Upton County Quitclaim Deed Form

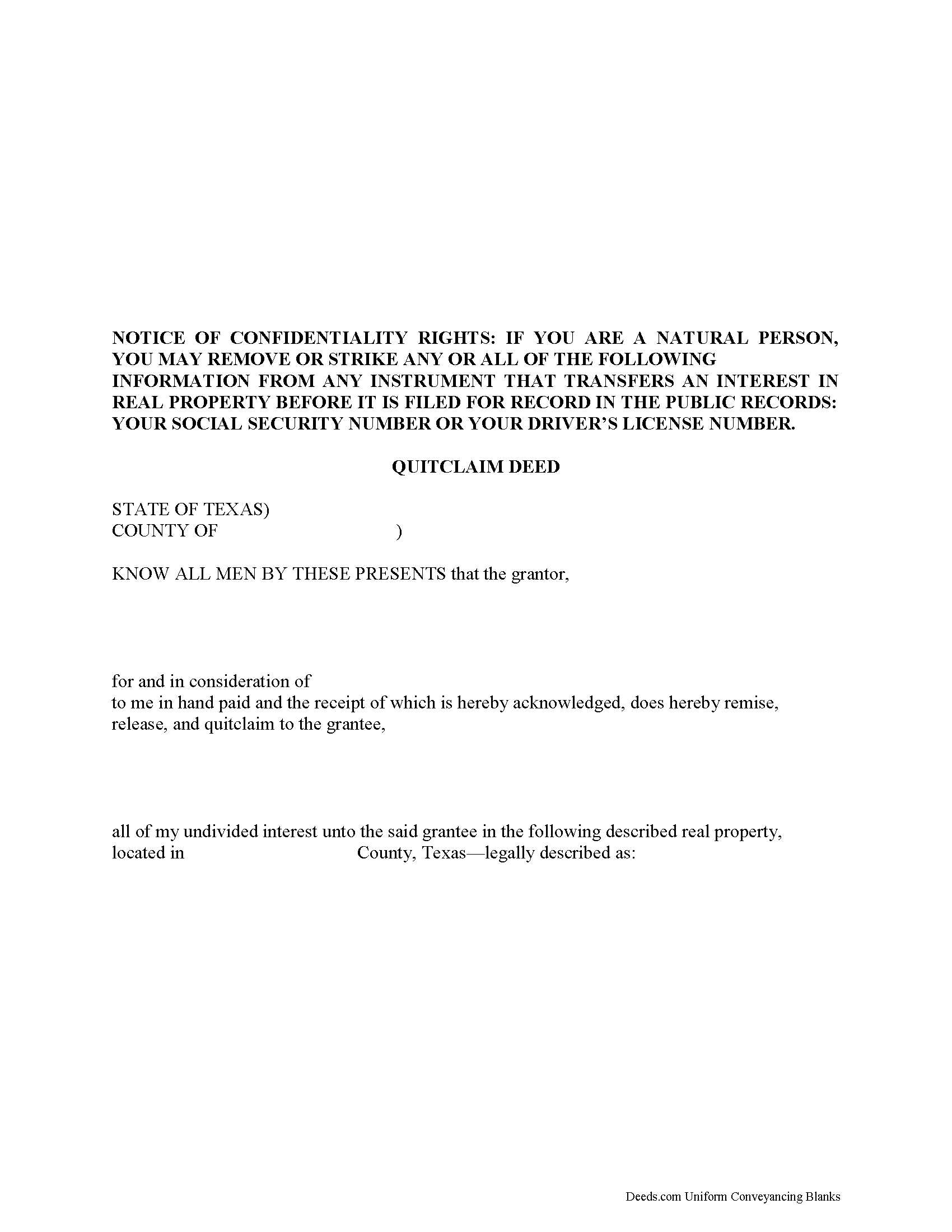

Upton County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

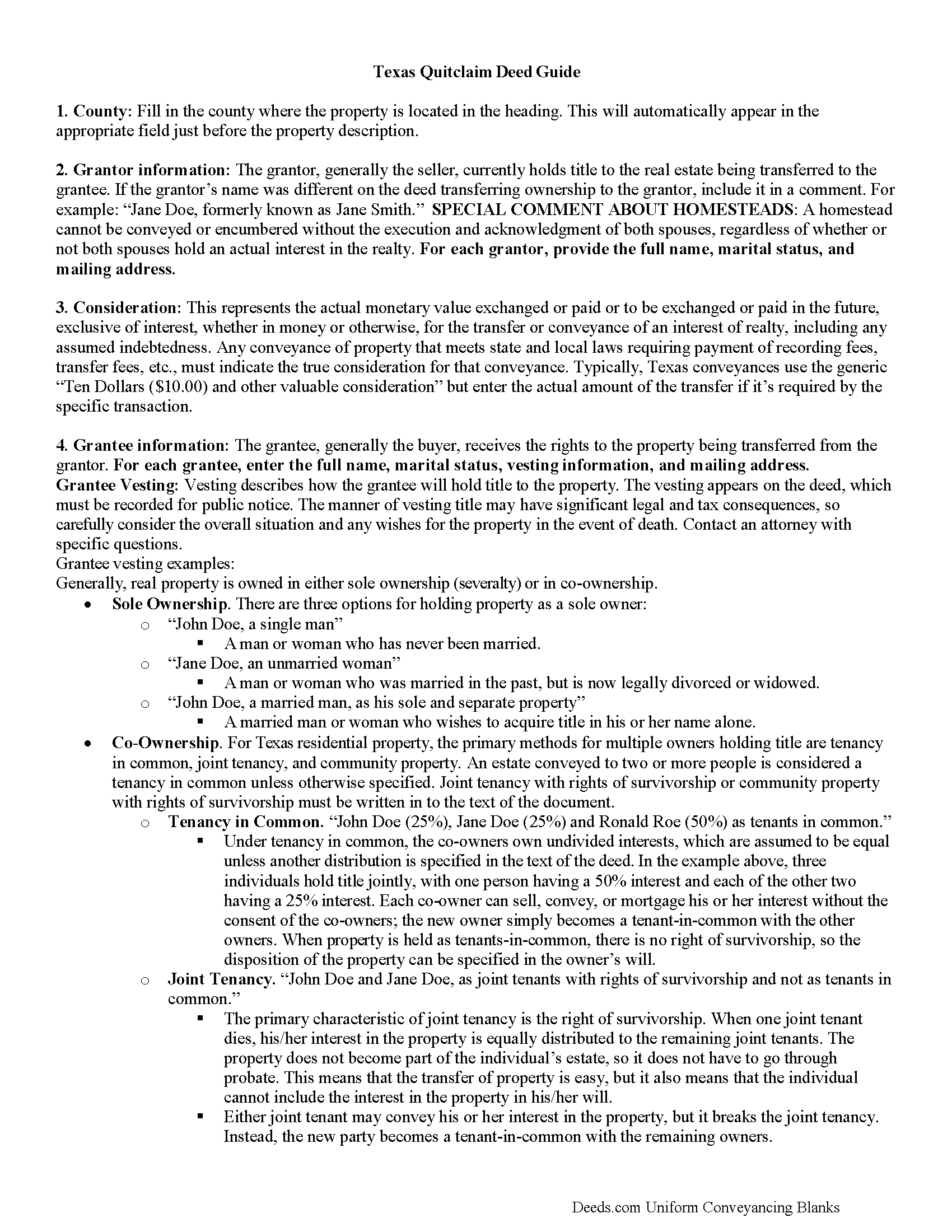

Upton County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

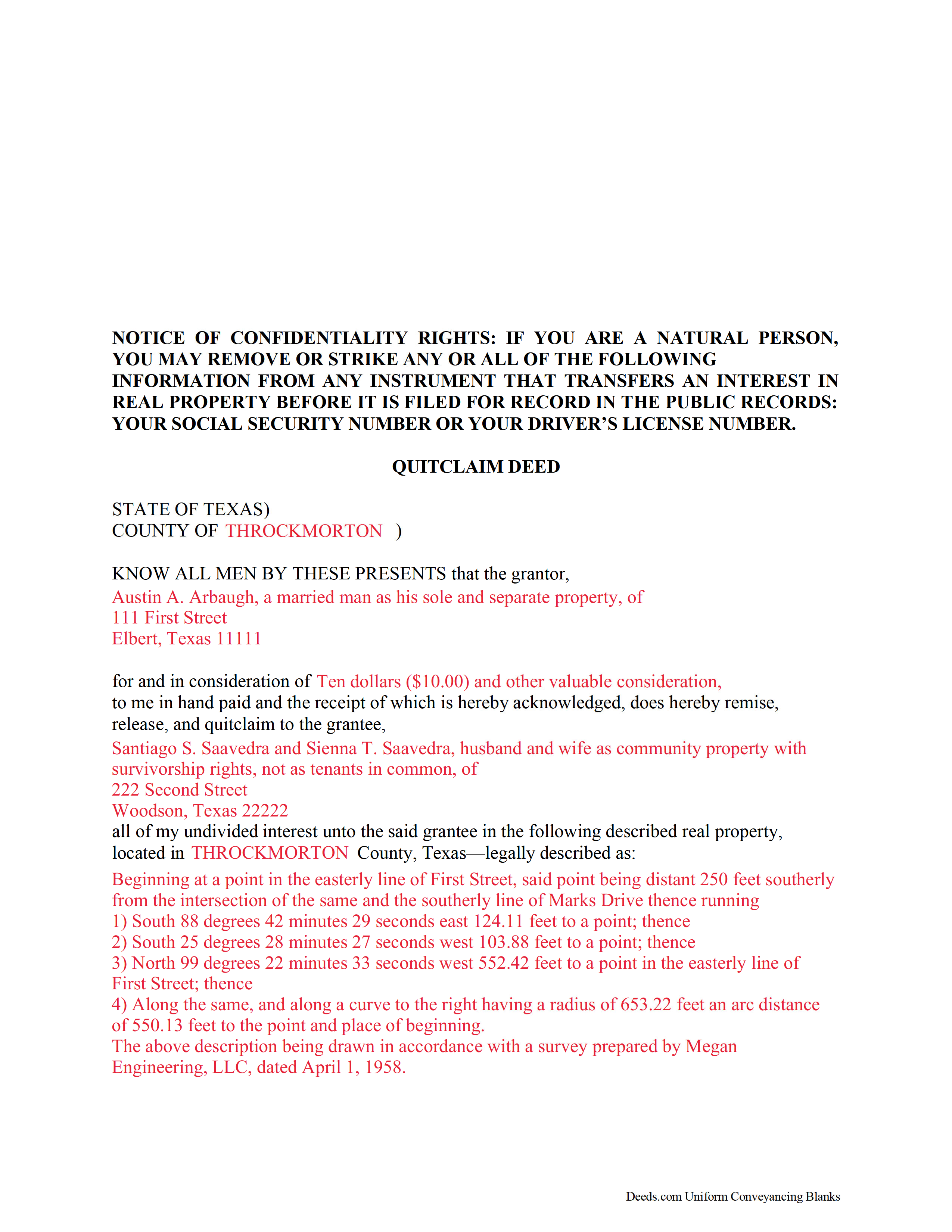

Upton County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Upton County documents included at no extra charge:

Where to Record Your Documents

Upton County Clerk

Rankin, Texas 79778

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (432) 693-2861

Recording Tips for Upton County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Upton County

Properties in any of these areas use Upton County forms:

- Mc Camey

- Midkiff

- Rankin

Hours, fees, requirements, and more for Upton County

How do I get my forms?

Forms are available for immediate download after payment. The Upton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Upton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Upton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Upton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Upton County?

Recording fees in Upton County vary. Contact the recorder's office at (432) 693-2861 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Upton County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Upton County.

Our Promise

The documents you receive here will meet, or exceed, the Upton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Upton County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!

Bea Lou H.

December 2nd, 2022

easy access and easy to find what I was looking for. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Milica K.

March 23rd, 2021

Very fast and reliable service.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Kaleigh S.

April 8th, 2020

I used Deeds.com to record two judgments with the County Recorder's Office. The site was very easy to use and I had my recorded copies back the very next day. I highly recommend their service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas D.

January 6th, 2019

Can I use this for easement in gross ? Like to grant cousins easement to use river front property with riparian rights ?

Sorry, we are unable to give advice on specific legal situations.

Leroy B.

February 7th, 2020

I have a Timeshare in Florida and started looking to sell it. Just finally downloaded this site, it looks fairly simple. I will start getting more serious soon. Looking forward to working with Deeds.com.

Thank you!

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Ken W.

February 3rd, 2019

Everything perfect, good price. Completely satisfied

Thank you!

Dave M.

March 10th, 2020

Service as needed. A bit expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Dee S.

July 18th, 2019

This was easy and much cheaper than getting a lawyer. Thanks! - From alabama

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!