Shackelford County Statutory Durable Power of Attorney Form

Shackelford County Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Shackelford County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

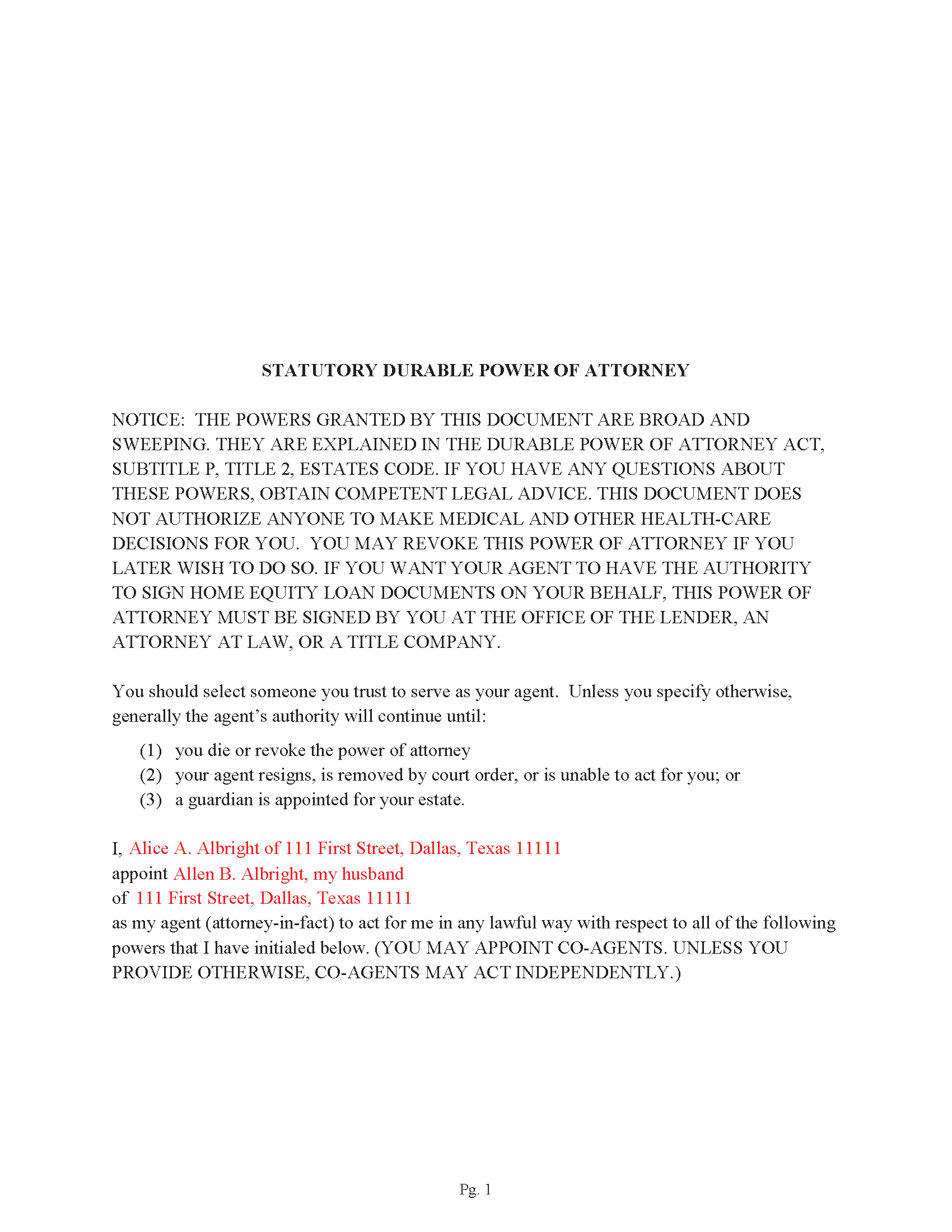

Shackelford County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Shackelford County documents included at no extra charge:

Where to Record Your Documents

Shackelford County Clerk

Albany, Texas 76430

Hours: 8:30am to 12:00 and 1:00 to 5:00pm M-F

Phone: (325) 762-2232 x3

Recording Tips for Shackelford County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Shackelford County

Properties in any of these areas use Shackelford County forms:

- Albany

- Moran

Hours, fees, requirements, and more for Shackelford County

How do I get my forms?

Forms are available for immediate download after payment. The Shackelford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shackelford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shackelford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shackelford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shackelford County?

Recording fees in Shackelford County vary. Contact the recorder's office at (325) 762-2232 x3 for current fees.

Questions answered? Let's get started!

This form allows for up to 3 Alternate/Successor Agents, formatted for County recording requirements in Texas.

Powers addressed:

(A) Real property transactions;

(B) Tangible personal property transactions;

(C) Stock and bond transactions;

(D) Commodity and option transactions;

(E) Banking and other financial institution transactions;

(F) Business operating transactions

(G) Insurance and annuity transactions;

(H) Estate, trust, and other beneficiary transactions;

(I) Claims and litigation;

(K) Benefits from social security, Medicare, Medicaid, or other governmental programs or civil or military service;

(L) Retirement plan transactions;

(M) Tax matters;

(N) Digital assets and the content of an electronic communication;

(Texas Durable POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Shackelford County to use these forms. Documents should be recorded at the office below.

This Statutory Durable Power of Attorney meets all recording requirements specific to Shackelford County.

Our Promise

The documents you receive here will meet, or exceed, the Shackelford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shackelford County Statutory Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Deborah G.

July 23rd, 2021

Absolutely wonderful customer service. I am very pleased with the service I received and highly recommend this to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra C.

December 8th, 2022

Not sure whether the two forms I printed will be helpful or not. Will find out when I go to a place for completion and to be notorized.

Thank you!

ROBERT B.

November 6th, 2020

The staff of DEEDS.COM is in a class of excellence all by themselves! From my own personal experience, I had multiple problems with some documents I was submitting. DEEDS.COM stayed with me and held my hand through the project until it was completed! I have never met the staff at DEEDS, but their personal service & professionalism make me feel like part of the DEEDS Family! If I ever need legal documents submitted to government agencies nationwide ever again, THE ONLY STOP ONLINE I WILL MAKE WILL BE DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

ziad k.

June 4th, 2024

FIRST TIME USER EXCELENT SERVICE.

Thank you for your feedback. We really appreciate it. Have a great day!

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lester A.

May 29th, 2020

Couldnt have been easier. Docs recorded the next day!

Thanks Lester, glad we could help.

Loren H.

December 11th, 2022

I really appreciate your forms according to South Dakota laws and statues. Your forms allow me to effectively do estate planning without extensive legal expenses. The "Revocable Transfer of Death Deed" is perfect to protect against extensive probate problems for seniors in retirement. Thank you and May God Bless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gabriela C.

August 2nd, 2022

Easy

Thank you!

Jane E.

November 4th, 2020

The form was incompatible with my son's new computer. I do not have a printer. We did use your form to type a copy into "word" so he could print it.

Thank you!

Nancy C.

April 3rd, 2024

Easy to use, found what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Alana G.

March 26th, 2021

I was very pleased. It was the form I needed. I was getting discouraged by companies that wanted me to sign up for monthly payments just to get the one form I needed. I prefer your system of paying for what I get. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Rebecca C.

January 26th, 2021

Great service ! Hawaii is not a "forms state" so unfortunately the public has no way to get templates on our local gov site but deeds.com to the rescue. The template was affordable and easy to use and successfully recorded. Great to use when you don't need to involve title or attorneys for simple deed changes, thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Jose G.

April 12th, 2022

One of the best downloads ever. Very easy to do. For the price, well worth it. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Donna L.

August 15th, 2023

Documents were easy to complete!

Thank you for your feedback. We really appreciate it. Have a great day!