Harris County Trustee Deed Form

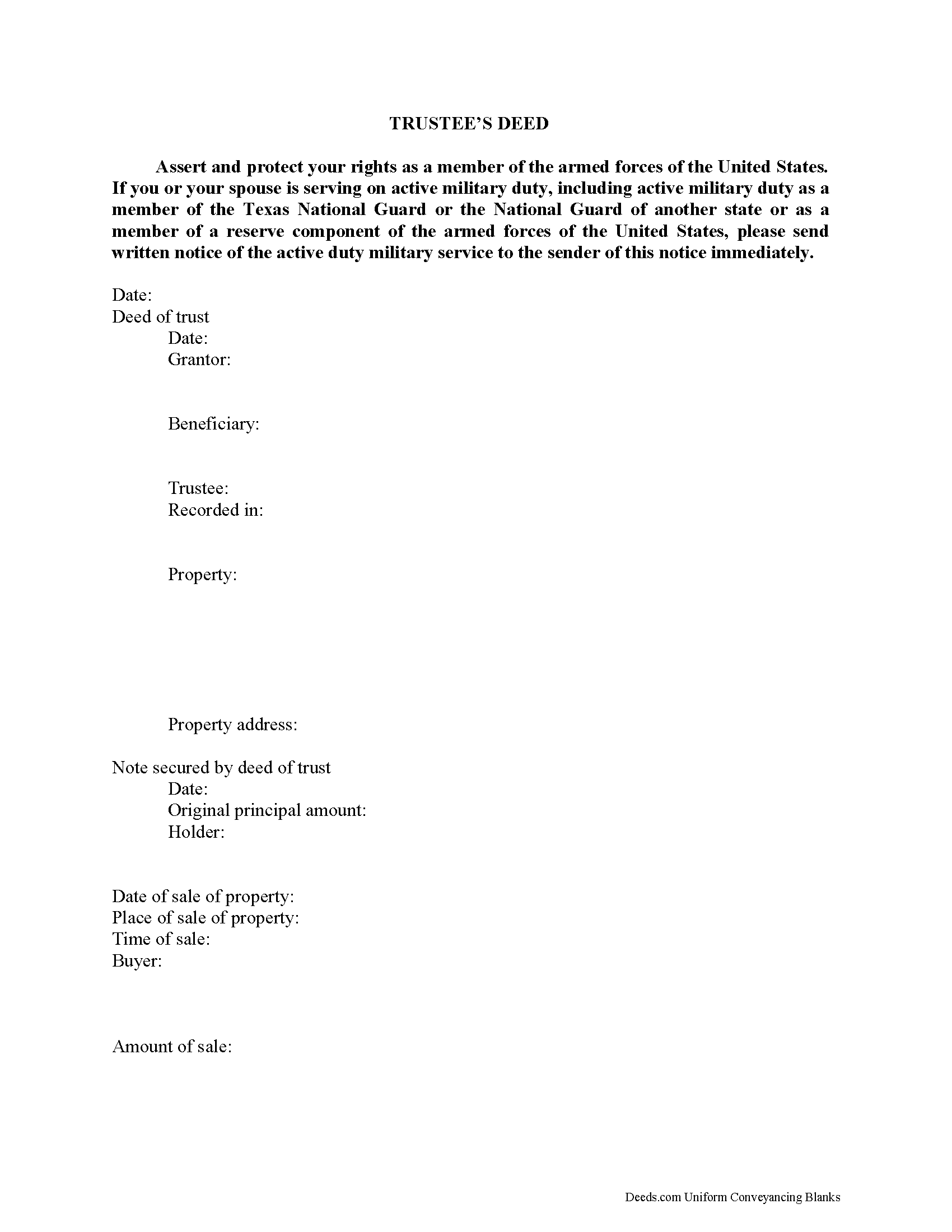

Harris County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

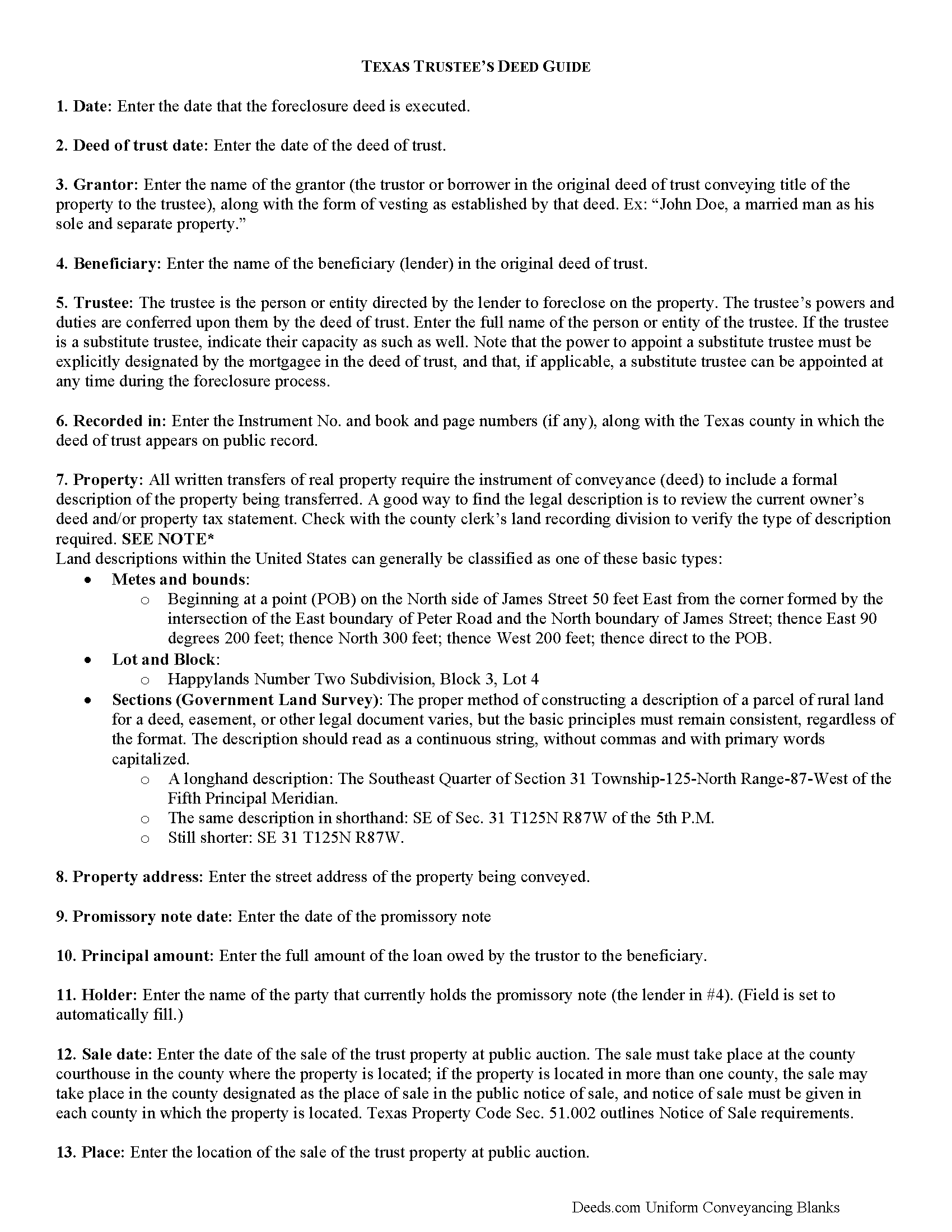

Harris County Trustee Deed Guide

Line by line guide explaining every blank on the form.

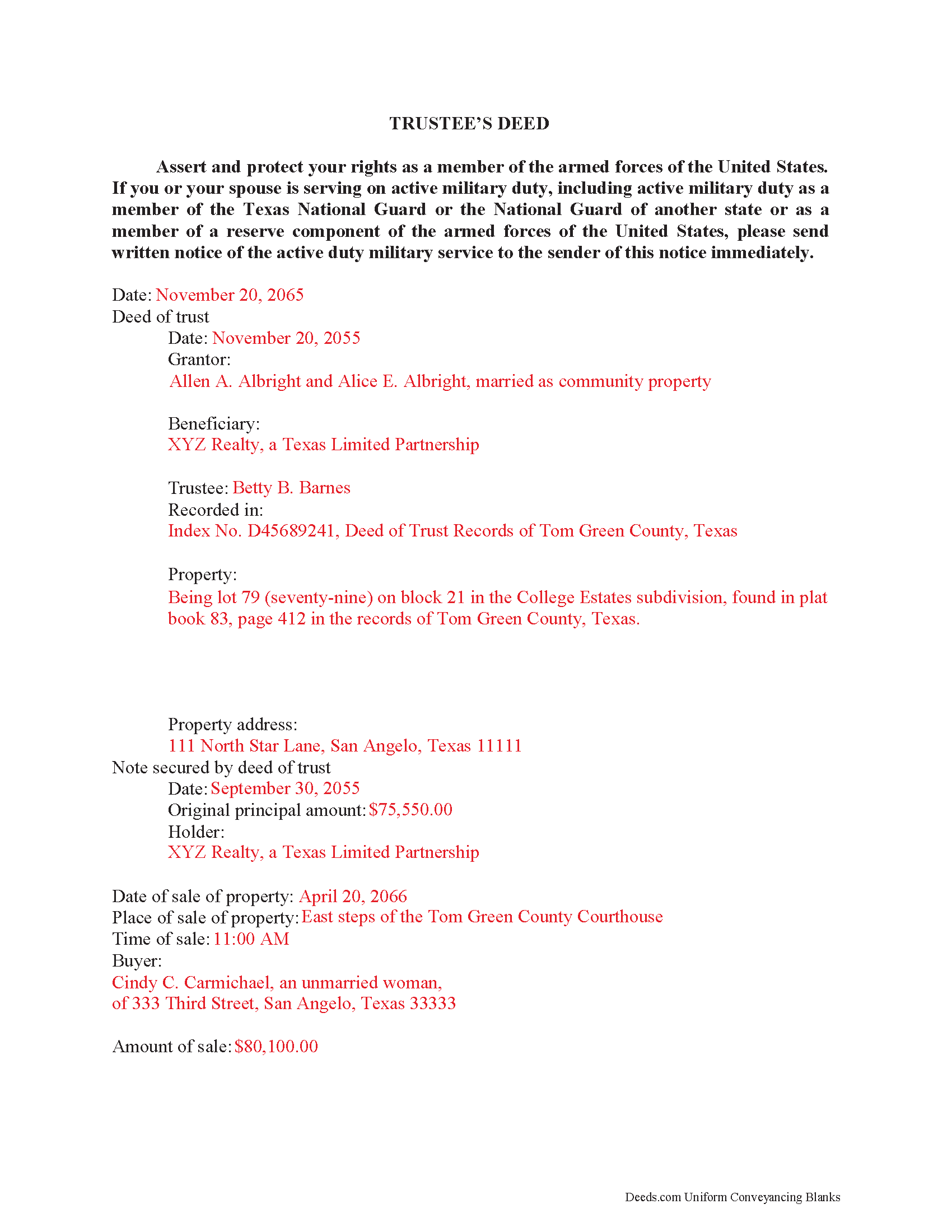

Harris County Completed Example of a Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Harris County documents included at no extra charge:

Where to Record Your Documents

Main Office

Houston, Texas 77002 / 77251-1525

Hours: 8:00 - 4:30 M-F

Phone: (713) 755-6439

Recording Tips for Harris County:

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Harris County

Properties in any of these areas use Harris County forms:

- Alief

- Barker

- Baytown

- Bellaire

- Channelview

- Crosby

- Cypress

- Deer Park

- Galena Park

- Highlands

- Hockley

- Houston

- Huffman

- Hufsmith

- Humble

- Katy

- Kingwood

- La Porte

- North Houston

- Pasadena

- Seabrook

- South Houston

- Spring

- Tomball

- Waller

- Webster

Hours, fees, requirements, and more for Harris County

How do I get my forms?

Forms are available for immediate download after payment. The Harris County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harris County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harris County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harris County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harris County?

Recording fees in Harris County vary. Contact the recorder's office at (713) 755-6439 for current fees.

Questions answered? Let's get started!

The majority of Texas foreclosures are non-judicial. They require a trustee's deed (alternately called a foreclosure deed or substitute trustee's deed, if applicable) to convey foreclosed property at a trustee's sale.

Trustee's deeds identify three primary parties: the grantor, who is the trustee in the deed of trust; the beneficiary, who is the lender and grantor in the deed of trust; and the buyer, who is the grantee and purchaser of the property at the foreclosure sale.

In a deed of trust, a trustee (the grantee under the original deed of trust instrument), appointed by the lender, holds the deed to the property as collateral for a loan to be repaid by the borrower (the trustor under the deed of trust). If the borrower fails to fulfill the terms of the deed of trust, the lender can direct the trustee to enforce the terms of the deed or begin the foreclosure process. This starts with a notice mailed to the borrower, now debtor, of the intent to accelerate. Notice of sale is also recorded and posted in the county where the subject property is located, as directed by Tex. Prop. Code 51.002 et seq.

A trustee's deed may sometimes be called a substitute trustee's deed, but it is functionally the same thing. The lender may appoint a substitute trustee if the original trustee is unable to administer the sale of property at public auction. A substitute trustee is a person named by the lender under the terms of the security instrument (deed of trust) to exercise the power of sale (Tex. Prop. Code 51.0001(7)). The power to appoint a substitute trustee must be expressly designated by the lender in the deed of trust, otherwise the appointment is invalid. A substitute trustee can be appointed at any time during the foreclosure process, so long as notice of the appointment is recorded. The foreclosing trustee, regardless, is generally an attorney for the lender. The trustee should identify in the deed whether they are serving as a trustee or substitute.

(Texas Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Harris County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Harris County.

Our Promise

The documents you receive here will meet, or exceed, the Harris County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harris County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Steven T.

August 1st, 2022

I needed the deed forms for setting up our living trust. It appears this will do the trick! Steve

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Danny H.

May 15th, 2020

You should list the address of where to mail the forms, so we don't have to look it up. It would make things a little easier.Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Kristina R.

March 27th, 2020

Fast and friendly service. I will use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara S.

March 11th, 2021

I found your site easy to use, though I would prefer an option to download to MWords but Adobe works well. The cost is very, very reasonable and provides documents I didn't know were needed. I would recommend this to anyone trying to deal with legal documents.

Thank you!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

John N.

July 19th, 2020

Very easy to navigate.

Thank you!

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Barry B.

July 16th, 2021

Convenient and easy.

Thank you!

Allen H.

April 30th, 2021

Your program was invaluable to us, I used it for my Mom's estate and when she passed the transition was seamless and no probate was involved. I am going to use this for myself to transfer my property over to my children in upon my death. Can't say enough positive things about it. Thanks, Allen

Thank you!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

David C.

December 14th, 2018

I needed to file an affidavit of succession. I downloaded the forms and filled in the blanks. The instructions and example sheet were very helpful. I got the paper recorded with the county today and all went smoothly. Good product.

Thank you for your feedback. We really appreciate it. Have a great day!

Melissa S.

April 13th, 2020

Not what I can use.

Thank you!