Smith County Release of Lien - by Deed of Trust and Note Form

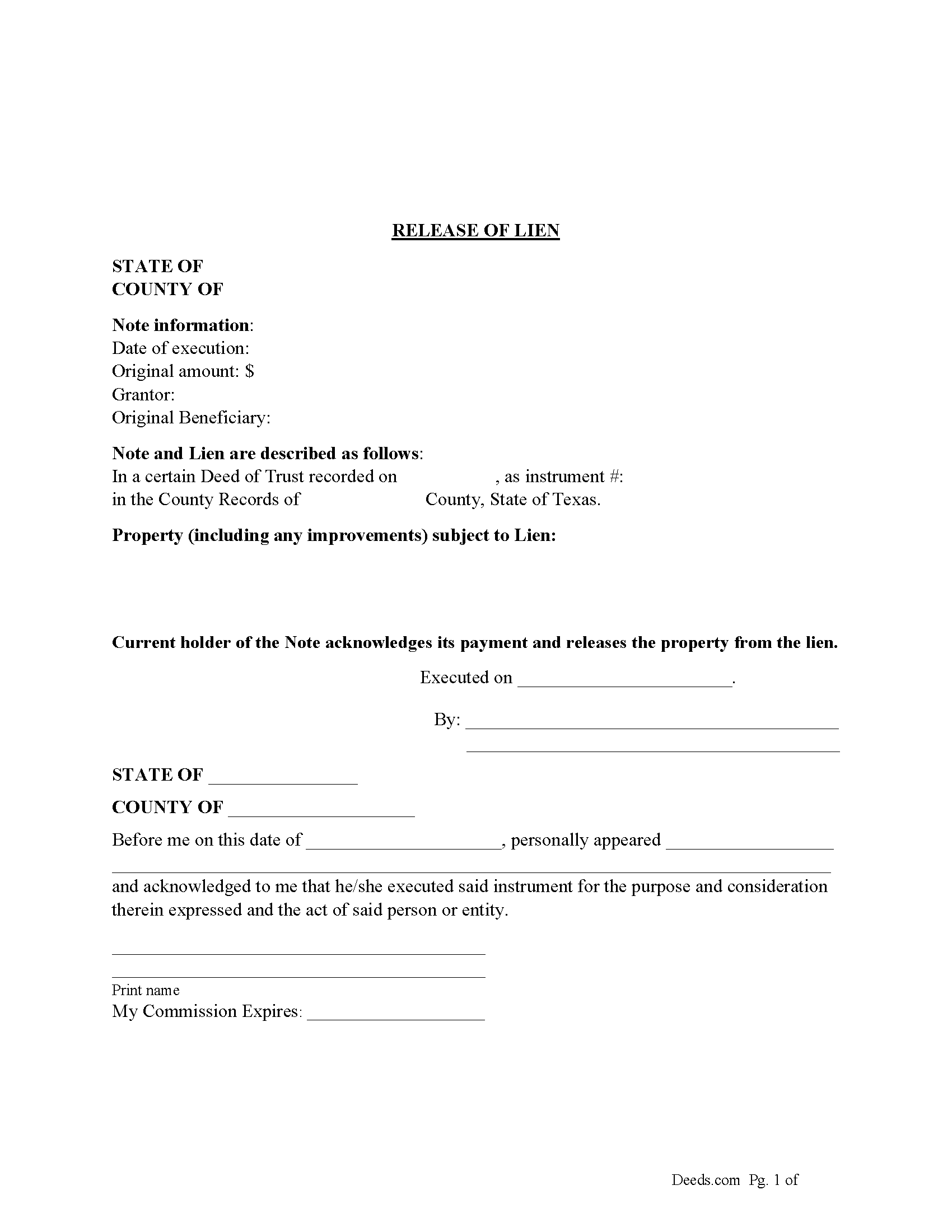

Smith County Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

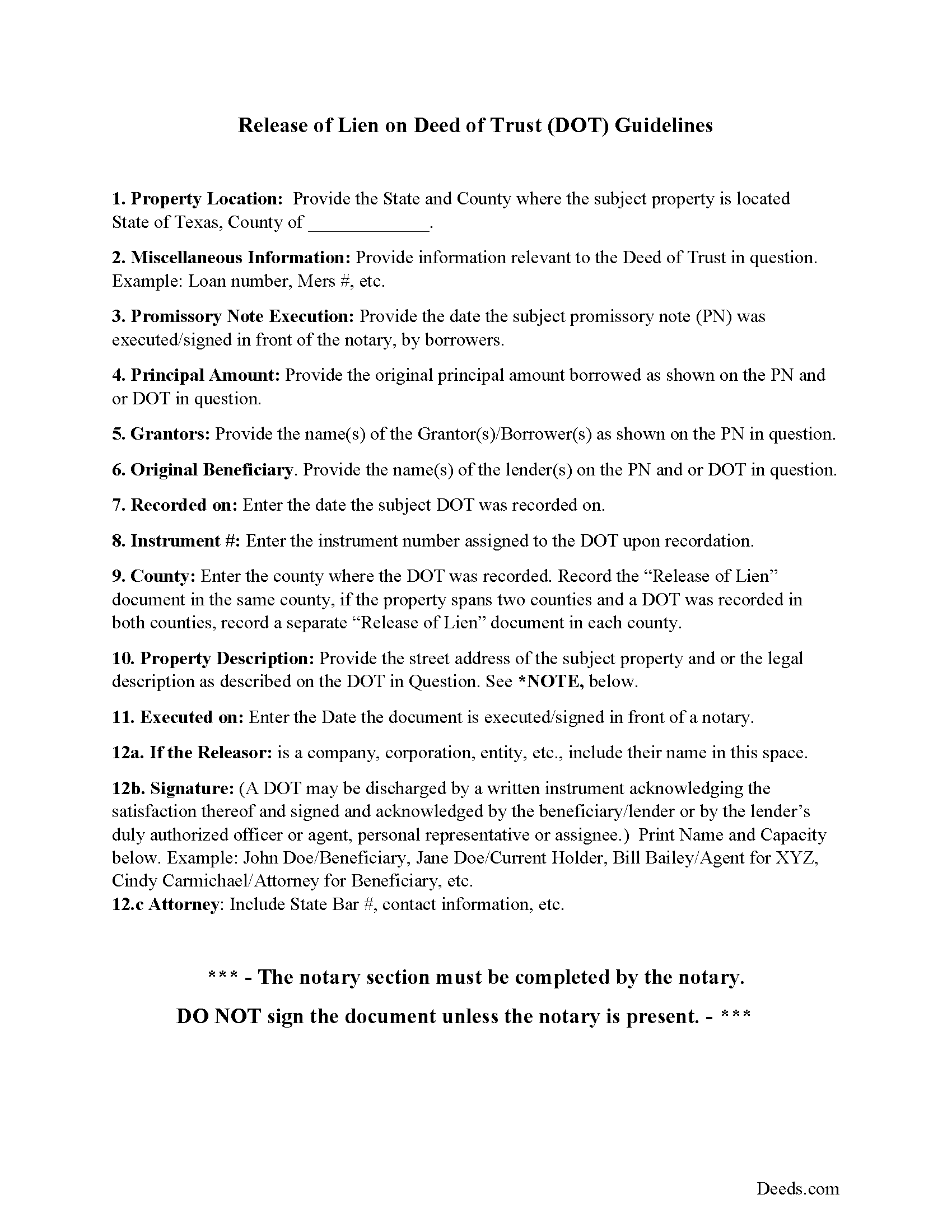

Smith County Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

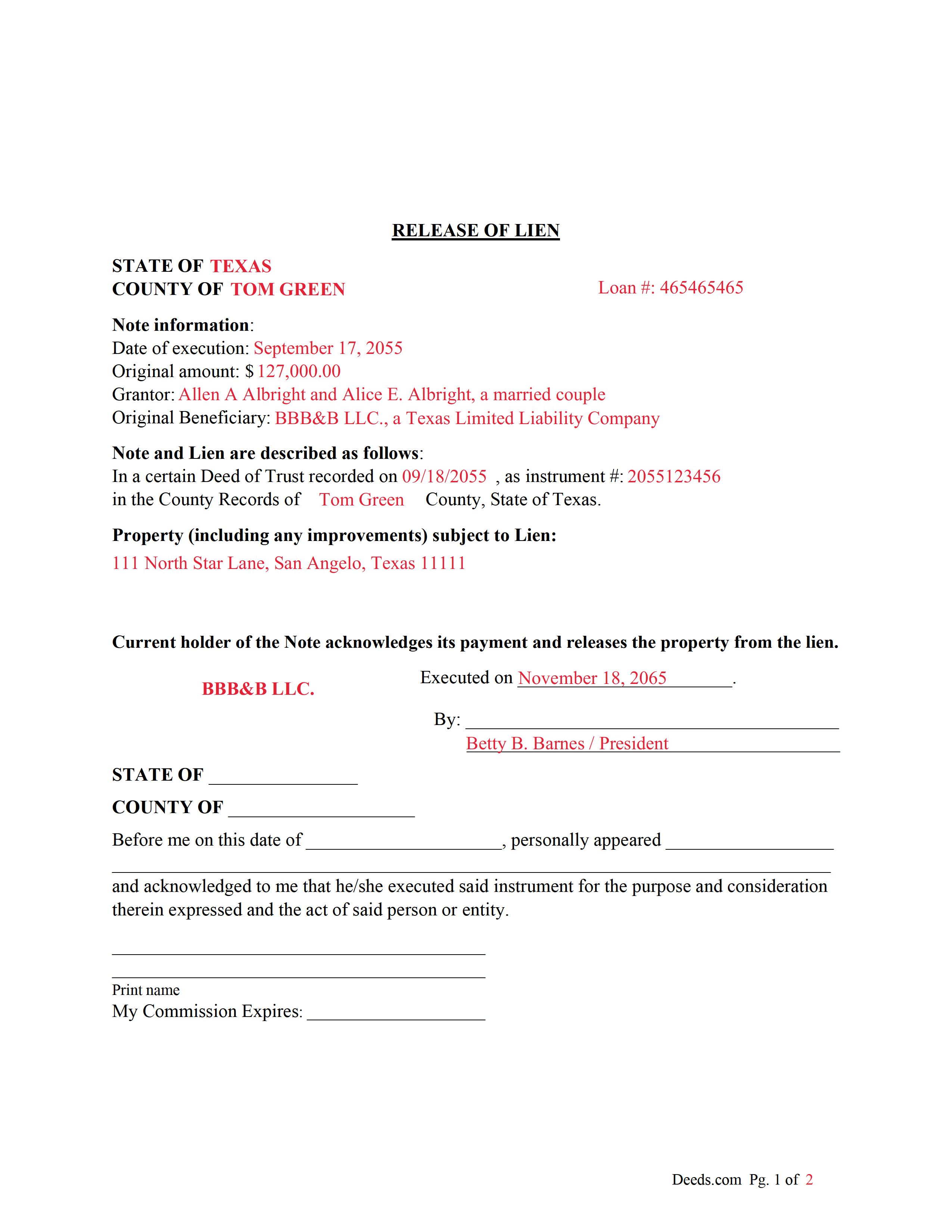

Smith County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Clerk

Tyler, Texas 75702

Hours: 8:00am - 4:45pm M-F

Phone: (903) 590-4670

Recording Tips for Smith County:

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Arp

- Bullard

- Flint

- Lindale

- Troup

- Tyler

- Whitehouse

- Winona

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (903) 590-4670 for current fees.

Questions answered? Let's get started!

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Release of Lien - by Deed of Trust and Note meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Amanda P.

April 14th, 2021

Quick kind and useful feedback provided related to issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LEON S.

November 16th, 2019

recorded deed space to small for corrective deed requirement

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

April 17th, 2020

I recommend you add a box "Add another document or package." The way it is now confused me, so I uploaded the same document two more times, thinking the upload failed the first two times.

Thank you for your feedback Stephen.

IVAN G.

September 4th, 2020

This Guys are accurate and FAST, Thanks Staff- KVH.!!!! you were awesome!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ethan N.

January 11th, 2021

Quick, responsive service always!! Preferred way to record documents. Thanks Deeds.com!!

Thank you!

Roger V.

April 26th, 2019

Very easy to use.

Thank you Roger, we appreciate your feedback.

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randi M.

November 30th, 2020

We could never figure out how to get to the website to order.

Sorry to hear that Randi. We do hope that you found something more suitable to your needs elsewhere.

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Abram A.

February 26th, 2019

Very easy to navigate around and to obtain desired forms and service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tanya D.

January 1st, 2019

No review provided.

Wilma M.

August 7th, 2020

Amazingly easy. Thank you

Thank you!

Keith C.

April 12th, 2019

not worth anything to me as i could never get notary info on form to print along with other info

Sorry to hear that Keith. We have processed a refund for your order.

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!