Hood County Notice of Specially Manufactured Materials Form

Last validated January 29, 2026 by our Forms Development Team

Hood County Notice of Specially Manufactured Materials Form

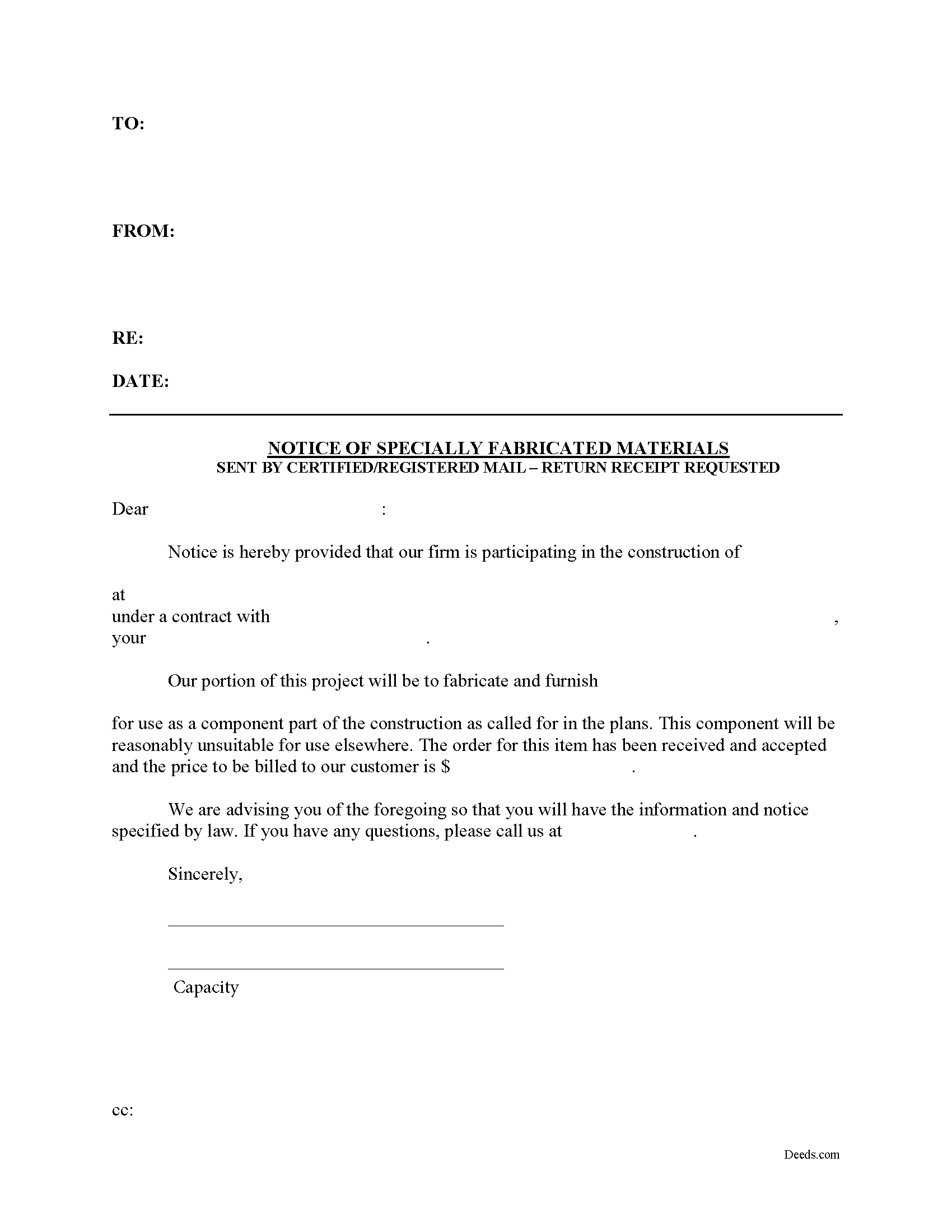

Fill in the blank Notice of Specially Manufactured Materials form formatted to comply with all Texas recording and content requirements.

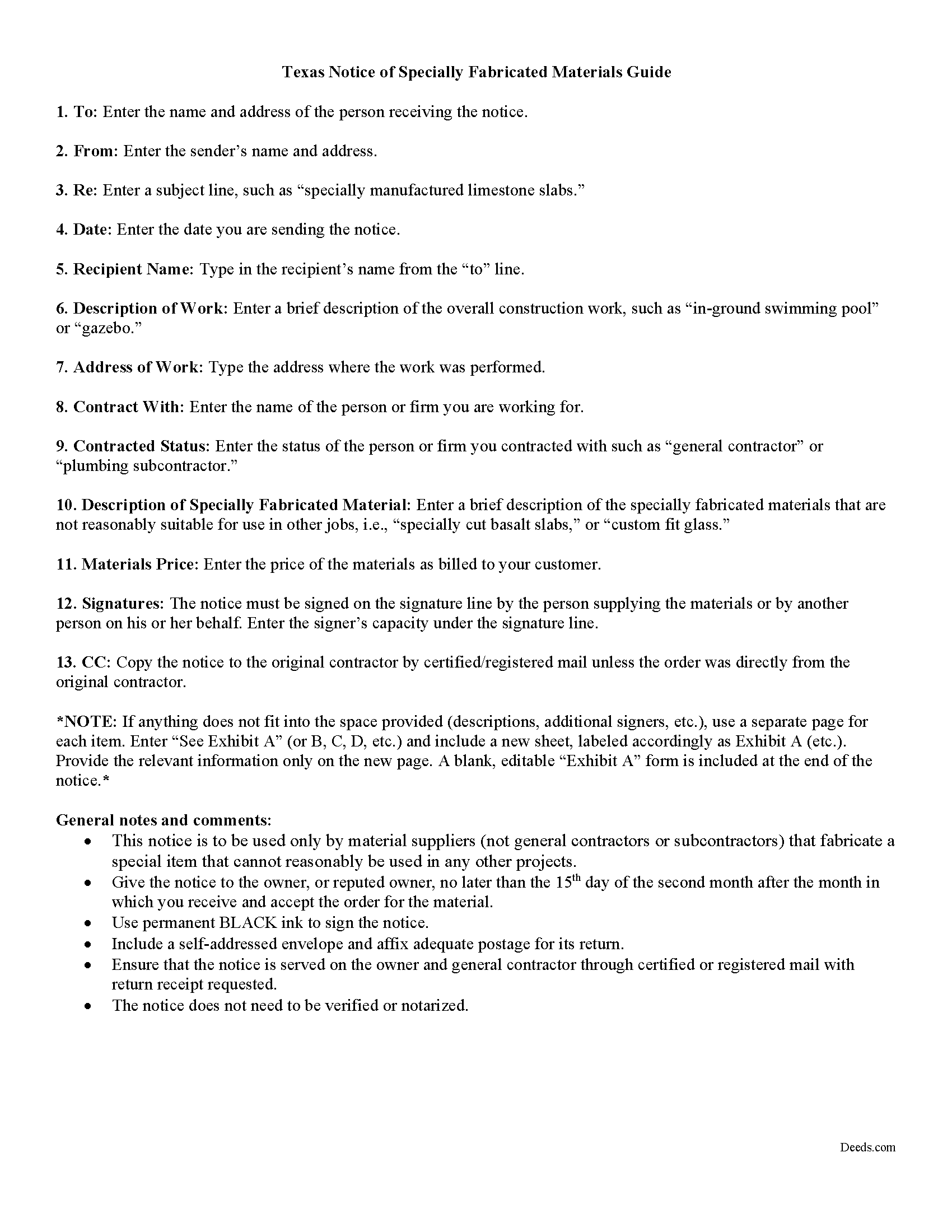

Hood County Notice of Specially Manufactured Materials Guide

Line by line guide explaining every blank on the form.

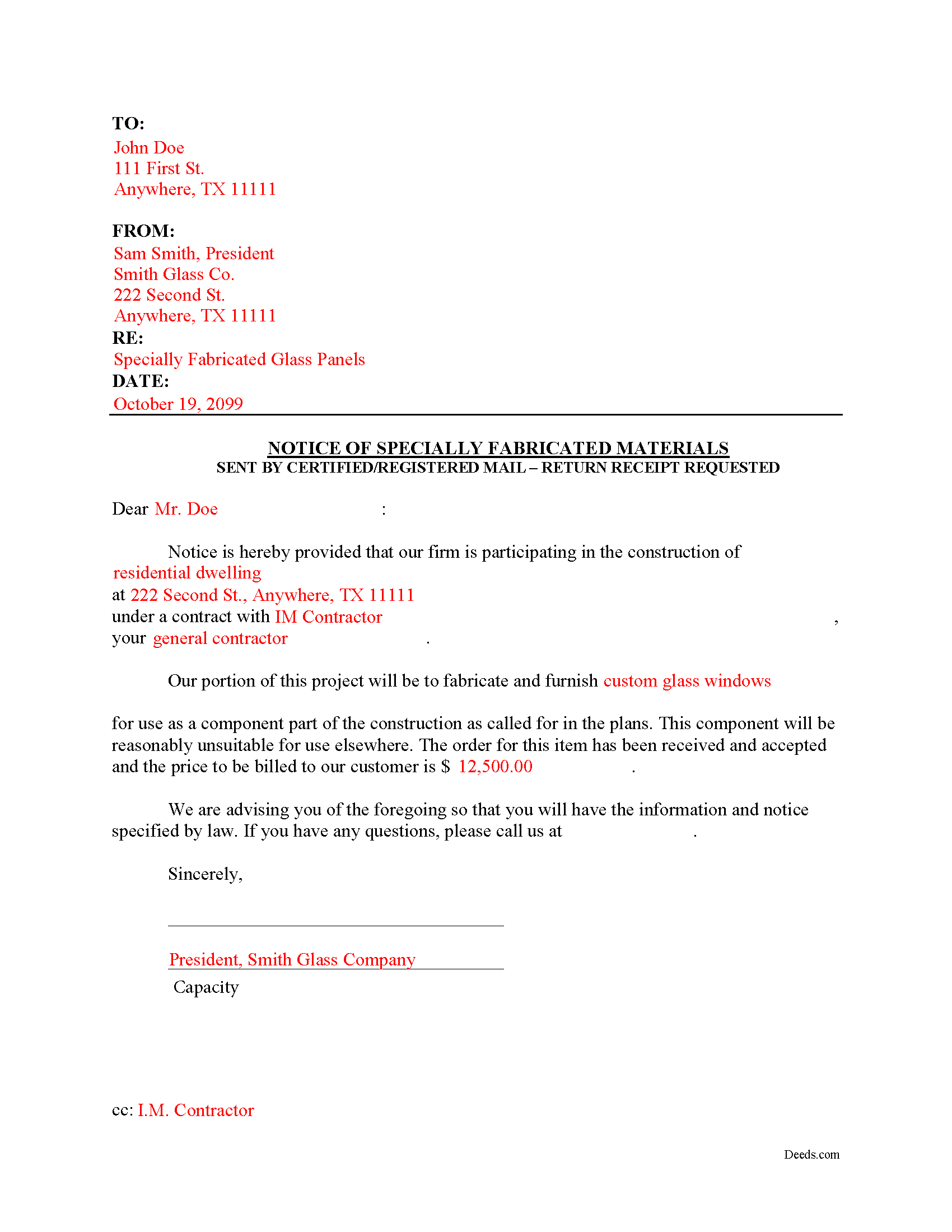

Hood County Completed Example of the Notice of Specially Manufactured Materials Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hood County documents included at no extra charge:

Where to Record Your Documents

Hood County Clerk

Granbury, Texas 76048

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (817) 579-3222

Recording Tips for Hood County:

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Hood County

Properties in any of these areas use Hood County forms:

- Cresson

- Granbury

- Lipan

- Paluxy

- Tolar

Hours, fees, requirements, and more for Hood County

How do I get my forms?

Forms are available for immediate download after payment. The Hood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hood County?

Recording fees in Hood County vary. Contact the recorder's office at (817) 579-3222 for current fees.

Questions answered? Let's get started!

Construction projects often demand custom materials that are only suitable for that specific job, due to unique dimensions of the materials or other customized aspects as specified by the customer. These materials are not suitable for use in other projects, except as possible salvage or scrap with a greatly diminished value.

Suppliers of specially manufactured items that are not reasonably suitable for other jobs may serve the Notice of Specially Manufactured Items as set out at Sec. 53.058 of the Texas Property Code. This notice is not required, but under 53.023(2), a person who creates such job-specific materials is entitled to lien, even if the materials were never delivered to the job site.

These claimants must also serve the Notice of Contractual Retainage, along with either a Second Month Notice or a Third Month Notice, warning the contractor and owner about the outstanding debt.

The document identifies the parties and the project, describes the materials, and lists the relevant dates, fees, and payments, if any. The Notice of Specially Manufactured Materials is not recorded in a county public records office and does not need to be verified or notarized. Simply fill out the required fields and send it via U.S. certified or registered mail with a return receipt requested.

Texas lien laws are complex and require strict adherence. Each case involving specially manufactured items is unique, so contact an attorney for complex situations, with specific questions about the Notice of Specially Fabricated Materials, or any other issues related to mechanic's liens.

Important: Your property must be located in Hood County to use these forms. Documents should be recorded at the office below.

This Notice of Specially Manufactured Materials meets all recording requirements specific to Hood County.

Our Promise

The documents you receive here will meet, or exceed, the Hood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hood County Notice of Specially Manufactured Materials form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4648 Reviews )

ROBERT B.

November 6th, 2020

The staff of DEEDS.COM is in a class of excellence all by themselves! From my own personal experience, I had multiple problems with some documents I was submitting. DEEDS.COM stayed with me and held my hand through the project until it was completed! I have never met the staff at DEEDS, but their personal service & professionalism make me feel like part of the DEEDS Family! If I ever need legal documents submitted to government agencies nationwide ever again, THE ONLY STOP ONLINE I WILL MAKE WILL BE DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

Betty G.

February 4th, 2020

I was very impressed with your site! My experience was excellent. Made my quest an easy one. Thank you!

Thank you so much Betty. We appreciate you!

Marc P.

March 4th, 2021

Simple and fast!

Thank you for your feedback. We really appreciate it. Have a great day!

ralph m.

March 1st, 2019

Overall the experience was pleasant and the services were delivered In a timely fashion

Thank you Ralph. Have a great day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

Lois B.

December 13th, 2018

It works pretty well, had trouble with the word December. It printed out Decedmber with weird spacing but I think it will be ok.

Thank you for the feedback. We will take a look at the date field to see if there are any issues. Have a great day!

Theresa B.

September 10th, 2019

Will review after I attempt to complete. I like your site. Im very nervous to try this Hope not outdated information. Will let you know if filing goes okay.

Thank you!

Melissa S.

April 13th, 2020

Not what I can use.

Thank you!

Sandra T.

May 4th, 2023

I hope this will address all I need to make sure my father is not being taken for granted by my siblings and a nephew and his wife. thank you

Thank you!

Joshua A.

May 13th, 2020

It was fast, secure, and reliable, and for the cost it saved me time, and driving four hours to the courthouse and back. It really saved me. Thank You.

Thank you Joshua, glad we could help.

Zehira D.

August 19th, 2025

Great service! fast, reliable, and very affordable. No contract, no subscription

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Kevin L.

May 31st, 2019

All the paperwork I need......Great service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim M.

February 2nd, 2024

This is my first time using this amazing service. I wish I was told about this before I went all the way downtown, drove thru construction zones, paid for parking only to be told the computer system had crashed. I was referred to Deeds.com and I will not use the downtown system again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!