Sevier County Deed of Distribution Form

Sevier County Deed of Distribution Form

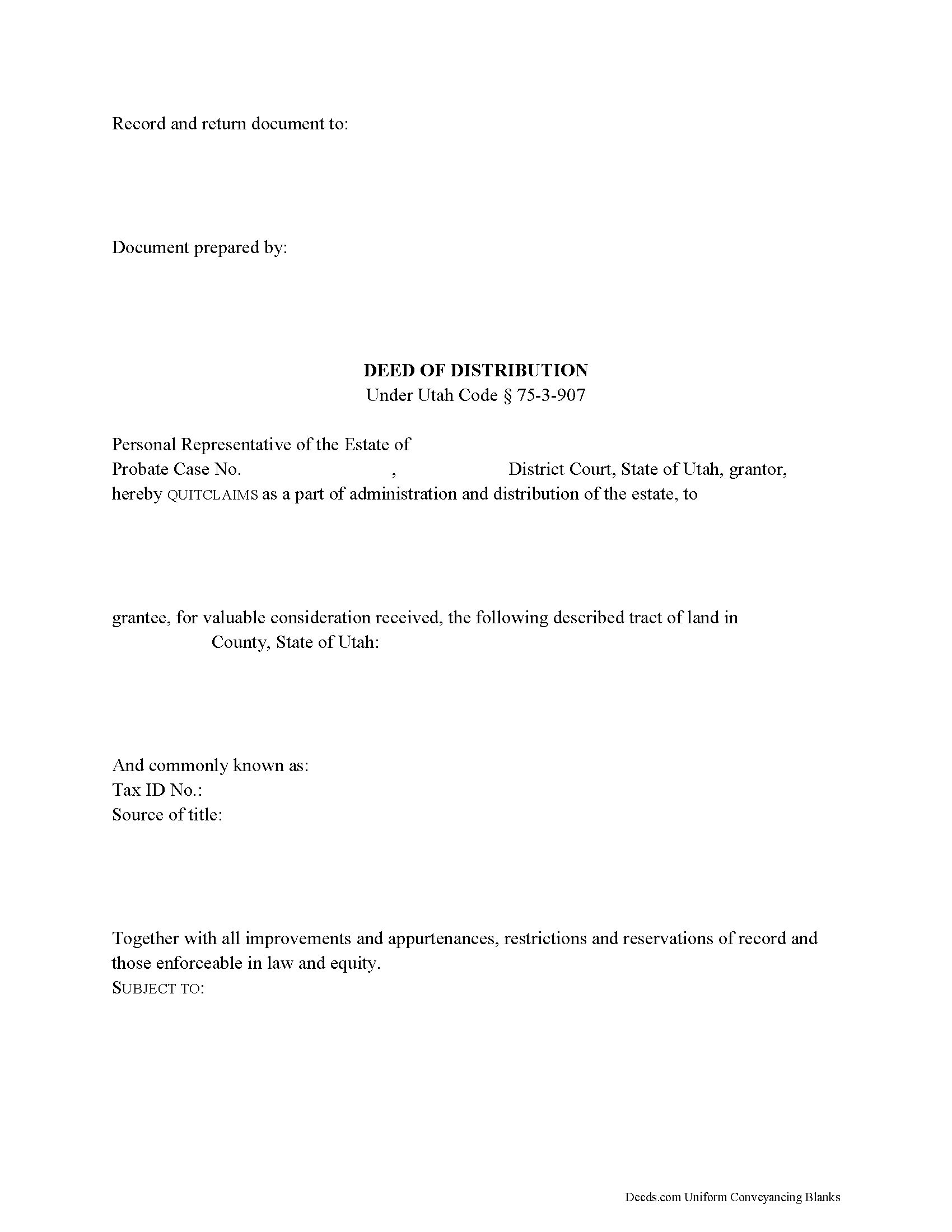

Fill in the blank form formatted to comply with all recording and content requirements.

Sevier County Deed of Distribution Guide

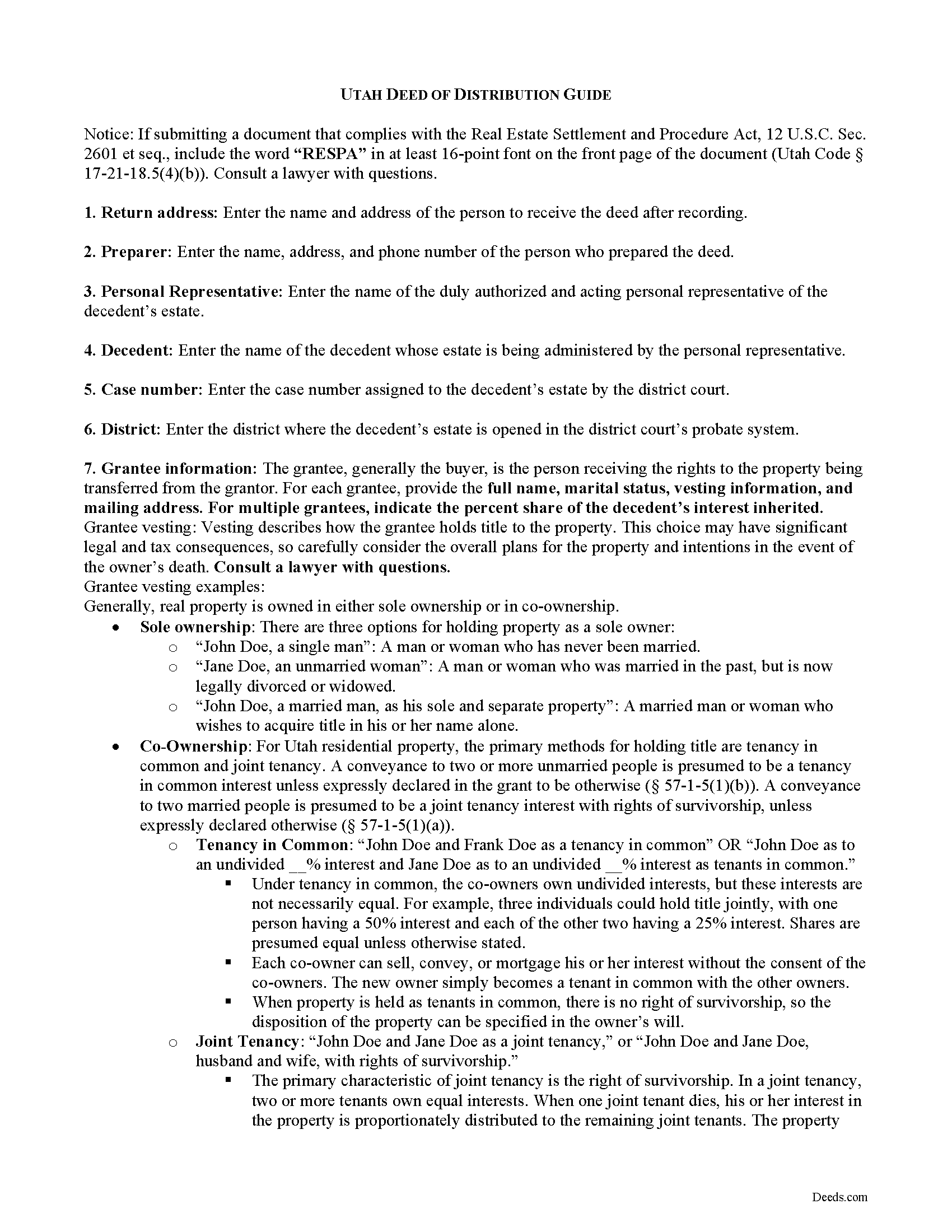

Line by line guide explaining every blank on the form.

Sevier County Completed Example of the Deed of Distribution Document

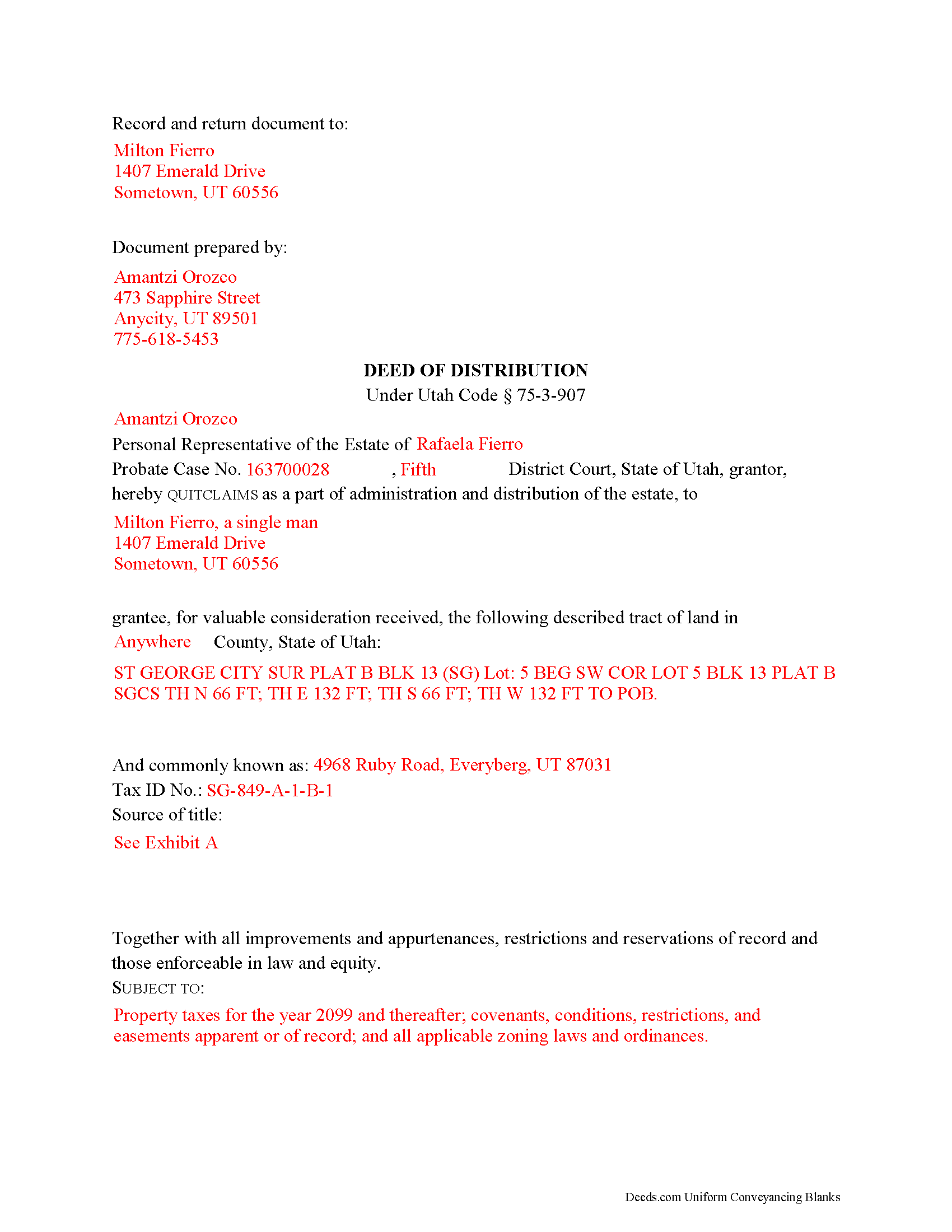

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Sevier County documents included at no extra charge:

Where to Record Your Documents

Sevier County Recorder

Richfield, Utah 84701

Hours: 8:00am to 5:00pm M-F

Phone: (435) 893-0411

Recording Tips for Sevier County:

- Bring your driver's license or state-issued photo ID

- Request a receipt showing your recording numbers

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Sevier County

Properties in any of these areas use Sevier County forms:

- Annabella

- Aurora

- Elsinore

- Glenwood

- Joseph

- Koosharem

- Monroe

- Redmond

- Richfield

- Salina

- Sevier

- Sigurd

Hours, fees, requirements, and more for Sevier County

How do I get my forms?

Forms are available for immediate download after payment. The Sevier County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sevier County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sevier County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sevier County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sevier County?

Recording fees in Sevier County vary. Contact the recorder's office at (435) 893-0411 for current fees.

Questions answered? Let's get started!

A deed of distribution is a legal instrument of conveyance recorded as part of probate proceedings. Probate is the process of settling and distributing a decedent's estate. The Utah Uniform Probate Code is codified at Title 75 of the Utah Code.

Following the payment of claims against the estate, the personal representative (PR) may execute a deed of distribution under 75-3-907 to transfer fee simple title to real property to the distributee of an estate. A recorded deed of distribution is "conclusive evidence that the distributee has succeeded to the interest" in the property "as against all persons interested in the estate" (75-3-908). The deed releases the PR's power over the property and establishes marketable title. The instrument is functionally equivalent to a quitclaim deed and carries no warranties.

Deeds of distribution name the personal representative as the granting party, reference the decedent by name, and cite information about the probated estate, including the district court in which probate is opened and the case number assigned to the estate. To properly transfer title, include the grantee's full name, mailing address, and vesting information. All documents must meet state and county recording standards for form and content.

As with all documents pertaining to an interest in realty, the deed of distribution requires a legal description of the subject parcel, the tax identification number assigned by the taxing authority, and a recitation of the grantor's source of title. Note any restrictions associated with the property on the face of the deed. The PR must sign the deed in the presence of a notary public before recording in the appropriate county.

Include a water rights addendum under 57-3-109. This form must be completed and signed by the grantor. Submit the deed and any required supporting documents, such as a copy of the PR's letters and the decedent's death certificate, to the recording office of the county where the real property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Utah with questions regarding deeds of distribution and probate procedures in that state, as each situation is unique.

(Utah DOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Sevier County to use these forms. Documents should be recorded at the office below.

This Deed of Distribution meets all recording requirements specific to Sevier County.

Our Promise

The documents you receive here will meet, or exceed, the Sevier County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sevier County Deed of Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

Lorraine F.

October 9th, 2024

I followed the instructions to download the form for my Mac, typed in the legal description of the real property but the space provided for it would not expand so I just typed the form into Word as a document. While I appreciate having the form to work with it would have been a breeze if it worked properly.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

ELIZABETH M.

January 10th, 2020

Great service! Training was fast and we went over very detail.

Thank you!

Jeffrey L.

May 17th, 2019

I like using Deeds.com for all of our out-of-state deeds because they make the process almost completely hassle free for us and our clients. I am confident that the service they provide for us is the absolute best anywhere. Because of Deeds.com, we look great to our clients and our people enjoy a level of trust that other firms do not offer them.

Thank you for your feedback. We really appreciate it. Have a great day!

Jon B.

April 27th, 2021

The information and documents received are great. But the communication with customer service is not good at all. I've been waiting three days for them to respond to a question. I don't think they are going too.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

July 11th, 2019

The website works fine. The process of changing my Mineral Deed is sure more expensive in Texas. But I appreciate the convenience of the website and the pages of directions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Sheneda A.

November 23rd, 2022

Great!

Thank you!

Cynthia S.

September 22nd, 2022

I am an attorney assisting my son with some simple legal docs & this service saved me a lot of time and is user friendly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STANLEY F.

March 25th, 2019

Forms were spot on and able to save over $100 by not going to an attorney to complete the same documents. There were templates on how forms are supposed to be completed. You just need a notary to sign.

Thank you Stanley, we really appreciate your feedback.

Christopher B.

November 26th, 2019

Record retrieval by staff is very prompt!!! Great customer service for sure!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas J.

March 3rd, 2021

I'm pleased with the service

Thank you!

Deborah K.

February 2nd, 2023

great job but, I wanted to upload a document. I got it wrong, but the info was good.

Thank you!

Alicia S.

August 17th, 2021

It's been a difficult time during my divorce. Glad I was able to get the house related documents easily here.

Thank you!