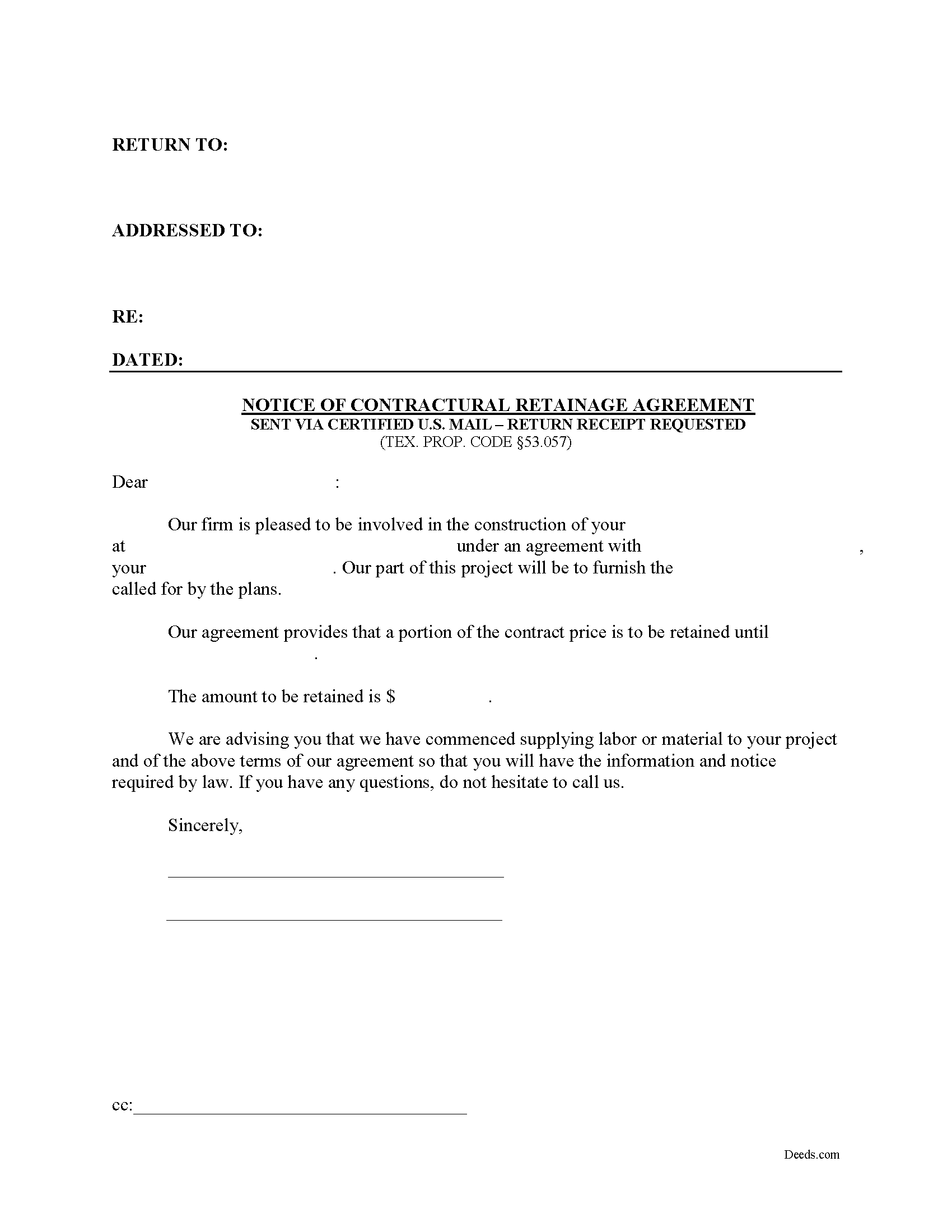

Franklin County Notice of Contractual Retainage Form

Franklin County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

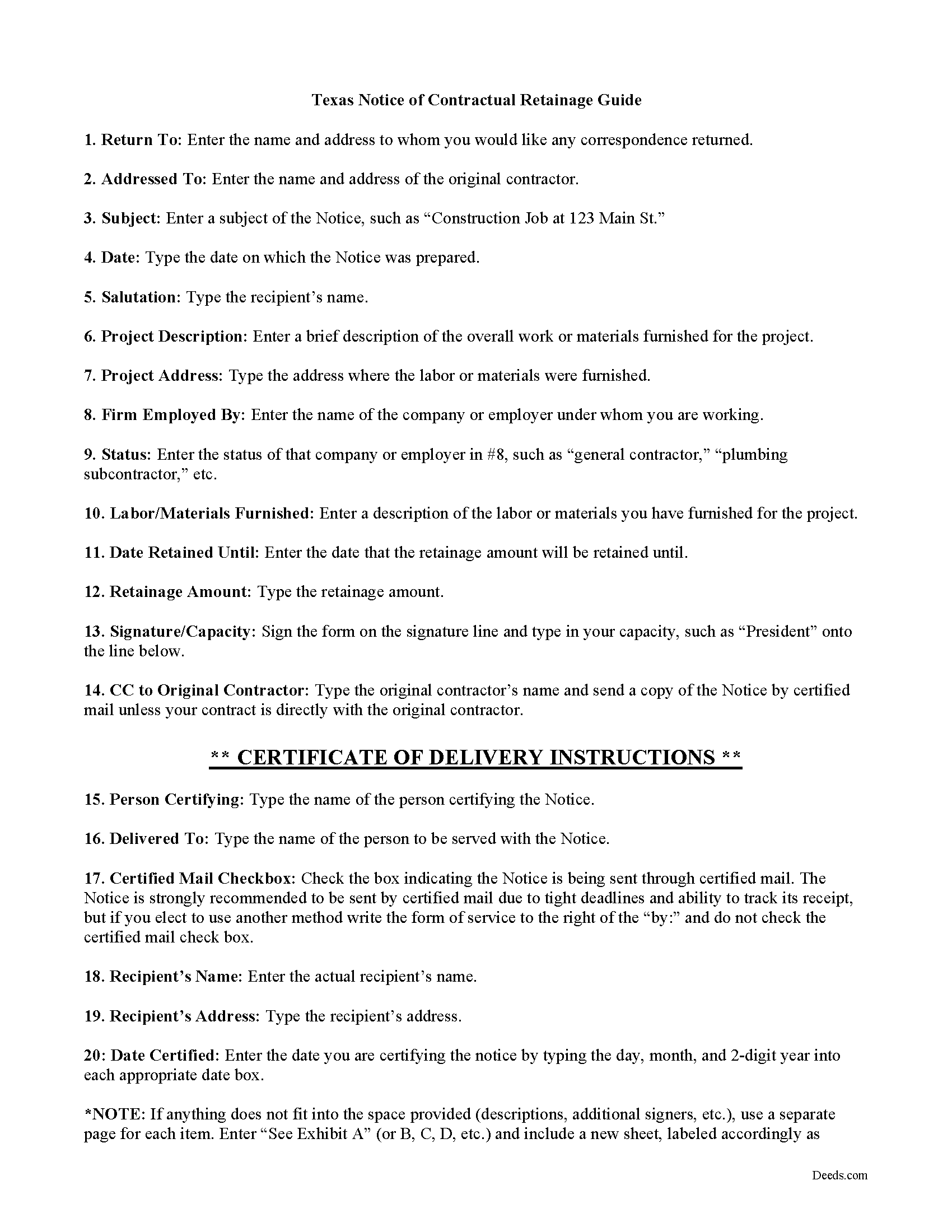

Franklin County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

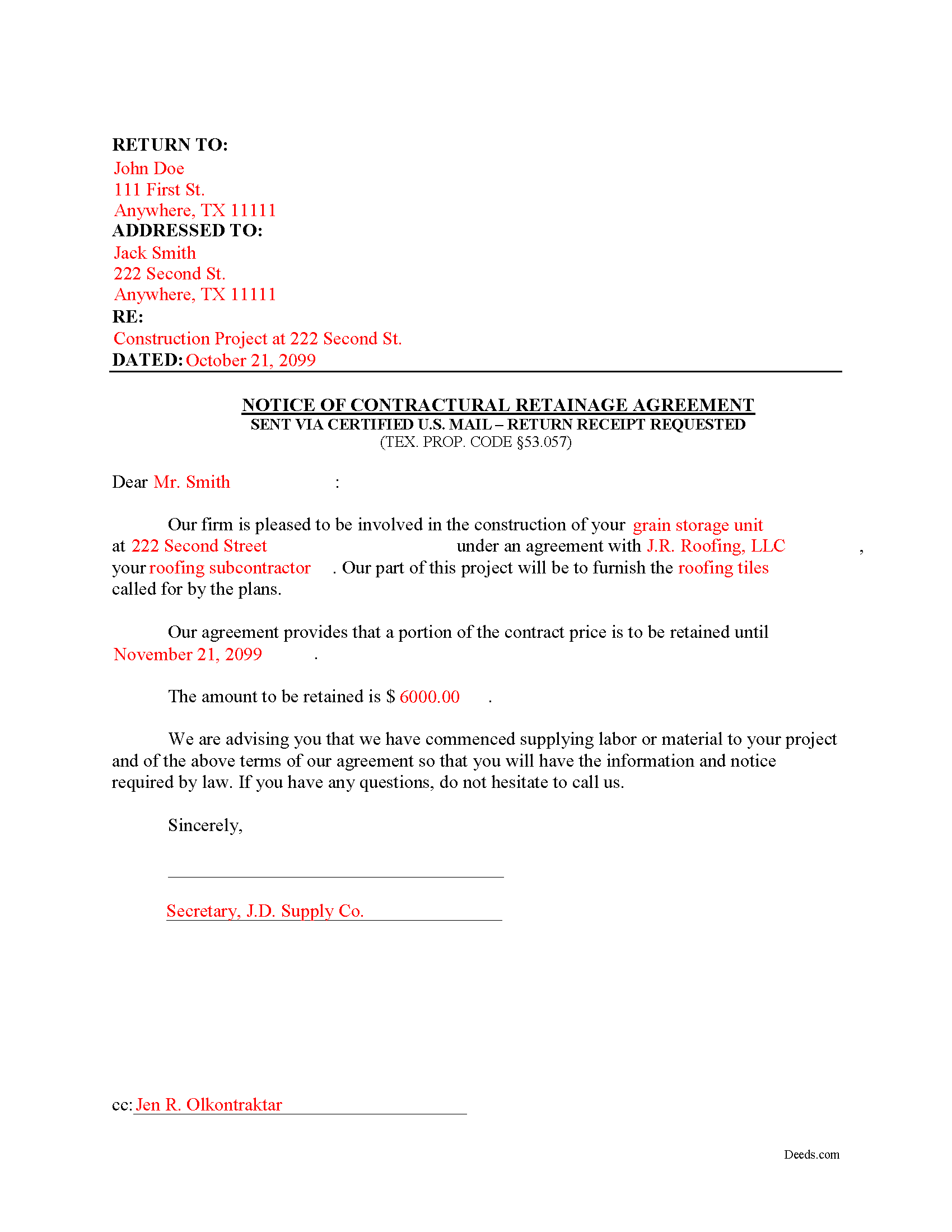

Franklin County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk's Office

Mt Vernon, Texas 75457

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm / Recording until 4:00pm

Phone: (903) 537-2342 Ext 2

Recording Tips for Franklin County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Mount Vernon

- Scroggins

- Talco

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (903) 537-2342 Ext 2 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

May 19th, 2020

Ordered the forms, completed them, had them notarized, then erecorded all in under 2 hours. Would have been faster but had to wait for the bank to open for notary. Might try the online notary next time. Fantastic experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

January 25th, 2022

I needed a quitclaim deed to transfer ownership of a home. An attorney wanted $400.00 to file the deed. I downloaded a blank deed for my area from deeds.com. I received it instantly. (Small fee) it came with instructions and a template. I filled it out and submitted it to the County Clerks office.it was simple and I saved a lot of money. There may be other forms you need, check with whoever you are submitting the deed. You'll have additional fees, but that is up to the municipality in which you reside. It will be helpful if you have the latest deed on file. It was much easier than I thought. This is an easy website to navigate through and it is 100% legitimate. I recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

Stephanie B.

May 28th, 2020

Really great, relevant and straight forward forms. Deeds.com is excellent and helps you avoid costly errors on documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry R.

December 8th, 2020

I appreciate the opportunity to take care of business without the hassle of parking, security checks and lines. It was all done quickly and easily.

Thank you!

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

Wendy B.

December 20th, 2019

Really appreciate you he quick response and solution to my problem!! Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Natalie F.

April 13th, 2020

So convenient and easy to use! Will definitely recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!

TERRY E.

August 19th, 2020

VERY EASY TO USE !

Thank you!

Timothy C.

January 6th, 2022

The process was all very clear and easy -- pay the fee online and download the state and county forms onto my computer. I will do as instructed for the Revocable Transfer on Death Deed, then update my review after I file this with the office of the Sandoval County (New Mexico) Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CLAUDE G.

September 18th, 2019

just what I needed Thank You

Thank you!

Timothy G.

June 3rd, 2019

Downloadable documents, instructions and a completed sample form were just what I needed. Very pleased and easy to use. Deeds.com will be my first stop for any future documents I may need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!