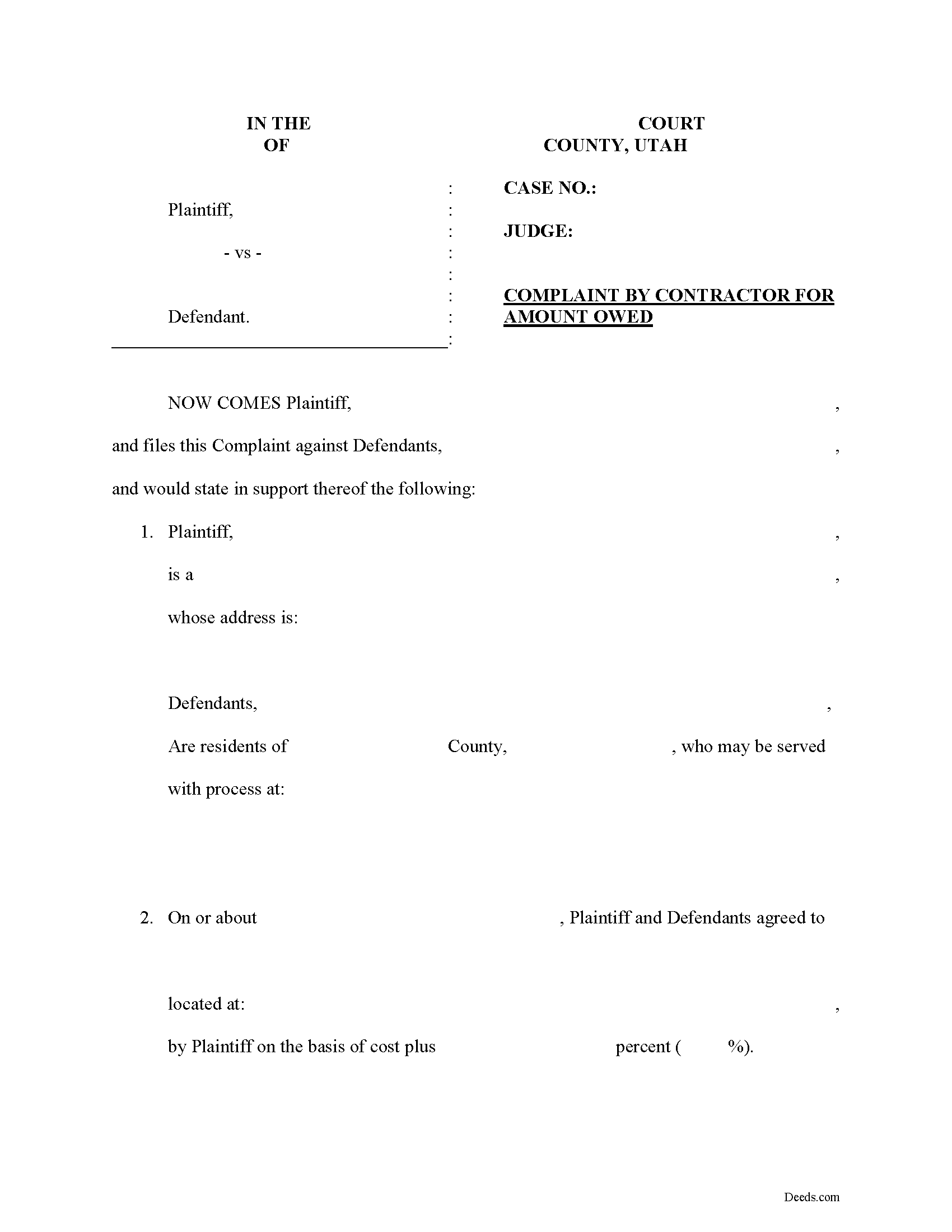

Cache County Complaint for Amount Owed Form

Cache County Complaint for Amount Owed Form

Fill in the blank Complaint for Amount Owed form formatted to comply with all Utah recording and content requirements.

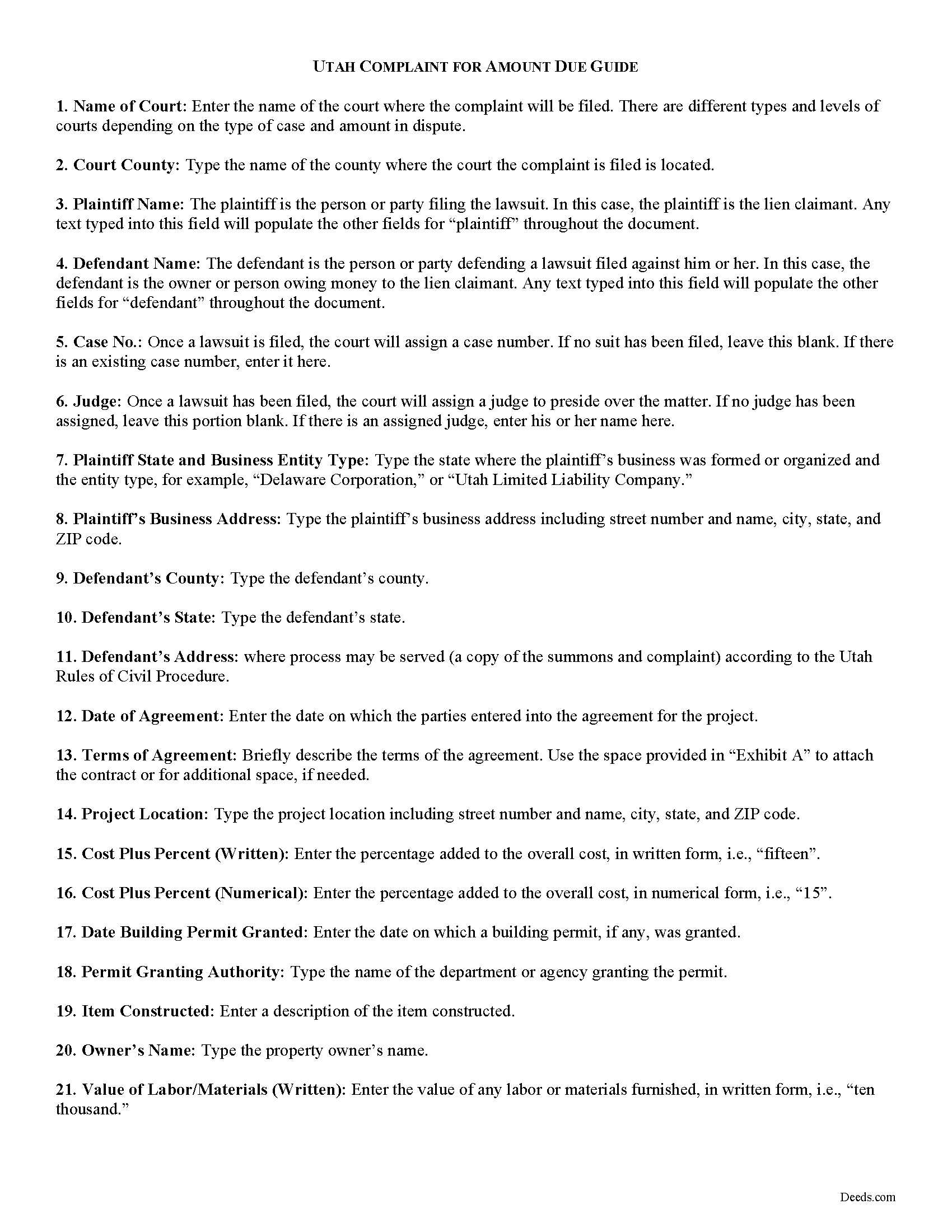

Cache County Complaint for Amount Owed Guide

Line by line guide explaining every blank on the form.

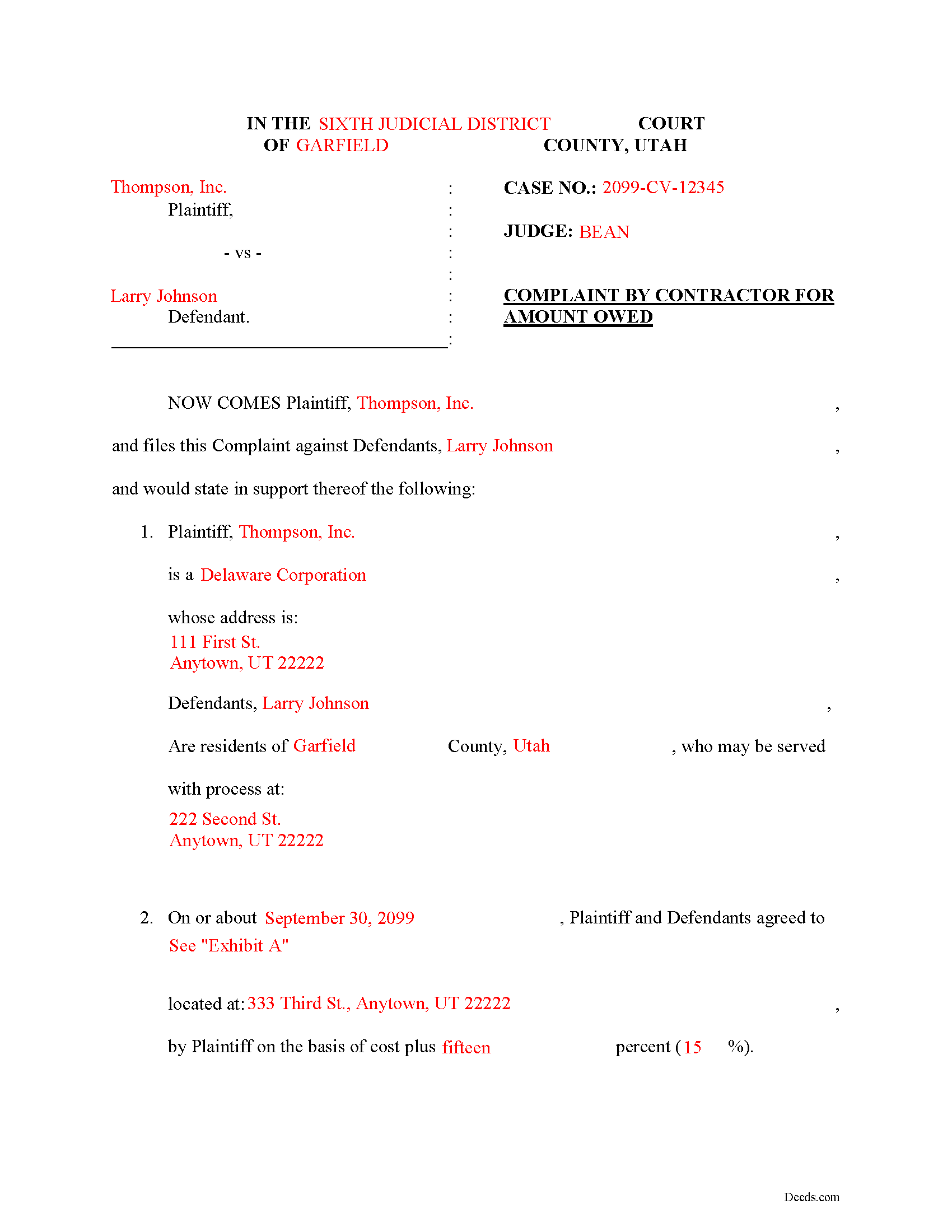

Cache County Completed Example of the Complaint for Amount Owed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Cache County documents included at no extra charge:

Where to Record Your Documents

Cache County Recorder

Logan, Utah 84321

Hours: 8:00 to 5:00 M-F

Phone: (435) 755-1530

Recording Tips for Cache County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Cache County

Properties in any of these areas use Cache County forms:

- Cache Junction

- Clarkston

- Cornish

- Hyde Park

- Hyrum

- Lewiston

- Logan

- Mendon

- Millville

- Newton

- Paradise

- Providence

- Richmond

- Smithfield

- Trenton

- Wellsville

Hours, fees, requirements, and more for Cache County

How do I get my forms?

Forms are available for immediate download after payment. The Cache County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cache County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cache County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cache County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cache County?

Recording fees in Cache County vary. Contact the recorder's office at (435) 755-1530 for current fees.

Questions answered? Let's get started!

Suing to Enforce a Utah Construction Lien

In Utah, mechanic's liens are governed under Title 38, Chapter 1A of the Utah Code.

Once a construction lien is in place, lien claimants must sue to foreclose on the lien in order liquidate any assets (turn them into cash). The lawsuit is a last resort, used after the claimant has exhausted all other options to induce payment or action on the contract.

Lawsuits are started by filing a complaint. A complaint sets forth the cause of action and specific allegations by way of a short and plain statement outlining the facts that make up the claim (such as a breach of contract, use of services without payment, etc.). It identifies the parties; the location and nature of the work or improvement; relevant dates, fees, and payments; and any other information necessary for the specific case. The complaint also asks the court for the type of relief (usually money but other grounds such as cancelling a contract because the other party failed to live up to their part are acceptable remedies).

Contact an attorney before filing a complaint. View this as money well spent, because lawsuits involve multiple steps, and mistakes could be fatal to the case and reduce any potential recovery.

File the complaint in the court of the county where the property is located (and where the lien was originally filed). Ensure all applicable costs are paid and any other forms such as a summons are properly completed as well.

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please contact a Utah attorney with any questions regarding construction liens or suing to enforce a lien.

Important: Your property must be located in Cache County to use these forms. Documents should be recorded at the office below.

This Complaint for Amount Owed meets all recording requirements specific to Cache County.

Our Promise

The documents you receive here will meet, or exceed, the Cache County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cache County Complaint for Amount Owed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Dennis O.

August 22nd, 2020

Everything I needed plus more. Great service!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald B.

July 8th, 2020

Simple to use, download, fill-in and print.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARIA G.

July 5th, 2021

I tried 3 local attorneys and got no where , wrong information, to busy and another one was very rude. One said he'd do it then didn't. I was so stressed and tried a different online form company advertising an in person attorney within hours. They did call back but gave me the wrong answer. I needed a form used in NC and knew about it from the clerk of the court. The deadline was approaching, I looked one more time and found Deeds.com. They have the form and the much need instructions and for less than $30.00. I am so pleased and also relived!

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Beaugwynn Wigley S.

October 26th, 2021

Thanks so much for all your help! That was painless.

Thank you!

ruth l.

January 6th, 2021

I found this sight very helpful. All the information that one needs to file a quit claim deed. thank you so much.

Thank you!

Petti V.

February 15th, 2022

Your site was so easy to use. And I got the form and instructions I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maria C.

June 3rd, 2022

Amazing service truly great to work with your team on a difficult filing!

Thank you!

Samantha A.

June 9th, 2022

Its exactly what it said it was. I received multiple downloads, loaded fast and was pretty easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Eduardo A.

January 22nd, 2022

Perfect, blank forms, just what I ordered. Easy to download, understand, and complete.

Thank you!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Evelynne H.

December 3rd, 2020

The service was quick and easy to use. Which is something I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOYCE R.

June 25th, 2019

I am a tax attorney and had worked as a Valuation Engineer with Internal Revenue Service. I can access (almost immediately) complete title reports and transactions history of real estate transfers. It is a joy to have access to your valuable service. JOYCE REBHUN,JD,MBA,PhD,EA

Thank you for your feedback. We really appreciate it. Have a great day!