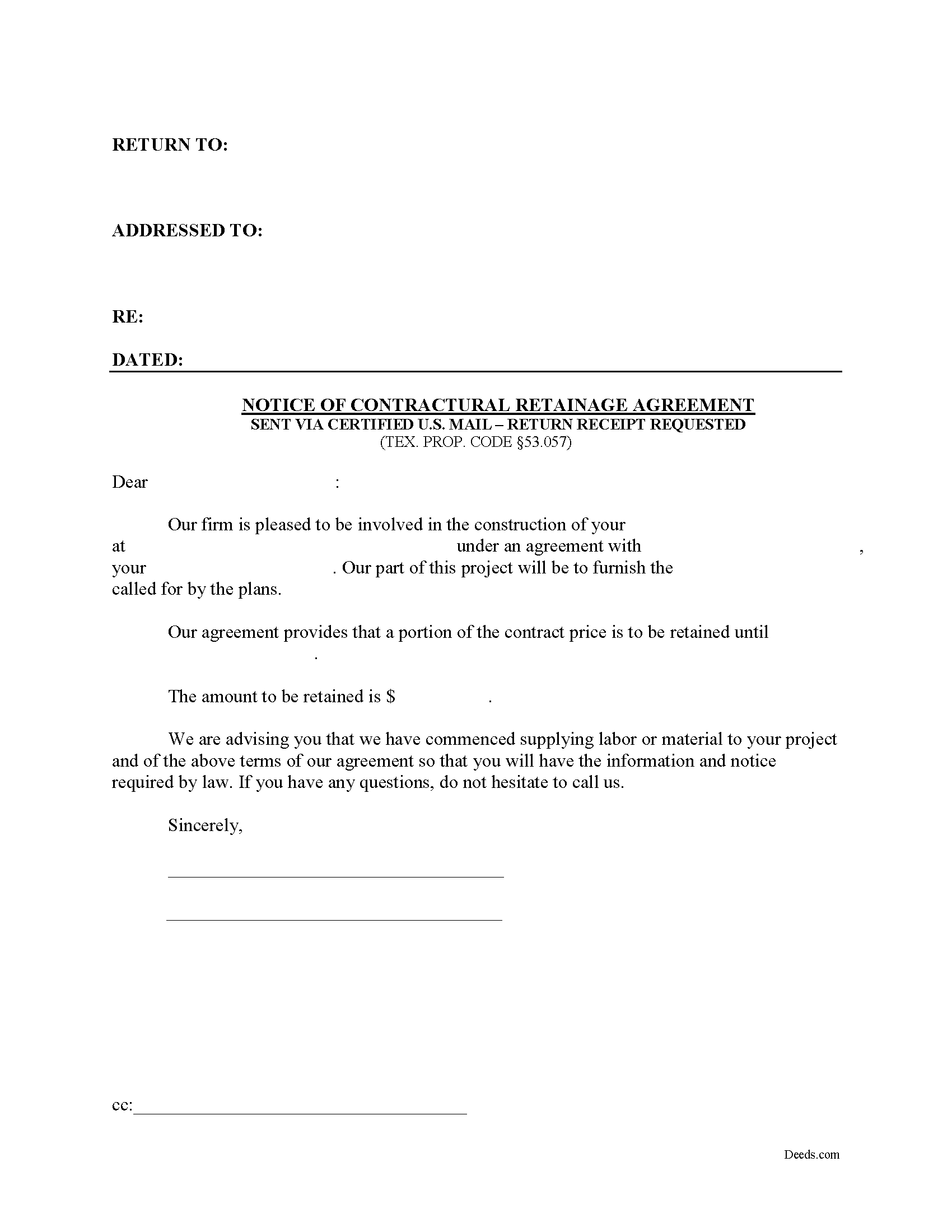

Starr County Notice of Contractual Retainage Form

Starr County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

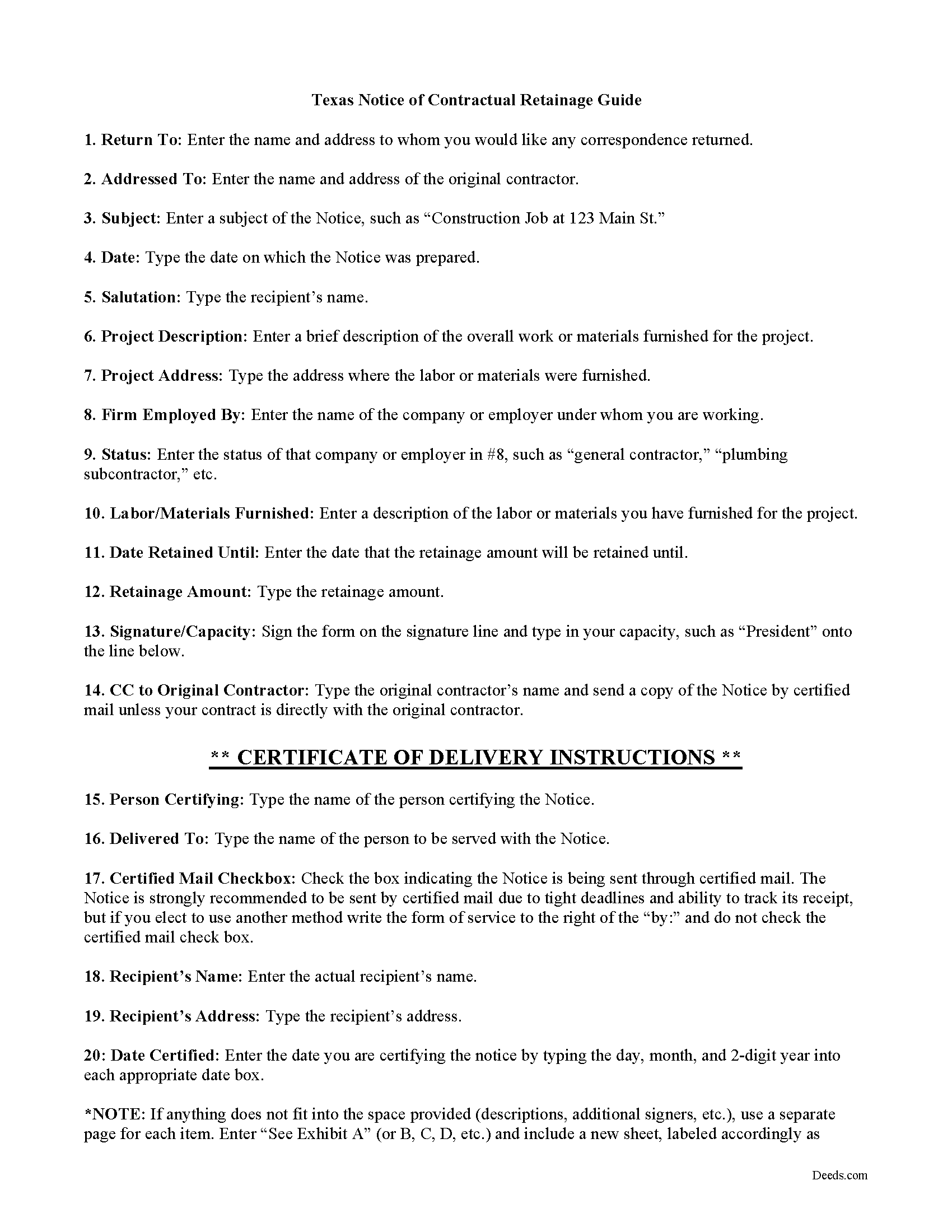

Starr County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

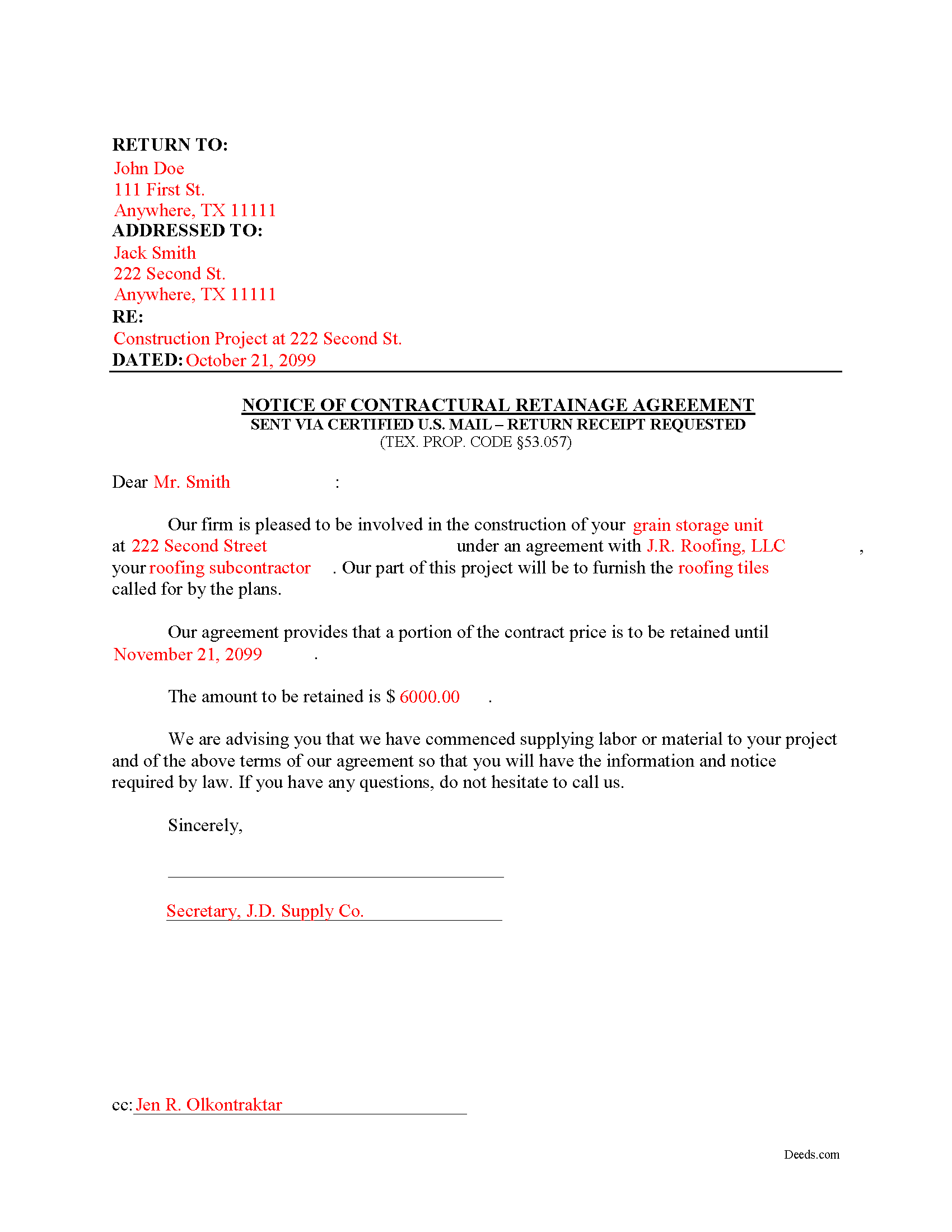

Starr County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Starr County documents included at no extra charge:

Where to Record Your Documents

Starr County Clerk

Rio Grande City, Texas 78582

Hours: 8:00am to 12:00 & 1:00 to 4:30pm M-F

Phone: (956) 716-4800 x8032

Recording Tips for Starr County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Starr County

Properties in any of these areas use Starr County forms:

- Delmita

- Falcon Heights

- Garciasville

- Grulla

- Rio Grande City

- Roma

- Salineno

- San Isidro

- Santa Elena

Hours, fees, requirements, and more for Starr County

How do I get my forms?

Forms are available for immediate download after payment. The Starr County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Starr County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Starr County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Starr County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Starr County?

Recording fees in Starr County vary. Contact the recorder's office at (956) 716-4800 x8032 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Starr County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Starr County.

Our Promise

The documents you receive here will meet, or exceed, the Starr County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Starr County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Nancy W.

November 6th, 2020

This was very easy to use to record my NOC. With the new COVID restrictions, I can't record my NOC in person and I'm working from home. This was a huge convenience and easy to use. I submitted the NOC late in the day and had the recorded NOC the next day.

Thank you!

Charles W.

July 7th, 2019

I was vey pleased with this service. It offered all of the necessary step by step information guides for completing the forms. Again, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn N.

May 3rd, 2019

Great website, efficient and informational. Very helpful!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Roberta U.

August 4th, 2022

Thanks for the quick reply Will use in future. Thanksgivings

Thank you!

alex b.

February 16th, 2021

I appreciate the very quick response that I received and I am very impressed with the access that you provide to records. I'm still in the process of trying to find out what's there but that will take a bit of time. All in all, you are to be commended for a first class operation.

Thank you!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

Steve V.

June 6th, 2025

Quick and easy. Quite the time saver.

Thanks, Steve! We're glad to hear the process was quick and easy—and that it saved you time. That’s exactly what we aim for!

Janalee T.

April 17th, 2020

Fast, easy. quickly accepted by county recorder.

Thank you!

Jeannine G.

June 28th, 2021

Very helpful and just what I needed for the job I was doing.

Thank you!

Kim K.

December 11th, 2020

Your service was easy to use and fee was reasonable. I would recommend to other lawyers who are in private practice.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy P.

January 2nd, 2025

Can you also make a search that includes the parcel number because that is all I had to go with and regular name searches didn't come up with anything I needed.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Anthony J S.

July 30th, 2022

It was nice to find a form to use for leaving my house without having my kids deal with Probate Court. The price was a lot cheaper than paying for a Lawyer to set up a transfer of ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary L.

February 6th, 2021

Great site. Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia H.

January 12th, 2019

No review provided.

Thank you!