Smith County Quitclaim Deed Form

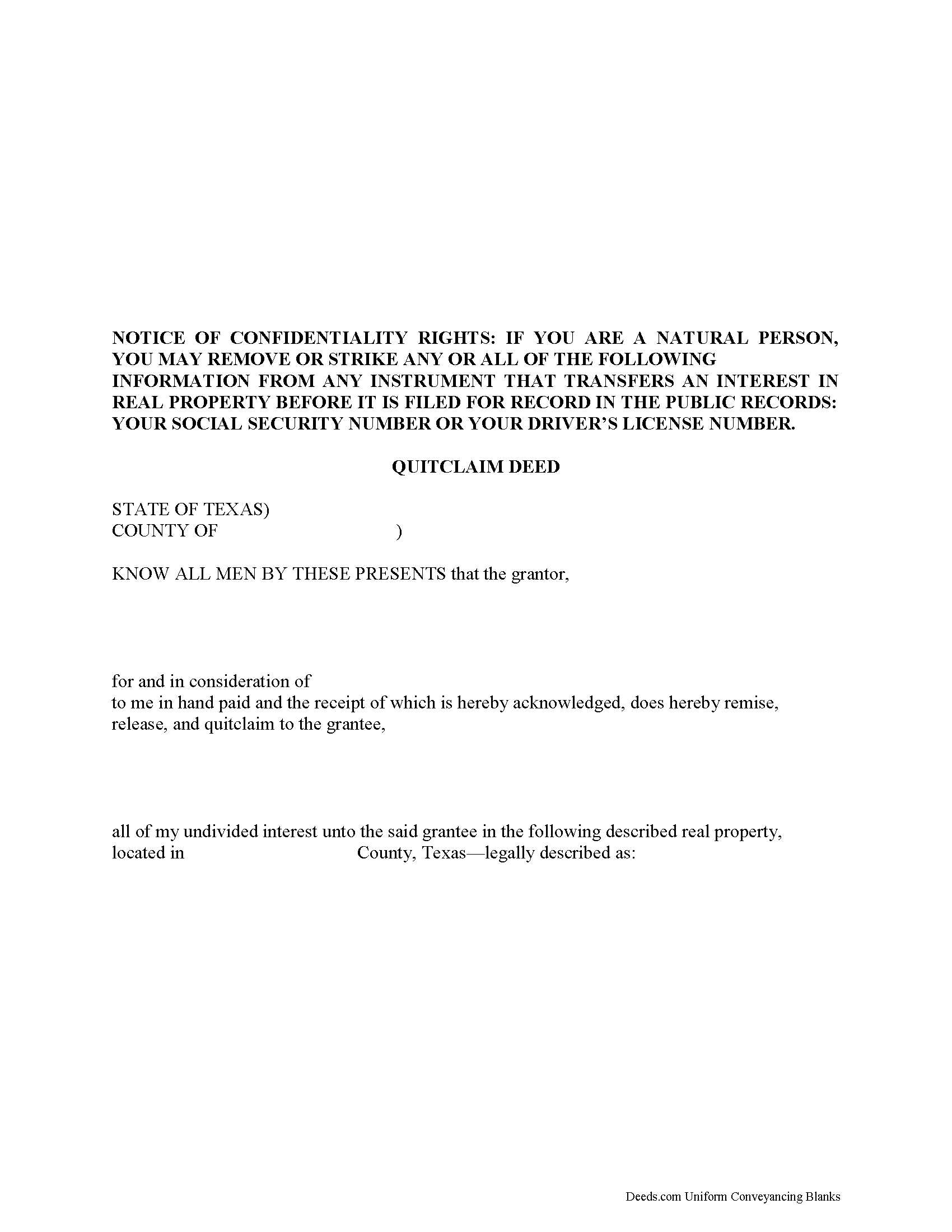

Smith County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

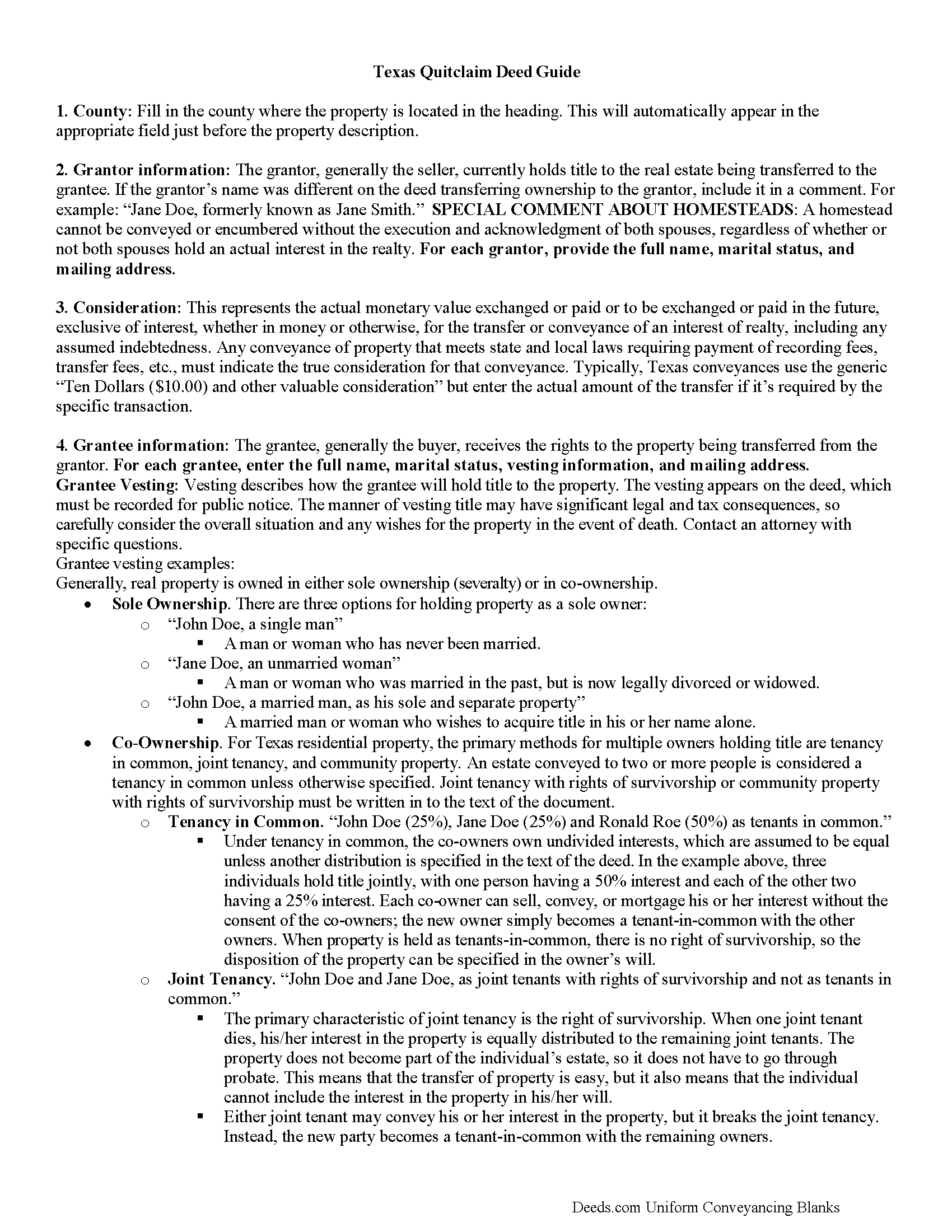

Smith County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

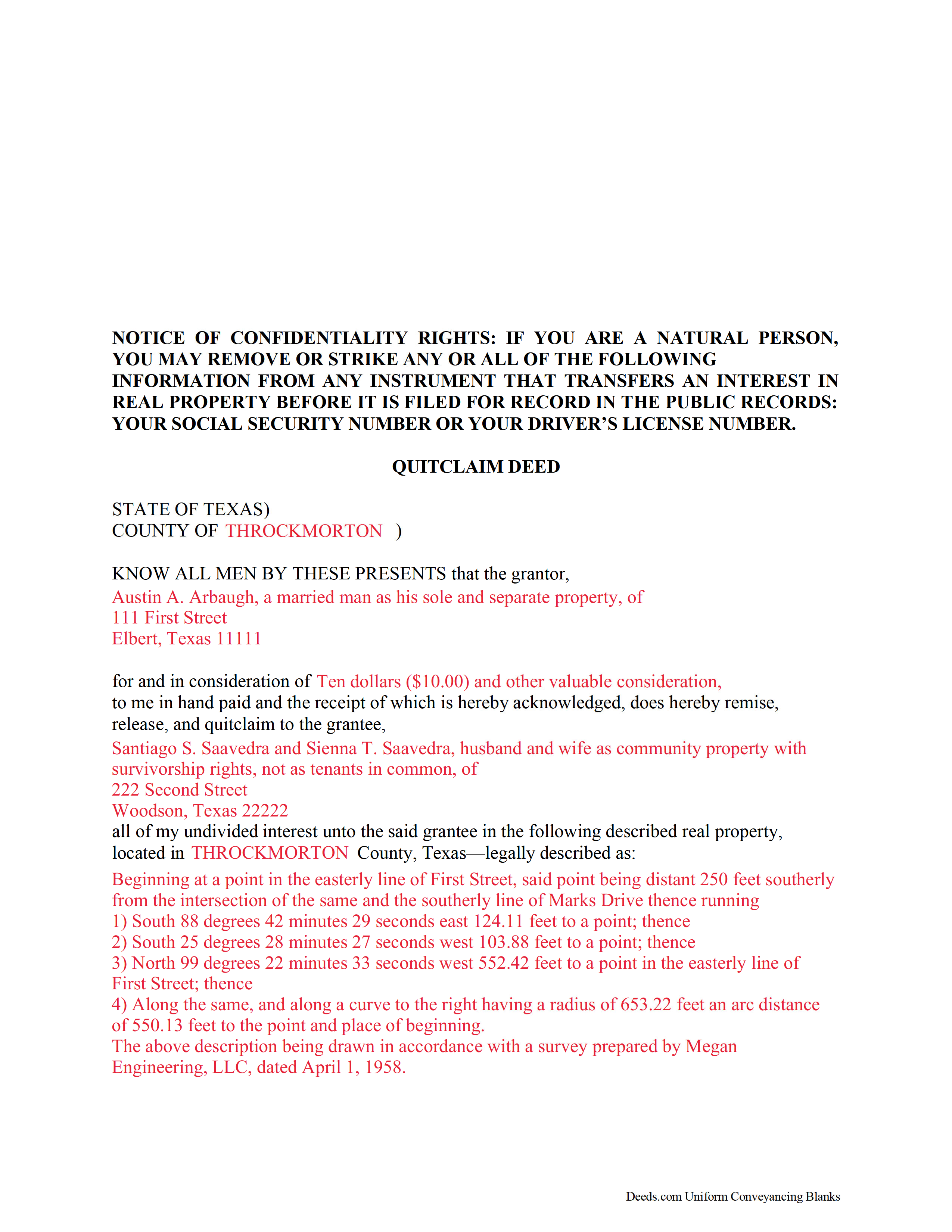

Smith County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Clerk

Tyler, Texas 75702

Hours: 8:00am - 4:45pm M-F

Phone: (903) 590-4670

Recording Tips for Smith County:

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Arp

- Bullard

- Flint

- Lindale

- Troup

- Tyler

- Whitehouse

- Winona

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (903) 590-4670 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Debra B.

October 1st, 2022

Easy to process and file with the courthouse.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamal .

July 29th, 2020

So far so good!

Thank you!

Mary Z.

December 2nd, 2021

Awesome forms, easy to complete and print.

Thank you!

victoria r.

September 22nd, 2020

Easiest and most efficient process awesome online communication

Thank you!

Yehong M.

November 27th, 2019

everything worked well,

Thank you!

Nicole M.

June 3rd, 2020

This is my very first use with your company. I submitted my package and within the hour you had responded with an Invoice for me to pay so you could proceed with my recording. So far I am very impressed! Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Eric L.

June 28th, 2021

Great service, but still needs some knowledge to complete. Also missing Michigan right to farm paragraph.

Thank you!

Tamara H.

August 7th, 2021

Absolutely awesome, all the information and forms I needed Thanks Tamie Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela C.

July 19th, 2022

Easy to use, understand and pay on the website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin S.

September 2nd, 2022

Very useful information

Thank you!

Jessica S.

December 21st, 2018

Paid the money, but never received any information; not even an email saying they couldn't find anything.

Thank you for your feedback. Reviewing your account, looks like the property detail report you ordered was completed on December 14, 2018 at 10:56am. The report has been available for you to download in your account ever since.

Roy B.

January 30th, 2021

Convenient yes, expensive "big YES" and with what I paid to record a lien it cost me close to $50. That seems quite exorbitant in my estimation!!

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

April 17th, 2025

Deeds.com consistently provides excellent service at a fair price, and we rely and are thankful them for assisting with our recording needs.

Thank you, Mary! We truly appreciate your kind words and continued trust in Deeds.com. It means a lot to us to be part of your recording process, and we’re always here to help whenever you need us.

Terri A B.

July 17th, 2025

The process was easy and cost was reasonable. My only suggestion is to allow user the ability to shorten the space between the county and state and the space after the month. I needed to draw a line at the courthouse before they would file it.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!