Panola County Transfer on Death Deed Form

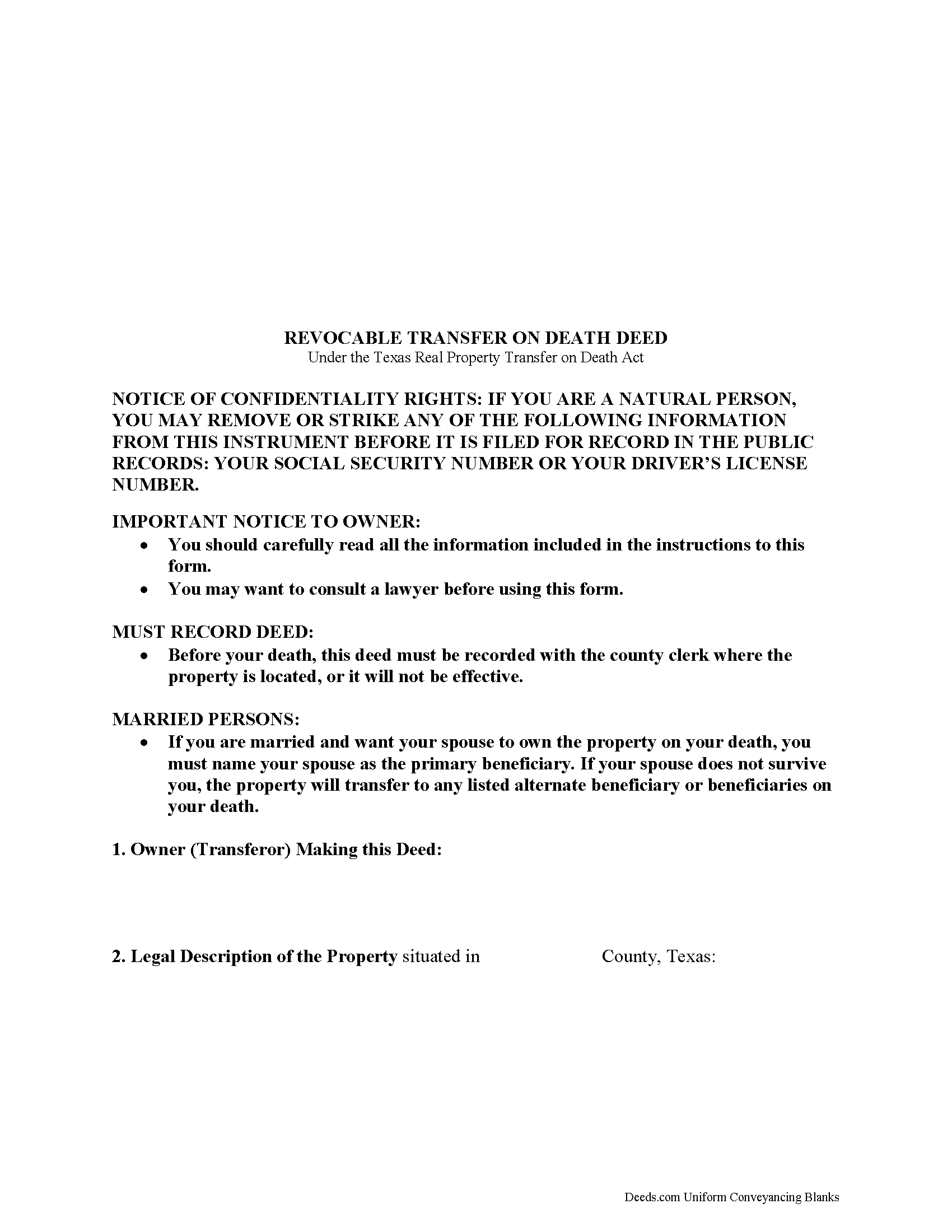

Panola County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

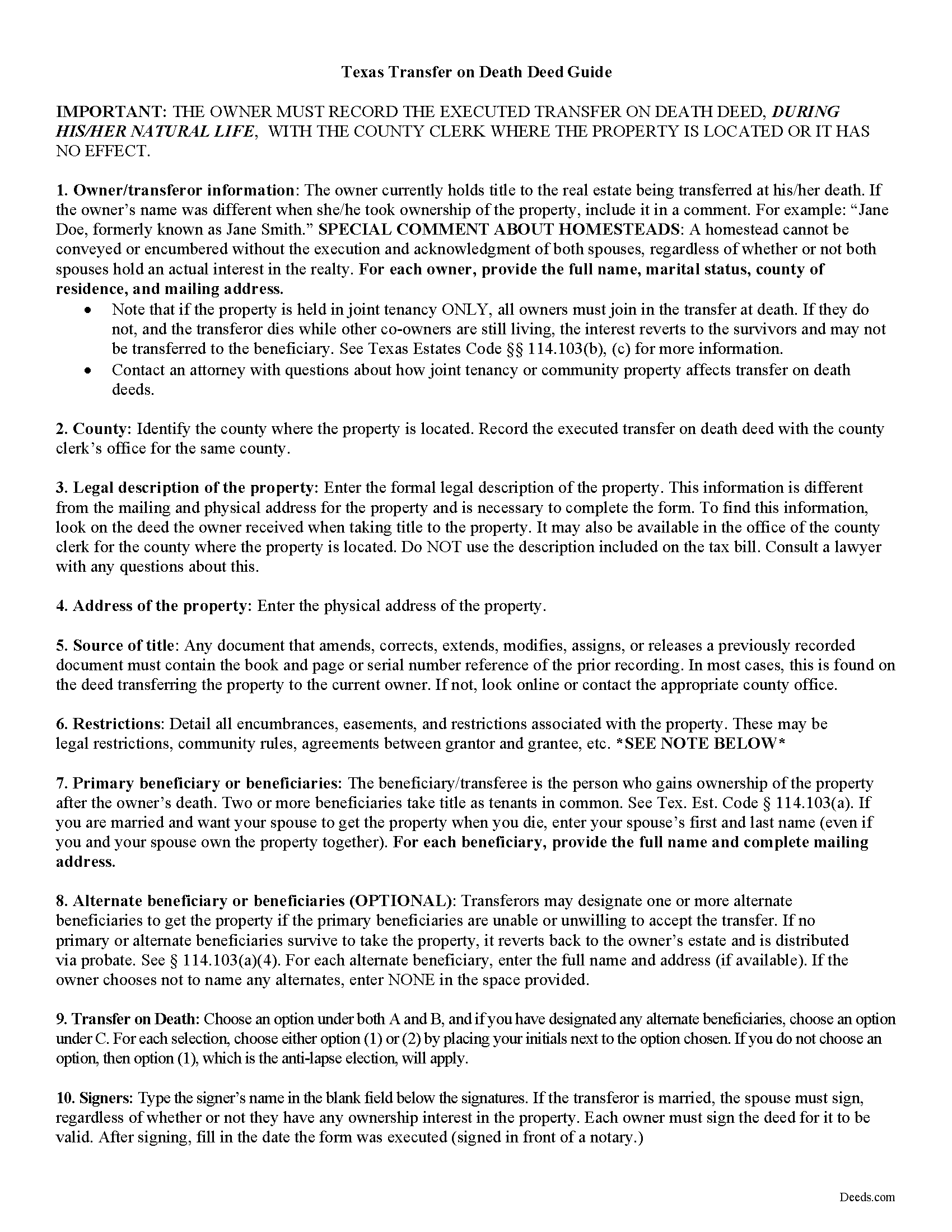

Panola County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

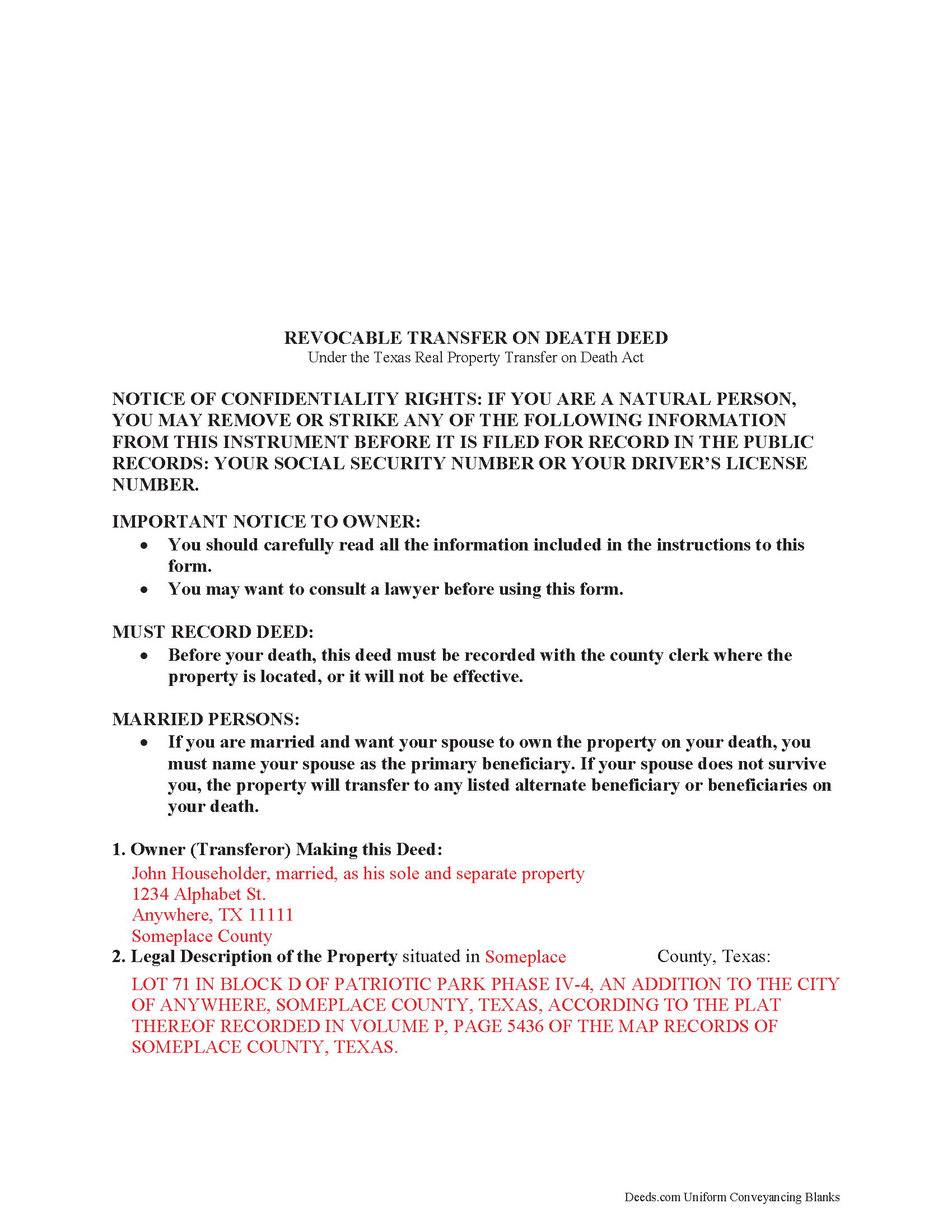

Panola County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Panola County documents included at no extra charge:

Where to Record Your Documents

Panola County Clerk's Office

Carthage, Texas 75633

Hours: Monday - Friday 8:00am - 5:00pm / sometimes closed 12:00 to 1:00

Phone: (903) 693-0302

Recording Tips for Panola County:

- Bring extra funds - fees can vary by document type and page count

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Panola County

Properties in any of these areas use Panola County forms:

- Beckville

- Carthage

- Clayton

- De Berry

- Gary

- Long Branch

- Panola

Hours, fees, requirements, and more for Panola County

How do I get my forms?

Forms are available for immediate download after payment. The Panola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Panola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Panola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Panola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Panola County?

Recording fees in Panola County vary. Contact the recorder's office at (903) 693-0302 for current fees.

Questions answered? Let's get started!

On September 1, 2015, owners of real property in Texas gained access to a useful estate planning tool: the statutory transfer on death deed (TODD). Modeled after the Uniform Real Property Transfer on Death Act and located at Chapter 14 of the Texas Estates Code, the Texas Real Property Transfer on Death Act governs the use of transfer on death deeds in the State of Texas.

IMPORTANT: TRANSFER ON DEATH DEEDS AND ASSOCIATED REVOCATIONS MUST BE RECORDED WHILE THE OWNER IS ALIVE OR THEY HAVE NO EFFECT.

Requiring the same level of competency as needed for a contract ( 114.054), transfer on death deeds are nontestamentary (not using a will) instruments. They allow transferors/owners to retain absolute ownership of and control over their land during their lives -- they may sell, mortgage, rent, or otherwise use the real estate as they desire, with no penalty for waste or obligation to notify the beneficiaries ( 114.101).

To be lawfully executed, a TODD must fulfill three minimum standards, set out in 114.055:

* Meet all state and local standards for recordable deeds, including appropriate content and format

* State that the transfer will take place at the owner's death

* Be recorded, during the owner's natural lifetime, in the deed records in the county clerk's office for the county where the property is located.

By recording the executed TODD, property owners may also take advantage of one of the most unique aspects of these instruments: revocability ( 114.052). Revocability is possible for two primary reasons: there is no obligation to notify the beneficiaries about the potential future interest they stand to gain when the owner dies; and these conveyances generally do not involve consideration (something of value given in exchange for the property) ( 114.056).

The statute provides several methods for revoking a TODD. The owner may execute and record a new TODD, cancelling the prior deed and designating a different beneficiary. The owner may also sell the real estate to someone else using a standard inter vivos conveyance such as a warranty deed or a quitclaim deed that contains a comment revoking the TODD. A third option uses a revocation form, which, after recording, cancels all previously recorded TODDs ( 114.057).

Transfer on death deeds convey title with no warranties of title, and subject to all agreements, encumbrances, and other interests in place at the time of the owner's death ( 114.104(a)). Two or more beneficiaries take ownership in equal and undivided shares with no right of survivorship ( 114.103(a)(3)).

In much the same way that owners may wish to change or revoke a beneficiary designation, sometimes beneficiaries are unable or unwilling to accept the property after the owner dies. To address this need, beneficiaries may disclaim all or part of the interest in land ( 114.105).

Under 114.057(b), the recorded TODD is not affected by information contained within the owner's will. Even so, best practices dictate that an efficient estate plan does not contain conflicting directions, so make sure that the documents work together to reinforce the owner's intent.

Overall, TODDs offer a useful, flexible estate planning tool to owners of real property in Texas. Before committing to a TODD, consider the effect it will have on the comprehensive estate plan as well as eligibility for income-and/or-asset-based benefits. Each situation is unique, so for complex circumstances or additional questions, contact a local attorney.

(Texas Transfer of Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Panola County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Panola County.

Our Promise

The documents you receive here will meet, or exceed, the Panola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Panola County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Cathern S.

January 23rd, 2020

Thanks much for your good help. Was a pleasure to use your help and was simple to use. Thanks much.

Thank you!

Marcia G.

June 24th, 2020

I am so happy with this service. I can not tell you. In about 30 minutes my records were recorded. Excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Viviana Hansen M.

March 3rd, 2024

I was thrilled that I could execute the paperwork for a lady bird deed here in Florida ! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Brandi P.

December 9th, 2020

The service itself is great, but the deed sample I ordered wasn't as accurate as I'd hoped. I needed to correct and resubmit. Not a huge deal, but a bit of an inconvenience.

Thank you for your feedback. We really appreciate it. Have a great day!

Ramona C.

October 28th, 2020

Easy to use and the sample really helped.

Thank you!

Jorge O.

June 11th, 2019

Everything work excellent. Don't think any update is needed at this time. Thank you

Thank you!

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!

Elizabeth C.

September 23rd, 2020

Very happy, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Louise D.

October 21st, 2022

It was easy to complete the form and I appreciated the sample form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim A.

January 26th, 2022

Your website is user friendly and when I brought up issues they were quickly addressed. thank you so much! jim atkinson

Thank you!

STANLEY F.

March 25th, 2019

Forms were spot on and able to save over $100 by not going to an attorney to complete the same documents. There were templates on how forms are supposed to be completed. You just need a notary to sign.

Thank you Stanley, we really appreciate your feedback.

Sylvia H.

February 8th, 2024

Thank you so very much for such an easy experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Any S.

January 11th, 2019

I was looking for realty transfer or deed in the name of ***** **** and could never find the list of realty transfers.

Thank you for the feedback Any. We do not offer searches by name, only by property.