Lee County Request for Information from Owner Form

Lee County Request for Information from Owner Form

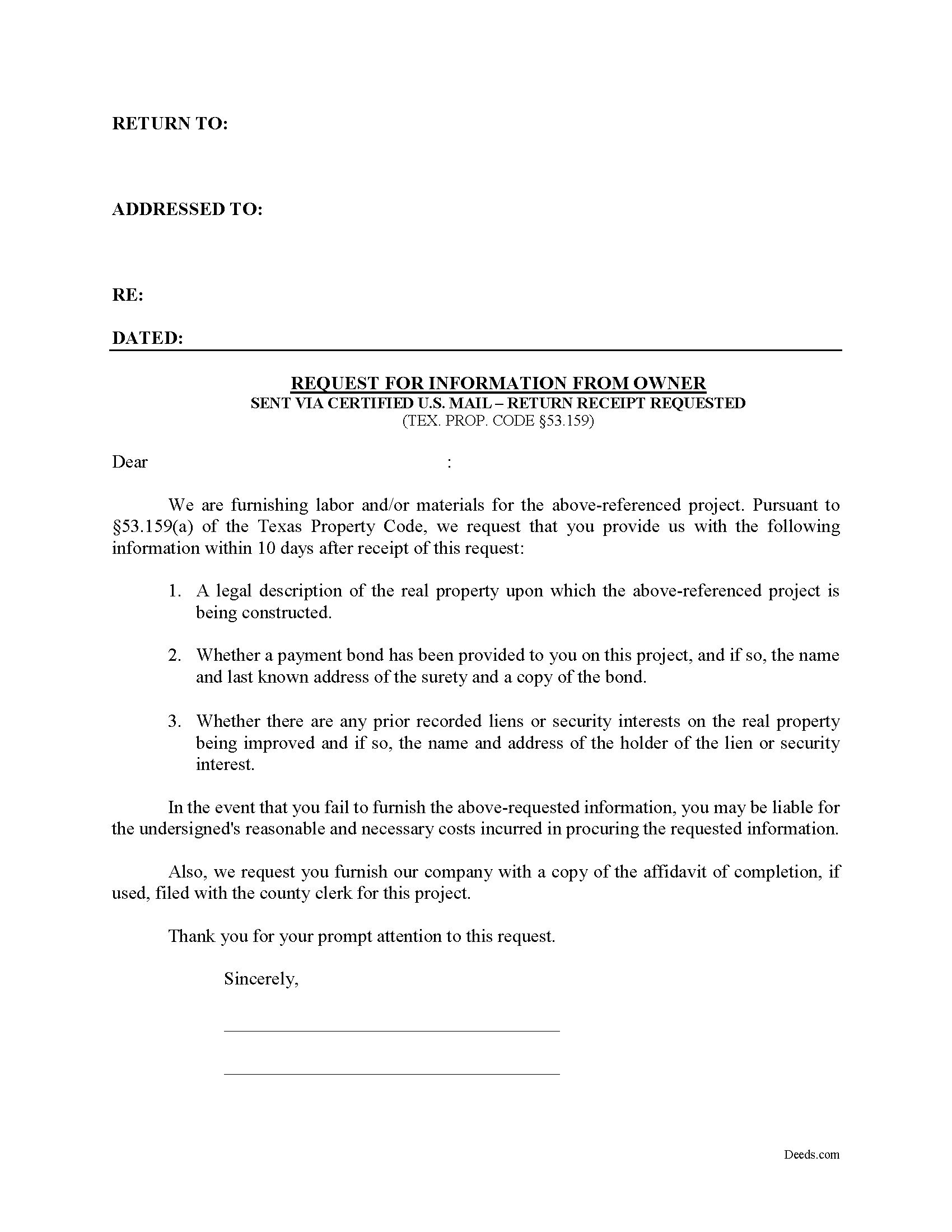

Fill in the blank Request for Information from Owner form formatted to comply with all Texas recording and content requirements.

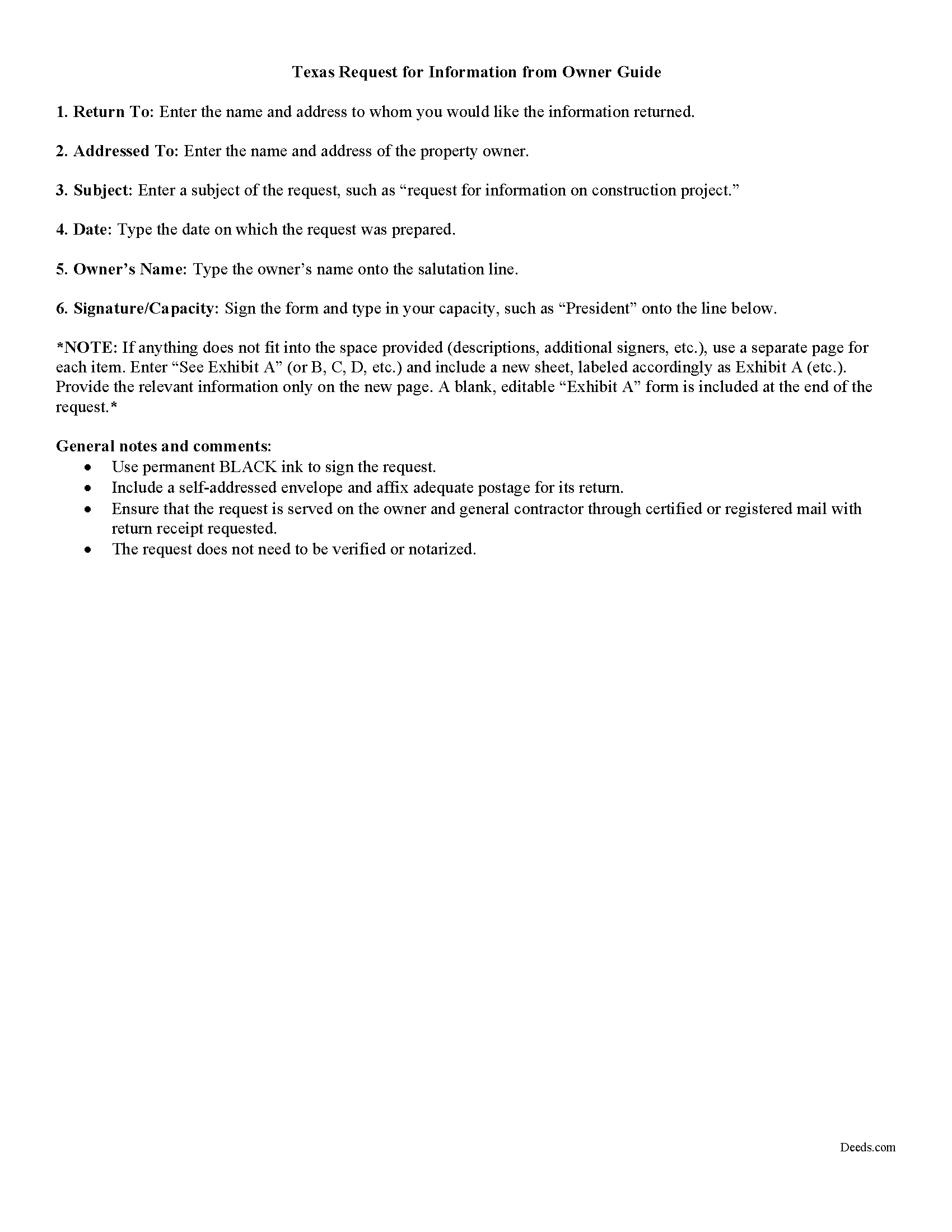

Lee County Request for Infomation from Owner Guide

Line by line guide explaining every blank on the form.

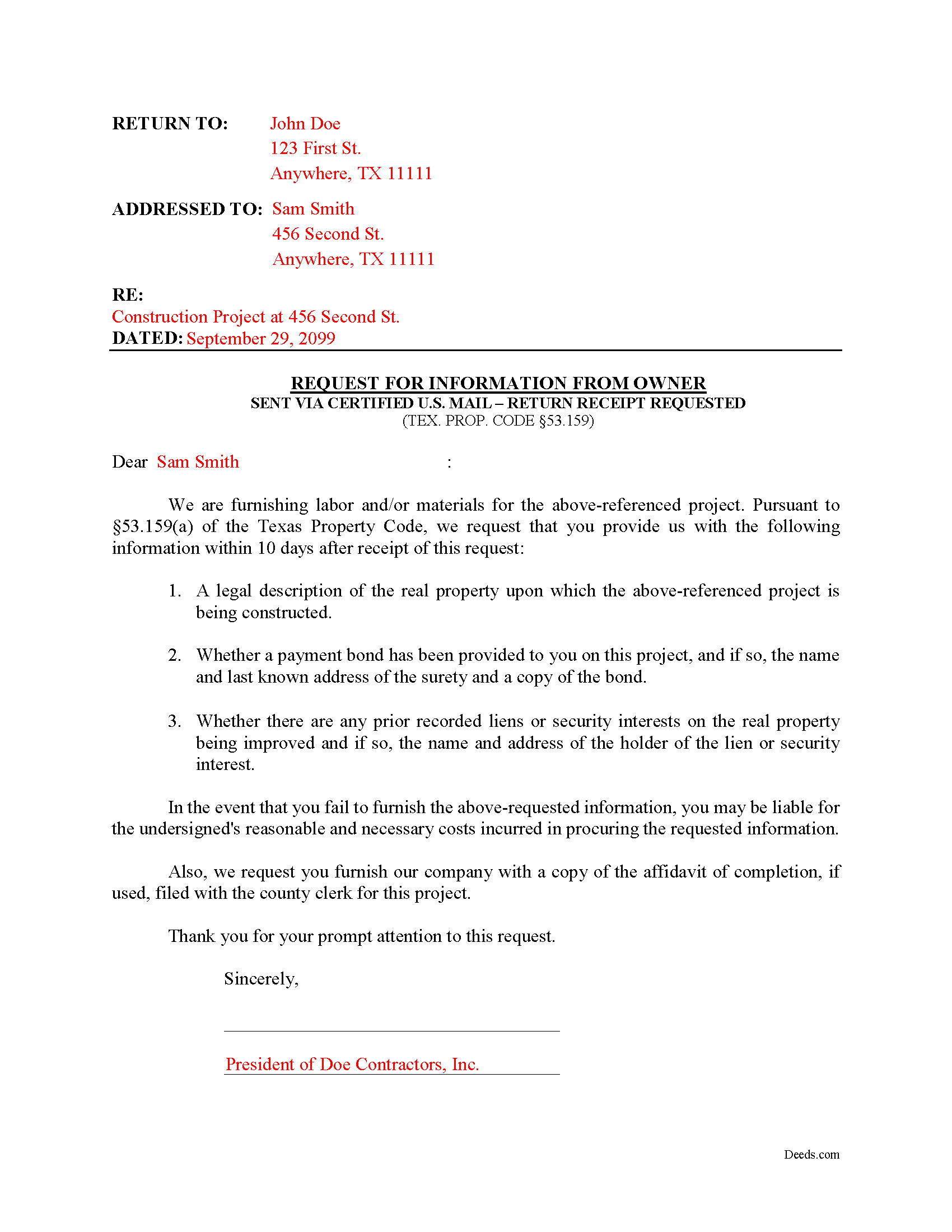

Lee County Completed Example of the Request for Information from Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Lee County documents included at no extra charge:

Where to Record Your Documents

Lee County Clerk

Giddings, Texas 78942

Hours: Monday-Friday 8am-5pm

Phone: (979) 542-3684

Recording Tips for Lee County:

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Lee County

Properties in any of these areas use Lee County forms:

- Dime Box

- Giddings

- Lexington

- Lincoln

Hours, fees, requirements, and more for Lee County

How do I get my forms?

Forms are available for immediate download after payment. The Lee County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lee County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lee County?

Recording fees in Lee County vary. Contact the recorder's office at (979) 542-3684 for current fees.

Questions answered? Let's get started!

What information must the owner provide on a Texas construction project?

The Request for Information from Owner is a form letter used to obtain information from the property owner on a construction job. The required information from the owner includes a description of the real property, details of any surety bond posted, whether there are prior recorded liens or security interests on the property, and the date on which the original contract for the project was executed.

Under TEX. PROP. CODE 53.159(a), upon a written request, the property owner must provide the information within a reasonable time to anyone who furnished labor or materials. The owner must respond no later than the 10th day after the date the request is received.

If the requester is not in direct contractual relationship with the owner on the project, the owner may require payment of the actual costs in producing the information which cannot exceed $25.00. TEX. PROP. CODE 53.159(e). Therefore, some people choose to enclose a check with the request form, up to $25.00, to cover any costs.

If the owner fails to furnish the required information, he or she may be liable for reasonable and necessary costs incurred in procuring the requested information. TEX. PROP. CODE 53.159(f).

Each case is unique, and the Texas lien law is complex. Contact an attorney with specific questions about requesting information about a construction project from the property owner, or any other issues related to mechanic's liens.

Important: Your property must be located in Lee County to use these forms. Documents should be recorded at the office below.

This Request for Information from Owner meets all recording requirements specific to Lee County.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Request for Information from Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

Jaime S.

May 26th, 2021

To call an affidavit of minor correction a Correction Deed in your descriptions is incorrect. They are two different products. I did not intend to purchase an affidavit. I intended to purchase a Correction Deed.

Thank you!

Carole L.

December 30th, 2018

Perfectly easy, perfectly complete! I had no problems with downloading these forms. I have been a paralegal for 20 years and came up on a situation where I was not familiar with the forms. Deeds.com saved my life and allowed me to get the documents done and done right. I will keep deeds.com on my list of favorites!

Thank you Carole. Glad we could help. We appreciate you taking the time to leave your review.

Petre A.

April 9th, 2022

Easy @ useful

Thank you!

Rubin C.

July 19th, 2020

Very good forms and the online recording was a blessing.

Thank you for your feedback. We really appreciate it. Have a great day!

Brian J.

September 4th, 2025

make filing doc so simple and fast saves time and money

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James V.

July 9th, 2020

Easy, quick and very proficient. I am glad I used Deeds.

Thank you!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary T.

February 29th, 2020

Thanks so much. Lawyers wanted $150 but with your help and my facts I knocked it out in less than 1 Hour

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki M.

August 16th, 2022

Deeds.com served my needs perfectly providing a form for a very reasonable price. Every other site was double or more. The form was easy to complete and I like that I can access it if I need to make changes. I had contacted a paralegal to prepare this form for me and she quoted $150. I saved time and money with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

DeBe W.

January 27th, 2024

Thanks for the quick response. That really helps when you're under a time deadline.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Earle T.

January 23rd, 2021

This is an excellent service. And very easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alfred D.

February 28th, 2023

The material was very usable and site was easy to navigate. Well worth the money. If I have similar needs, I'll ber back.

Thank you for your feedback. We really appreciate it. Have a great day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Herman B.

May 19th, 2022

Special Warranty Deed I can't seem to type all my info in the blank spaces. It won't allow me to type any more. Maybe you should consider either allowing typists to type more (leaving more space) or allowing more room to type more.

Thank you!