Panola County Grant Deed Form

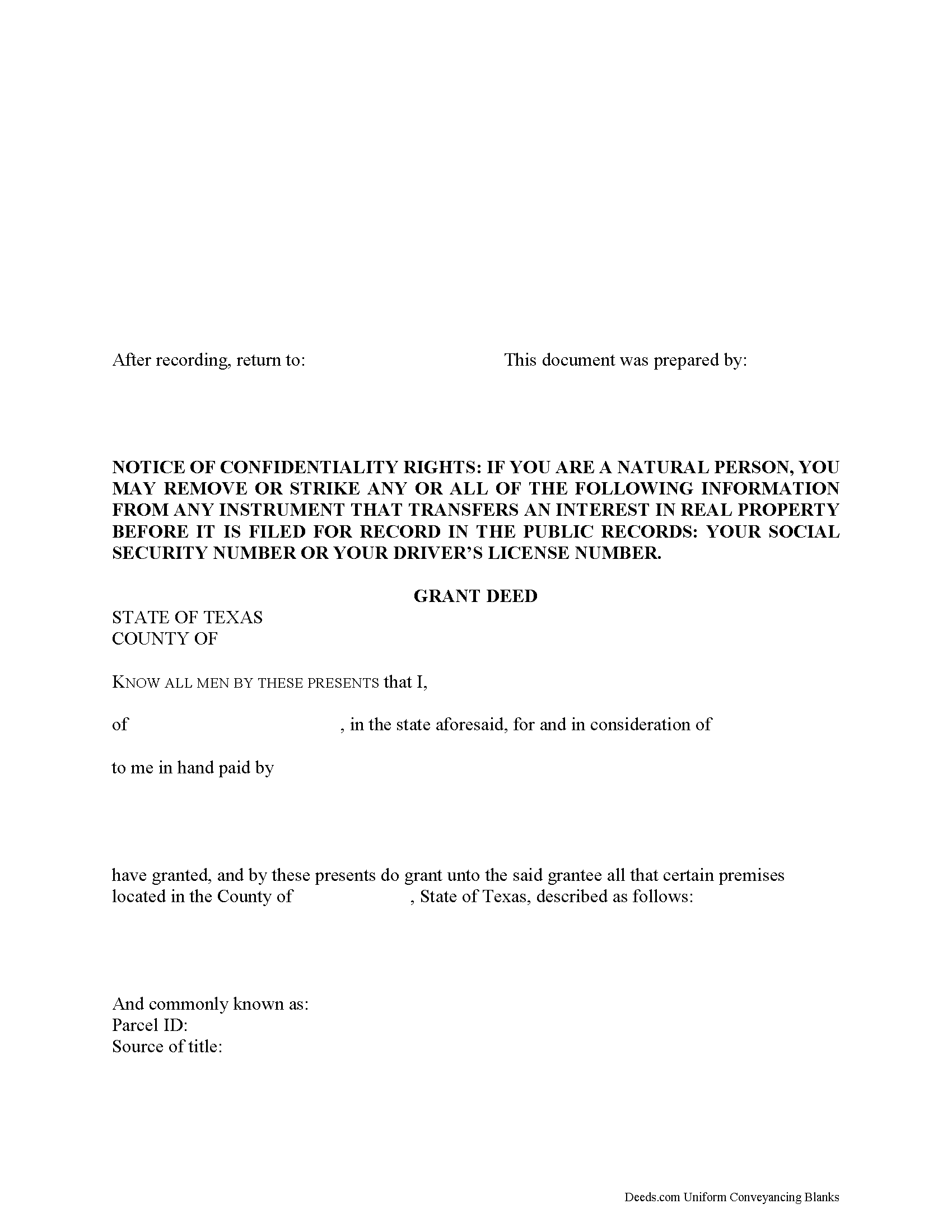

Panola County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

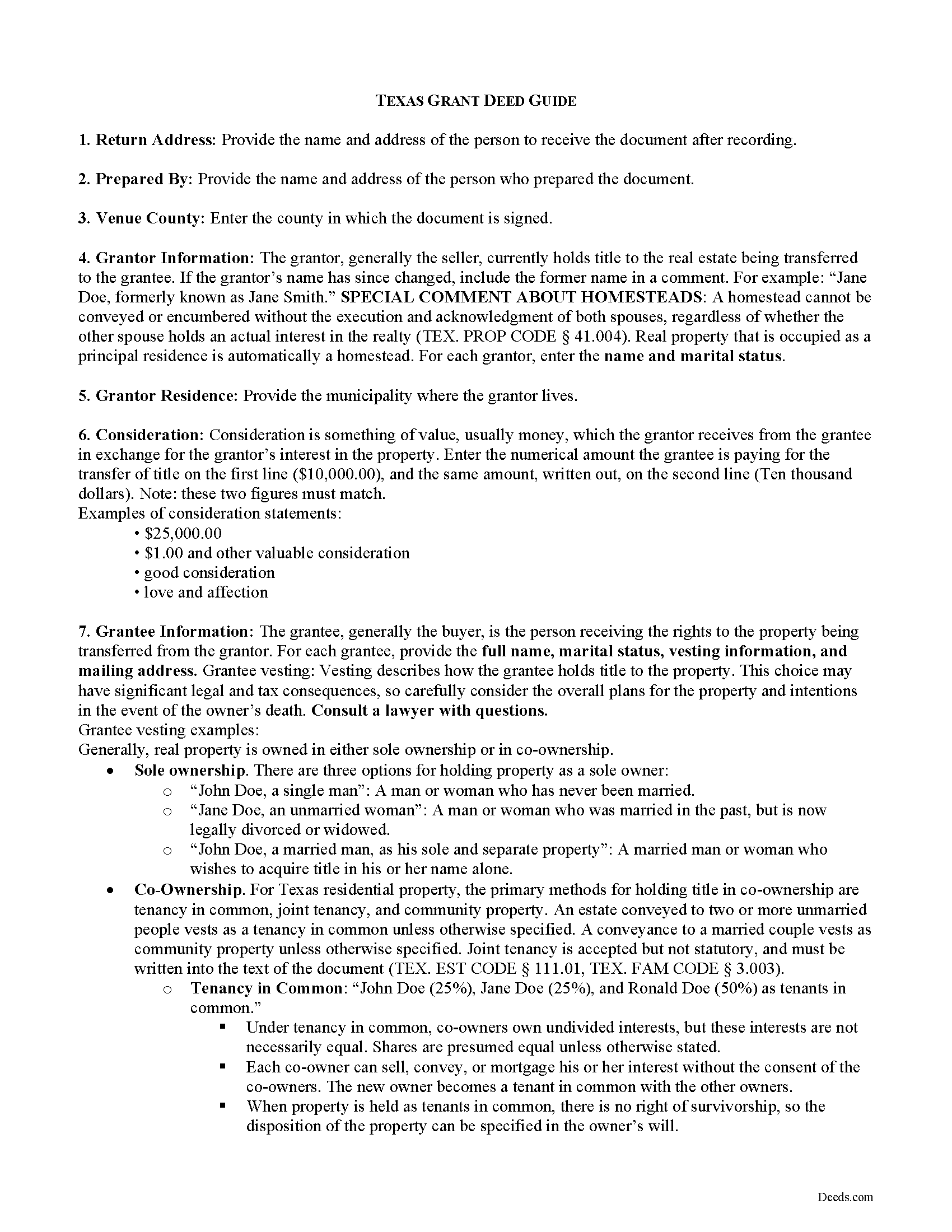

Panola County Grant Deed Guide

Line by line guide explaining every blank on the form.

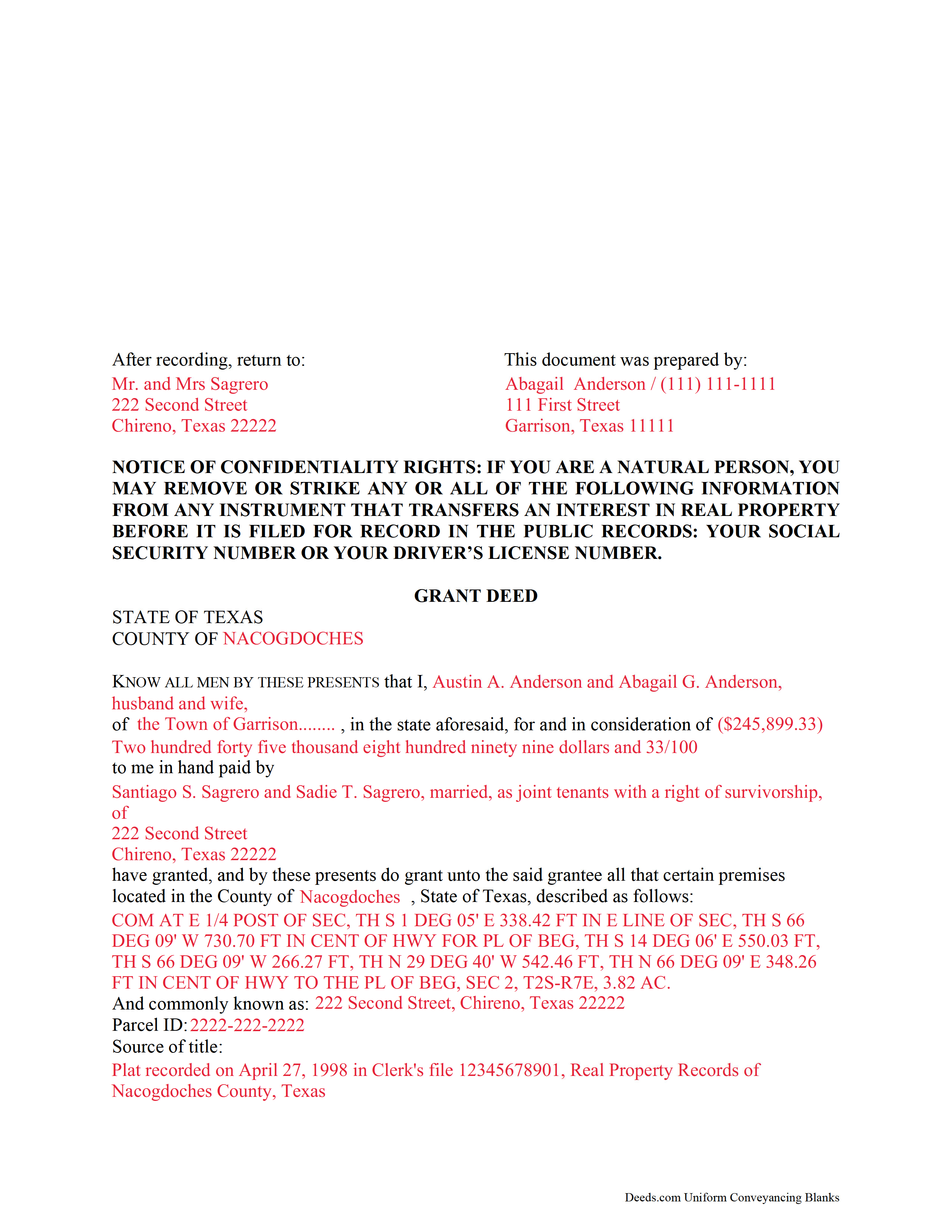

Panola County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Panola County documents included at no extra charge:

Where to Record Your Documents

Panola County Clerk's Office

Carthage, Texas 75633

Hours: Monday - Friday 8:00am - 5:00pm / sometimes closed 12:00 to 1:00

Phone: (903) 693-0302

Recording Tips for Panola County:

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Panola County

Properties in any of these areas use Panola County forms:

- Beckville

- Carthage

- Clayton

- De Berry

- Gary

- Long Branch

- Panola

Hours, fees, requirements, and more for Panola County

How do I get my forms?

Forms are available for immediate download after payment. The Panola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Panola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Panola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Panola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Panola County?

Recording fees in Panola County vary. Contact the recorder's office at (903) 693-0302 for current fees.

Questions answered? Let's get started!

In Texas, a grant deed conveys title to real property with implied covenants. By including the words "grant" or "convey," the grantor guarantees that he/she has not transferred title to the property to anyone other than the grantee, and that, at the time of transfer, the estate is free from impediments. Implied covenants carry the same legal implications as if they were explicitly stated (TEX. PROP CODE 5.023).

The document must state the grantor's full name and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting information, and mailing address. Include a complete legal description of the parcel, and recite the source of title to maintain a clear chain of title, detailing any restrictions associated with the property. The document must be signed and acknowledged by the grantor in the presence of two credible witnesses or a certified officer (TEX. PROP CODE 12.001b).

Depending on the nature of the transaction, the deed might also require supporting and/or supplemental documentation. Record the completed deed, along with any additional materials, in the clerk's office of the county where the property is located.

Using a Grant Deed in Texas

A deed is a legal document that transfers real property from one party to another. In Texas, property owners can use a grant deed to transfer real estate with implied covenants of title. By including the words "grant" or "convey," the grantor (seller) guarantees that he/she has not transferred title to the property to anyone other than the grantee (buyer), and that, at the time of legal transfer of property, the estate is free from any impediments to the transfer. Implied covenants carry the same legal implications as if they were explicitly stated (TEX. PROP CODE 5.023).

A lawful grant deed includes the grantor's full name and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Depending on the nature of the transaction, the deed might also require supporting and/or supplemental documentation. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Texas residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community property (TEX. EST CODE 111.001, TEX. FAM CODE 3.003).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the source of title in order to confirm a clear chain of title, and detail any restrictions associated with the property. Record the completed deed, along with any additional materials, in the clerk's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

In Texas, an unrecorded deed (or instrument) "is binding on a party to the instrument, on the party's heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument" (TEX. PROP CODE 13.001). This means that, even if a grant deed is unrecorded, it is still a binding document that applies to parties who have signed or acknowledged it.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Texas lawyer with any questions about grant deeds or other issues related to the transfer of real property.

(Texas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Panola County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Panola County.

Our Promise

The documents you receive here will meet, or exceed, the Panola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Panola County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

John D.

September 1st, 2021

Very helpful and easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Molly A.

April 12th, 2020

Super easy to download and Deeds dot com had the documents I was looking for and set up in a manner that the County Government office would accept. Nice! Thank you, Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy H.

January 14th, 2021

Deeds.com was an amazing experience. They made it so easy and stress free. The agent I worked with was fantastic and communicated quickly to make it a very positive experience. I will be using them from now on. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Charmaine D.

August 7th, 2022

Very easy to use.

Thank you!

Cherif T.

June 17th, 2019

I wish every state offered such an easy and economical download of these forms. You were reasonable in price, I received one of every form you offered along with instructions, and it made my day so easy. Why pay a lawyer a fortune for these simple (almost) everyday forms when you can do it all for less than $20. Thank you for being reasonable, well organized, and available for common use! Cherif T.

Thank you!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith G.

January 25th, 2019

Thank you, it was easy and fast. The clerks office filed without question.

Thank you Judith, have a fantastic day!

Lacina B.

July 25th, 2020

Forms were appropriately priced, easy to download

Thank you for your feedback. We really appreciate it. Have a great day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

PEGGY D.

April 1st, 2022

Very easy to find what I needed. Really liked the instructions included with the forms and also the suggestion of other forms that I might need.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn R.

June 21st, 2020

Responses to my needs were prompt and professional. I found the service easy to use and clearly outlined for processing. Thank you.

Thank you!

Diana T.

July 15th, 2022

Very helpful Got information and form I wanted.

Thank you for your feedback. We really appreciate it. Have a great day!

Heidi S.

April 21st, 2022

I do not enjoy the process of not knowing how something works. When I get to a new website I cringe inside. When I find one that works I am pleased to have function. Thank you for making it easy for a lay person

Thank you for your feedback. We really appreciate it. Have a great day!