Young County Unconditional Waiver on Progress Payment Form

Young County Unconditional Waiver on Progress Payment Form

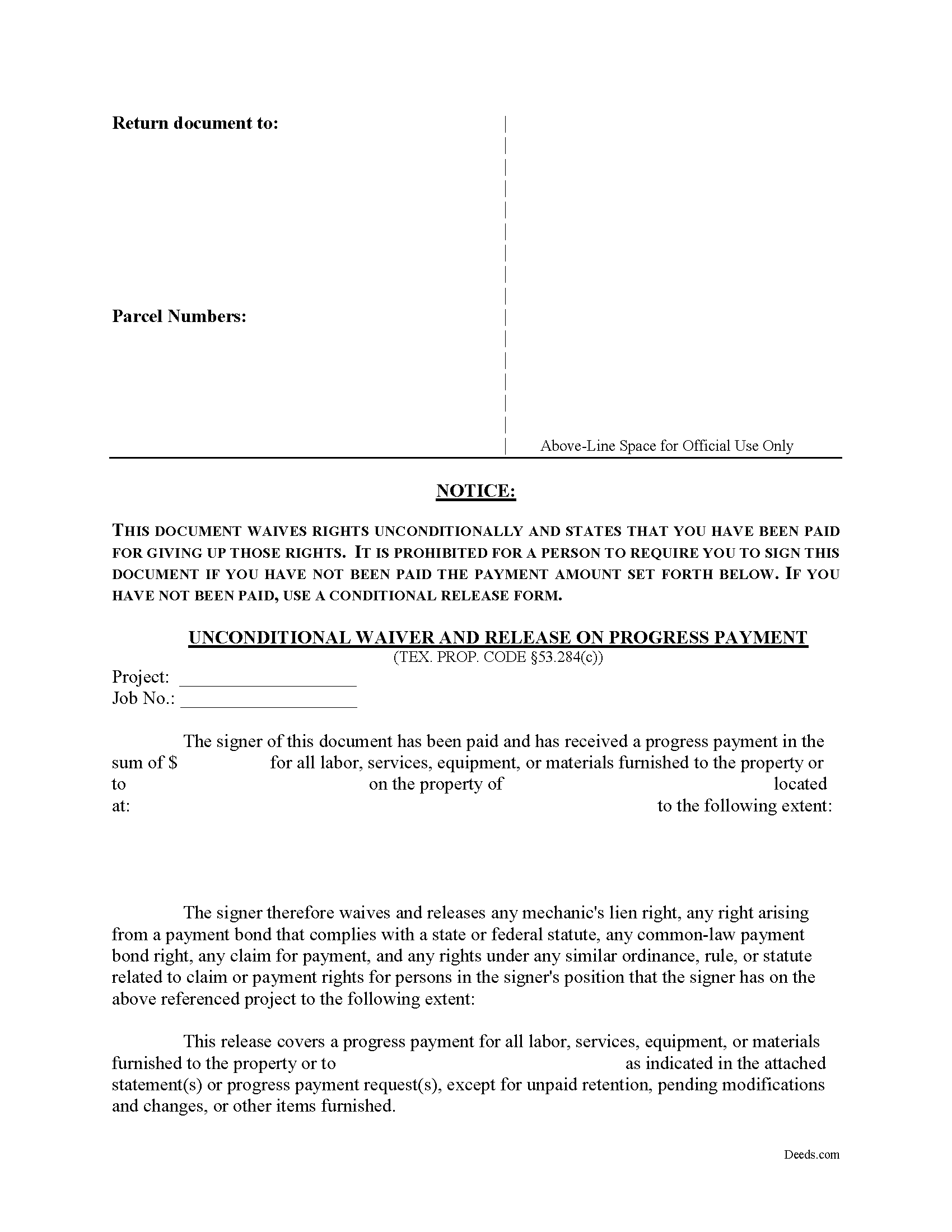

Fill in the blank Unconditional Waiver on Progress Payment form formatted to comply with all Texas recording and content requirements.

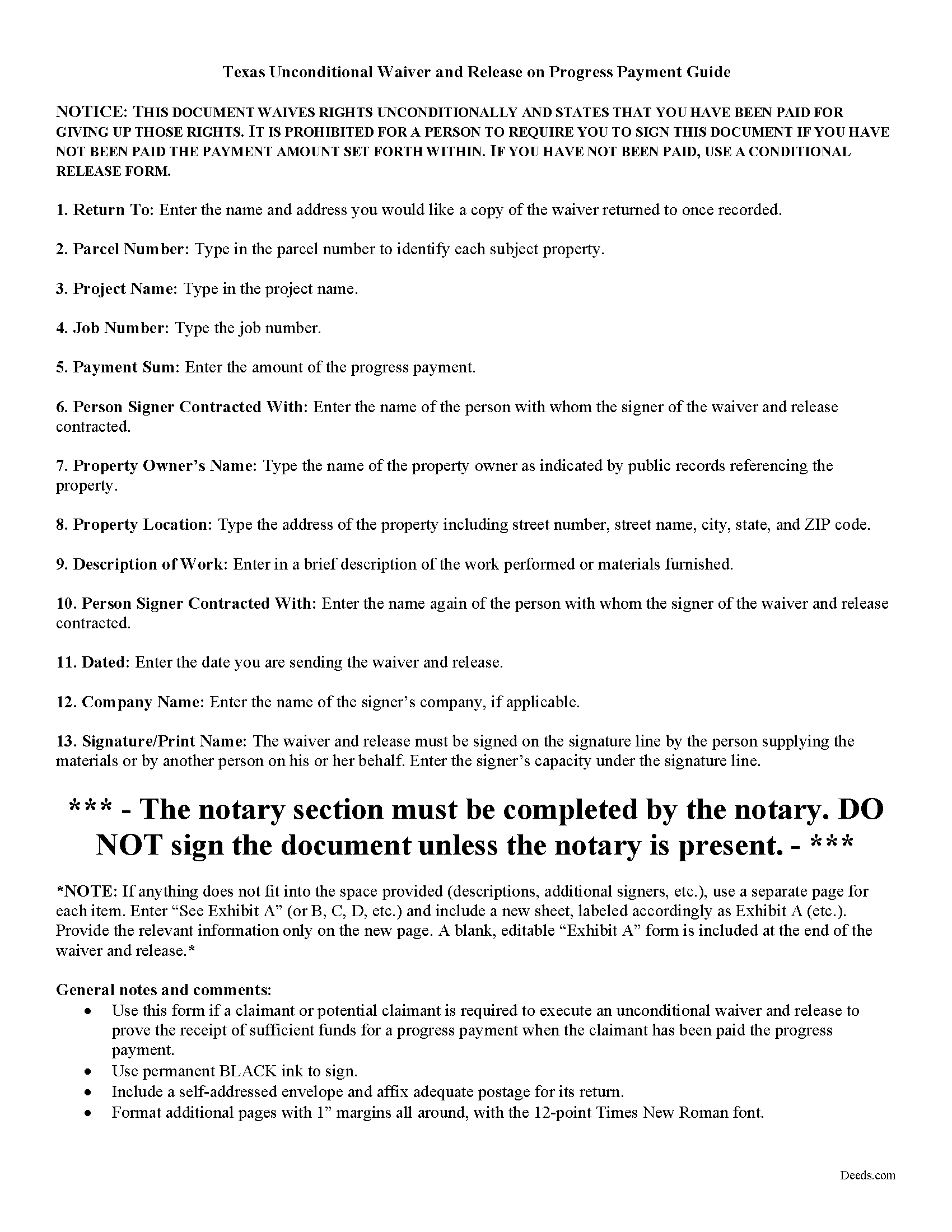

Young County Unconditional Waiver of Progress Payment Guide

Line by line guide explaining every blank on the form.

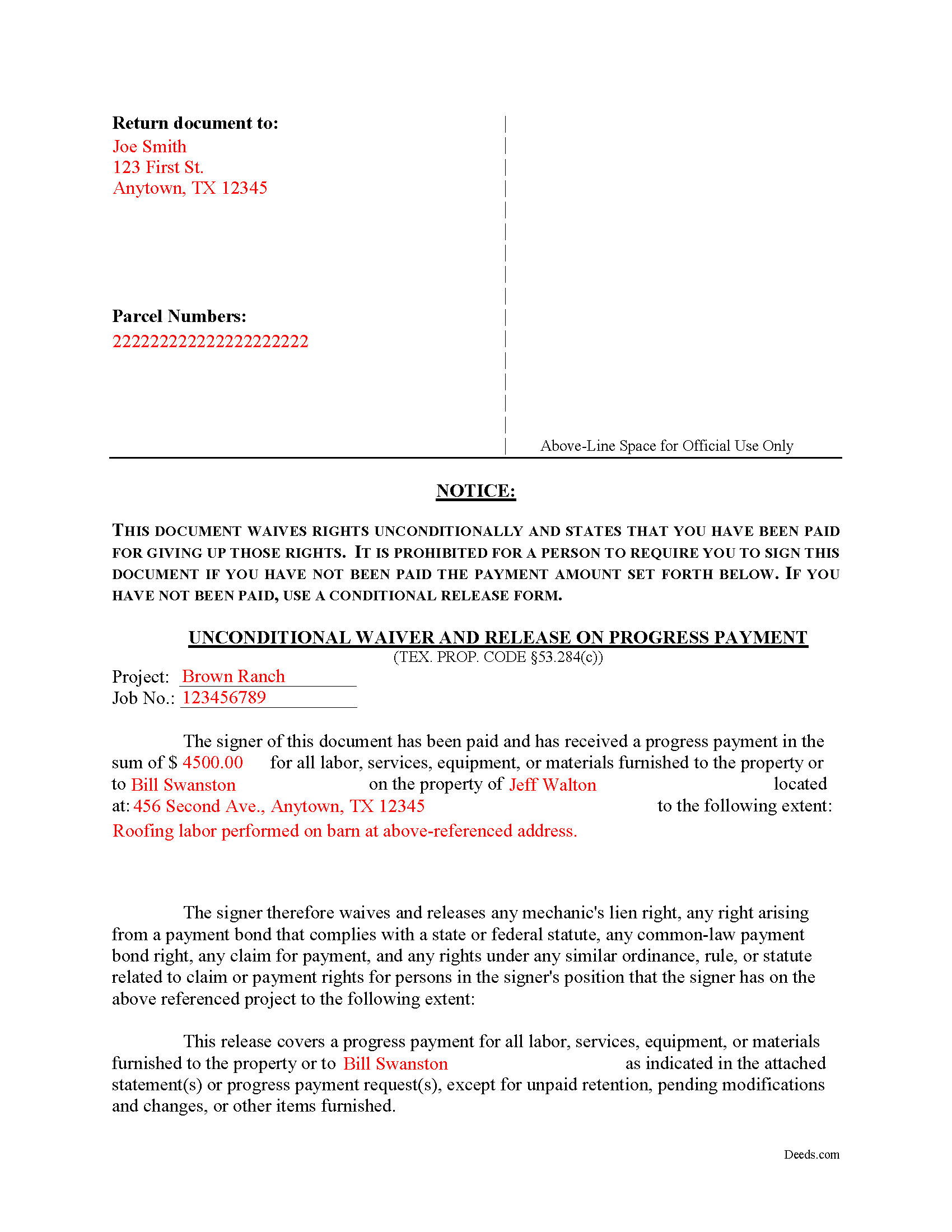

Young County Completed Example of the Unconditional Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Young County documents included at no extra charge:

Where to Record Your Documents

Young County Clerk

Graham, Texas 76450

Hours: Monday-Friday 8:30am - 5:00pm

Phone: (940) 549-8432

Recording Tips for Young County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Young County

Properties in any of these areas use Young County forms:

- Graham

- Loving

- Newcastle

- Olney

- South Bend

Hours, fees, requirements, and more for Young County

How do I get my forms?

Forms are available for immediate download after payment. The Young County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Young County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Young County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Young County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Young County?

Recording fees in Young County vary. Contact the recorder's office at (940) 549-8432 for current fees.

Questions answered? Let's get started!

A lien waiver is used by a lien claimant or potential claimant to forfeit his or her right to a lien upon a progress payment or final payment. The waiver can be conditional, meaning that the payment must clear the bank before the lien is released, or unconditional, meaning the lien is released upon the recording of the waiver regardless of whether or not the claimant is ever actually paid.

A waiver and release given by a claimant or potential claimant is unenforceable unless it substantially complies with the applicable form described in Sec. 53.284 of the Texas Property Code.

The four types of lien waivers in the State of Texas include:

- Conditional Waiver and Release on Progress Payment;

- Unconditional Waiver and Release on Progress Payment;

- Conditional Waiver and Release on Final Payment; and

- Unconditional Waiver and Release on Final Payment

Let's say a contractor reaches an agreed-upon point a project where she recorded a lien. The owner wants the lien released up to that point, and writes a check for the amount due on the work completed. The contractor offers an unconditional waiver and release on progress payment, which protects her interests in case the bank refuses to honor the check. As long as the check is good, the lien gets released up to the date of the progress payment. Otherwise, the claimant retains the lien until the responsible party finds another way to pay the bill.

Texas lien law requires an actual payment before an owner may request an unconditional waiver. A person may not require a claimant or potential claimant to execute an unconditional waiver and release for a progress payment or final payment amount unless the claimant or potential claimant received payment in that amount in good and sufficient funds. See Sec. 53.283.

Under Sec. 53.284(c), if a claimant or potential claimant is required to execute an unconditional waiver and release in exchange for or to induce a progress payment, the waiver becomes effective immediately, up to the point set out in the document.

All unconditional waivers must be titled as such and contain the following required statutory warning: "This document waives rights unconditionally and states that you have been paid for giving up those rights. It is prohibited for a person to require you to sign this document if you have not been paid the payment amount set forth below. If you have not been paid, use a conditional release form."

Further, the waiver identifies the parties, the project, the work and/or materials provided, and relevant dates and payment amounts. Sign it in front of a notary and submit it to the local recording office.

In summary, a lien waiver is an important tool, but take care to use the proper form. The wrong choice can lead to a loss of lien rights before receiving payment. Each case is unique, and Texas lien law can be complicated. Contact an attorney for complex situations, with questions about waivers, or any other issues related to mechanic's liens.

Important: Your property must be located in Young County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver on Progress Payment meets all recording requirements specific to Young County.

Our Promise

The documents you receive here will meet, or exceed, the Young County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Young County Unconditional Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Dennis O.

August 22nd, 2020

Everything I needed plus more. Great service!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!

Evelyn R.

July 16th, 2020

Filing my deed through your service was great. All directions were clear and specific; it was very easy to upload the documents and most of all feedback from your office was professional and very timely. You service was excellent. Thank you!! Thank you so very much!!

Thank you for your feedback. We really appreciate it. Have a great day!

Tyrone L.

April 24th, 2025

Great time saver fast service

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

NormaJean Q.

July 4th, 2021

Thank you, thie was very helpful. I did find the forms I needed.Very easy to use.,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Deb F.

July 16th, 2022

The county clerk accepted your mineral deed. It was a blessing finding your deed and instructions for filling it out online. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Sherry F.

January 5th, 2019

Good product and service.

Thank you!

Robert D.

December 25th, 2020

I was trying to register a financial statement (non real estate document). There was no link or statement on the home page to indicate that this could be done. All I had to do was to create an account, name and then upload the document. It took me over a day and several phone calls to the local deed recording office to try to figure this out. A simple link or statement to this effect would have saved me a lot of time

Thank you for your feedback. We really appreciate it. Have a great day!

Steven S.

December 31st, 2021

Accurate and informative, great site for deed forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph H.

October 22nd, 2022

They must have busy when I applied. The screen said it should be done in under10 mins unless heavier traffic. I was a little nervous because of a time deadline. It was completed in 45 mins and for under $30 it was worth every penny to have my deed details at my fingertips. So I give it a 5 on ease of use and quick handling. You can get it done less expensively, but great in a time crunch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald H.

April 17th, 2020

Easy to use and very quick turn around ... Very satisfied with ease of use and services provided ...

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda M.

November 9th, 2021

I am very pleased with my purchase of the Affidavit Death of Joint Tenant form. I previously purchased this form from the leading providing of DIY legal forms and it was rejected by the Registrar in my state. I then had to start over. Plus I needed a form that would show me a completed example and give me line-by-line instructions. Deeds.com filled the bill perfectly. Their website also let me know the last date the form was updated.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!