Hansford County Quitclaim Deed Form

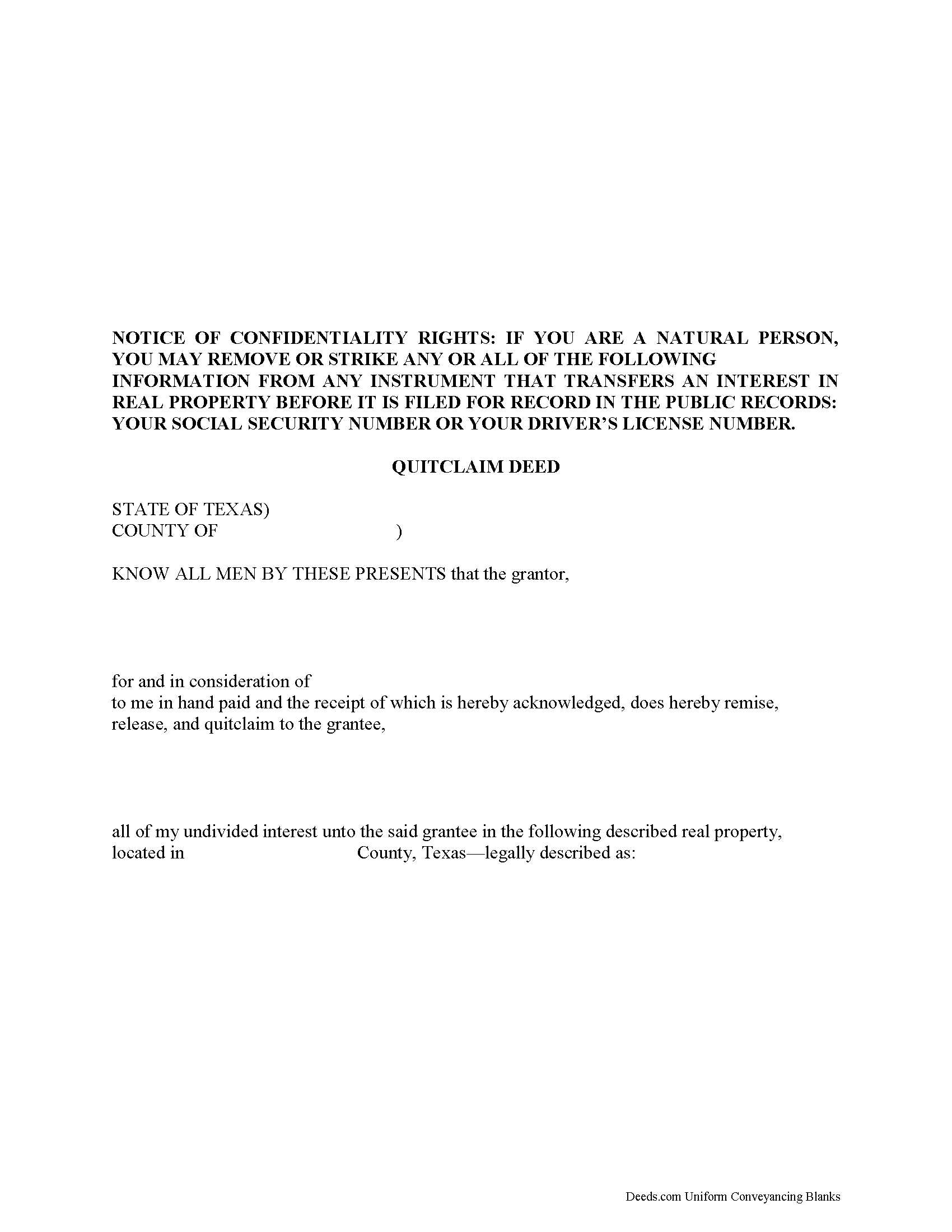

Hansford County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

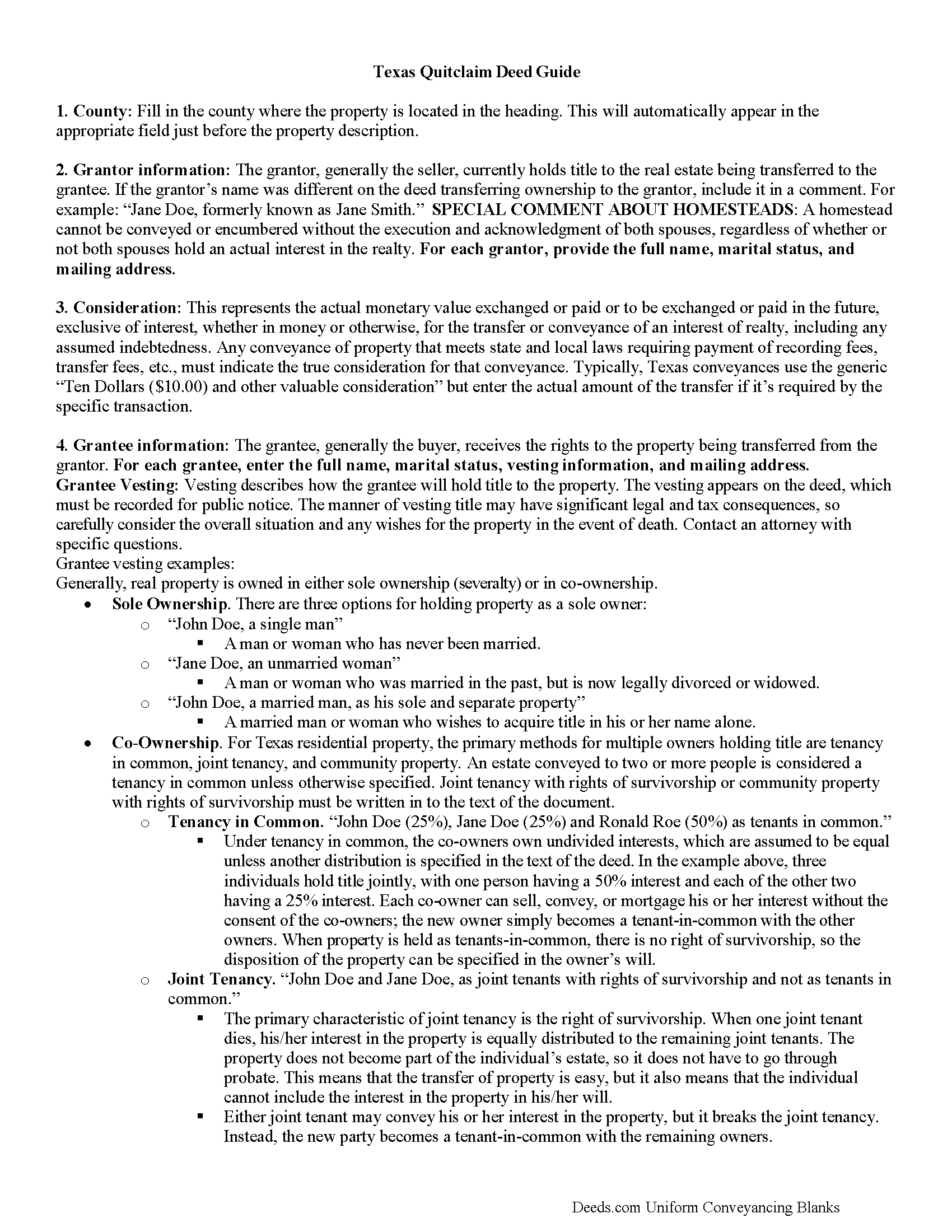

Hansford County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

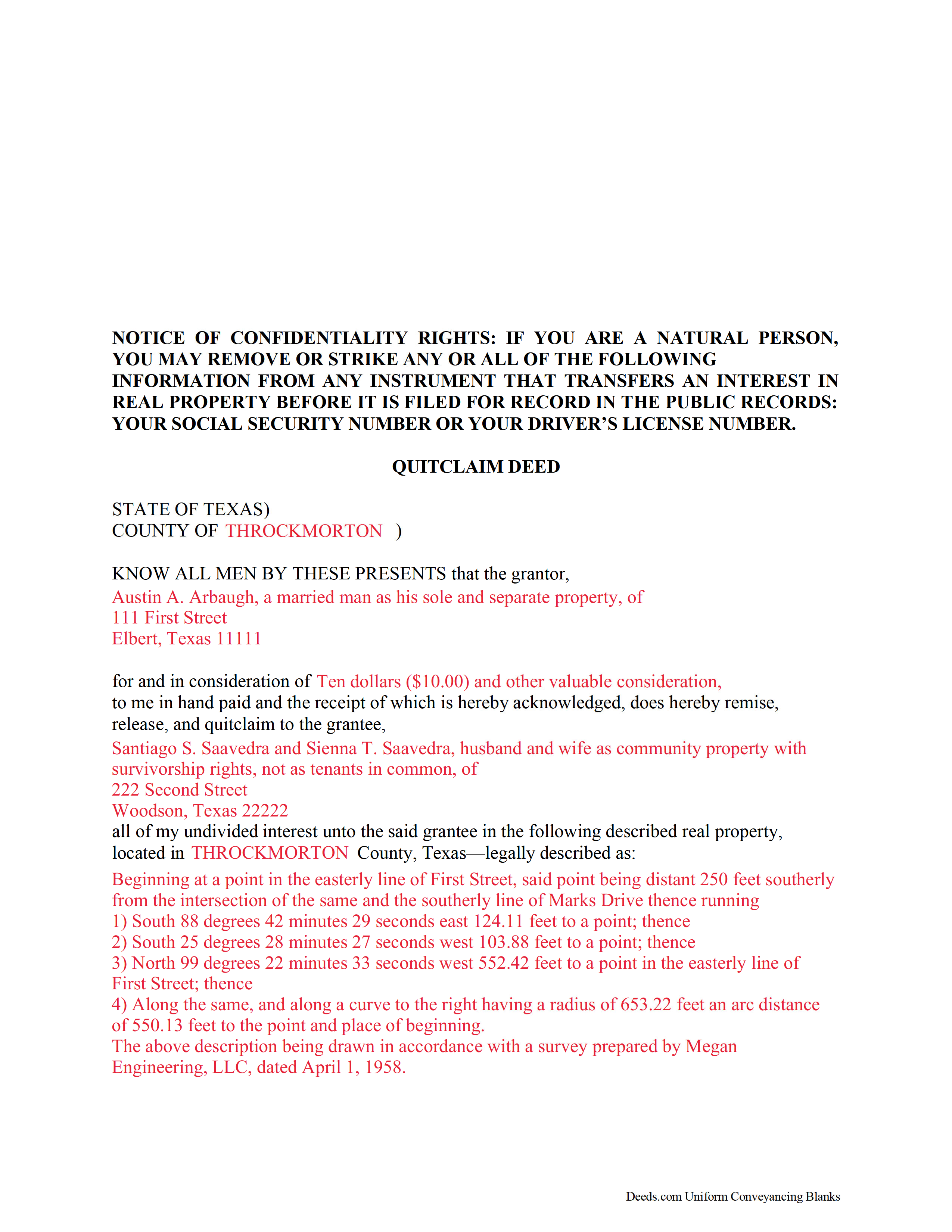

Hansford County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hansford County documents included at no extra charge:

Where to Record Your Documents

Hansford County Clerk

Spearman, Texas 79081

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (806) 659-4110

Recording Tips for Hansford County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Bring multiple forms of payment in case one isn't accepted

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Hansford County

Properties in any of these areas use Hansford County forms:

- Gruver

- Morse

- Spearman

Hours, fees, requirements, and more for Hansford County

How do I get my forms?

Forms are available for immediate download after payment. The Hansford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hansford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hansford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hansford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hansford County?

Recording fees in Hansford County vary. Contact the recorder's office at (806) 659-4110 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hansford County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Hansford County.

Our Promise

The documents you receive here will meet, or exceed, the Hansford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hansford County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Richard R.

April 16th, 2021

Deeds.com got the job done. My deed was successfully recorded.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret M.

August 9th, 2022

Quick and easy, but the 2MB file limit ended up causing some big headaches. Had I known the limit could be easily increased, it would have saved me a lot of time and trouble.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David S.

February 25th, 2020

All Star Support and less than a one day turnaround. Outstanding service. Thank you !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn S.

February 18th, 2021

Listen, I love your services. It's been such a convenience utilizing it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin G.

June 2nd, 2020

Very Pleased. Was so easy and No hidden cost. Second time I have used their services. Would not use any other deed website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry S.

March 23rd, 2022

Forms were very easy to use using the completed form as an example.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott W.

April 8th, 2024

Finding and downloading necessary forms, and especially the example forms, were tremendously easy and trouble free, and the fact the forms were updated recently was a big selling point. If other forms are needed, this is were I'm coming.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joel B.

August 10th, 2022

I would have liked more room in the text fields for describing the potential claim. had to use Exhibit A. Could not delete Exhibit B. Alo would like to have a custom footer - not deeds.com. Unprofessional.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara M.

October 5th, 2024

Efficient, well written documents

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon C.

October 29th, 2022

Easy process considering not too technical savvy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Michael T.

October 17th, 2019

Good site. Two things to note. 1. The Documentary Transfer Tax Exemption sheet, the word "computer" is used when I think it should be "computed" Error in state form? 2. The California Trust Guide could have a watermark which is less distracting. Kind of hard to read the print with the DEEDS.COM logo so prominent.

Thank you for your feedback. We really appreciate it. Have a great day!

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!

LEON S.

November 16th, 2019

recorded deed space to small for corrective deed requirement

Thank you for your feedback. We really appreciate it. Have a great day!

Tracey T.

January 20th, 2022

I downloaded the Lady Bird deed. The process was quick and easy to download. Just select your county, fill out the form. You will need the property description from your original deed. In my case I had to go downtown Wayne County (Detroit). (Make an appt online). 1st you will have to get the property tax certified to ensure all taxes are paid to date (5th floor at the Wayne County Treasurer office). Give them the form you just filled out and they will stamp certified $5. After that take the form to the Register of Deeds (7th floor) appt needed. $18. Make sure it is properly notarized and all signatures completed. Once approved, they will scan it, stamp it, give it back with a receipt and mail a copy also. All Done. Worked beautifully. My co worker go a lawyer and paid over $250. I just used deeds.com and total for forms and going downtown with notarizing was less than $40 Yea!

Thank you for your feedback. We really appreciate it. Have a great day!