Lynn County Specific Power of Attorney for the Sale of Property Form

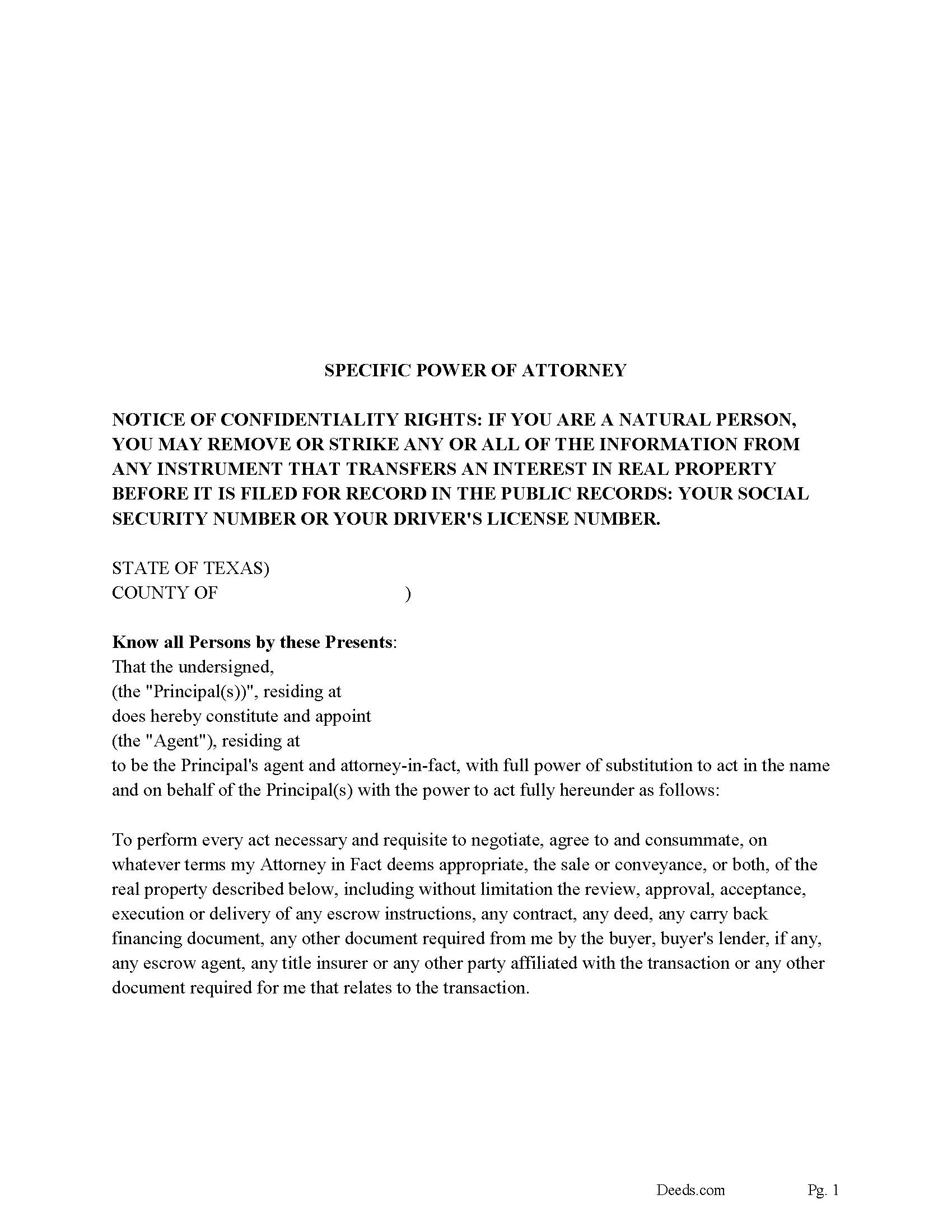

Lynn County Specific Power of Attorney

Fill in the blank form formatted to comply with all recording and content requirements.

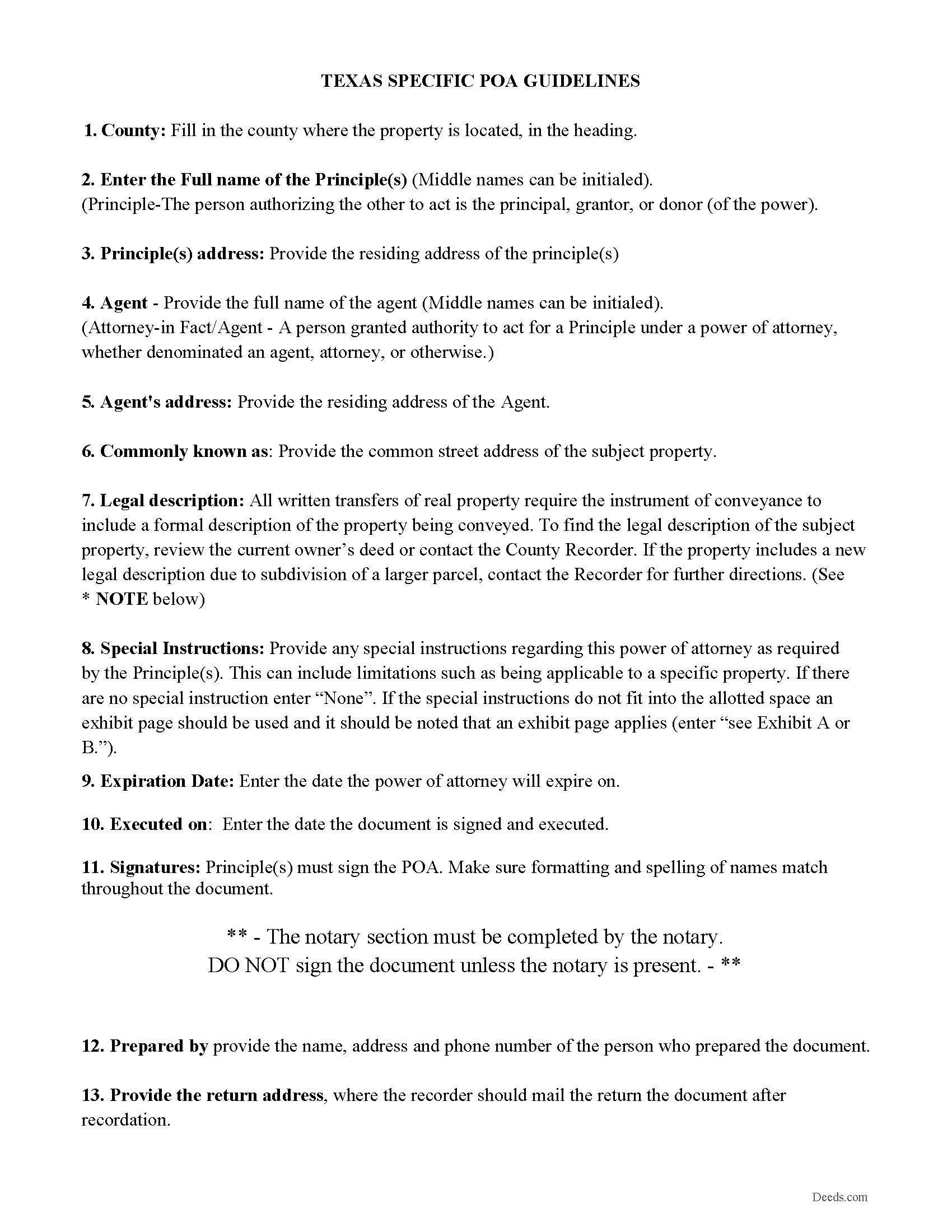

Lynn County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

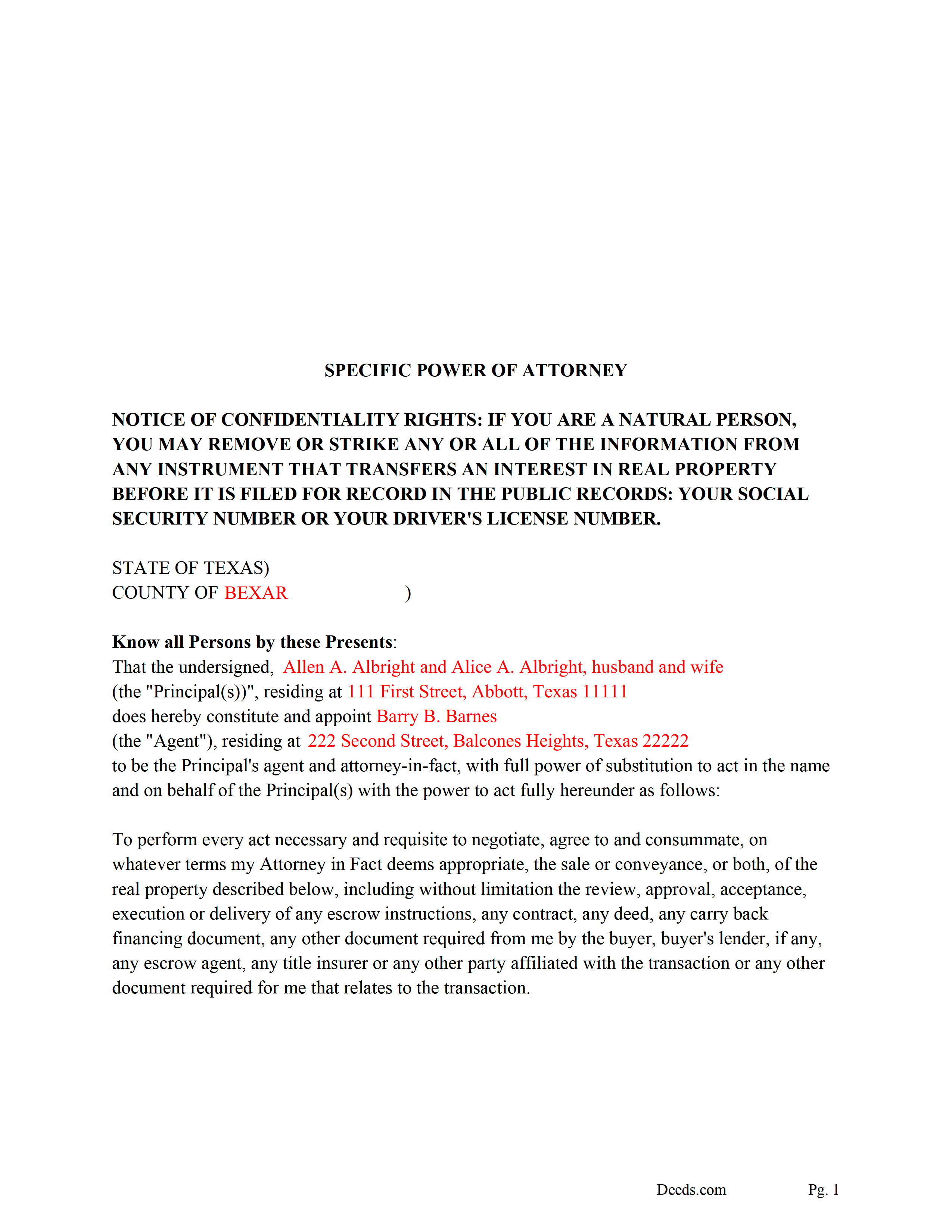

Lynn County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Lynn County documents included at no extra charge:

Where to Record Your Documents

Lynn County Clerk

Tahoka, Texas 79373

Hours: Monday - Friday 8:30am - 12:00 & 1:00 - 5:00pm

Phone: (806) 561-4750

Recording Tips for Lynn County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Lynn County

Properties in any of these areas use Lynn County forms:

- New Home

- Odonnell

- Tahoka

- Wilson

Hours, fees, requirements, and more for Lynn County

How do I get my forms?

Forms are available for immediate download after payment. The Lynn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lynn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lynn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lynn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lynn County?

Recording fees in Lynn County vary. Contact the recorder's office at (806) 561-4750 for current fees.

Questions answered? Let's get started!

This is a specific power of attorney for the sale of real property, in this form the principal(s) appoint an Agent to perform any tasks necessary to sell or convey a specific property. There is a "Special Instructions" section where the principle can further limit/define the agents powers. Since this document must be recorded it is formatted for county requirements and is governed by Texas laws.

This power of attorney is not affected by any subsequent disability or incapacity of the principal and shall be considered a "Durable Power of Attorney."

(Texas Specific POA Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Lynn County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Lynn County.

Our Promise

The documents you receive here will meet, or exceed, the Lynn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lynn County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

Geoffrey M.

February 17th, 2021

Very convenient online document recording with great and quick service. Thank you!

Thank you!

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Thi W.

May 3rd, 2019

Absolutely the easiest and fastest service ever!!! staff very helpful.

Thank you!

Florentes P.

January 20th, 2019

The form is so limited in space that I can not fit the vesting information as well as the real property information. The property information, I could put it as Exhibit A. which is not the usual way. Not happy.

Sorry to hear that you are not happy with the available space on the document you received. Per your request we have canceled your order. We do hope you are able to find a solution that meets your needs and the recording/statutory requirements of the document. Have a great day!

Nga C.

January 5th, 2022

I am so happy to discover the Deeds.com website. It is worth to pay the package fee and the recording fee for my beneficiary deed in AZ state. It is so convenient, I highly recommend everybody to use the service. Thank you and thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason B.

January 15th, 2022

You saved me $275.00 perfect! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

PETER C.

October 7th, 2020

The process was quick and simple to follow. Very efficient way to document Deeds.

Thank you!

Stan P.

November 16th, 2020

Great, covered all the legal area I needed to identify.

Thank you!

Cheryl S.

April 30th, 2021

quick response

Thank you!

Karen W.

October 18th, 2021

Great experience. Easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Altaray S.

January 14th, 2019

Really fast turn around time, and was provided exactly what I was looking for this time. This is my first experience with this site. It would have been cool to also get a document depicting/describing a property line, but like I said before, exactly what I was looking for this time.

Thank you so much for your feedback Altaray, we really appreciate it.

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

David B.

May 16th, 2024

Prompt review and submission of documents could be an appropriate tagline for this business. The attention to detail and rapid response makes the company a great go to for servicing needs related to deeds.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!