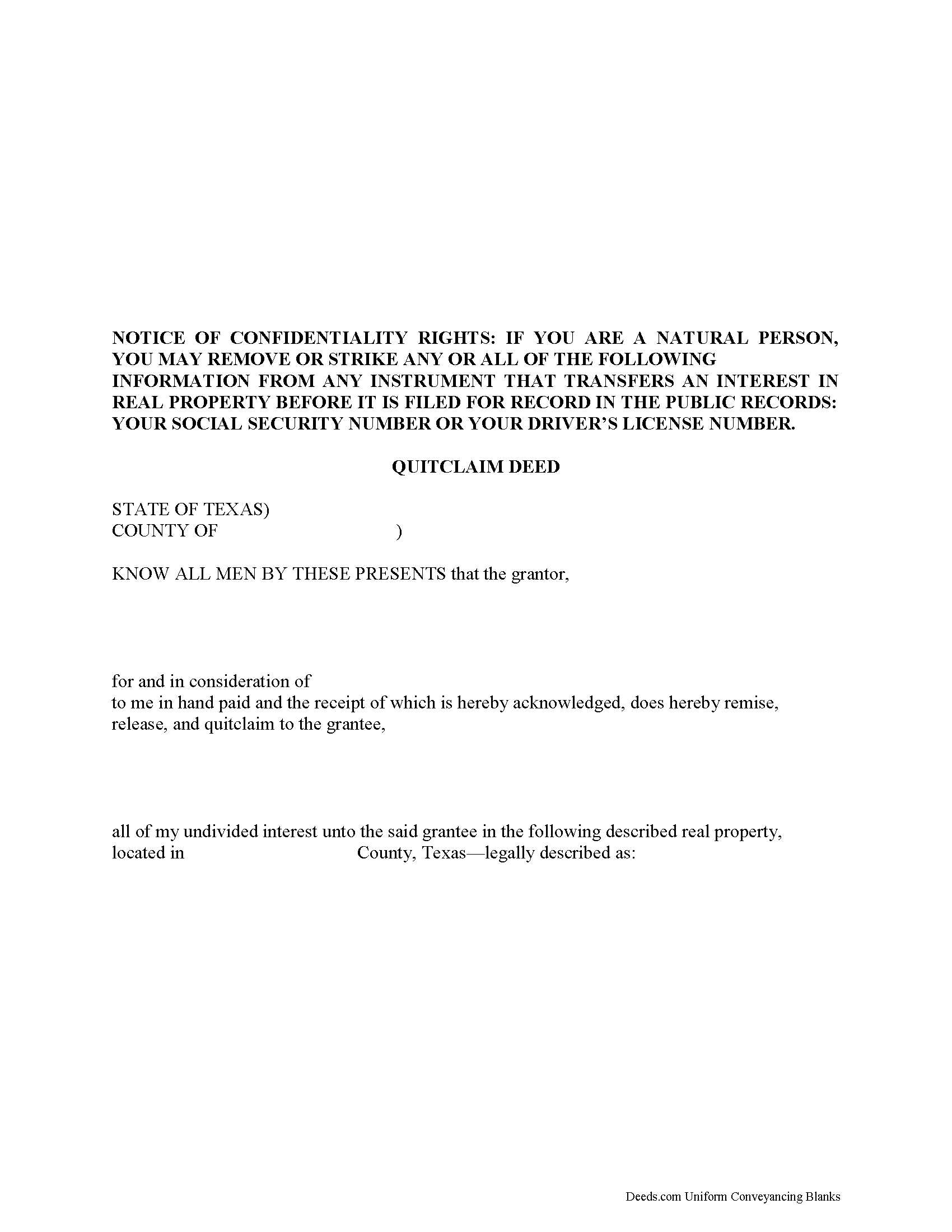

Franklin County Quitclaim Deed Form

Franklin County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

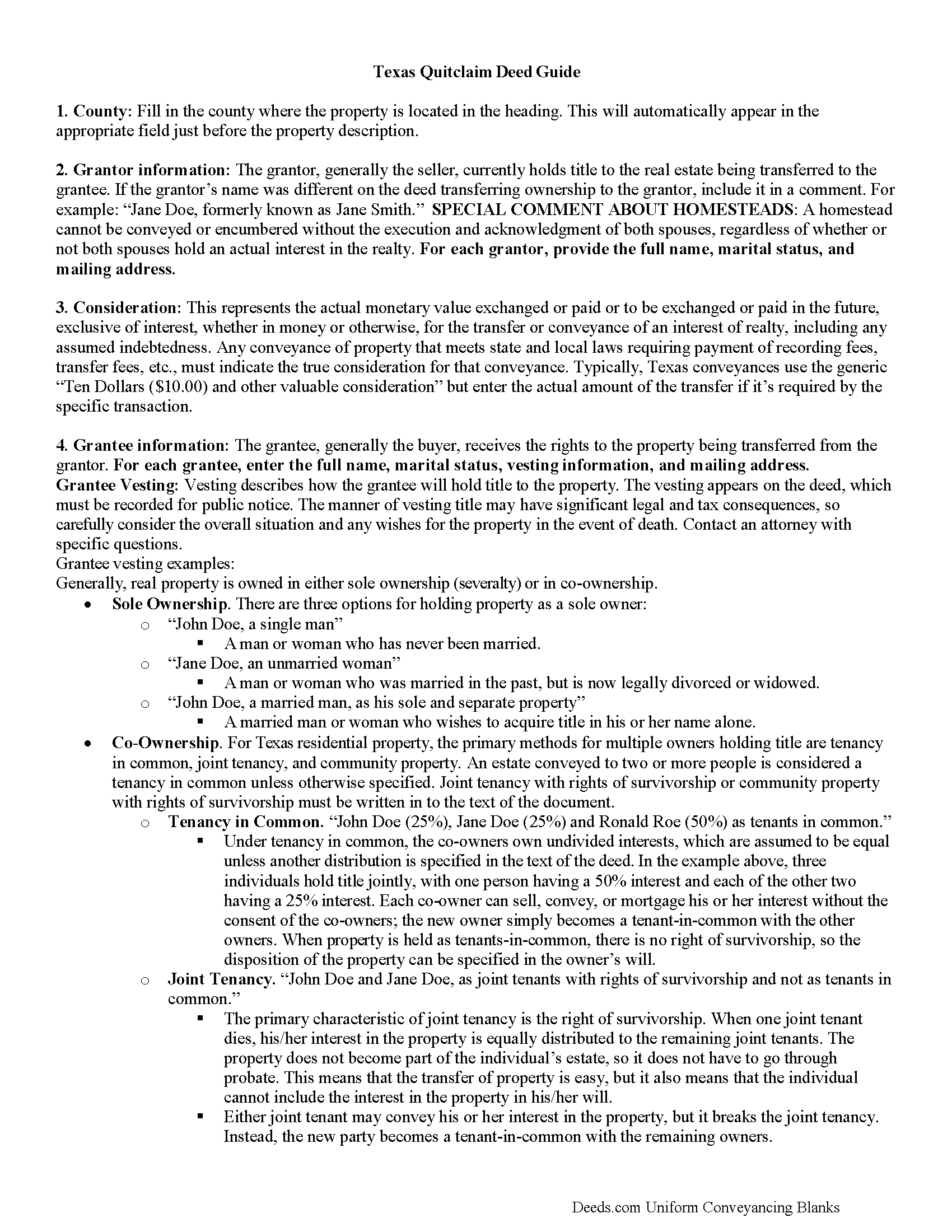

Franklin County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

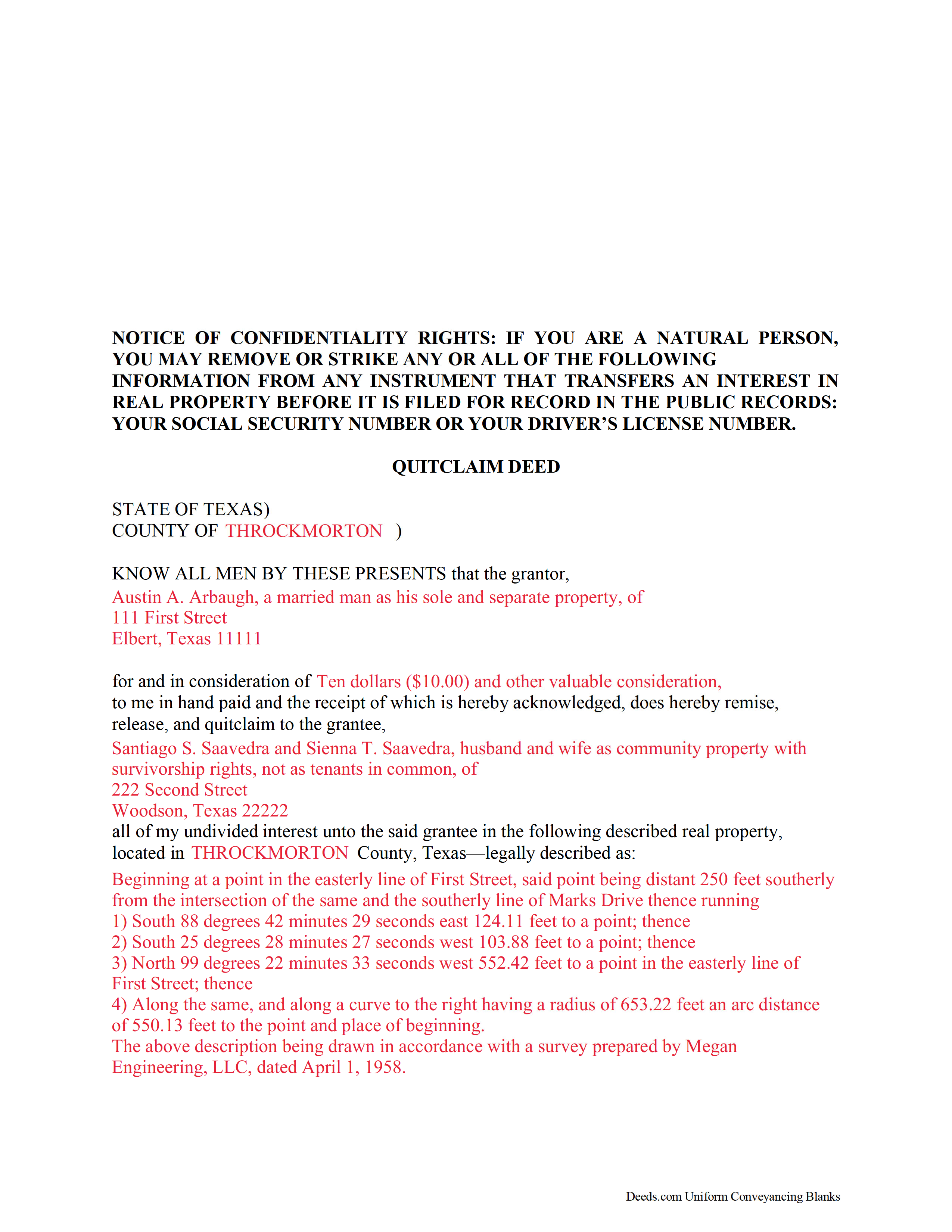

Franklin County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk's Office

Mt Vernon, Texas 75457

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm / Recording until 4:00pm

Phone: (903) 537-2342 Ext 2

Recording Tips for Franklin County:

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Mount Vernon

- Scroggins

- Talco

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (903) 537-2342 Ext 2 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Bryan A.

April 9th, 2020

Very easy thank you for this quick process.

Thank you for the kind words Bryan.

Carole M.

June 9th, 2020

So far it seems easy and hopefully be acceptable to Hillsborough Co

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Claudia H.

May 21st, 2022

***** Have not used this option before. Found it easy to use and understand. Cost was reasonable and options on recording helpful. Would use again in a heartbeat.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana M.

October 18th, 2020

Awesome service. Quick and easy. Complete directions on how to complete the forms with examples for further assistance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SHERRILL B.

October 10th, 2024

I received prompt attention to the package I submitted. It was submitted promptly the recorders office with a quick turn around for the recorded document. Overall a very pleasant experience.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Charles S.

July 2nd, 2021

Easy to set up and fast service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie J.

June 20th, 2023

Very important information and easily accessable.

Thank you!

Christopher Shawn S.

November 4th, 2020

Swift and Concise Process!!! I would recommend, as well as, use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna C.

June 24th, 2021

I was very impressed with the system. Easy to navigate. Took less than 15 minutes to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David D.

February 11th, 2019

Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not usually respond quickly, it seems)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda G.

August 22nd, 2021

I like it so far- now I just need to complete my filing in the County seat!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Precious M.

June 23rd, 2020

great quick response

Thank you!

Wanda C.

August 20th, 2020

Site is very well laid out and easy to use. My only issue is that it wouldn't allow me to change my password, so I'm stuck with the "temporary" one. Not a big deal, but I would have preferred to change it.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly E.

January 23rd, 2021

This process could not have been made any easier!! Very easy instructions to follow and the response time was incredible! Thank you!

Thank you!

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!