Anderson County Release of Lien - by Deed of Trust and Note Form

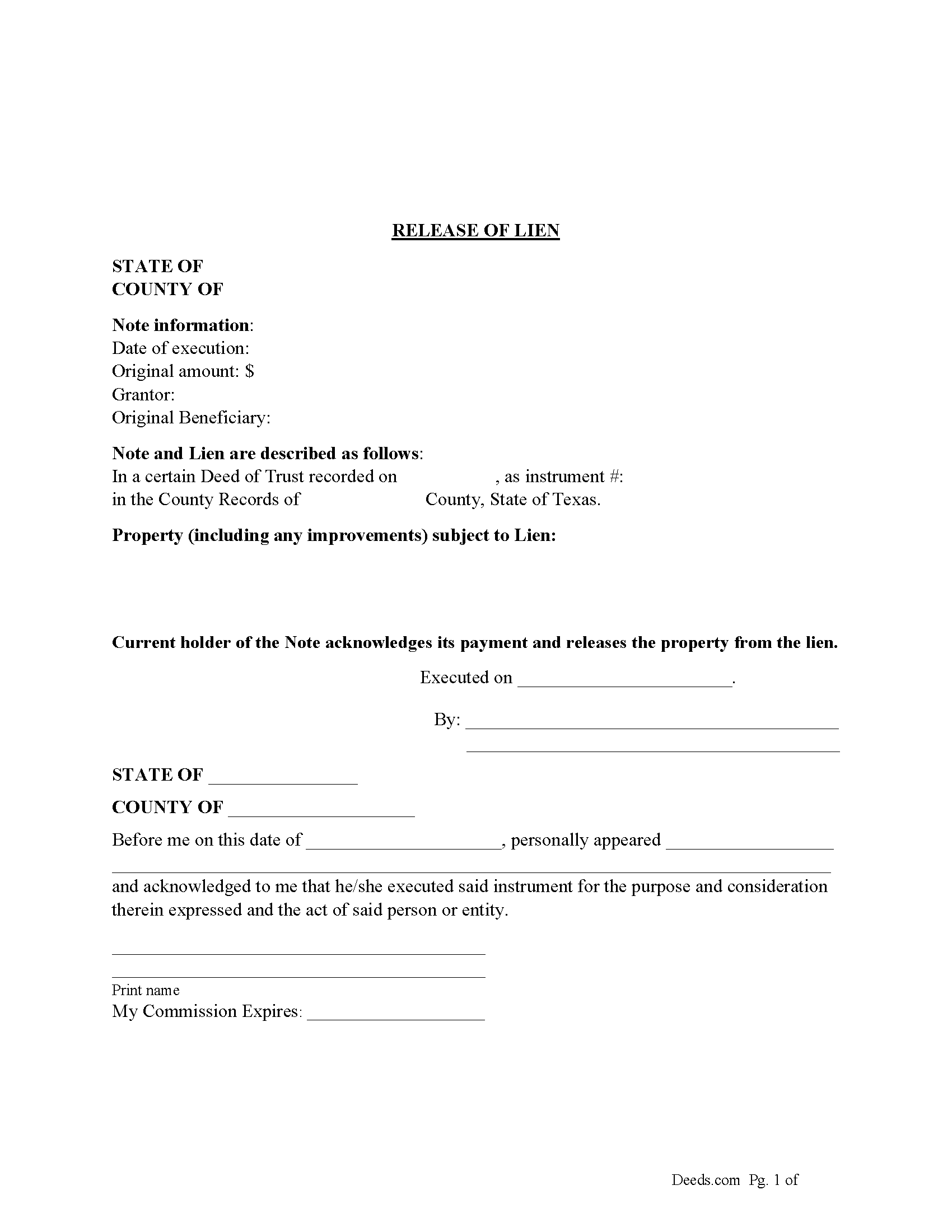

Anderson County Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

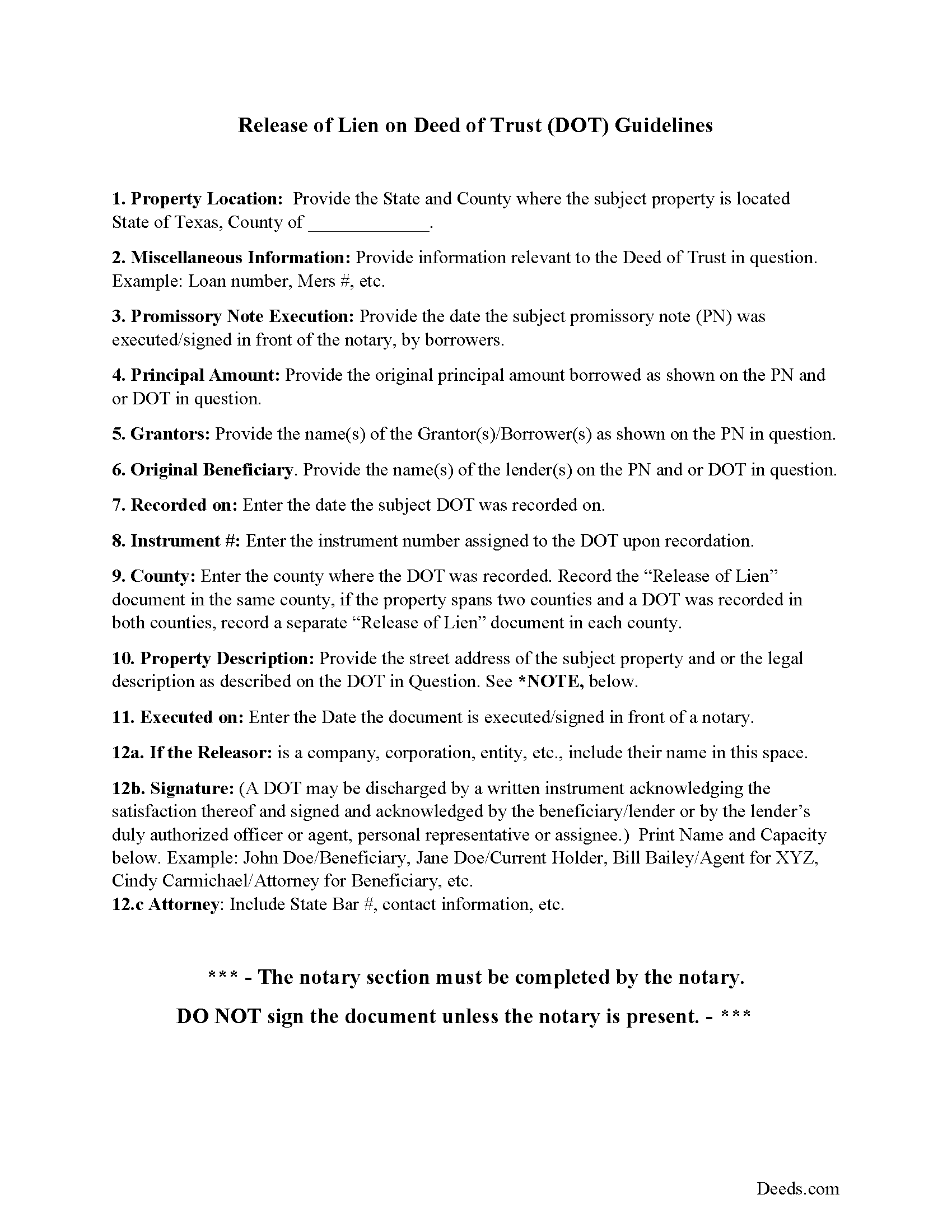

Anderson County Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

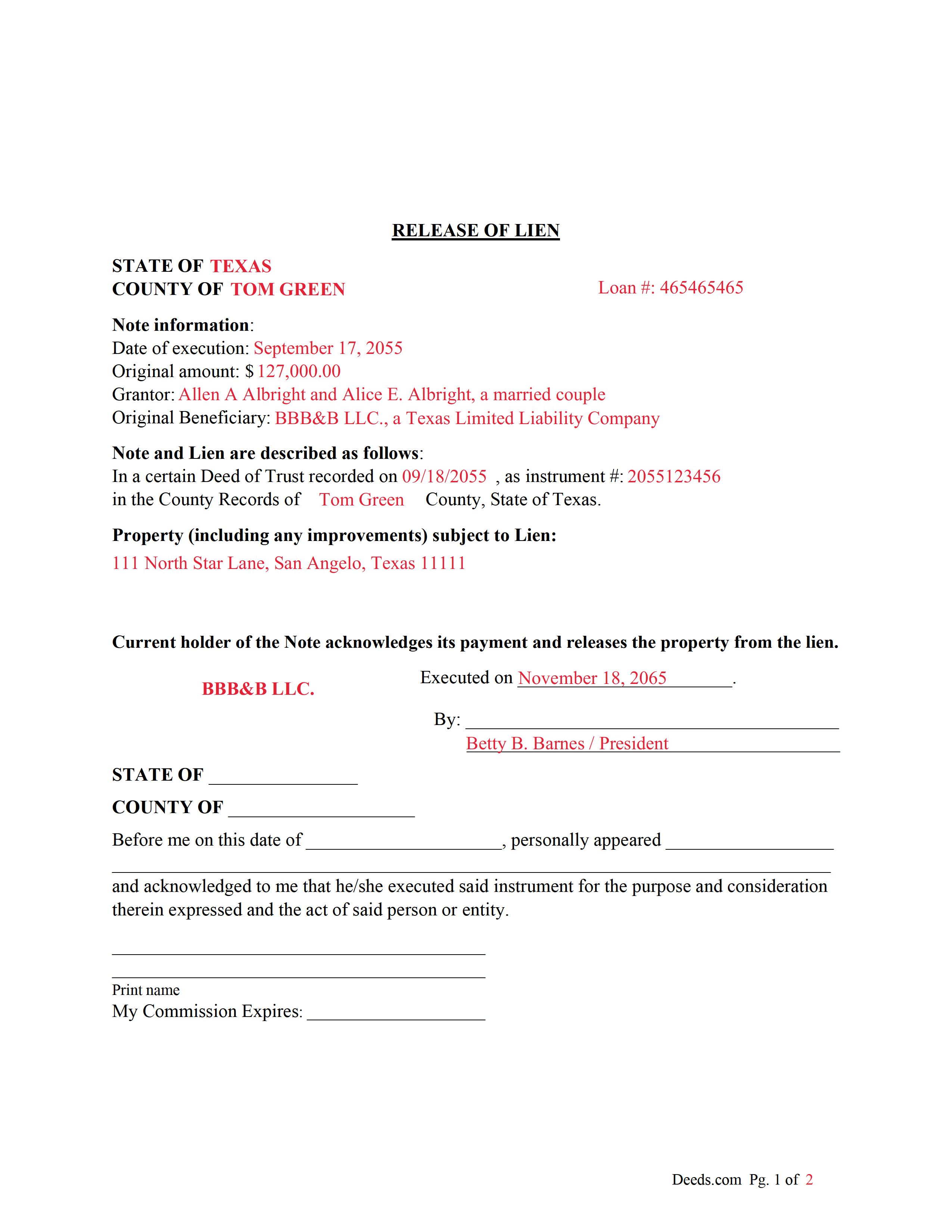

Anderson County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Anderson County documents included at no extra charge:

Where to Record Your Documents

Anderson County Clerk

Palestine, Texas 75801

Hours: 8:00am to 12:00 & 1:00 to 5:00pm Monday - Friday (except holidays)

Phone: 903-723-7402

Recording Tips for Anderson County:

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Anderson County

Properties in any of these areas use Anderson County forms:

- Cayuga

- Elkhart

- Frankston

- Montalba

- Neches

- Palestine

- Tennessee Colony

Hours, fees, requirements, and more for Anderson County

How do I get my forms?

Forms are available for immediate download after payment. The Anderson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Anderson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Anderson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Anderson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Anderson County?

Recording fees in Anderson County vary. Contact the recorder's office at 903-723-7402 for current fees.

Questions answered? Let's get started!

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Anderson County to use these forms. Documents should be recorded at the office below.

This Release of Lien - by Deed of Trust and Note meets all recording requirements specific to Anderson County.

Our Promise

The documents you receive here will meet, or exceed, the Anderson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Anderson County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Joseph D.

November 14th, 2024

Easy to use and a quick turnaround Deed was recorded and retuned within 24 hours

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Luwana C.

April 2nd, 2019

I think the Website takes out a lot of leg work, Makes it easier to take care of paperwork 10 times faster.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOHN R.

March 15th, 2023

This is an Outstanding Website for easy access in expediting my property investment needs. Thank you for this much needed online service.

Thank you!

PETER C.

October 7th, 2020

The process was quick and simple to follow. Very efficient way to document Deeds.

Thank you!

Veronica F.

April 24th, 2019

Im so happy with this site. It was quick and painless and worth the money hassle free if I ever need to settle another deed I will be back.

Thank you Veronica, we really appreciate your feedback.

Dallas S.

July 19th, 2023

Very easy

Thank you!

Chrystal L.

February 25th, 2023

Excellent! Follow the prompts for easy access. Forms readily available. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan S.

October 4th, 2019

Great forms, easy to understand and use (the guide helped a lot). Recorded with no issues. Will be back when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Myron M.

June 30th, 2020

This is what we need and it was very helpful and easy to fill out. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!