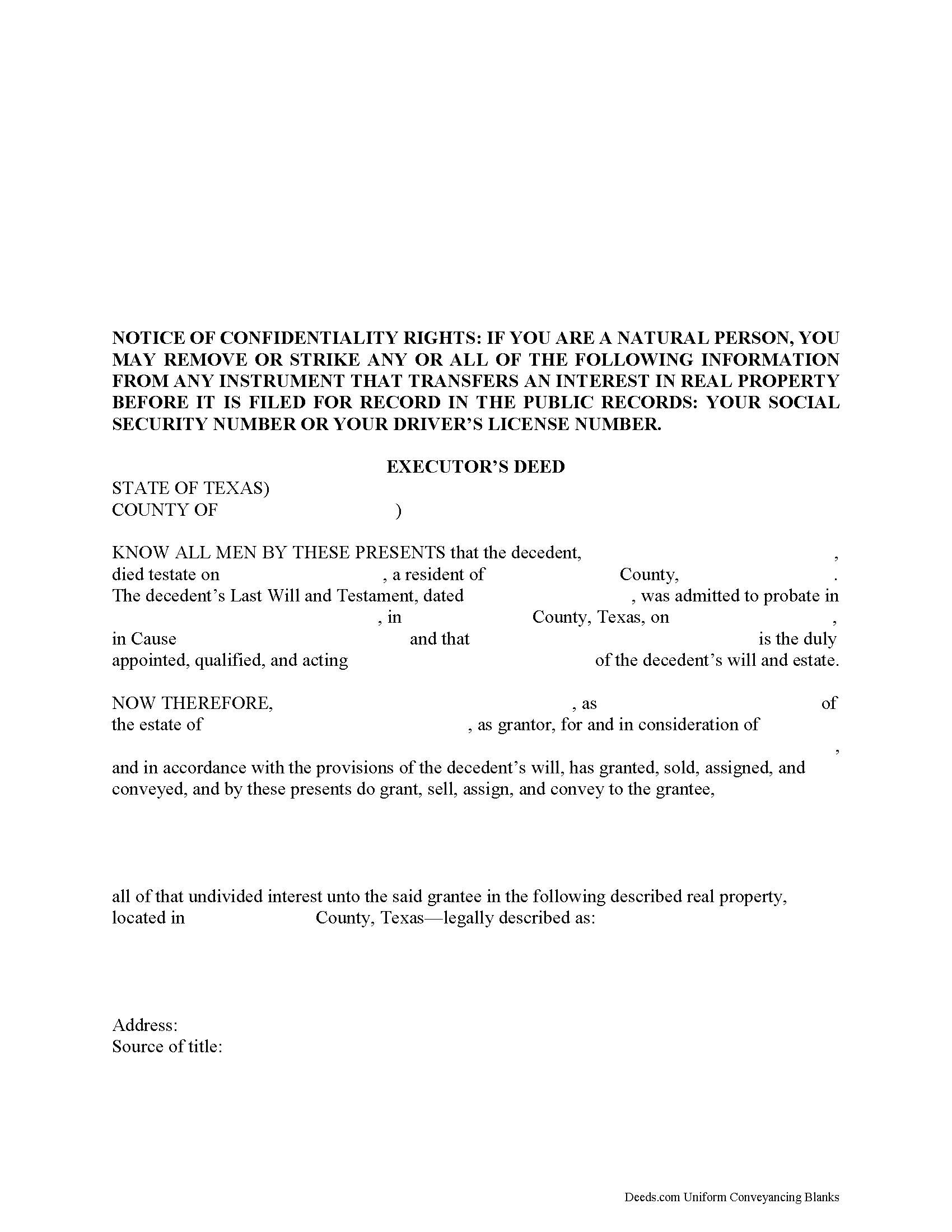

Real County Executor Deed Form

Real County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

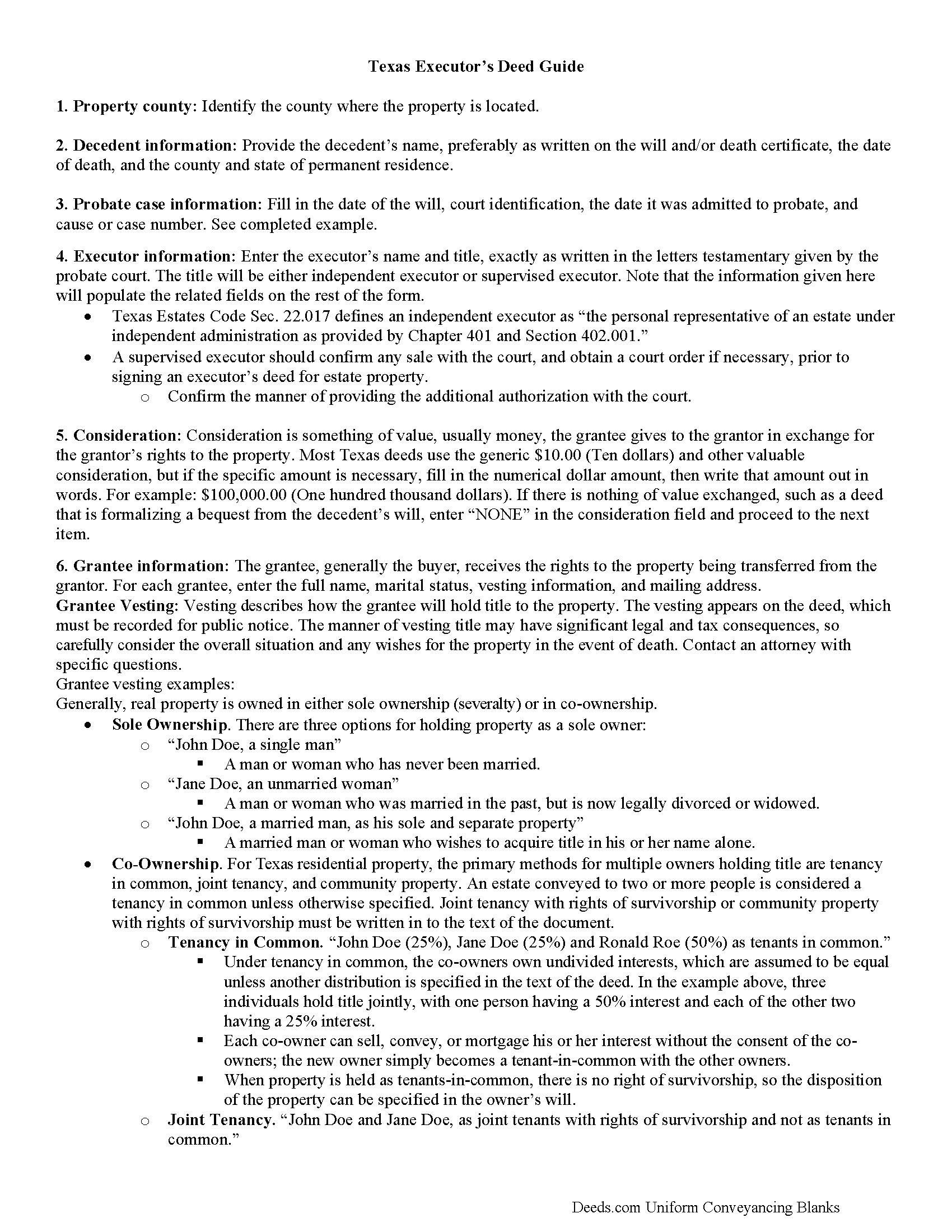

Real County Executor Deed Guide

Line by line guide explaining every blank on the form.

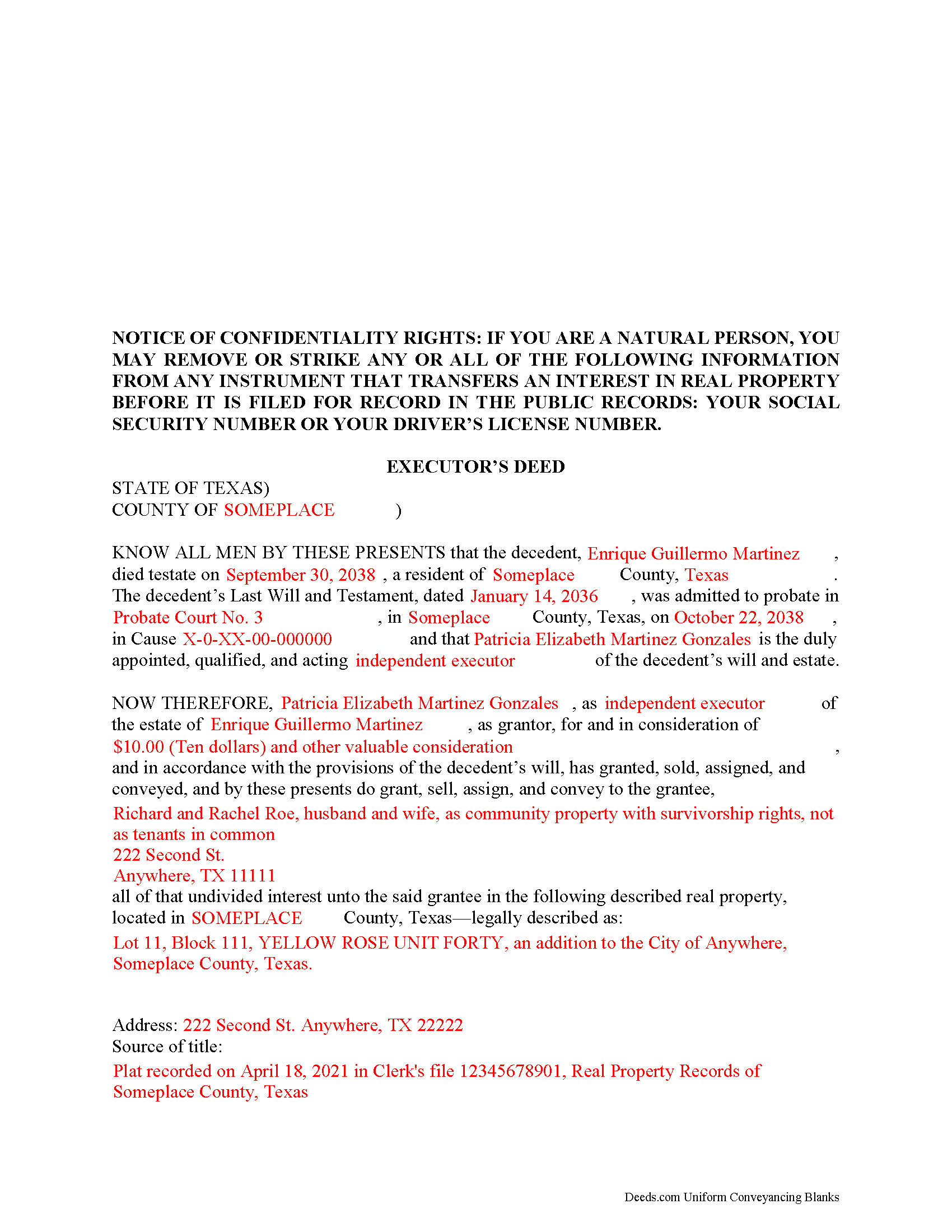

Real County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Real County documents included at no extra charge:

Where to Record Your Documents

District & County Clerk Office

Leakey, Texas 78873

Hours: Mon - Thu 8:00am - 5:00pm, Fri 8:00am - 4:30pm

Phone: (830) 232-5202

Recording Tips for Real County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Real County

Properties in any of these areas use Real County forms:

- Camp Wood

- Leakey

- Rio Frio

Hours, fees, requirements, and more for Real County

How do I get my forms?

Forms are available for immediate download after payment. The Real County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Real County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Real County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Real County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Real County?

Recording fees in Real County vary. Contact the recorder's office at (830) 232-5202 for current fees.

Questions answered? Let's get started!

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Real County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Real County.

Our Promise

The documents you receive here will meet, or exceed, the Real County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Real County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Irma D.

June 14th, 2021

Very impressed with the Service in Miami-Dade County. THank you

Thank you!

Darren D.

December 29th, 2019

Easy-peasy to find, download and use the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

HAROLD V.

April 2nd, 2020

Great website to have your buyer's deeds done correctly! I highly recommend this website to anyone in the real estate business.

Thank you!

Margaret M.

October 28th, 2019

Great job with these forms. Super easy and up to date, a rare find online these days. Thank you.

Thank you!

Kathryn C.

April 20th, 2022

descriptions for some areas were longer than what would print out on document - it showed and was visible on the form but would not print out - for example in the legal description. would be nice in fill in areas could be extended as needed

Thank you for your feedback. We really appreciate it. Have a great day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Russell L.

November 9th, 2021

Your Personal Representative's Deed and example for the state of PA were extremely helpful. Exactly what I needed! Two feedback comments: 1. Valuation Factors/Short List in my download is an outdated table dated July 2020. The PA Dept of Revenue website has a more current table dated June 2021. (Maybe same for Valuation Factors/Long List, which I didn't use.) 2. Notarization section on deed page 3 has a gender-related input needed, which confused the Notary Public representative where I live in the state of CO. Notary input the word she to apply to my wife, but wasn't clear to him if the gender input applied to the Grantor or the Notary. He assumed Grantor. Also in our non-binary world, some might find that wording offensive. Thanks again for your documents. Russ Lewis

Thank you!

Ben G.

September 21st, 2020

Faster AND less expensive than recording in person. Will be using again (and not just because of COVID).

Thank you!

Mike M.

October 27th, 2020

Get Rid of the places to initial each page on the Trust Deed. The Co. Recorder (Davis) does not require that each page be initialled... If I and the "borrower" had initialed each page, then I would have to use US Mail to get the form from AZ to UT because scans of initials are not acceptable, but only a notarized signature from the borrower is...

Thank you for your feedback. We really appreciate it. Have a great day!

Sherry F.

January 5th, 2019

Good product and service.

Thank you!

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

March 10th, 2021

Was a lot easier than driving to the County Building and faster than expected. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sonia C.

July 11th, 2021

Ordered and received the appropriate quitclaim deed docs for my area. Recorded with no questions or issues. All arounds solid product and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!